|

市場調査レポート

商品コード

1523335

スクールバス:市場シェア分析、産業動向、成長予測(2024~2029年)School Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スクールバス:市場シェア分析、産業動向、成長予測(2024~2029年) |

|

出版日: 2024年07月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

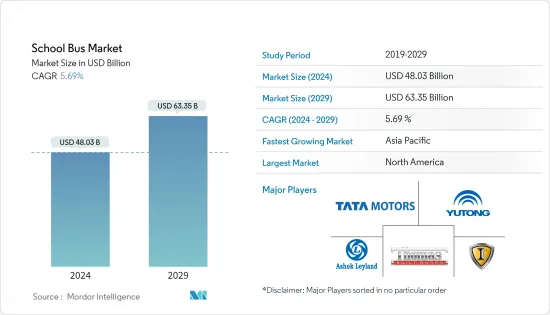

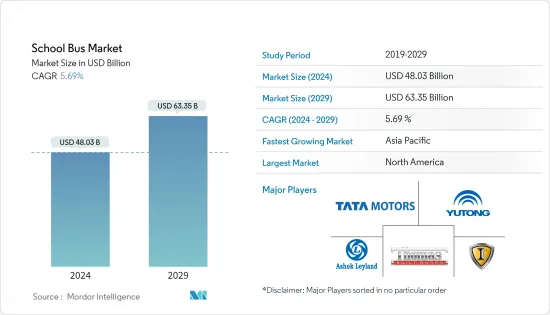

スクールバス市場規模は2024年に480億3,000万米ドルと推定され、2029年には633億5,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは5.69%で成長する見込みです。

スクールバス市場は、学生輸送を再編する複数の要因によって変貌しつつあります。生徒の安全に対する関心の高まりが、技術的に先進的なバスの需要を促進しています。さらに、教育インフラを支援する世界各国の政府の取り組みが成長を後押ししています。2023年、地域別市場シェアは北米が圧倒的で、次いで欧州、アジア太平洋、ラテンアメリカ、中東・アフリカと続く。

さらに、急速な都市化と人口増加が、ルート最適化と混雑緩和のための革新的なソリューションを必要とする主な要因となっています。世界の持続可能性へのシフトを背景とした電動スクールバスの需要の高まりは、市場に成長機会をもたらしています。また、ゼロエミッションの電動バスへの関心も急増しています。ルート最適化のための人工知能やIoT対応メンテナンス監視などの先進技術の統合は、市場プレーヤーが自社の製品を差別化する大きなチャンスとなります。

さらに、リアルタイムの追跡、メンテナンス・スケジューリング、データ分析を含む車両管理ソリューションの採用が、重要な動向として浮上しています。これにより、教育機関は業務を最適化し、安全性を高め、全体的なコストを削減することができます。しかし、特に新興国地域の教育機関では予算の制約があり、市場拡大の課題となっています。

スクールバスメーカー、テクノロジープロバイダー、教育機関の連携がイノベーションを促進します。このようなパートナーシップは、市場の多様なニーズに対応し、包括的で統合されたソリューションを提供する上で不可欠です。

課題は山積しているもの、スクールバス市場は今後も成長軌道を維持すると予想されます。

スクールバス市場の動向

電動スクールバスの販売台数増加により、今後数年で成長が見込まれる

エレクトロモビリティの採用や電気自動車の販売に対する政府のインセンティブ、石油価格の上昇、汚染レベルの上昇、環境意識の高まり、ICEモビリティよりも低い運転コスト、欧州、中国、インドなどの様々な主要市場が2035年までにICエンジン車の新規販売を禁止すると発表したことなどにより、エレクトロモビリティは世界中で急速に普及しています。

世界のスクールバスの95%以上は化石燃料、特にディーゼルで走っています。ディーゼルの排気ガスを吸い込むと呼吸器系疾患が引き起こされ、主な通勤者である子どもたちに広く見られることが、多くの研究で明らかになっています。米国のスクールバスのみをすべて電気バスに置き換えれば、年間平均530万トンの温室効果ガス排出を回避できます。

電気バスは排出ガスがゼロで、年間運行コストはディーゼルバスのほぼ半分です。中国の深では、電気バスに対するインセンティブがスクールバスにも拡大され、電気バスの普及が進むと予想されています。米国のカリフォルニア州やニューヨーク州、カナダのケベック州などでも、電気バスの試験・導入が進んでおり、市場成長の原動力となることが期待されています。米国カリフォルニア州は、電気スクールバスの採用で最先端を走っています。例えば、米国カリフォルニア州は2022年11月、スクールバスの電動化にさらに18億米ドルを投資すると発表しました。同州はこれまで、スクールバスの電動化に12億米ドルを費やしてきました。

さらに、2035年から欧州でのICエンジン車の販売を禁止するという欧州委員会の発表により、欧州でもスクールバスの電動化が進んでいます。

さらに、スクールバス市場の大手企業は、電気バス分野で競争優位に立つために、調査、M&A、戦略的提携などを通じて、この需要に積極的に対応しています。例えば

2022年10月、BYDはLos Olivos Elementary School Districtと100%ゼロエミッションバスを導入する米国初の学区を作る契約を締結しました。

2022年5月、カナダのブリティッシュコロンビア州バンクーバーに本社を置くGreenpower Motor社は、米国市場向けにNano BEAST(Battery Electric Automotive School Transportation)と名付けられた新しいタイプAのバッテリー電気スクールバスを発表しました。

このように、スクールバスの電気分野はスクールバス市場の成長を牽引すると予想されています。

北米がスクールバス市場開拓で主な役割を果たす

確立された広範な学校輸送システムを持つ北米は、生徒の移動にスクールバスを多用する学校や教育機関が多いです。さらに、この地域の人口密度と地理的要因は、特に徒歩で学校に簡単にアクセスできない郊外や農村部でのスクールバスの需要に大きく貢献しています。

北米の経済的繁栄も極めて重要な役割を果たしており、スクールバス車両の一貫した更新と拡張を含め、教育と関連インフラへの多額の投資を可能にしています。米国とカナダは、スクールバスに厳しい安全規制を課しているため、高度な安全機能を備えた車両の市場が育っています。例えば

米国では、バイデン政権が超党派インフラ法の一環として「クリーン・スクールバス」(CSB)プログラムを展開しました。このイニシアチブは、化石燃料で走る現行のスクールバスを、低排出ガスまたはゼロ・エミッションの新型モデルに置き換えることを目的としています。環境にやさしく、学校の子供たちの健康に貢献するバスを普及させることに重点が置かれています。

さらに、環境保護庁(EPA)も、より厳しい排出基準を実施する温室効果ガス(GHG)フェーズ3プログラムを実施することにより、重要な役割を果たしています。さらに北米では、液化天然ガス(LNG)としても知られるプロパンにもインセンティブを与えており、低排出ガスオプションとしてCSBプログラムに含まれています。

さらに、政府からの資金援助や補助金が市場をさらに活性化させ、教育機関が近代的で効率的なバスに投資するための財政支援を行っています。さらに、北米では先進安全機能の統合や代替燃料の探求など、技術的進歩をいち早く採用しているため、スクールバス市場全体の成長可能性が高まっています。例えば

2022年10月、北米ダイムラー・トラックの子会社であるThomas Built Buses社は、米国インディアナ州のモンロー郡公立学校に200台目のProterra Powered Saf-T-Liner C2 Jouleyバッテリー電気式スクールバスを納入したと発表しました。

アジア太平洋と欧州のスクールバス市場も、通学する子供たちの安全で安心な交通手段に対する需要の高まり、中国やインドなどの市場で子供たちにスクールバスサービスを提供できるようになった保護者の可処分所得の増加、欧州での電気スクールバスの販売台数の増加、子供たちの就学率の増加、これらの市場における大手バスメーカーの存在などにより、急成長が見込まれています。

スクールバス業界の概要

スクールバス市場は適度に統合されています。この市場の特徴は、世界の大手スクールバスメーカーと、他国にも供給している地元スクールバスメーカーが存在することです。米国、中国、インドのメーカーが主に市場を独占しています。これらのプレーヤーは、ブランドポートフォリオを拡大し、市場での地位を固めるために、合弁事業、M&A、新製品の発売、製品開拓も行っています。

世界市場を独占している主要企業には、Thomas Built Buses、Yutong Bus Co.、Tata Motors Ltd、Ashok Leyland Ltd、IC Busなどがあります。主要企業は、市場での地位を確保し、市場のカーブを先取りするために、大規模な受注を確保し、新製品を発表しています。例えば、2022年4月、全電気式中型・大型トラックメーカーの大手であるLion Electric Companyは、ケベック州向けにLIONCセグメントの全電気式スクールバス50台を受注したと発表しました。2022年9月、ドワイト・スクール・ロンドンは、世界のスマートバス輸送会社Zeeloと提携し、電気バスサービスを導入しました。この取り組みにより、ドワイト・スクール・ロンドンの二酸化炭素排出量は年間33%も削減される見込みです。

さらに2022年5月、ファースト・スチューデント社は、ライオン・エレクトリック社から調達した電気バスをネットワークに導入しました。ファースト・スチューデントは、最終的に250台の電気バスをネットワークに導入することを目指しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 教育インフラを支援する世界の政府の取り組みが成長を促進

- 市場抑制要因

- 排出ガスと安全性に関する厳しい規制遵守基準がハードルとなっている

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(金額単位)

- 推進力タイプ別

- 内燃機関(ICE)

- 圧縮天然ガス(CNG)/液化天然ガス(LNG)

- 電気およびハイブリッド

- 容量設計タイプ別

- タイプA

- タイプB

- タイプC

- Dタイプ

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 世界のその他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Thomas Built Buses Inc.

- Collins Bus Corporation

- IC Bus(Navistar International Corporation)

- Blue Bird Corporation

- Lion Electric Company

- Yutong Buses Co. Ltd

- Anhui Ankai Automobile

- JCBL Limited

- Tata Motors

第7章 市場機会と今後の動向

- バスにおけるAIとIoT対応技術の統合が今後の成長機会をもたらす

第8章 市場規模と台数予測

第9章 各地域政府によるスクールバスの安全性に関する規制基準

The School Bus Market size is estimated at USD 48.03 billion in 2024, and is expected to reach USD 63.35 billion by 2029, growing at a CAGR of 5.69% during the forecast period (2024-2029).

The school bus market is transforming, driven by multiple factors reshaping student transportation. Growing concerns for student safety are fuelling the demand for technologically advanced buses. Additionally, government initiatives worldwide supporting education infrastructure are propelling growth. In 2023, the regional market share was dominated by North America, followed by Europe, Asia-Pacific, Latin America, and the Middle-East and Africa.

Furthermore, rapid urbanization and population growth are key drivers necessitating innovative solutions for route optimization and congestion reduction. The growing demand for electric school buses, driven by a global shift toward sustainability, presents growth opportunities for the market. There has also been a surge in interest in zero-emission, electric-powered buses. Integrating advanced technologies, including artificial intelligence for route optimization and IoT-enabled maintenance monitoring, presents a significant opportunity for market players to differentiate their offerings.

Moreover, the adoption of fleet management solutions, encompassing real-time tracking, maintenance scheduling, and data analytics, is emerging as a key trend. This allows educational institutions to optimize operations, enhance safety, and reduce overall costs. However, budget constraints in educational institutions, especially in developing regions, pose challenges for market expansion.

Collaboration between school bus manufacturers, technology providers, and educational institutions fosters innovation. These partnerships are essential in addressing the market's diverse needs and providing comprehensive, integrated solutions.

Despite all the challenges, the school bus market is expected to continue its growth trajectory in the coming years.

School Bus Market Trends

Growing Sales of Electric School Buses to Witness Growth in Coming Years

Electromobility is gaining pace across the world due to the government incentives provided to the adoption of electromobility and sales of electric vehicles, rising oil prices, increasing pollution levels, growing environmental consciousness, lower operating costs than ICE mobility, and announcements by various major markets like Europe, China, and India to ban new sales of IC engine vehicles by 2035.

More than 95% of school buses worldwide run on fossil fuels, especially diesel. Numerous studies show that inhaling diesel exhaust causes respiratory diseases, seen widely in children, who are the main commuters. Replacing all the school buses only in the United States with electric buses would avoid an average of 5.3 million tons of greenhouse gas emissions yearly.

Electric buses emit zero emissions, and their annual operating cost is almost half that of diesel buses. In Shenzhen, China, it is expected that the incentives for electric transit buses will also be extended to school buses, thus increasing their adoption. A few states in the United States, such as California and New York, and Quebec in Canada, are also testing and adopting electric buses, which is expected to drive the growth of the market. The state of California in the United States is at the forefront of adopting electric school buses. For instance, in November 2022, the state of California in the United States announced the investment of another USD 1.8 billion in the electrification of school buses. The state has spent USD 1.2 billion on the electrification of school buses so far.

Furthermore, the electrification of school buses in Europe is also rising due to the announcement of the European Commission to ban the sales of IC engine vehicles in Europe from 2035.

In addition, leading players in the school bus market are actively catering to this demand through research, mergers and acquisitions, strategic collaborations, etc, to gain a competitive edge in the electric bus segment. For instance,

In October 2022, BYD signed a deal with Los Olivos Elementary School District to create the first US school district with a 100% zero-emissions bus fleet.

In May 2022, Greenpower Motor Co., based in Vancouver, British Columbia, Canada, unveiled a new Type A battery electric school bus named Nano BEAST (Battery Electric Automotive School Transportation) for the US market.

Thus electric segment of school buses is anticipated to drive the growth of the school bus market.

North America to Play a Key Role in the Development of the School Bus Market

With a well-established and extensive school transportation system, North America boasts many schools and educational institutions that heavily rely on school buses for student transportation. Additionally, the region's population density and geographic factors contribute significantly to the demand for school buses, especially in suburban and rural areas where schools are not easily accessible by foot.

The economic prosperity of North America also plays a pivotal role, allowing substantial investments in education and related infrastructure, including the consistent update and expansion of school bus fleets. The United States and Canada enforce stringent safety regulations for school buses, fostering a market for vehicles with advanced safety features. For instance,

In the United States, the Biden administration has rolled out the 'Clean School Bus' (CSB) program as part of the Bipartisan Infrastructure Law. This initiative aims to replace current school buses running on fossil fuels with newer low- or zero-emission models. The key focus is on promoting buses that are environmentally friendly and contribute to the health of school children.

Furthermore, the Environmental Protection Agency (EPA) also plays a crucial role by implementing the Green House Gases (GHG) phase 3 program, which enforces stricter emission standards. Additionally, North America also provides incentives for propane, also known as liquefied natural gas (LNG), and it is included in the CSB program as a low-emission option.

Moreover, government funding and subsidies further fuel the market, providing financial support for educational institutions to invest in modern and efficient buses. Additionally, North America's early adoption of technological advancements, such as integrating advanced safety features and exploring alternative fuels, increases the overall growth potential of the school bus market. For instance,

In October 2022, Thomas Built Buses, a subsidiary of Daimler Truck North America, announced the delivery of the 200th Proterra Powered Saf -T-Liner C2 Jouley battery-electric school bus to Monroe County Public Schools in Indiana, United States.

The market for school buses in Asia-Pacific and Europe is also expected to grow rapidly due to the growing demand for safe and secure transportation for school-going children, rising disposable incomes of parents in markets like China and India who now can afford school bus services for their children, rising sales of electric school buses in Europe, increasing enrolment of children in schools, and the presence of large bus manufacturers in these markets.

School Bus Industry Overview

The school bus market is moderately consolidated. The market is characterized by the presence of major global and local school bus manufacturers who also cater to other countries. The United States, China, and India players mainly dominate the market. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

Some of the major players dominating the global market are Thomas Built Buses, Yutong Bus Co., Tata Motors Ltd, Ashok Leyland Ltd, and IC Bus. Key players are securing large orders and launching new products to secure their market position and stay ahead of the market curve. For instance, in April 2022, Lion Electric Company, a leading all-electric medium and heavy truck manufacturer, announced that it had received an order for 50 all-electric school buses of the LIONC segment for the province of Quebec. In September 2022, Dwight School London introduced electric bus services in partnership with the global smart bus transport company Zeelo. The initiative is expected to reduce the carbon emissions of Dwight School London by as high as 33% annually.

Additionally, in May 2022, First Student introduced electric school buses in its network with the buses procured from Lion Electric Company. First Student aims to eventually induct 250 electric school buses into its network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth

- 4.2 Market Restraints

- 4.2.1 Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (VALUE IN USD BILLION)

- 5.1 By Propulsion Type

- 5.1.1 Internal Combustion Engine (ICE)

- 5.1.2 Compressed Natural Gas (CNG)/ Liquified Natural Gas (LNG)

- 5.1.3 Electric and Hybrid

- 5.2 By Capacity Design Type

- 5.2.1 Type A

- 5.2.2 Type B

- 5.2.3 Type C

- 5.2.4 Type D

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Thomas Built Buses Inc.

- 6.2.2 Collins Bus Corporation

- 6.2.3 IC Bus (Navistar International Corporation)

- 6.2.4 Blue Bird Corporation

- 6.2.5 Lion Electric Company

- 6.2.6 Yutong Buses Co. Ltd

- 6.2.7 Anhui Ankai Automobile

- 6.2.8 JCBL Limited

- 6.2.9 Tata Motors

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of AI and IoT enabled Technologies in Buses Presents Growth Opportunities for Future