|

市場調査レポート

商品コード

1433775

自動車用ガスケット・シール:市場シェア分析、産業動向・統計、成長予測(2024~2029年)Automotive Gaskets and Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用ガスケット・シール:市場シェア分析、産業動向・統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

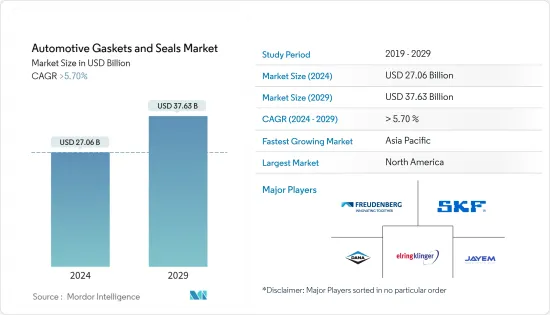

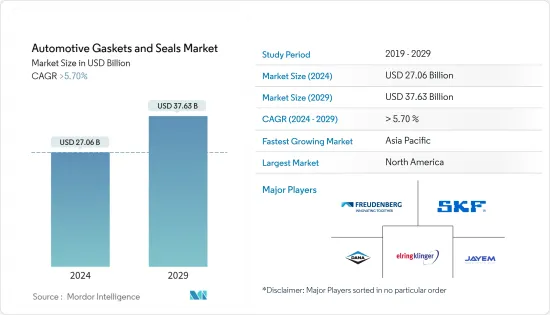

世界の自動車用ガスケット・シールの市場規模は、2024年に270億6,000万米ドルに達し、2024~2029年の予測期間中にCAGR 5.70%以上で成長し、2029年には376億3,000万米ドルに達すると予測されています。

調査した市場の成長は、新興国市場における電気自動車の普及率、先進国における電気自動車インフラ動向の増加、原材料価格の変動など、さまざまな要因に左右されます。さらに、米国、欧州、中国の自動車部品の関税率の影響もガスケット・シールの需要に寄与する可能性があります。

ガスケット・シールのメーカーは、ICエンジン車やバッテリー式電気自動車の需要増加が予想されるため、特殊タイプのガスケット・シールを開発する研究開発活動を行っています。

国内での電気自動車保有台数の増加は、市場をさらに押し上げると思われます。インド自動車販売店連盟(FADA)の最新の数字によると、インドにおける電気自動車の小売販売台数は2022年10月に前年同月比で約185%増加しました。インド政府はすでに、電気自動車インフラへの多額の投資とともに、さまざまな生産奨励策を提供しています。

市場に参入しているメーカーには、Freudenberg、Dana Incorporated、Federal-Mogul、SKF GmbH、 ElringKlinger AGなどがあります。中国が電気自動車の販売を支配しているため、Kunshan Sanwa Engine Parts Industryのような地元メーカーは、大部分の自動車に必要なシリンダーヘッドとエキゾーストマニホールドガスケットを供給しています。

自動車用ガスケット・シール市場の動向

自動車生産の増加が市場成長を促進

世界の自動車産業は、長年にわたって自動車生産台数が大幅に増加しています。この成長は、人口の増加、新興市場における所得水準の上昇、インフラの改善、技術の進歩など、さまざまな要因によるものです。欧州自動車工業会(仏:によると、2022年には世界中で8,540万台の自動車が生産され、2021年比で5.7%増加しました。

発展途上国、特にアジア諸国では自動車生産が急増しています。中国やインドなどの国々は急速な経済成長を遂げ、可処分所得の増加と自動車需要の増加につながった。その結果、多くの世界自動車メーカーが、増大する需要に対応するため、これらの市場に生産施設を設置しました。

自動車産業は、電気自動車(EV)や自律走行車(AV)など、目覚ましい技術進歩を目の当たりにしてきました。環境問題への関心や政府の取り組みによってEVの人気が高まり、電気自動車やハイブリッド車の生産が増加しています。さらに、AVの開発がメーカーに研究開発への投資を促し、自動運転車の生産につながっています。

自動車メーカーは絶えず新市場を開拓し、世界に事業を拡大しています。各地域の需要に応え、生産コストを削減するために、さまざまな地域に生産施設を設立しています。この拡大戦略により、企業は新たな顧客基盤を開拓し、新興市場の潜在力を活用することができます。

このように、自動車台数が増加するにつれて、自動車用ガスケット・シール市場で事業を展開するプレーヤーが収益を上げる機会も増え、市場全体の拡大が促進されます。

アジア太平洋と欧州が市場を独占する

- 過去10年間で、アジア太平洋の自動車産業は歴史上最も大きな変貌を遂げました。同市場は、世界の自動車販売に占める割合が増加しています。自動車用ガスケット・シール市場の成長を促すもう一つの大きな要因は、同地域における電気自動車の生産と販売の増加です。

- アジア太平洋には、中国、インド、タイといった主要な自動車市場があります。中国は世界最大の自動車市場であり、2020年に欧州が電気自動車を上回ったのに次いで2番目に大きな市場です。ガスケット・シールは電気自動車と従来型の内燃機関車(ICE)の両方に使用されるため、中国には大きな市場機会があります。乗用車と商用車の市場が大きいインドは、ガスケット・シール市場にとってもう一つの潜在的成長可能性を秘めた主要地域です。

- インドの自動車セクターの売上高は2026年までに3,000億米ドルに達すると予測され、現在の740億米ドルからCAGR 15%で成長し、自動車用ガスケット・シール市場で事業を展開するプレーヤーにチャンスをもたらします。

- さらに、欧州も世界の自動車用ガスケット・シール市場で大きなシェアを占めると予想されています。同地域では商用車の需要が伸びており、自動車産業の内燃機関車と電気自動車の両セグメントで高い発展を見せています。自動車販売全体では減少傾向が見られるが、特にアジア太平洋では中古車などの中古車販売が増加しており、ガスケット・シールのアフターマーケット販売の大きな成長要因となっています。

自動車用ガスケット・シール産業の概要

自動車用ガスケット・シール市場は細分化された市場です。市場の主要企業としては、Freudenberg Group、SKF Group、Dana Incorporated、Elringklinger AG、Jayem Auto Industries、Kunshan Sanwa Engine Parts Industry、Sumitomo Rikoなどが挙げられます。さまざまなメーカーが、世界中で新製品を開発・発売し、人気を集めています。例えば

- 2023年8月、Freudenberg SEは、Freudenberg Sealing Technologiesが3Dサーマルバリアを開発したと発表しました。

- 2022年8月、Trelleborg ABは、Trelleborg Sealing Solutionsが低温および高温アプリケーションの静的シーリング用フラットガスケット材料の新シリーズであるHMFフラットシールを発売したと発表しました。このシリーズには、自動車産業を含む様々な産業で過酷な化学薬品や媒体に使用される専門材料が含まれています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 世界の自動車販売台数の増加による需要拡大

- 市場抑制要因

- 原材料価格の変動

- 産業の魅力 - ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- ガスケット

- シール

- ガスケットアプリケーションタイプ

- シリンダーヘッド

- エキゾーストマニホールド

- その他のガスケットアプリケーションタイプ

- シールアプリケーションタイプ

- エンジン

- トランスミッション

- ステアリング

- バッテリー

- 車両タイプ

- 乗用車

- 商用車

- 販売チャネル

- OEM

- アフターマーケット

- 地域

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- SKF Group

- Dana Incorporated

- Elringklinger AG

- Jayem Auto Industries Pvt Ltd

- Kunshan Sanwa Engine Parts Industry Co. Ltd

- Sumitomo Riko

第7章 市場機会と今後の動向

The Automotive Gaskets and Seals Market size is estimated at USD 27.06 billion in 2024, and is expected to reach USD 37.63 billion by 2029, growing at a CAGR of greater than 5.70% during the forecast period (2024-2029).

The growth of the market studied depends on various factors, such as the adoption rate of electric vehicles in developing nations, increasing electric vehicle infrastructure trends in developed nations, variations in raw material prices, etc. Additionally, the impact of tariff rates among the United States, Europe, and China for automotive components may also contribute to the demand for gaskets and seals.

Manufacturers of gaskets and seals have been conducting R&D activities to develop special types of gaskets and seals for the expected rise in demand for IC engine vehicles and battery electric vehicles.

The growing electric vehicle fleet in the country will propel the market further. According to the newest figures from the Federation of Automobile Dealers Association of India (FADA), retail electric car sales in India increased by around 185% in October 2022, over the same month last year. The Indian government has already offered various production incentives along with heavy investments in electric vehicle infrastructure.

Some of the manufacturers in the market include Freudenberg, Dana Incorporated, Federal-Mogul, SKF GmbH, ElringKlinger AG, etc. As China dominates electric vehicle sales, local manufacturers, such as Kunshan Sanwa Engine Parts Industry Co. Ltd, have been supplying the necessary cylinder heads and exhaust manifold gaskets to the majority of the vehicles.

Automotive Gaskets & Seals Market Trends

Increasing Vehicle Production to Propel the Market Growth

The global automotive industry has been experiencing significant growth in vehicle production over the years. This growth can be attributed to various factors, including increasing population, rising income levels in emerging markets, improved infrastructure, and technological advancements. According to the European Automobile Manufacturers' Association (French: L'Association des Constructeurs Europeens d'Automobiles (ACEA)), in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021.

Developing countries, particularly in Asia, have witnessed a surge in vehicle production. Countries like China and India have experienced rapid economic growth, leading to a rise in disposable income and increased demand for automobiles. As a result, many global automakers have set up production facilities in these markets to cater to the growing demand.

The automotive industry has witnessed remarkable technological advancements, including electric vehicles (EVs) and autonomous vehicles (AVs). The growing popularity of EVs, driven by environmental concerns and government initiatives, has led to increased production of electric cars and hybrids. Additionally, the development of AVs has prompted manufacturers to invest in research and development, leading to the production of self-driving cars.

Vehicle manufacturers are continually exploring new markets and expanding their operations globally. They establish manufacturing facilities in different regions to meet local demand and reduce production costs. This expansion strategy enables companies to tap into new customer bases and leverage the potential of emerging markets.

Thus, as the number of vehicles increases, so will the opportunity for players operating in the automotive gaskets & seals market to generate revenue, facilitating overall market expansion.

Asia-Pacific and Europe to dominate the Market

- Over the last decade, the Asia-Pacific automotive industry has undergone the most significant transformation in its history. The market is recording an increasing share of global vehicle sales. Another major factor driving the growth of the automotive gaskets and seals market is increased production and sales of electric vehicles in the region.

- The Asia-Pacific region is home to major automotive markets like China, India, and Thailand. China is the world's biggest automotive market and the second-largest market for electric vehicles after Europe recently surpassed it in 2020. Since gaskets and seals find applications in both electric vehicles and conventional internal combustion engine (ICE) vehicles, China presents huge market opportunities. With a large market for passenger and commercial vehicles, India is another major area for potential growth for the gaskets and seals market.

- The Indian vehicle sector is predicted to reach USD 300 billion in revenue by 2026, growing at a CAGR of 15% from its present value of USD 74 billion creating opportunities for players operating in the vehicle gaskets and seals market.

- In addition, Europe is also expected to hold a significant share of the global automotive gaskets and seals market. The commercial vehicle demand is growing in the region, with high developments in both the ICE and electric vehicle segments of the automobile industry. Although a decreasing trend is being observed in terms of vehicle sales in its entirety, the increase in sales for used cars and other used vehicles, especially in the Asia-Pacific region, is a major growth factor in the aftermarket sales for gaskets and seals.

Automotive Gaskets & Seals Industry Overview

The automotive gaskets and seals market is a fragmented market. Some of the major players in the market are Freudenberg Group, SKF Group, Dana Incorporated, Elringklinger AG, Jayem Auto Industries, Kunshan Sanwa Engine Parts Industry, and Sumitomo Riko, among others. Different manufacturers are gaining traction by developing and launching new products across the world. For instance,

- In August 2023, Freudenberg SE announced that Freudenberg Sealing Technologies has developed the 3D thermal barriers, acting as protective layers that help slow down or even stop thermal runaway by increasing resistance to propagation, hence the better safety for electric cars.

- In August 2022, Trelleborg AB announced that Trelleborg Sealing Solutions has launched HMF FlatSeal, a new range of flat gasket materials for static sealing in low and high-temperature applications. The range includes specialist materials for use with harsh chemicals and mediums in various industries including the automotive industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automobile Sales Across the Globe is Likely to Bolster Demand

- 4.2 Market Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Gaskets

- 5.1.2 Seals

- 5.2 Gasket Application Type

- 5.2.1 Cylinder Head

- 5.2.2 Exhaust Manifold

- 5.2.3 Other Gasket Application Types

- 5.3 Seal Application Type

- 5.3.1 Engine

- 5.3.2 Transmission

- 5.3.3 Steering

- 5.3.4 Battery

- 5.4 Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 Sales Channel Type

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 SKF Group

- 6.2.2 Dana Incorporated

- 6.2.3 Elringklinger AG

- 6.2.4 Jayem Auto Industries Pvt Ltd

- 6.2.5 Kunshan Sanwa Engine Parts Industry Co. Ltd

- 6.2.6 Sumitomo Riko