|

|

市場調査レポート

商品コード

1689787

粗鋼:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Crude Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 粗鋼:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

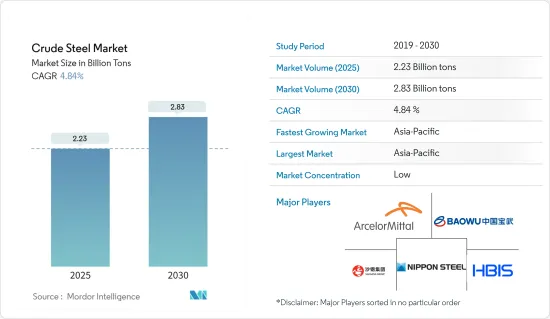

- 目次

粗鋼市場規模は2025年に22億3,000万トンと推定され、予測期間(2025~2030年)のCAGRは4.84%で、2030年には28億3,000万トンに達すると予測されます。

COVID-19は2020年の市場にマイナスの影響を与えました。パンデミックのため、2020年の全車両の世界販売台数は減少しました。しかし、2021年には市場は回復し、さまざまな自動車部品の製造における粗鋼消費が増加しました。2021年には、建設、工具・機械、エネルギー、輸送など様々な産業での需要増加により、石油鋼の需要が増加しました。

主要ハイライト

- 中期的には、建築・建設産業からの需要の増加と、電気自動車の急速な成長による自動車生産の回復が市場の成長を牽引するとみられます。

- その反面、鉄鋼生産による天然資源の枯渇と代替品の入手可能性が市場成長の妨げになると予想されます。

- 鉄鋼が回収、再利用、再製造、リサイクルを通じて大きく貢献するとされる循環型経済の傾向の高まりは、調査対象市場にとって好機となりそうです。

- アジア太平洋が市場を独占し、中国やインドなどの国々からの消費が最も大きいと予想されます。

粗鋼市場の動向

建築・建設産業からの需要増加

- 鉄鋼とその合金は、建設産業で世界中で最も一般的に使用されている金属のひとつです。鋼鉄は屋根や外壁の被覆材としても使用されています。屋根材、母屋、内壁、天井、被覆材、外壁用断熱パネルなどの製品は鋼鉄製です。

- 国連(UN)によると、世界人口の約50%が都市部に居住しており、2030年には60%に達すると予測されています。経済成長と人口増加のペースは、商業、住宅、施設の建設需要と調和していなければならないです。

- 中国の建設産業は世界最大です。中国国家統計局によると、建設産業の事業活動指数(BASI)は2023年11月の55.9から12月には56.9に上昇しました。BASIスコアが50を超えると産業の成長を示し、2023年10月のBASIスコアは53.5でした。

- 同様に、ドイツでは、2023年の住宅建設の売上高は579億5,000万ユーロ(624億米ドル)に達しました。しかし、2022年の610億ユーロ(656億9,000万米ドル)と比較すると、登録された収益は低いです。

- 連邦統計局(ドイツの連邦当局)によると、ドイツの住宅と非住宅建築物の建築許可件数は、住宅が110.7件、非住宅が2万6,000件に達しています。

- さらに、Eurostat(欧州委員会総局)によると、イタリアの建設収入は2025年までに約576億8,000万米ドルに達すると予想されています。

- インドの建設産業は、2025年までに1兆4,000億米ドルに成長すると予測されています。2030年までに推定6億人が都心部に住むようになり、その結果、中・超高級住宅がさらに2,500万戸必要となります。国家投資計画(NIP)のもと、インドには1兆4,000億米ドルのインフラ投資予算があり、その24%が再生可能エネルギー、道路・高速道路、都市インフラ、12%が鉄道に割り当てられています。

- インドでは、今後7年間で住宅に約1兆3,000億米ドルの投資が見込まれており、その間に6,000万戸の住宅が新たに建設される可能性があります。2024年には、手頃な価格の住宅の供給率が約70%上昇すると予想されています。アワス・ヨジャナ(グラミン)のもと、政府は受益者向けに2,950万戸の住宅建設を目指し、2024年12月までに295億戸が建設されます。

- したがって、このような産業の動向は、同時に建築・建設産業における鉄鋼需要を促進すると予想されます。

アジア太平洋が市場を独占する

- アジア太平洋は、中国やインドのような国々が大きな消費シェアを占めており、粗鋼産業で良好な成長を遂げています。

- 中国は世界最大の粗鋼生産国です。しかし、中国国家統計局によると、同国の粗鋼生産量は2023年12月に6,744万トンに達し、2023年11月の7,610万トンと比較すると低水準を記録しました。この鉄鋼生産の減少は、汚染レベルに関連する問題に取り組むために鉄鋼生産を削減する中国の施策変更によるものです。

- 中国における自動車セグメントの拡大は、粗鋼需要に恩恵をもたらすと予想されます。中国の自動車製造業は世界最大です。OICAによると、2023年の同国の自動車生産台数は3,016万台に達し、2022年の2,702万台に比べて約11.6%増加しました。

- さらに、中国の航空会社は今後20年間で約7690機、約1兆2,000億米ドルの航空機の新規購入を計画しており、粗鋼市場の需要をさらに高めると予想されます。

- インド自動車工業会の報告によると、2022年4月から2023年3月までのインドの自動車生産台数は2,593万1,867台で、2021年4月から2022年3月までの2,304万66台と比較して成長を記録しました。さらに、"Aatma Nirbhar Bharat "や"Make in India "プログラムといった政府の改革が自動車産業を後押しすると期待されています。

- IATA(国際航空運送協会)の報告書によると、インドは予測期間終了までに世界第3位の航空市場になる見込みです。同国では、今後20年間で2,100機の航空機需要が見込まれ、売上高は2,900億米ドルを超えると予測されています。こうした要因から、航空宇宙産業からの粗鋼需要は今後増加すると予想されます。

- さらに、粗鋼はインフラや住宅・商業構造物の建設に不可欠な基礎資材として建設産業と密接に結びついており、その需要は都市化、経済成長、建設プラクティスの技術進歩などの要因に影響されます。

- 鉄鋼は、太陽エネルギーを電力に変換する上で極めて重要です。鋼鉄は、太陽熱システム、ポンプ、容器、熱伝導装置の基礎となります。さらに、鉄柱は潮力発電システムの潮力発電機の主要な要素です。

- 韓国の第1一次電力基本計画では、2038年までに電力の70%を再生可能エネルギーで生産することを目指しています。

- したがって、上記のすべての要因は、今後数年間、調査対象市場の需要に大きな影響を与える可能性が高いです。

粗鋼産業概要

調査対象市場は細分化されており、市場参入企業間のシェア拡大のための競争は中程度に激しくなっています。市場の主要企業(順不同)には、China BaoWu Steel Group Corporation Limited、ArcelorMittal、Nippon Steel Corporation、HBIS Group、Shagang Groupなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 建築・建設産業からの需要増加

- 自動車生産の回復

- その他

- 抑制要因

- 天然資源の枯渇と代替品の入手可能性

- その他

- バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション

- 構成

- キルド鋼

- セミキルド鋼

- 製造プロセス

- 塩基性酸素炉(BOF)

- 電気アーク炉(EAF)

- エンドユーザー産業

- 建築・建設

- 輸送

- 工具と機械

- エネルギー

- 消費財

- その他

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧

- トルコ

- ロシア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- ナイジェリア

- カタール

- エジプト

- アラブ首長国連邦

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)分析

- 主要企業の戦略

- 企業プロファイル

- ArcelorMittal

- China Ansteel Group Corporation Limited

- China BaoWu Steel Group Corporation Limited

- China Steel Corporation(CSC)

- Fangda Special Steel Technology Co. Ltd

- HBIS Group

- Hyundai Steel

- JFE Steel Corporation

- JSW

- Nippon Steel Corporation

- NLMK(Novelipetsk Steel)

- Nucor Corporation

- POSCO

- Rizhao Steel Holding Group Co. Ltd

- Steel Authority of India Limited(SAIL)

- ShaGang Group Inc.

- Tata Steel Limited

- United States Steel Corporation

- Techint Group

- Hunan Valin Iron And Steel Group Co. Ltd

第7章 市場機会と今後の動向

- 成長するサーキュラー・エコノミーの動向

The Crude Steel Market size is estimated at 2.23 billion tons in 2025, and is expected to reach 2.83 billion tons by 2030, at a CAGR of 4.84% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. Owing to the pandemic, the global sales of all vehicles in 2020 declined. Still, the market recovered in 2021, thereby enhancing crude steel consumption in manufacturing different automotive parts. In 2021, the demand for oil steel increased due to increased demand in various industries such as construction, tools and machinery, energy, transportation, and others.

Key Highlights

- Over the medium term, increasing demand from the building and construction industry and recovering automotive production due to rapid electric vehicle growth are likely to drive the market's growth.

- On the flip side, the depletion of natural resources due to the production of steel and the availability of substitutes are expected to hinder the market's growth.

- The growing trend of a circular economy, where steel is touted to make a significant contribution through its recovery, reuse, remanufacturing, and recycling, is likely to act as an opportunity for the market studied.

- Asia-Pacific is expected to dominate the market, with the most significant consumption from countries such as China and India.

Crude Steel Market Trends

Increasing Demand from the Building and Construction Industry

- Steel and its alloys are among the most common metals used worldwide in the construction industry. Steel is also used on roofs and as cladding for exterior walls. Products such as roofing, purlins, internal walls, ceilings, cladding, and insulating panels for exterior walls are made of steel.

- According to the United Nations (UN), around 50% of the global population resides in urban cities, which is projected to touch 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for commercial, residential, and institutional construction activities.

- China's construction industry is the largest in the world. According to the National Bureau of Statistics of China, the construction industry's business activity index (BASI) rose from 55.9 in November 2023 to 56.9 in December 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- Similarly, in Germany, revenue in housing construction reached EUR 57.95 billion (USD 62.40 billion) in 2023. However, the revenue registered was low when compared to EUR 61 billion (USD 65.69 billion) in 2022.

- According to the Federal Statistical Office (a federal authority of Germany), the number of building permits for residential and non-residential buildings in Germany has reached 110.7 for residential and 26 thousand for non-residential buildings, respectively.

- Furthermore, as per Eurostat (a directorate-general of the European Commission), it is anticipated that the construction revenue in Italy will reach around USD 57.68 billion by the year 2025.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- India is expected to witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it may witness the construction of 60 million new homes. The availability rate of affordable housing is expected to rise by around 70% in 2024. Under the PM Awas Yojana (Gramin), the government aims to build 29.5 million houses for beneficiaries, with 2.95 crore houses built by December 2024.

- Therefore, such industry trends are expected to simultaneously drive the demand for steel in the building and construction industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific has experienced favorable growth in the crude steel industry, with countries like China and India holding significant consumption shares.

- China is the largest producer of crude steel globally. However, according to the National Bureau of Statistics of China, the crude steel production in the country reached 67.44 million metric tons in December 2023 and registered low production when compared to 76.1 million metric tons in November 2023. This decline in steel production was due to policy changes in China that reduced steel output to tackle problems related to pollution levels.

- The expansion of the automotive segment in China is anticipated to benefit the demand for crude steel. The Chinese automotive manufacturing industry is the largest in the world. According to OICA, in 2023, automotive production in the country reached 30.16 million units, which increased by about 11.6%, compared to 27.02 million vehicles produced in 2022.

- Moreover, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, further expected to raise the market demand for crude steel.

- As per the reports by the Society of Indian Automobile Manufacturers, India produced 25,931,867 vehicles from April 2022 to March 2023 and registered growth when compared with 23,040,066 units from April 2021 to March 2022. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are expected to boost the automotive industry.

- According to the IATA (International Air Transport Association) report, India is poised to become the third-largest global aviation market by the end of the forecast period. The country is projected to have a demand for 2,100 aircraft over the next two decades, accounting for over USD 290 billion in sales. Due to these factors, the demand for crude steel from the aerospace industry is expected to rise in the future.

- Furthermore, crude steel is closely tied to the construction industry as a fundamental material essential for building infrastructure and residential and commercial structures, with its demand influenced by factors such as urbanization, economic growth, and technological advancements in construction practices.

- Steel is crucial in transforming solar energy into electrical power. It serves as the foundation for solar thermal systems, pumps, containers, and heat transfer devices. Additionally, a steel column is the primary element of a tidal generator in tidal power systems.

- South Korea aims to produce 70% of its electricity using renewable sources by 2038, a significant increase from the current figure of less than 40% in 2023, as outlined in the nation's 11th Basic Electricity Plan.

- Therefore, all the factors mentioned above are likely to significantly impact the demand in the market studied in the years to come.

Crude Steel Industry Overview

The market studied is fragmented, with moderately high competition among the market players to increase their shares. Some of the key companies in the market (not in any particular order) include China BaoWu Steel Group Corporation Limited, ArcelorMittal, Nippon Steel Corporation, HBIS Group, and Shagang Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Building and Construction Industry

- 4.1.2 Recovering Automotive Production

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Depleting Natural Resources and Availability of Substitutes

- 4.2.2 Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Composition

- 5.1.1 Killed Steel

- 5.1.2 Semi-killed Steel

- 5.2 Manufacturing Process

- 5.2.1 Basic Oxygen Furnace (BOF)

- 5.2.2 Electric Arc Furnace (EAF)

- 5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Transportation

- 5.3.3 Tools and Machinery

- 5.3.4 Energy

- 5.3.5 Consumer Goods

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 China Ansteel Group Corporation Limited

- 6.4.3 China BaoWu Steel Group Corporation Limited

- 6.4.4 China Steel Corporation (CSC)

- 6.4.5 Fangda Special Steel Technology Co. Ltd

- 6.4.6 HBIS Group

- 6.4.7 Hyundai Steel

- 6.4.8 JFE Steel Corporation

- 6.4.9 JSW

- 6.4.10 Nippon Steel Corporation

- 6.4.11 NLMK (Novelipetsk Steel)

- 6.4.12 Nucor Corporation

- 6.4.13 POSCO

- 6.4.14 Rizhao Steel Holding Group Co. Ltd

- 6.4.15 Steel Authority of India Limited (SAIL)

- 6.4.16 ShaGang Group Inc.

- 6.4.17 Tata Steel Limited

- 6.4.18 United States Steel Corporation

- 6.4.19 Techint Group

- 6.4.20 Hunan Valin Iron And Steel Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends of Circular Economy