|

市場調査レポート

商品コード

1439785

ラテラルフローアッセイ:市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Lateral Flow Assay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ラテラルフローアッセイ:市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 139 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

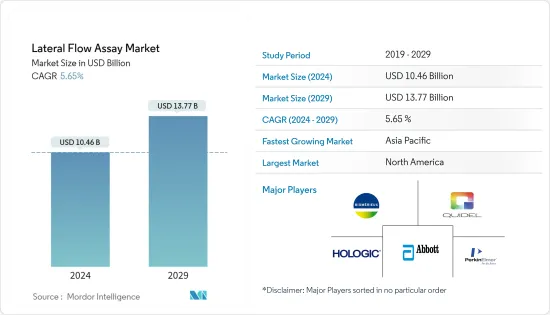

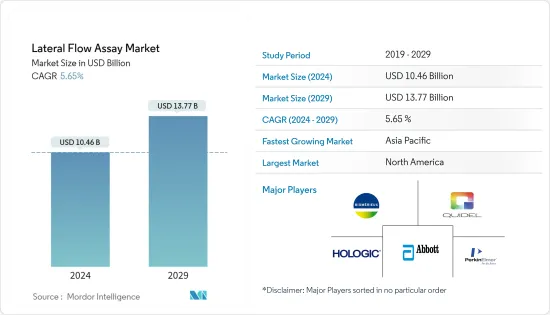

ラテラルフローアッセイの市場規模は、2024年に104億6,000万米ドルと推定され、2029年には137億7,000万米ドルに達すると予測され、予測期間中(2024~2029年)のCAGRは5.65%で成長する見込みです。

COVID-19パンデミックは市場に好影響を与えました。患者サンプルを検査室に送る代わりに、ラテラルフロー検査キットを使用すれば、小型で持ち運びができ、最小限のトレーニングで管理できるので便利です。このため、ヘルスケア施設外や中低所得国、あるいは集団スクリーニング・プログラムを展開する国にとって、魅力的な検査キットとなります。PCR検査より精度が劣るとはいえ、低コスト、迅速性、使いやすさから、COVID-19スクリーニングのためのPCR検査を容易に実施できる大規模な検査施設や訓練を受けた医療従事者がいない国にとって、ラテラルフロー検査は特に魅力的です。スロバキアや英国など一部の国では、集団スクリーニング・プログラムの手段としてラテラルフロー検査を広く使用しています。例えば、英国政府は、現在COVID-19の検出率が高いリバプールにおいて、Innova SARS-CoV-2 Antigen Rapid Qualitative Testの使用を監視しており、全国的に展開する予定です。

ラテラルフローアッセイ市場の成長を促進する主な要因は、世界中で感染症、HIV、がんの発生率が増加していることであり、死亡率の増加に歯止めをかけるために、効果的な治療の新しい診断方法が必要とされています。例えば、HIV/AIDSに関する世界保健機関(WHO)の2021年11月の報告書によると、2020年には世界中で約3,770万人がHIVとともに生活しており、そのうち2,540万人がWHOアフリカ地域に居住していました。同報告書によると、2020年には世界中で約150万人がHIVに感染していると診断されています。このように、HIVの有病率の高さは、HIVの効率的かつ早期診断のための効果的で精密な診断検査に対する需要を促進すると予想され、正確な診断を提供することから市場成長の原動力となると予想されます。

さらに、ラテラルフローアッセイ(LFA)分野の技術進歩も市場成長を後押ししています。近年、LFA開発における主な進歩には、新規シグナル増強技術、新規ラベルの使用、定量システムの改良、同時検出などが含まれます。いくつかの新しい技術は、金ナノ粒子(コロイド状ナノ粒子)からのシグナルを増強するために使用されてきました。技術の進歩に伴い、GNPは銀の増強技術や、GNPと酵素(西洋ワサビペルオキシダーゼなど)の組み合わせを採用し、その結果、シグナルが触媒的に増幅されるようになった。例えば、Novacytは2021年6月、PathFlow COVID-19 Rapid Antigen ProとPathFlow COVID-19 Rapid Antigenと呼ばれる2つのCOVID-19抗原ラテラルフローテストを発売しました。

さらに、感染症の発生を抑制するための政府の関与の増加、感染症の蔓延、診断、予防に関する啓発プログラムの増加、在宅医療現場での診断システムの発売などが、予測期間中の世界市場の成長に寄与すると予想されます。しかし、厳しい規制政策による製品承認の遅れや、検査結果の誤認などの要因が、予測期間中の調査対象市場の成長を阻害すると予想されます。

ラテラルフローアッセイ市場動向

臨床検査セグメントがラテラルフローアッセイ市場で最大の市場シェアを占める見込み

ラテラルフローアッセイ市場は、疾患の同定・検出におけるその重要性から、臨床検査セグメントが最大の市場シェアを占めると予測されています。感染症やその他の病状の発生率の上昇に伴い、これらのアッセイに対する需要は増加し、同分野の成長を牽引すると予想されています。例えば、世界保健機関(WHO)の「Global Tuberculosis Report 2020」によると、2019年には約140万人が結核関連疾患で死亡し、約1,000万人が結核を発症しました。したがって、結核の負担の増大は、特に新興諸国において、迅速で手頃な価格の診断薬の必要性を促進し、調査対象市場の成長を助長すると予想されます。

同分野の需要増加は、近年開発されたAtomo HIV Self-Test、TRUSTline HIV-Ab/Ag 4th Gen Rapid Test、Dr Trust Hiv Sureなどの自己検査装置の新規承認が増加したことによります。これらの自己検査装置やキットは、患者の確実な診断、早期診断、利便性の向上、使いやすさなどに役立ち、市場を活性化させる可能性が高いです。

さらに、COVID-19の大流行により、臨床検査分野での発売や研究が飛躍的に増加し、同分野の成長を後押ししています。例えば、2020年9月、RocheはCEマークを受け入れる市場向けにSARS-CoV-2迅速抗原検査を発売しました。SARS-CoV-2 Rapid Antigen Testは、有症状者、無症状者ともにポイントオブケアで使用できます。

北米が市場を独占、予測期間中も同様と予想

北米は、ライム病や結核などの様々な感染症や慢性疾患の罹患率の上昇、HIV/AIDSに関連した死亡率の増加により、予測期間を通じてラテラルフローアッセイ市場全体を支配すると予想されます。北米では、患者数が多く、可処分所得の増加に伴い価格も手ごろであることから、米国が最大の市場シェアを占めると予想されます。

2020年1月に発表された米国保健社会福祉省の報告書によると、米国では2018年に約3万7,832人がHIVと診断され、現在も3万8,000人が新たにHIVに感染しています。また、髄膜炎や尿路感染症など様々な感染症が急速に蔓延しており、早急な診断が必要であることも報告されているため、迅速診断検査機器の需要が高まり、市場成長の原動力となっています。さらに、先進的なインフラの導入率の増加、診断センター数の増加、人々の意識の高まりが同地域の市場を押し上げ、予測期間中の世界市場収益と予測における同地域の傑出したシェアに貢献していると推計されます。

さらに、パンデミックは同地域に大きな打撃を与え、政府は集団検診プログラムの実施を余儀なくされ、同地域の市場成長を後押ししています。2020年、Abbott Laboratoriesは、COVID-19の大量スクリーニングを可能にする新しいツールを含むコロナウイルス検査キットの生産を増強しました。同社は、コロナウイルスの4番目の診断検査を開発中であることを発表しました:「ラテラルフロー」血液検査は、一般集団への大量検査を可能にし、この地域の市場にプラスの影響を与えることが期待されます。

ラテラルフローアッセイ産業概要

ラテラルフローアッセイ市場の競争は激しく、複数の大手企業が参入しています。M&Aなどさまざまな戦略を採用して市場ポジションを拡大している企業もあれば、診断のための新たな検査法を開発したり、新製品を投入したりして市場シェアを維持している企業もあります。例えば、2019年2月、Abbottは最新のインフルエンザ迅速診断検査(RIDT)であるBinaxNOW Influenza A &B Card 2の発売を発表しましたが、この検査は米国食品医薬品局(FDA)によるインフルエンザウイルスの迅速検出のための臨床検査改善法(CLIA)の下で認可され、市場にプラスの影響を与えています。現在市場を独占している企業には、Abbott Laboratories、Hologic Inc.、Quidel Corporation、PerkinElmer Inc.、bioMerieux SAなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 技術の進歩に伴うポイントオブケア検査需要の増加

- 世界の感染症流行に伴う家庭用機器の導入増加

- 市場抑制要因

- 製品の承認を遅らせる厳しく面倒な規制の枠組み

- 新興国の人々における偽結果のリスクと製品への消極性

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 用途

- 臨床検査

- 妊娠検査

- インフルエンザ検査

- 結核検査

- Dダイマー検査

- その他の臨床検査

- 薬物乱用検査

- その他の用途

- 臨床検査

- 検査方法

- サンドイッチアッセイ

- 競合アッセイ

- マルチプレックスアッセイ

- 製品

- ラテラルフローリーダー

- デジタル/モバイルリーダー

- ベンチトップリーダー

- キットと試薬

- ラテラルフローリーダー

- エンドユーザー

- ホームケア

- 病院・クリニック

- その他のエンドユーザー

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- PerkinElmer Inc.

- Merck KGaA

- QIAGEN NV

- Abbott Laboratories(Alere Inc.)

- Quidel Corporation

- Hologic Inc.

- Thermo Fisher Scientific Inc.

- bioMerieux SA

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Abcam PLC

- Danaher Corporation

- F.Hoffmann-La Roche AG

- Siemens AG

- Chembio Diagnostic Systems Inc.

第7章 市場機会と今後の動向

The Lateral Flow Assay Market size is estimated at USD 10.46 billion in 2024, and is expected to reach USD 13.77 billion by 2029, growing at a CAGR of 5.65% during the forecast period (2024-2029).

The COVID-19 pandemic had a positive impact on the market. Instead of sending patient samples to the laboratory, the usage of lateral flow test kits can be convenient as they are smaller, portable, and can be controlled with minimal training. This makes them attractive for deployment outside of healthcare facilities, in low- and middle-income countries, or for countries rolling out mass population screening programs. Even though they are less accurate than PCR tests, their low cost, speed, and ease of use make lateral flow tests particularly attractive to countries that do not have extensive laboratory facilities or trained health workers to easily conduct PCR tests for COVID-19 screening. Some countries, such as Slovakia and the United Kingdom, are extensively using lateral flow tests as a means of mass screening programs. For example, the British government has been monitoring the use of the Innova SARS-CoV-2 Antigen Rapid Qualitative Test in Liverpool, which currently has high COVID-19 rates, and it plans to roll it out nationwide.

The major factor driving the growth of the lateral flow assay market is the growing global rate of infectious diseases, HIV, and cancer around the world, which require new diagnostic methods of effective treatment to end the growing mortality rate. For instance, according to the November 2021 report of the World Health Organization (WHO) on HIV/AIDS, about 37.7 million people around the world were living with HIV in 2020, of which 25.4 million were residing in the WHO African region. As per the same report, in 2020, about 1.5 million people were diagnosed with HIV around the world. Thus, the high prevalence of HIV is expected to drive the demand for effective and precise diagnostics tests for the efficient and early diagnostics of HIV, which is anticipated to drive the market growth as they provide accurate diagnostics.

Further, technological advancements in the field of lateral flow assays (LFA) have also boosted the market growth. In recent years, major advances in LFA development have included novel signal enhancement techniques, the use of new labels, improved quantification systems, and simultaneous detection. Some new techniques have been used to enhance the signal from gold nanoparticles (colloidal nanoparticles). With the advancement in technology, GNPs have adopted silver enhancement technology or combinations of GNPs with an enzyme (such as horseradish peroxidase), which results in catalytic amplification of the signal. For instance, in June 2021, Novacyt launched two COVID-19 antigen lateral flow tests called PathFlow COVID-19 Rapid Antigen Pro and PathFlow COVID-19 Rapid Antigen.

Additionally, increased participation of the government to control the outbreaks of infectious diseases and the increasing awareness programs about the spread of infections, diagnosis, and prevention, along with the launch of diagnosis systems at home care settings, are expected to contribute to the growth of the global market during the forecast period. However, factors such as delays in product approvals due to stringent regulatory policies and false results from the test are expected to impede the growth of the studied market over the forecast period.

Lateral Flow Assays Market Trends

The Clinical Testing Segment is Expected to Hold the Largest Market Share in the Lateral Flow Assay Market

The clinical testing segment is anticipated to hold the largest market share in the lateral flow assay market due to its importance in the identification and detection of diseases. With the rise in the incidence of infectious diseases and other medical conditions, the demand for these assays is expected to increase, driving the segment's growth. For instance, according to the World Health Organization, Global Tuberculosis Report 2020, approximately 1.4 million people died from tuberculosis-related illnesses in 2019, and nearly 10 million individuals developed tuberculosis in 2019. Hence, the growing burden of tuberculosis is expected to drive the need for rapid and affordable diagnostics, especially in developing countries, which aids in the growth of the studied market.

The increased demand for the segment is due to an increase in the new approvals of self-test devices, such as Atomo HIV Self-Test, TRUSTline HIV-Ab/Ag 4th Gen Rapid Test, Dr Trust Hiv Sure, and others, developed in recent years. These self-test devices and kits help the patients in assurance, earlier diagnosis, enhanced convenience, and ease of use, which are likely to fuel the market.

Further, the COVID-19 pandemic has drastically increased launches and research in the field of clinical testing, bolstering the segment growth. For instance, in September 2020, Roche launched a SARS-CoV-2 Rapid Antigen Test for markets accepting the CE Mark. The SARS-CoV-2 Rapid Antigen Test is for use in point-of-care settings for both symptomatic and asymptomatic people.

North America Dominates the Market, and It is Expected to do the Same During the Forecast Period

North America is expected to dominate the overall lateral flow assay market throughout the forecast period, owing to a rise in the incidence of various infectious and chronic diseases, such as Lyme disease and tuberculosis, and an increased mortality rate associated with HIV/AIDS in the region. In North America, the United States is anticipated to hold the largest market share due to the presence of a high patient pool and affordability with increasing disposable income.

As per the United States Department of Health & Human Services report, published in January 2020, about 37,832 people in the United States were diagnosed with HIV in 2018, and 38,000 new HIV infections still occur in the United States. It has also been reported that there is a rapid spread of various infectious diseases such as meningitis and urinary tract infections, necessitating immediate diagnosis, thereby increasing the demand for fast diagnostic test devices and fueling the market growth. Furthermore, the increased adoption rate of advanced infrastructure, the volume of diagnostic centers, and the rise in awareness among people are estimated to boost the market in the region, contributing to its outstanding share of the global market revenue during the forecast period.

Furthermore, the pandemic hit the region very hard and forced the government to implement mass screening programs, boosting the market growth in the region. In 2020, Abbott Laboratories ramped up its production of coronavirus test kits, including a new tool that could enable mass COVID-19 screening. The company has announced that it is developing the fourth diagnostic test for the coronavirus: A 'lateral flow' blood test that could provide mass testing to the general population, which is further expected to positively impact the market in the region.

Lateral Flow Assays Industry Overview

The lateral flow assay market is moderately competitive and consists of several major players. Some of the companies are expanding their market positions by adopting various strategies, such as mergers and acquisitions, while others are developing new test methods for diagnosis and introducing new products to retain their market shares. For instance, in February 2019, Abbott announced the availability of its latest rapid influenza diagnostic test (RIDT), BinaxNOW Influenza A & B Card 2, which was granted under the Clinical Laboratory Improvements Amendments (CLIA) by the United States Food and Drug Administration (FDA) for rapid detection of influenza virus, positively impacting the market. Some of the companies currently dominating the market are Abbott Laboratories, Hologic Inc., Quidel Corporation, PerkinElmer Inc., and bioMerieux SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Point-of-care Testing with Technological Advancements

- 4.2.2 Rise in Adoption of Home-based Devices, along with Global Incidence of Infectious Diseases

- 4.3 Market Restraints

- 4.3.1 Stringent and Tedious Regulatory Framework that Delays the Approval of Products

- 4.3.2 Risk of False Results and Reluctance Toward these Products among the People in Emerging Nations

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Application

- 5.1.1 Clinical Testing

- 5.1.1.1 Pregnancy Testing

- 5.1.1.2 Influenza Testing

- 5.1.1.3 Tuberculosis

- 5.1.1.4 D-Dimer Testing

- 5.1.1.5 Other Clinical Testings

- 5.1.2 Drug Abuse Testing

- 5.1.3 Other Applications

- 5.1.1 Clinical Testing

- 5.2 Technique

- 5.2.1 Sandwich Assay

- 5.2.2 Competitive Assay

- 5.2.3 Multiplex Assay

- 5.3 Product

- 5.3.1 Lateral Flow Readers

- 5.3.1.1 Digital/Mobile Readers

- 5.3.1.2 Benchtop Readers

- 5.3.2 Kits and Reagents

- 5.3.1 Lateral Flow Readers

- 5.4 End User

- 5.4.1 Home Care

- 5.4.2 Hospitals and Clinics

- 5.4.3 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PerkinElmer Inc.

- 6.1.2 Merck KGaA

- 6.1.3 QIAGEN NV

- 6.1.4 Abbott Laboratories (Alere Inc.)

- 6.1.5 Quidel Corporation

- 6.1.6 Hologic Inc.

- 6.1.7 Thermo Fisher Scientific Inc.

- 6.1.8 bioMerieux SA

- 6.1.9 Becton, Dickinson and Company

- 6.1.10 Bio-Rad Laboratories Inc.

- 6.1.11 Abcam PLC

- 6.1.12 Danaher Corporation

- 6.1.13 F. Hoffmann-La Roche AG

- 6.1.14 Siemens AG

- 6.1.15 Chembio Diagnostic Systems Inc.