|

市場調査レポート

商品コード

1439732

航空宇宙用フォーム:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Aerospace Foams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空宇宙用フォーム:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

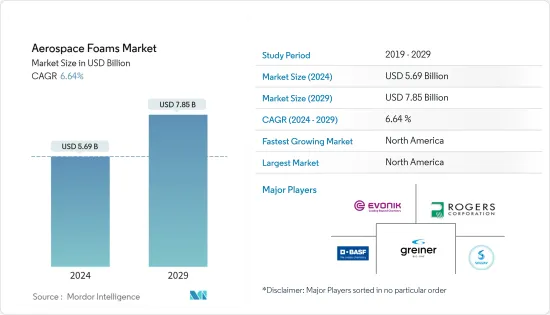

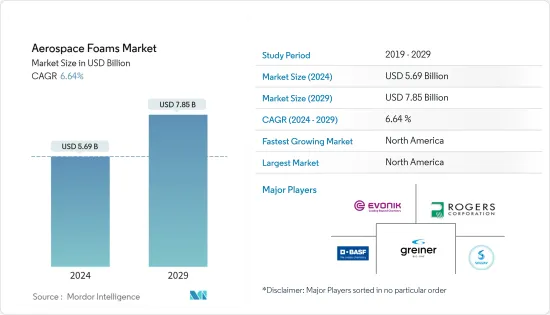

航空宇宙用フォーム市場規模は、2024年に56億9,000万米ドルと推定され、2029年までに78億5,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に6.64%のCAGRで成長します。

主なハイライト

- 2020年、市場はCOVID-19による悪影響を受けました。パンデミックの影響で旅客需要が低迷したため、それに伴う渡航制限と景気後退により、航空会社はコスト削減の方法を模索する必要に迫られました。航空機発注の中止や延期などのコスト削減策が実施されました。しかし、2021年と2022年に制限が解除されるとすぐに旅行が増加し、これにより航空貨物の需要が増加しました。

- 短期的には、調査対象の市場を推進する主な要因は、軽量で燃料効率の高い航空機に対する需要の増加です。ポリウレタン(PU)フォームの製造は依然として石油への依存度が高く、これが市場の抑制要因となっています。

- バイオベースのポリウレタンフォーム製造への動向の増加は、予測期間中に市場にとって機会となる可能性があります。予測期間中、北米が市場を独占すると予想されます。

航空宇宙用フォーム市場動向

民間航空からの需要の増加

- 燃料価格変動の減少と運航効率の向上が、過去数年間の民間航空機運航の成長を支えてきました。主にアジア太平洋と南米の新興経済国での航空旅行料金の上昇と、世界中での可処分所得の増加が、世界の航空機保有数の増加を推進しています。

- 乗客数の増加と退職者の増加により、今後20年間で6兆8,000億米ドルに相当する44,040機の新しいジェット機の必要性が高まると予想されます。世界中の商用航空機は、すべての新しい航空機とジェット機が運航を続けることを考慮すると、2038年までに50,660機に達すると予想されます。

- さらに、ボーイング商業市場見通し2022-2041によると、2031年までに航空機は年率2.6%で商用機材を増加させ、運航機数は35,400機に達し、2041年までにこの数は47,080機に達し、年間の割合で2019年から2041年の期間では2.8%。

- さらに、2022年から2041年までのラテンアメリカにおける民間航空機への新規航空機納入は、納入総数に占める割合が5%、中東が7%、北米が23%、アジアが21%、欧州が21%となります。

- 前述のすべての要因により、今後数年間でこれらの航空機の製造中に航空宇宙用フォームの需要が高まり、それによって調査対象の市場が拡大すると予想されます。

北米が市場を独占する

- 北米は航空宇宙産業にとって世界最大の市場です。北米の航空宇宙メーカーは、最近の地域での航空乗客数の増加と軍事支出の増加を理由に、事業を拡大すると予想されています。

- 米国は北米最大の航空市場であり、世界最大級の航空機規模を有しています。したがって、航空宇宙用フォームの最大の市場の1つです。連邦航空局(FAA)によると、航空貨物の増加により、民間航空機の総保有数は2037年に8,270機に達すると予想されています。また、米国のメインライナー空母艦隊は、既存の艦隊が老朽化しているため、年間54機の割合で増加すると予想されています。

- 2022年国防予算で、米国政府は国防プログラムに7,682億米ドルを認めたが、これはバイデン政権の当初予算要求より約2%増加し、この分野で航空宇宙材料の使用が増加していることを示しています。

- ボーイングの商業見通し2022-2041によると、北米では航空旅行の13%がビジネス目的、50%がレジャー、37%が友人や親戚を訪問するために行われています。

- さらに、報告書によると、北米の貨物輸送量は2022年から2041年にかけて3分の1増加すると推定されています。この地域の商用サービスに対する市場需要は他の地域に比べて最も高く、その総額は1兆450億米ドルに達します。

- 世界的には、カナダは民間飛行シミュレーションで第1位、民間エンジンの生産で第3位、民間航空機の生産で第4位にランクされています。すべての主要カテゴリーの中で全国的に唯一トップ5にランクインしています。カナダの航空宇宙産業は、製品の70%以上を6大陸の190以上の国に輸出しています。

- メキシコでは、ボラリスは格安航空会社の1つであり、パンデミック前の状況と比較して、2021年 7月に国内旅行の旅客流入が23%、国際線で10%増加しました。ボラリス航空はエアバス機3機とさらに数機を発注し、98機で年末を迎えると報じられています。

- これらすべての要因により、航空宇宙用フォームの需要は、予測期間中にこの地域で増加すると予測されています。

航空宇宙用フォーム業界の概要

航空宇宙用フォーム市場は、トップレベルのプレーヤーの間で部分的に統合されています。主要企業には、Greiner Aerospace、BASF SE、Evonik Industries AG、Rogers Corporation、およびSolvayが含まれます(順不同)。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 軽量かつ燃費の良い航空機への需要の高まり

- 航空宇宙産業の着実な成長

- その他の 促進要因

- 抑制要因

- PUフォームの使用に関する厳しい規制

- その他の拘束具

- 業界のバリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替製品やサービスの脅威

- 競合の程度

第5章 市場セグメンテーション(金額ベースの市場規模)

- タイプ

- ポリウレタン

- ポリイミド

- 金属発泡体

- メラミン

- ポリエチレン

- その他のタイプ

- 用途

- 民間航空

- 軍用航空

- ビジネスおよび一般航空

- 地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- サウジアラビア

- 南アフリカ

- その他の中東およびアフリカ

- アジア太平洋地域

第6章 競合情勢

- 合併と買収、合弁事業、コラボレーション、および契約

- 市場ランキング分析

- 有力企業が採用した戦略

- 企業プロファイル

- 3A Composites

- Aerofoam Industries, LLC

- ARMACELL

- BASF SE

- Boyd

- Diab Group

- DuPont

- ERG Aerospace Corporation

- Evonik Industries AG

- General Plastics Manufacturing Company

- Grand Rapids Foam Technologies

- Greiner Aerospace

- Rogers Corporation

- Technifab, Inc.

- UFP Technologies, Inc.

- Zotefoams plc

- Recticel NV/SA

第7章 市場機会と将来の動向

- バイオベースのPUフォーム製造への動向が高まる

- その他の機会

目次

Product Code: 67705

The Aerospace Foams Market size is estimated at USD 5.69 billion in 2024, and is expected to reach USD 7.85 billion by 2029, growing at a CAGR of 6.64% during the forecast period (2024-2029).

Key Highlights

- The market was negatively impacted by COVID-19 in the year 2020. As passenger demand was low because of the pandemic, the corresponding travel restrictions and the economic recession forced airlines to find ways to cut costs. Cost-cutting measures such as the cancellation or postponement of aircraft orders were carried out. However, traveling increased as soon as the restrictions were picked up in the years 2021 and 2022, and this has increased the demand for air freights.

- Over the short term, the major factor driving the market studied is the increasing demand for lightweight and fuel-efficient aircraft. The production of polyurethane (PU) foam is still highly petroleum-dependent, and this acts as a restraint for the market.

- Increasing trends toward bio-based polyurethane foam manufacturing may act as an opportunity for the market during the forecast period. North America is expected to dominate the market over the forecast period.

Aerospace Foams Market Trends

Increasing Demand from Commercial Aviation

- The decreasing fuel price fluctuations and the increasing operational efficiencies have supported the growth of commercial aircraft operations in the past few years. The increasing air travel rates, majorly in emerging economies in Asia-Pacific and South America, along with increasing disposable incomes around the world, have been driving the growth in the aircraft fleet globally.

- The increasing volumes of passengers and the increasing retirements are expected to drive the need for 44,040 new jets, valued at USD 6.8 trillion, over the next two decades. The global commercial fleet is expected to reach 50,660 airplanes by 2038, with all the new airplanes and jets would remaining in service considered.

- Additionally, according to the Boeing Commercial Market Outlook 2022-2041, by 2031, airplanes will grow their commercial fleet with an annual rate of 2.6% and reach 35,400 airplanes in service, and by 2041 this number will reach 47,080, representing an annual rate of 2.8% over the 2019-2041 period.

- Further, new airplane deliveries for commercial fleet from 2022-2041 in Latin America will be 5%, Middle East 7%, North America 23%, Asia 21%, and Europe 21% out of the total deliveries.

- All the aforementioned factors are expected to enhance the demand for aerospace foams during the manufacture of these aircraft in the coming years, thereby boosting the market studied.

North America to Dominate the Market

- North America is the largest market for the aerospace industry across the world. Aerospace manufacturers in North America are expected to expand their operations on account of the rising number of air passengers and increasing military expenditure in the region in recent times.

- The United States is the largest aviation market in North America and has one of the largest fleet sizes in the world; hence, it is one of the largest markets for aerospace foams. According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 in 2037, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow at a rate of 54 aircraft per year due to the existing fleet getting older.

- In the 2022 defense budget, the United States government allowed USD 768.2 billion for national defense programs, which is about a 2% increase from the Biden administration's original budget request, registering a growing usage of aerospace materials in the sector.

- According to the Boeing Commercial Outlook 2022-2041, in North America, 13% of travel by air is done for business purposes, 50% for leisure, and 37% for visiting friends and relatives.

- Further, according to the report, the North American freight fleet is estimated to grow by one-third from 2022-2041. The market demand for commercial services in the region is highest as compared to other regions, with a total value of USD 1,045 billion.

- Globally, Canada ranks first in civil flight simulation, third in civil engine production, and fourth in civil aircraft production. It is the only nationally ranked in the top five of all the key categories. The Canadian aerospace industry exports over 70% of its products to over 190 countries across six continents.

- In Mexico, Volaris is one of the low-cost airlines, which witnessed a 23% growth in passenger influx of domestic travel and 10% in international flights during July 2021 compared to the pre-pandemic situation. Volaris airlines were reported to order three Airbus aircraft and some more to close the year with 98 aircraft.

- Owing to all these factors, the demand for aerospace foams is projected to grow in the region during the forecast period.

Aerospace Foams Industry Overview

The aerospace foams market is partially consolidated among the top-level players. The major companies include (not in any particular order) Greiner Aerospace, BASF SE, Evonik Industries AG, Rogers Corporation, and Solvay.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight and Fuel-efficient Aircraft

- 4.1.2 Steady Growth in the Aerospace Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Regarding the Use of PU Foams

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyurethane

- 5.1.2 Polyimide

- 5.1.3 Metal Foams

- 5.1.4 Melamine

- 5.1.5 Polyethylene

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Commercial Aviation

- 5.2.2 Military Aviation

- 5.2.3 Business and General Aviation

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3A Composites

- 6.4.2 Aerofoam Industries, LLC

- 6.4.3 ARMACELL

- 6.4.4 BASF SE

- 6.4.5 Boyd

- 6.4.6 Diab Group

- 6.4.7 DuPont

- 6.4.8 ERG Aerospace Corporation

- 6.4.9 Evonik Industries AG

- 6.4.10 General Plastics Manufacturing Company

- 6.4.11 Grand Rapids Foam Technologies

- 6.4.12 Greiner Aerospace

- 6.4.13 Rogers Corporation

- 6.4.14 Technifab, Inc.

- 6.4.15 UFP Technologies, Inc.

- 6.4.16 Zotefoams plc

- 6.4.17 Recticel NV/SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Trends toward Bio-based PU Foam Manufacturing

- 7.2 Other Opportunities