|

市場調査レポート

商品コード

1910943

人工知能:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 人工知能:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 175 Pages

納期: 2~3営業日

|

概要

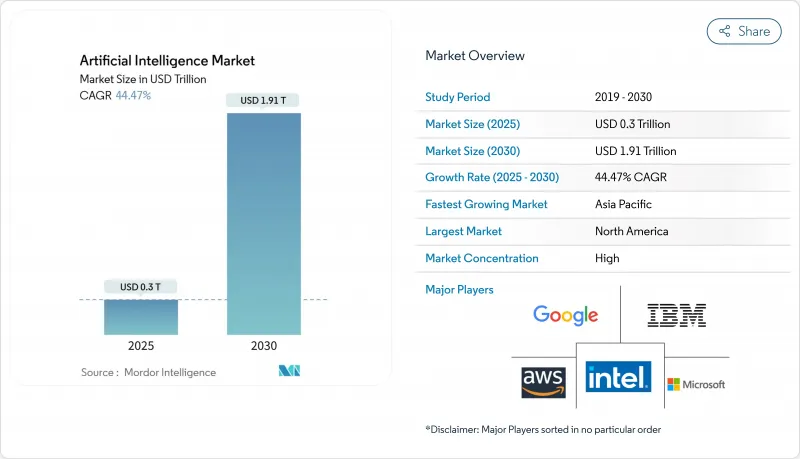

人工知能市場は、2025年の3,060億4,000万米ドルから2026年には4,344億2,000万米ドルへ成長し、2026年から2031年にかけてCAGR41.95%で推移し、2031年までに2兆5,031億3,000万米ドルに達すると予測されております。

主権型AIプログラム、企業のコスト最適化、そして急速なハードウェア革新により、この技術は実験的なパイロット段階から中核的な生産ワークフローへと移行しつつあり、あらゆる主要セクターで持続的な需要を促進しています。大企業は総所有コストとデータガバナンスを直接管理したいと考えているため、オンプレミス導入が再び注目を集めています。同時に、クラウドハイパースケーラーは新たな容量に多額の投資を行っており、開発環境への容易なアクセスを確保しています。GPUの進歩、エネルギー効率の高いアーキテクチャ、ハードウェアとソフトウェアスタック間の緊密な統合により、価値実現までの時間が短縮され、競争上の差別化が鮮明になっています。

世界の人工知能市場の動向と洞察

主権AIと国家計算プログラム

政府資金が地域エコシステムを形成しています。インドの「IndiaAI Mission」は、現地言語ニーズを満たす国産大規模言語モデルに10,372カロールインドルピー(1億2,450万米ドル)を投入しています。日本はAIと半導体能力に10兆円を動員し、自立への長期的なコミットメントを示しています。こうした投資は、ローカライゼーション規則に準拠できる国内ハードウェアベンダーやシステムインテグレーターにとって保護された需要を生み出します。

データ量と多様性の爆発的増加

産業用IoTの導入により、毎日テラバイト規模のセンサーデータが生成され、企業はAI駆動型分析の導入を迫られています。シーメンス社は、財務業務に機械学習を導入した結果、請求書処理の90%を非接触化するとともに、年間565万米ドルのROIを達成したと報告しています。医療画像、自動運転車、リアルタイム小売取引もデータ洪水に拍車をかけ、スケーラブルなストレージ、エッジ処理、合成データ生成ツールへの需要を高めています。

GPUと電力網供給のボトルネック

NVIDIAは2026年度見通しにおいて、H100の継続的な供給不足を指摘しました。この制約によりスポット価格はメーカー希望小売価格(MSRP)を30~50%上回り、企業の導入サイクルが遅延しています。電力会社は、データセンターの電力需要が2026年までに1,050テラワット時(TWh)に達する可能性があると予測しており、これは複数の主要地域で計画されている増設計画を上回る規模です。これにより、新たなAIクラスターのプロジェクトスケジュールに圧力がかかっています。

セグメント分析

ソフトウェアは2025年に61.35%の収益シェアを維持し、人工知能市場における基盤的役割を強化しました。しかしながら、企業が実験段階から本格的な導入へ重点を移す中、サービス分野は2031年までCAGR40.85%で急成長すると予測されています。規制産業の多くでは、単なるライセンシングではなく、コンプライアンス要件の解釈やワークフローの再設計が可能なベンダーが求められています。そのため、特に医療や金融サービス分野のドメイン特化型プロジェクトにおいて、有資格インテグレーターの不足がサービスプロバイダーの高価格設定を可能にしております。

コンサルティング、統合、マネージドサービス各分野において、垂直的専門性を有するベンダーが優先的に選ばれています。放射線医学分野では、データガバナンス、アルゴリズム検証、臨床医ワークフロー再設計を組み合わせたサービス提携により、病院グループは5年間で451%のROIを達成しています。ハードウェア、ソフトウェア、アドバイザリー支援を成果ベース契約にパッケージ化する専門企業は、顧客が抽象的なモデル精度ではなく具体的な生産性目標でプロジェクトを評価する中、バリューチェーンの上流へと移行しつつあります。

2025年時点で人工知能市場シェアの43.72%を占めたパブリッククラウドは、デフォルトの開発環境としての役割を反映しています。しかしながら、組織が本番環境におけるレイテンシ最適化とコスト可視性を求める中、ハイブリッドモデルは2031年までにCAGR45.55%で拡大すると予測されています。早期導入企業はハイパースケールクラスターでトレーニングを実行し、リアルタイム応答のために推論をオンプレミスまたはエッジデバイスにプッシュしています。自動車メーカーはこのアーキテクチャを、工場現場でミリ秒レベルのビジョンタスクを実行しつつ、モデル再トレーニングのためのクラウドの伸縮性を維持することで実証しています。

エッジ展開は、帯域幅が高額な海洋掘削装置や小売店舗など、リソース制約のある環境においても同様に重要です。データ居住に関する厳格な規制に直面する金融業界や公共機関では、オンプレミス導入が再び増加傾向にあります。ハードウェアサプライヤーは現在、ポリシールールに基づきコンテナをクラウド間、オンプレミスラック、エッジデバイス間で移行するオーケストレーションソフトウェアをバンドルしており、これによりハイブリッドソリューション向け人工知能市場の規模は上昇傾向を維持しています。

本AI市場レポートでは、業界を以下の区分で分析しております:コンポーネント別(ハードウェア、ソフトウェア、サービス)導入形態別(パブリッククラウド、オンプレミス、ハイブリッド)技術別(機械学習、深層学習、自然言語処理、コンピュータビジョン、生成AI、コンテキスト認識コンピューティング等)エンドユーザー産業(BFSI、IT・通信、医療・ライフサイエンス、製造など)、および地域別に分析しています。

地域別分析

北米は、豊富なベンチャーキャピタル、成熟したクラウドエコシステム、企業による急速な導入により、2025年においても37.12%のシェアで収益トップを維持しました。CHIPS and Science Actなどの連邦プログラムは、AI対応ファブへの追加資金を投入し、国内ハードウェア供給を支え、人工知能市場を強化しています。バージニア州、テキサス州、オレゴン州の高性能コンピューティングクラスターは、低遅延を実現するためクラウド利用可能ゾーン近くに拠点を構えるソフトウェアスタートアップを引き続き集めています。

欧州の成長特性は、厳格なデータプライバシー規制と大規模な政府コンピューティング予算という二つの要因によって形作られています。GDPR準拠のアーキテクチャはベンダーに対し、推論ワークロードを地域内へローカル化することを促し、オンプレミスGPUアプライアンスの需要を生み出しています。フランスの官民共同プロジェクト「Mistral AI」は2025年に20億ユーロの評価額を獲得し、多言語モデルトレーニングの拡大に向け10億米ドルの資金調達を目指しています。ドイツや北欧諸国における同様のプログラムは、野心的な炭素削減目標に沿ったグリーンデータセンターの設置に焦点を当てており、人工知能市場における二桁の地域成長を持続させています。

アジア太平洋地域は2031年までにCAGR40.75%を記録し、世界最速の成長が見込まれます。中国の国家半導体ミッションは2030年までにチップ及び関連インフラに1兆人民元を配分し、インドは国家AIコンピューティングに1037億2千万ルピーを割り当て、国内インテグレーターを世界ランキングに押し上げています。日本の数兆円規模の基金はファブ(半導体製造工場)のアップグレードを加速させ、緩やかなAI規制が商用展開までの時間を短縮します。シンガポールやマレーシアを含む東南アジア諸国は、ハイパースケーラーを地域ハブに誘致するデータセンター税制優遇措置を導入しており、これにより同地域の人工知能市場規模はさらに拡大します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 予測分析に対する需要の高まり

- データ量・多様性の爆発的増加

- クラウドベースAIサービスの急速な普及

- ソブリンAIおよび国家計算イニシアチブ

- TCO管理のためのオンプレミス/プライベートAIへの移行

- 省エネルギー型AIハードウェアの需要

- 市場抑制要因

- 高額な設備投資と人材不足

- データプライバシーとコンプライアンス上の障壁

- GPU/電力網供給のボトルネック

- データセンターの炭素排出量上限

- 重要な規制枠組みの評価

- バリューチェーン分析

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 主要利害関係者への影響評価

- 主要な使用事例と事例研究

- 市場のマクロ経済的要因への影響

- 投資分析

第5章 市場セグメンテーション

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- 展開モード別

- パブリッククラウド

- オンプレミス

- ハイブリッド

- 技術別

- 機械学習

- ディープラーニング

- 自然言語処理

- コンピュータビジョン

- 生成AI

- コンテキスト認識コンピューティングおよびその他

- エンドユーザー業界別

- BFSI

- IT・通信

- ヘルスケアおよびライフサイエンス

- 製造業

- 小売および電子商取引

- 自動車・輸送機器

- 政府および防衛

- エネルギー・公益事業

- メディアとエンターテイメント

- 建設

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧諸国

- その他欧州地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- その他アフリカ

- 中東

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- International Business Machines Corporation

- Intel Corporation

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- Amazon Web Services, Inc.(Amazon.com, Inc.)

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Cisco Systems, Inc.

- Siemens AG

- NVIDIA Corporation

- Hewlett Packard Enterprise Company

- Accenture plc

- Baidu, Inc.

- Alibaba Cloud(Intelligent Cloud Business of Alibaba Group Holding Limited)

- Palantir Technologies Inc.

- OpenAI, Inc.

- Meta Platforms, Inc.

- Huawei Technologies Co., Ltd.

- Tencent Holdings Limited

- ServiceNow, Inc.

- Snowflake Inc.