|

市場調査レポート

商品コード

1689721

自律走行列車:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Autonomous Train - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自律走行列車:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

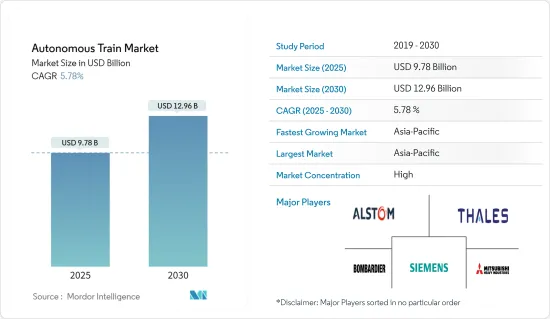

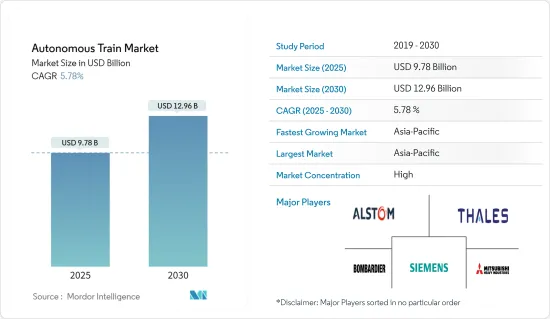

自律走行列車の市場規模は2025年に97億8,000万米ドルと推定され、予測期間中(2025~2030年)のCAGRは5.78%で、2030年には129億6,000万米ドルに達すると予測されます。

長期的には、輸送分野における電化の進展が自律走行列車市場に大きな成長をもたらすと思われます。輸送分野におけるモノのインターネット(IoT)の導入は、自律走行列車市場の主要な促進要因です。

主なハイライト

- 2023年3月、フランス国有鉄道SNCFは業界パートナーとともに、人工知能などの統合技術を搭載した自律走行列車2両の発売を発表しました。

- 市場の成長は、政府が鉄道の接続性を高めることに注力していることや、旧型車両を先進的な新世代車両に置き換えることに重点が置かれていることなど、その他の要因にも起因しています。

世界の新興経済諸国は、鉄道インフラ開発に多額の投資を行っています。世界各国の政府機関は、貨物・旅客輸送需要の増大に対応するため、鉄道接続の拡大に多額の投資を行ってきました。例えば、2023年末の中国の鉄道総延長は15万9,000kmで、2022年末の15万5,000kmから増加しています。

中国、米国、日本を含む先進国と新興国の主要政府はコネクテッド・モビリティへの投資を進めており、自律走行列車市場に大きな成長機会をもたらす可能性があります。予測期間中、アジア太平洋と北米が自律走行列車市場を独占すると予想されます。アジア太平洋は世界最大級の鉄道網を有しており、今後のプロジェクトによって大きな成長が期待されています。例えば

主なハイライト

- 2024年1月、CRRCはインドネシアに自律走行列車を導入する計画を発表し、2024年7月にIKNで展示される予定です。インドネシア政府は、インドネシアの新首都ヌサンタラ(Nusantara)またはIKNに同社の自律走行列車一式を使用するため、中国鉄路車両公司(CRRC)と協議を続けています。

こうした要因を考慮すると、同市場は今後飛躍的な成長が見込まれます。

自律走行列車市場の動向

地下鉄/モノレールが自律走行列車市場を独占

効率的で安全かつ手頃な交通手段に対する需要の高まりにより、地下鉄/モノレールが自律走行列車市場を独占しています。メトロ鉄道におけるGoA 4技術の浸透の高まりが、市場の成長を後押しする可能性が高いです。GoA 4は無人列車運転(UTO)であり、発車や停止、ドアの操作、緊急事態への対応などの活動が、列車内のスタッフなしで完全に自動化されます。

鉄道は最も安全な陸上輸送手段のひとつと考えられており、潜在的な乗客により良いサービスを提供し、乗客数を増加させるため、顧客にとってより魅力的です。世界中の消費者は、より安全で効率的な輸送手段をますます求めるようになっており、先進技術に基づく輸送手段、すなわち通勤目的の自律走行列車を採用することの重要性が浮き彫りになっています。

また、世界中で厳しい排ガス規制が制定されたことにより、地下鉄/モノレールの電化が進んでいることも、市場の成長を後押ししています。接続された地下鉄鉄道の導入は、自律走行列車市場にとっての課題となっています。鉄道は最もエネルギー効率の高い輸送手段の1つとして認識されており、世界の自動車による旅客輸送の8%、貨物の7%を占めるが、輸送エネルギーの消費はわずか2%です。

主要産業は共同で鉄道プロジェクトに取り組み、自律走行地下鉄の先進技術を開発しています。運転手のいない乗用車のテストのような最近の動向は、市場の成長をさらに促進すると予想されます。例えば

- 2023年5月、インド初のムンバイの地下地下鉄路線は、2023年12月にフェーズ1(バンドラ・クルラ・コンプレックス~アーレイ)を完成させた後、無人運転を開始するための安全認可を求めました。2021年9月、三菱重工エンジニアリングは、ドバイ・メトロとドバイ・トラムの新たなコンセッションのため、ケオリスおよび三菱商事と合弁会社を設立しました。

- 同様に2023年6月、アルストムはバンコクのMRTイエローラインの運行開始を発表しました。30両編成の4両編成モノレールは、最高時速80kmで運行できます。

このような開発は、今後数年間の市場開拓に貢献すると予想されます。

アジア太平洋地域は予測期間中に大きな成長を遂げる見込み

アジア太平洋地域は世界最大級の鉄道網を有しており、自律走行列車市場は世界的に支配的となる可能性が高いです。中国、インド、日本を含む地域全体の政府による鉄道インフラ開拓のための投資の増加は、同地域における市場の成長を後押しする可能性があります。

インドでは公共交通機関として地下鉄の人気が高まっていることも、同地域の自律走行列車市場の大きな成長につながっています。したがって、鉄道網はアジア太平洋諸国の経済開発において非常に重要な役割を果たしています。

例えば、2024年3月、ベンガルール・メトロ・レール・コーポレーション(BMRCL)は、建設中のイエローライン向けに、CBTC(Communication-based Train Control)システムの一部である6両編成の客車を初めて受領しました。

RVロードとボマサンドラを結ぶ全長18.8kmの路線は、運転手のいない列車を導入する最初の路線となります。

アジア太平洋には、シンガポール、マレーシア、インドネシア、バングラデシュなど、先進経済諸国と新興経済諸国の両方が存在するのも特徴です。主要産業はアジア太平洋地域で鉄道プロジェクトの設立を計画しており、市場の著しい成長を目の当たりにしています。例えば、東日本旅客鉄道(JR東日本)は2024年1月、2030年代半ばまでにほぼ自動化された新幹線を導入する計画を発表し、この省力化策を実施する日本初の企業となりました。同社は、グレード・オブ・オートメーション3(GoA3)の達成を目指しています。これは、人間がドアを管理し、緊急時にはオペレーターが引き継ぐことで、列車が自動運転できることを意味します。

大手企業によるこのような開発と国内進出に伴い、自律走行列車の開発は今後数年間で増加すると予想されます。

自律走行列車産業の概要

自律走行列車市場は、世界および地域で確立されたプレーヤーによって統合され、主導されています。各社は市場での地位を維持するため、新製品の発表、提携、合併などの戦略を採用しています。

- 2024年2月、JR東日本は、2030年代半ばまでに日本で運転手のいない新幹線を導入する計画を発表しました。JR東海はさらに早く、2028年までに自動運転新幹線を導入する可能性があります。チェンジ2027」計画の一環として、JR東日本は2021年後半に12両編成のE7系新幹線を使った一連の無人新幹線試験走行を実施したことがあります。JR東日本はこの試験走行に推定2億円の予算を割り当てた。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 安全性への関心の高まり

- 市場抑制要因

- 新規プロジェクト立ち上げのための高額な初期投資

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 自動化グレード別

- GoA 1

- GoA 2

- GoA 3

- GoA 4

- 用途別

- 旅客

- 貨物

- 技術別

- CBTC

- ERTMS

- ATC

- PTC

- 列車タイプ別

- 地下鉄/モノレール

- ライトレール

- 高速鉄道

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Siemens AG

- Alstom SA

- Thales Group

- Hitachi Rail STS(Ansaldo STS)

- Mitsubishi Heavy Industries Ltd

- Kawasaki Heavy Industries

- Construcciones y Auxiliar de Ferrocarriles(CAF)

- CRRC Corporation Limited

- Wabtec Corporation

- Ingeteam Corporation SA

第7章 市場機会と今後の動向

- 自律走行列車ネットワークの拡大

- 高度道路交通システム(ITS)の統合

- ハイパーループと磁気浮上式鉄道技術の開発

- 人工知能(AI)と機械学習(ML)の採用

The Autonomous Train Market size is estimated at USD 9.78 billion in 2025, and is expected to reach USD 12.96 billion by 2030, at a CAGR of 5.78% during the forecast period (2025-2030).

Over the long term, growing electrification in the transportation sector will likely provide major growth for the autonomous train market. The introduction of the Internet of Things (IoT) in transportation is a major driver for the autonomous train market.

Key Highlights

- In March 2023, the SNCF, French national railway, with industry partners, announced the launch of two autonomous trains with integrated technologies, such as artificial intelligence.

- The market's growth is also attributed to other factors, including the government's focus on increasing railway connectivity and increased focus on replacing older rolling stock with advanced, new-generation rolling stocks.

Economies across the world are investing heavily in railway infrastructure development. Government bodies of several countries worldwide have invested heavily to expand their railway connectivity to cater to growing freight and passenger transportation requirements. For instance, at the end of 2023, the total length of railway tracks in China was 159 thousand km, an increase from 155 thousand km at the end of 2022.

Major governments across developed and developing countries, including China, the United States, and Japan, are investing in connected mobility, which may provide significant growth opportunities for the autonomous train market. Asia-Pacific and North America are expected to dominate the autonomous train market during the forecast period. Asia-Pacific has one of the largest rail networks in the world and is expected to show major growth with upcoming projects in the market. For example,

Key Highlights

- In January 2024, CRRC announced its plans to introduce the autonomous train to Indonesia, which is planned to be exhibited at the IKN in July 2024. The Indonesian government has been in talks with China Railway Rolling Stock Corporation (CRRC) to use a set of its autonomous trains for Indonesia's new capital, Nusantara or the IKN.

Considering such factors, the market is expected to witness exponential growth in the future.

Autonomous Train Market Trends

Metro/Monorail is Dominating the Autonomous Train Market

Metro/monorail is dominating the autonomous train market due to the increasing demand for an efficient, safe, and affordable mode of transport. The rising penetration of GoA 4 technology in metro rail is likely to boost the market's growth. GoA 4 is an unattended train operation (UTO) where activities like starting and stopping, operation of doors, and handling of emergencies are fully automated without any on-train staff.

Rail is considered one of the safest modes of land transport and is more attractive to the customer as it offers a much better service to potential passengers and boosts passenger numbers. Consumers worldwide are increasingly demanding safer and more efficient transport, highlighting the importance of adopting advanced technology-based transport, i.e., autonomous trains for commuting purposes.

The growing electrification of metro/monorails due to the enactment of stringent emission norms across the world is also boosting the market's growth. The introduction of connected metro rail is creating a challenge for the autonomous train market. Rail has been identified as one of the most energy-efficient transport modes, accounting for 8% of global motorized passenger movements and 7% of freight but consuming only 2% of transport energy.

Major industries are jointly working on rail projects to develop advanced technology for autonomous metro rail. Recent developments like testing driverless passenger cars are expected to further propel the market's growth. For instance,

- In May 2023, Mumbai's first underground metro line in India sought safety approval to begin driverless operations after completing Phase 1 (Bandra Kurla Complex to Aarey) in December 2023. In September 2021, Mitsubishi Heavy Industries Engineering formed a joint venture with Keolis and Mitsubishi Corp. for a new concession of Dubai Metro and Dubai Tram.

- Similarly, in June 2023, Alstom announced the entry into service of the MRT yellow line in Bangkok, a driverless system. The 30 four-car monorail trains can operate at speeds up to 80km/h.

Thus, such developments are expected to contribute to the market's growth in the coming years.

Asia-Pacific is Expected to Witness Significant Growth During the Forecast Period

Asia-Pacific has one of the largest rail networks globally, which is likely to dominate the autonomous train market worldwide. The growing investment by governments across the region, including China, India, and Japan, for rail infrastructure development may boost the market's growth in the region.

The growing popularity of metro travel as public transportation in India is also leading to significant growth in the region's autonomous train market. Therefore, the railway network plays a very significant role in the economic development of countries in Asia-Pacific.

For instance, in March 2024, the Bengaluru Metro Rail Corporation Limited (BMRCL) received the first set of six train coaches, part of the Communication-based Train Control (CBTC) system, for its under-construction yellow line, which is set to undergo various safety tests.

The 18.8 km-long line connecting RV Road and Bommasandra will be the first to have a driverless train.

Asia-Pacific is also characterized by the presence of both developed and developing economies, such as Singapore, Malaysia, Indonesia, and Bangladesh. Major industries are planning to establish rail projects in Asia-Pacific, which is witnessing significant growth in the market. For instance, in January 2024, East Japan Railway (JR East) announced plans to introduce largely automated bullet trains by the mid-2030s, becoming the first company in Japan to implement this labor-saving measure. The company aims to achieve Grade of Automation 3 (GoA3), which means the train can drive itself with a human operator managing the doors and taking over in case of emergencies.

With such developments by major players and their expansion into the country, the development of autonomous trains is expected to increase over the coming years.

Autonomous Train Industry Overview

The autonomous train market is consolidated and led by global and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- In February 2024, JR East announced its plans to introduce driverless Shinkansen in Japan by the mid-2030s. JR Tokai could launch self-driving bullet trains even earlier, or by 2028. As part of its Change 2027 program, JR East previously conducted a series of driverless Shinkansen test runs in late 2021, using a 12-car E7-series bullet train. JR East allocated an estimated budget of JPY 200 million for the trials.

Some of the major players in the autonomous train market include Bombardier, Mitsubishi Heavy Industries, Alstom, Thales, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Focus on Safety

- 4.2 Market Restraints

- 4.2.1 High Initial Investment in the Launch of New Projects

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Automation Grade

- 5.1.1 GoA 1

- 5.1.2 GoA 2

- 5.1.3 GoA 3

- 5.1.4 GoA 4

- 5.2 By Application

- 5.2.1 Passenger

- 5.2.2 Freight

- 5.3 By Technology

- 5.3.1 CBTC

- 5.3.2 ERTMS

- 5.3.3 ATC

- 5.3.4 PTC

- 5.4 By Train Type

- 5.4.1 Metro/Monorail

- 5.4.2 Light Rail

- 5.4.3 High-speed Rail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Siemens AG

- 6.2.2 Alstom SA

- 6.2.3 Thales Group

- 6.2.4 Hitachi Rail STS (Ansaldo STS)

- 6.2.5 Mitsubishi Heavy Industries Ltd

- 6.2.6 Kawasaki Heavy Industries

- 6.2.7 Construcciones y Auxiliar de Ferrocarriles (CAF)

- 6.2.8 CRRC Corporation Limited

- 6.2.9 Wabtec Corporation

- 6.2.10 Ingeteam Corporation SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Autonomous Train Networks

- 7.2 Integration of Intelligent Transportation Systems (ITS)

- 7.3 Development of Hyperloop and Maglev Technologies

- 7.4 Adoption of Artificial Intelligence (AI) and Machine Learning (ML)