|

市場調査レポート

商品コード

1851133

デジタル印刷:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Digital Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタル印刷:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月24日

発行: Mordor Intelligence

ページ情報: 英文 195 Pages

納期: 2~3営業日

|

概要

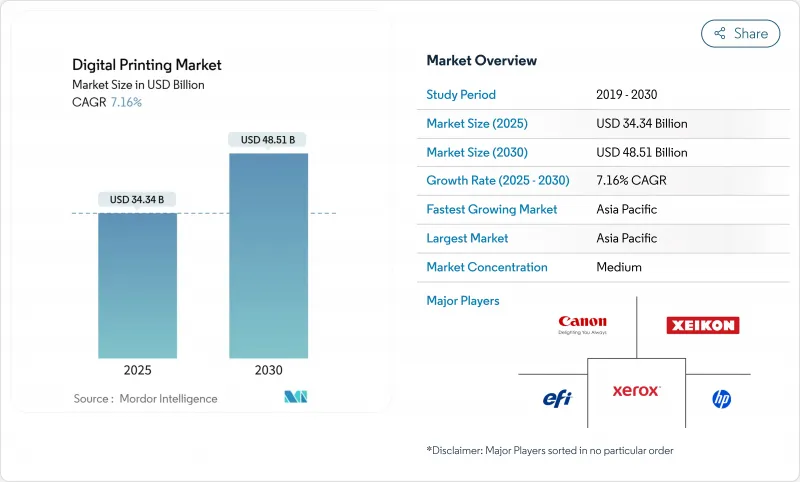

デジタル印刷の市場規模は2025年に343億4,000万米ドル、2030年には485億1,000万米ドルに達し、2025-2030年のCAGRは7.16%で推移すると予測されます。

オンデマンド生産、AI主導のワークフローオーケストレーション、アナログからデジタル製造への軸足への堅調な需要は、サプライチェーンが不安定なままであっても成長を持続させる。市場の魅力は、マイクロバッチ生産で利益を上げ、製版の遅れをなくし、納期を短縮できることで、大規模なマス・カスタマイゼーションを求めるコンバーターやブランドオーナーを惹きつけています。揮発性有機化合物やPFASに対する規制上の監視が、水性顔料やUV硬化型化学物質への移行を加速させる一方、ドロップオンデマンド・プリントヘッドの進歩が、解像度、速度、基材の多様性の最前線を押し上げています。競合戦略は、耐量子性セキュリティ・モジュール、自律的メンテナンス・アルゴリズム、資本コストを分散させるための研究開発資産をプールするパートナーシップを中心に展開されるようになっています。これらの要因が相まって、パッケージング、テキスタイル、工業、商業、装飾の各分野における市場セグメンテーションの裾野が広がっています。

世界のデジタル印刷市場の動向と洞察

ショートランカスタマイズパッケージング需要の高まり

食品、飲食品、パーソナルケアなどのブランドオーナーは、限定版リリースや地域固有のラベリング要件に対応するため、1万個以下のロットサイズを要求するケースが増えています。HP Indigo 200K印刷機を活用するコンバーターは、リードタイムと在庫リスクを削減するプレートフリー切り替えを実現し、デジタル印刷市場を俊敏なサプライチェーンに不可欠なものに変えています。eコマースの成長はSKUの複雑さを増大させ、印刷会社を、ダウンタイムなしに基材や箱のフォーマットを切り替えるワークフロー構成へと押し上げています。小売業者はまた、追跡や偽造防止コーディングのためのバリアブルデータを重要視しており、これらの機能はツールを追加することなくインラインで実行されます。これらの利点は、季節や販促サイクルが激化するたびに、デジタルワークフローの選好を強化します。

マイクロバッチ注文のための迅速なAI対応ワークフロー自動化

HPのNio AIエージェントは、インクのレイダウン、ノズルの健全性、基材の前進をリアルタイムで最適化し、シフトをまたいだ無人運転と予測可能なカラーを可能にします。AI主導のジョブ・ギャンギングを導入している日本の施設では、セットアップ・シートが30%削減され、稼働時間が2桁向上しました。予知保全モデルは、ヘッドの交換を数週間前に予測し、予定外の停止を防ぎ、要求の厳しいパッケージング・アカウントの品質を安定させる。機械学習はまた、基材ごとのICCプロファイルを精製し、高級箔や合成樹脂の無駄を削減します。AIは労働投入と材料オーバーランを削減することで、マイクロボリューム層でも利益プールを拡大し、中小コンバーターがアクセス可能なデジタル印刷市場を拡大します。

ハイエンドプレスのための高額な設備投資と研究開発費

多層ニスや白インクに対応する産業用インクジェットラインは、1台当たり100万米ドルを超えるのが普通です。空調室、インライン検査カメラ、RIPサーバーなどを含めると初期費用はさらに膨らみ、中小のコンバーターは最高レベルのスループットから締め出されてしまいます。急速な陳腐化もリスクを増大させる。ヘッド・ジェネレーションは5年以内にリフレッシュされるため、継続的な設備投資を余儀なくされるか、利幅が縮小するリスクがあります。大手グループは、シンジケート・ローンやシェアード・サービス・センターを通じてアップグレードの資金を調達し、技術格差を広げています。こうして統合が加速し、プロバイダー・カーブのテールが削られ、資金力のあるプレーヤーにボリュームが集中します。

セグメント分析

インクジェット技術は、2024年のデジタル印刷市場シェアの68.12%を占め、2030年までのCAGRは11.7%と予測されます。このセグメントのリーダーシップは、これまで以上に小さな液滴量、ネイティブ1,200dpiヘッド、多孔質・非多孔質メディアを問わずバンディングを低減するクローズドループ・メニスカスコントロールに起因しています。電子写真方式は、トナーの光沢仕上げが魅力的なオフィス文書や写真集向けの関連性を維持しているが、トナー定着によって基材の多様性とエネルギー効率が制限されるため、その採用は頭打ちとなっています。

エプソンのDirect-to-Shapeシステムは、6軸ロボティクスとPrecisionCoreヘッドを組み合わせ、曲面プラスチックやガラス上で35μm以内の見当精度を可能にします。この3Dオブジェクトへの拡大により、自動車用ノブから飲料用タンブラーまで、対応可能なアプリケーションの幅が広がり、このセグメントのデジタル印刷市場全体の成長への貢献が強化されます。インクジェットはまた、迫り来る溶剤禁止に対応する水性顔料セットとの組み合わせも容易であり、コンバーターの設備投資を将来にわたって支えます。波形が粘度の変動に動的に適応するため、稼働時間が延び、プリントヘッドの寿命が延びる。

溶剤系は、ビニールバナーや車両用ラップへの強力な粘着性により、2024年の売上高の49.43%を占める。しかし、水性顔料システムは、屋内グラフィックスや食品パッケージングで低VOCが支持され、CAGR 9.34%で上昇しています。UV硬化型インキは、即時硬化で待ち時間と労力を削減できる折りたたみカートンやダイレクト・トゥ・オブジェクトの分野でシェアを拡大し、ラテックスブレンドはグリーンプロファイルと屋外耐久性のバランスをとっています。

インキメーカーはPFASや芳香族炭化水素を除去するための研究開発サイクルを加速させ、ミマキの2025年UVセットはCMRフリーケミストリーへの道を示しています。認証機関がより厳しい移行閾値を課す中、溶剤プラットフォームは再認証が必要であり、歴史的優位性にもかかわらず量的拡大が抑制されています。逆に、水性顔料はインライン乾燥機や高度なプライマーによって、かつては手が届かないと考えられていたプラスチックや金属化フィルムを開放することで利益を得る。予測期間中、水性インキのデジタル印刷市場規模は従来の溶剤ラインとの差を縮め、サプライヤーの勢力図と調達戦略を再構築すると予想されます。

デジタル印刷市場レポートは、印刷プロセス(電子写真、インクジェット)、インクタイプ(水性顔料、溶剤、UV硬化型、その他)、基材(紙・板紙、プラスチック・フィルム、繊維・ファブリック、その他)、用途(書籍・出版、商業印刷、パッケージング、その他)、地域(北米、欧州、アジア太平洋、南米、中東・アフリカ)で区分されています。

地域分析

アジア太平洋地域は2024年に世界売上高の38.56%を占め、インダストリー4.0と付加製造エコシステムを支援する国家インセンティブにより、2030年までのCAGRが10.88%と最も高くなります。高価値輸出を推進する中国は、高級消費財向けに可変データやカラフルな装飾を提供するラベル・カートンラインに資本を振り向ける。日本は、印刷機をMESおよびERPスタックと同期させ、工場クラスター全体のジョブシーケンシングを最適化する、AIを組み込んだワークフローを育成しています。インドの急成長する中産階級がフレキシブルパッケージング需要を牽引し、ターンキーデジタルハブで現地インテグレーターと提携するグローバルOEMを惹きつけています。

北米は成熟しているが有利な分野であり、コンバーターはクラブ・ストアやeコマース・パッケージングにおけるSKUの急増に対応するため、長時間のフレキソから俊敏なデジタルラインに軸足を移しています。米国は、ブランド資産と消費者データを保護する耐量子プリンターセキュリティの採用で先陣を切っています。カナダは炭素の透明性を重視する規制により、水性インキとクローズドループのカラーキャリブレーションへの移行を推進し、メキシコはニアショアリングにより、これまでアジア向けだったアセンブリを、地域ごとの印刷を必要とする地域のフルフィルメントセンターにルーティングすることで利益を得ています。

欧州では、EUグリーンディールの下、持続可能性と循環型経済への適合が重視されています。テキスタイルとパッケージングのデジタル製品パスポートでは、アイテムレベルのエンコーディングが必要だが、この機能は高解像度のインクジェット・ラインに自然に組み込まれています。ドイツの機械工学の基盤は、印刷モジュールをロボット化された仕上げセルに統合し、フランスの高級品部門は、厳密な特色再現と触感の良いニス効果を要求します。英国は、クリエイティブ産業の特注限定印刷の需要を開拓し、中小企業にコンパクトなB2インクジェット・ユニットの購入を促しています。これらの地域力学を総合すると、デジタル印刷市場は、世界の次世代製造業の礎石として強化されています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 活況を呈するショートラン・カスタマイズ・パッケージング需要

- マイクロバッチ注文のための迅速なAI対応ワークフロー自動化

- EUと米国におけるデジタル繊維マイクロファクトリーの拡大

- 印刷単価の低下と短納期化

- 市場抑制要因

- ハイエンド印刷機のための高額な設備投資とRandD支出

- PFAS/ソルベントインク規制の強化が再認証の遅れを引き起こす

- サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 印刷プロセス別

- エレクトログラフィ(トナー)

- インクジェット

- インクタイプ別

- 水性顔料

- 溶剤

- UV硬化型

- ラテックス

- 昇華型

- 基材別

- 紙・板紙

- プラスチック・フィルム

- テキスタイル/ファブリック

- ガラス・セラミックス

- 金属

- 用途別

- 書籍・出版

- 商業印刷

- パッケージ

- ラベル

- 段ボール包装

- カートン

- 軟包装

- 硬質プラスチック包装

- 金属パッケージ

- テキスタイル印刷

- 写真および商品

- 看板および大型グラフィック

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- ポーランド

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリアおよびニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ケニア

- ナイジェリア

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- HP Inc.

- Canon Inc.

- Xerox Holdings

- Ricoh Company

- Electronics For Imaging(EFI)

- Konica Minolta

- Xeikon NV

- Smurfit WestRock

- Mondi PLC

- DS Smith PLC(International Paper)

- Amcor PLC

- Multi-Color Corporation

- Avery Dennison Corporation

- Quad/Graphics Inc.

- Durst Phototechnik

- Landa Digital Printing

- Domino Printing Sciences

- Screen Holdings Co.

- Fujifilm Holdings