|

市場調査レポート

商品コード

1851107

5Gコネクション:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)5G Connection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 5Gコネクション:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月20日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

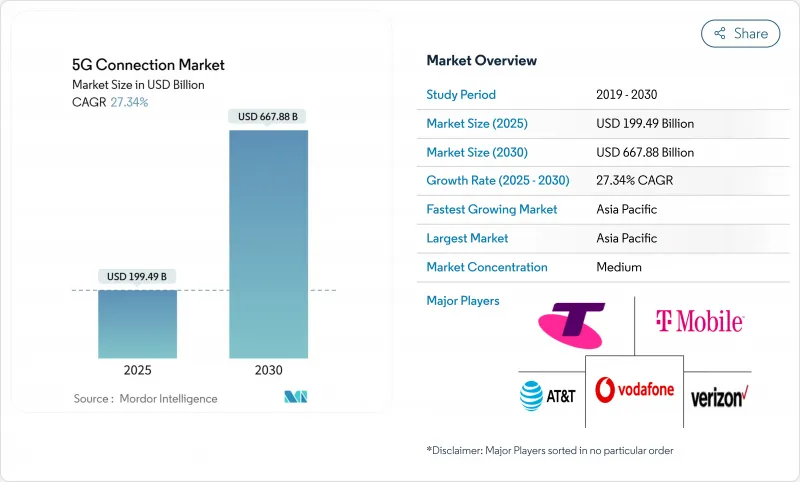

5G接続市場は現在1,994億9,000万米ドルの収益を上げており、2030年には6,678億8,000万米ドルに達し、CAGR27.34%で成長すると予測されています。

商用展開はカバレッジの拡大からネットワークの高密度化へと進んでおり、スライシング、エッジコンピューティング、RedCapデバイスなどの先進機能の急速な導入が可能になっています。アジア太平洋は、中国の440万の基地局とインドの全国的なスタンドアロン構築により、世界の契約数の52%を占める一方、北米は固定無線アクセス(FWA)の普及でリードしています。通信事業者は、ノン・スタンドアロン(NSA)コアからスタンドアロン(SA)コアへの移行を加速させています。SAコアは、特にエンタープライズや超信頼低遅延(URLLC)の使用事例において、より高い収益化の可能性を引き出すからです。製造、ヘルスケア、車載のプライベート5Gネットワークは急速に規模を拡大しており、ネットワークAPIマーケットプレースは近い将来、さらなる収益源を約束します。しかし、ミッドバンド周波数帯の価格高騰、地方におけるカバレッジの経済性、ファイバーの価格競争が、特定地域における成長を引き続き抑制しています。

世界の5Gコネクション市場動向と洞察

大容量ネットワークを必要とするモバイル・データ・トラフィックの急増

5G回線当たりの月間データ使用量は平均70GB近く、4Gの4倍に達します。中国の5G基地局は440万局で、この負荷に対応するために必要な規模の大きさを示しており、ミッドバンドスペクトラムが不可欠であることに変わりはないが、中国以外の拠点では現在4分の1しか導入されていないです。トラフィックの移行に伴い、通信事業者はキャリアアグリゲーションの追加、Massive MIMOのアップグレード、ダイナミック・スペクトラム・シェアリングを優先します。これらの投資は5G接続市場の収益成長を支える一方で、ネットワークのエネルギー効率を最適化する必要性を高めています。

固定無線アクセス(FWA)がブロードバンドの主流代替手段として台頭

米国の事業者は合計で1,150万回線のFWAを提供しており、ダウンロード速度の中央値が200Mbpsを超えるようになると、2028年までに2,000万回線に達すると予測しています。インドの事業者は、限定的なファイバー敷設よりもコスト面で有利な点を生かし、2027年までに3,000万人のFWA加入者を目指しています。ベライゾンは2024年第1四半期に4億5,200万米ドルのFWA売上を計上し、短期的な収益性を示しました。これらの市場開拓を総合すると、ユーザー1人当たりの平均売上高が増加し、5G接続市場の対応可能ベースが拡大します。

高いCAPEXとミッドバンド周波数帯コスト

2022年から2025年にかけて、世界のインフラ投資額は6,000億米ドルを超えると予想されるが、欧州のオークションでは資金調達の負担が不均衡になり、SAコアを持つ地域通信事業者は中国の80%に対してわずか2%にとどまる。新興市場の通信事業者はオークションを延期し、レバレッジの上昇を緩和するためにタワー・シェアリングを模索。北欧経済のネットワークシェアリングは前向きな例を示しているが、資本圧力は依然として5G接続市場への完全参入を抑制しています。

セグメント分析

2024年の5G接続市場は、スマートフォンの普及と動画消費の伸びに支えられたモバイルブロードバンドが62%を占める。同時に、M2MおよびIoTリンクは、スマート工場、病院、物流ハブにおけるプライベート5Gネットワークの展開に後押しされ、CAGR 28.63%で拡大しています。特に、ミッションクリティカルな通信やFWAサブスクリプションがトラフィックの増加に寄与しているため、企業向けの傾斜がネットワークスライシングの5G接続市場規模を大幅に拡大しています。ハードウェアベンダーは、産業用センサーの消費電力を低減するRedCapチップセットを発表し、M2Mプロジェクトの実現性を加速させています。エッジネイティブなアーキテクチャは、リアルタイム分析が競争力のある製造業において重要な課題となるため、M2Mの収益化をさらに促進します。

セルラーIoTエンドポイントの継続的な普及により、デバイス数は2028年までに倍増すると予測され、コスト最適化モジュールと簡素化されたオンボーディングツールに対する絶え間ない需要が生まれます。米国のFirstNetの拡大から韓国の全国的な公共安全ネットワークまで、ミッションクリティカルな通信の使用事例は、サービスの差別化の機会を広げています。その結果、消費者向けトラフィックは依然として大きいもの、企業向けトラフィックが将来の5G接続市場の成長において圧倒的なシェアを獲得するという新たな均衡が確立されました。

ストリーミングとゲームがモバイル・ブロードバンド・トラフィックを支えているため、2024年の5G接続市場規模に占める消費者利用のシェアは76%を維持した。それにもかかわらず、企業向け回線は、自動車、ヘルスケア、エネルギーにおけるデジタル変革の指令によって、2030年までのCAGRが30.47%に達すると思われます。製造業が際立っています。1,000を超える活発なプロジェクトが、プライベート5Gに切り替えた後、回線効率が15~20%向上したと報告しています。シンガポールとスウェーデンの病院では、超低遅延ビデオリンクが統合されると、手術時間が短縮され、患者の転帰が向上しています。

また、スマートシティプログラムでは、監視カメラ、接続された街灯、環境モニターが導入され、それぞれ企業加入者数を増やしています。公益事業者はリアルタイムのグリッドバランシングのために5Gに目を向け、石油・ガス事業者は自動検査ドローンを優先しています。これらの促進要因は、長期的な収益の集中を企業向けに傾け、1接続あたりの平均収益を増加させ、5G接続市場の粘り強さを深めています。

5Gコネクション市場レポートは、接続タイプ(モバイルブロードバンド、固定無線アクセス、その他)、エンドユーザー(コンシューマー、エンタープライズ)、スペクトルバンド(サブ1GHz、1~6GHz、その他)、ネットワークアーキテクチャ(ノンスタンダロン、スタンドアロン)、デバイスカテゴリ(スマートフォン、タブレット、FWA CPE、その他)、サービスタイプ(拡張モバイルブロードバンド(eMBB)、大規模マシン型通信(mMTC)、その他)、地域別に分類されています。

地域分析

アジア太平洋地域は、2024年の世界契約数の52%を占め、2030年までCAGR 30.28%で成長すると予測され、中国の440万基地局とインドの急速なスタンドアロン拡大に牽引されます。中国のデジタル経済への貢献は、製造業、小売業、サービス業における5Gプラットフォームの普及を反映して、2030年までに2兆米ドルに達するとみられています。インドのリライアンス・ジオ(Reliance Jio)は100万以上のクラウドネイティブ・セルサイトを運営しており、予想されるFWA回線数は500万から2027年までに3,000万に増加する可能性があります。日本と韓国は、5Gの先進的な商用サービスを早期に開始したことで、地域のイノベーション・リーダーシップを維持しており、東南アジアでは2030年までに1,300億米ドルのGDP効果が見込まれます。

北米は成熟しつつもイノベーション中心の舞台であり、人口の98%がすでに5Gを利用しています。Tモバイルの全国的なSA展開と643万のFWA回線は、消費者と企業の多様化を示しています。ベライゾンはASTスペースモバイルと衛星通信で提携し、地方に残る格差を埋めようとしており、カナダとメキシコの通信事業者はRedCapなどの5G先進機能を統合しています。現在は、ネットワークAPI、エッジ・コンピュート、AI支援サービス・オーケストレーションの収益化に焦点が当てられており、5G接続市場全体でサイトあたりの収益密度を高めています。

欧州の進捗はまちまちである:ドイツ、デンマーク、フィンランドは人口カバー率95%を超えているが、SAコアで稼働している契約はわずか2%に過ぎないです。英国のボーダフォンとスリーの合併は、地方での普及を目指したネットワークのアップグレードに148億6,000万米ドルを投入し、北欧の周波数共有モデルは低コストで高い可用性を実現した。大陸の通信事業者は現在、投資サイクルを維持するため、オークションの合理化とライセンス料の引き下げを規制当局に求めており、SAギャップを解消し、5G接続市場でより大きな価値を引き出そうとしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 大容量ネットワークを必要とするモバイル・データ・トラフィックの急増

- ブロードバンド代替の主流として台頭する固定無線アクセス(FWA)

- 企業のデジタル化とIoTが5G導入を加速する

- ジェネレーティブAI主導のアップリンク急増が5G-SAの早期展開に拍車をかける

- オープンAPIエコシステムによる収益化

- 市場抑制要因

- 高いCAPEXとミッドバンド周波数コスト

- 農村部のカバー経済性は依然として魅力に欠ける

- ファイバーの価格競争が都市部のFWA普及に水を差す

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力/消費者

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 接続タイプ別

- モバイルブロードバンド

- 固定無線アクセス

- M2MとIoT

- ミッションクリティカル通信

- プライベートネットワーク

- エンドユーザー別

- 消費者

- 企業

- 製造業

- ヘルスケア

- 自動車・輸送機器

- スマートシティと公共安全

- エネルギー・公益事業

- 小売・物流

- 周波数帯域別

- サブ1 GHz(ローバンド)

- 1-6 GHz(ミッドバンド)

- 24GHz以上(ミリ波/ハイバンド)

- ネットワークアーキテクチャ別

- ノンスタンダロン(NSA)

- スタンドアロン(SA)

- デバイスカテゴリ別

- スマートフォンとタブレット

- FWA CPE

- IoTモジュールとゲートウェイ

- ウェアラブルとAR/VRデバイス

- 産業用ルーターと堅牢モジュール

- サービスタイプ別

- エンハンスト・モバイル・ブロードバンド(eMBB)

- 大規模マシン型通信(mMTC)

- 超高信頼低遅延通信(URLLC)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- その他南米

- 欧州

- ドイツ

- フランス

- 英国

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- China Mobile Ltd.

- China Telecommunications Corp.

- T-Mobile US Inc.

- Telstra Corp. Ltd.

- Telefonica SA

- Deutsche Telekom AG

- Reliance Jio Infocomm Ltd.

- SK Telecom Co. Ltd.

- NTT Docomo Inc.

- KT Corp.

- Orange SA

- KDDI Corp.

- Bharti Airtel Ltd.

- Saudi Telecom Company(stc)

- Rakuten Mobile Inc.

- Etisalat by eand

- MTN Group Ltd.