|

市場調査レポート

商品コード

1687931

ロボットエンドエフェクタ:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Robot End Effector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ロボットエンドエフェクタ:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

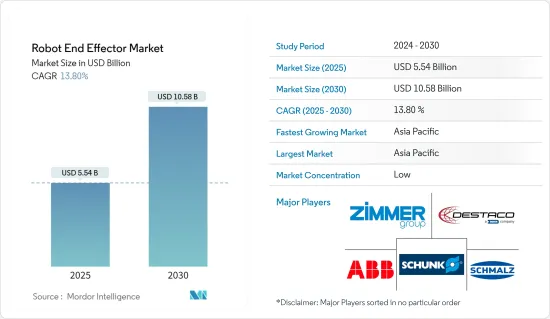

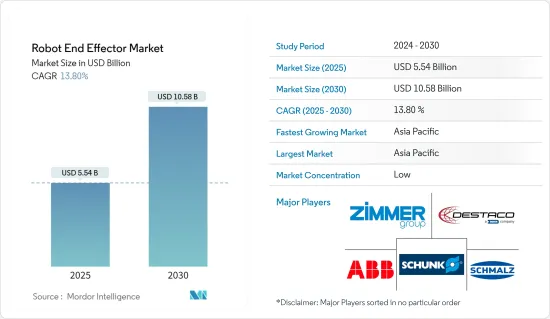

ロボットエンドエフェクタ市場規模は2025年に55億4,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは13.8%で、2030年には105億8,000万米ドルに達すると予測されます。

主要ハイライト

- 人工知能、自動化、モノのインターネット、コンピューティング能力、ロボット工学など様々な技術の統合により、新世代のスマート工場の構築が促進されます。ロボット工学と自動化は過去数年間で大きく変化しました。エレクトロニクス、自動車、食品、金属加工、マテリアルハンドリングなど、継続的に成長するさまざまな産業において、先進的自動化への投資の増加はロボットの十分な機会を生み出し、エンドエフェクタの需要を促進しています。

- ロボットは人間とより密接に働くため、ユーザーに反応し、行動を適応させなければならないです。今後数年間で、研究者は人間の基本的な行動を認識し、それに対応するためにこれらのロボットの行動を適応させることが期待されています。今後数年で、これは複雑なタスクのニーズに適応する、より先進的プログラムへと開発されると考えられます。自力で動くことなく安全に重量を持ち上げるために作られたインテリジェントなリフトアシストデバイスから、障害物回避のためのビジョン統合システムを搭載した最初のコボットの出現まで、市場はさらに成長すると予想されます。

- 協働ロボットはますます手頃な価格になり、複雑さも軽減され、利用しやすくなっています。このことは、組織に複数の選択肢を提供し、市場における協働ロボットの需要を増大させると考えられます。協働ロボットは、プラグアンドプレイ技術、先進的センサ、CADデータからの自動ロボットプログラミングを利用するため、あらゆる規模や規模の企業が競合を維持することができます。また、同市場の参入企業は戦略的M&Aを通じて事業を拡大しています。このように、協働ロボットの急速な普及が、エンドエフェクタの急成長をもたらしています。

- ロボットエンドエフェクタの主要限界は、人間のピッカーに比べて速度が遅いこと、ビジョンシステムとグリッパーが異常なアイテムに対応できないこと、完全自律型であることの信頼性の点で観察されています。調査対象となった市場の企業は、トートから個々の品目をピッキングすることにある程度の成功を示しています。しかし、残りの半数の企業は、これらのシステムを大規模に導入するとなると、さまざまな課題に直面します。

- COVID-19パンデミックは、労働力不足、ウイルスの蔓延を制限するための製造施設の操業停止、全国的なロックダウンのため、ロボット製造の低迷につながり、ロボットエンドエフェクタ市場に大きな影響を与えました。IFRによると、2018年には世界で約28万3,000台の産業用ロボットが出荷され、2021年には25万台に減少した9。設置台数が最も多いのはアジア/オーストラリアで、2020年だけで26万6,000台が設置されると推定されます。2024年までに、アジア/オーストラリアにおける産業用ロボットの設置台数は37万台に達すると予測されています。

ロボットエンドエフェクタの市場動向

自動車用エンドユーザーセグメントが大きな市場シェアを占める見込み

- 自動車産業は、ロボティクスとオートメーションの主要な導入企業のひとつです。著名な自動車メーカーは、溶接、塗装、フライスビット、カッター、マシンテンディング、部品搬送などの重要な活動を支援するためにロボットを使用しています。ロボット工学の利用は、工業作業の複雑さを軽減しながら、製品の品質を向上させるのに役立っています。

- 自動車製造では、溶接、塗装、組み立て、マテリアルハンドリングなどの作業において、ロボットのエンドエフェクタが重要な役割を果たしています。これらのエンドエフェクタは、多用途かつ高精度に設計されており、生産プロセスの効率と品質を向上させます。溶接トーチを装備したエンドエフェクタは、ボディパネル、フレーム、排気システムなどの部品の溶接に使用されます。これらのエンドエフェクタは、正確で一貫性のある溶接を保証し、自動車部品の構造の完全性を向上させます。

- 自動車産業は、世界中の工場で最も多くのロボットを使用しています。国際ロボット連盟によると、稼働台数は過去最高の約100万台で、全産業における導入台数の約3分の1を占めています。IFRによると、2023年の世界の産業用ロボット出荷台数は約59万台で、2022年と比較してわずかな増加にとどまりました。産業用ロボットの出荷台数は今後数年で大幅に増加し、2026年には約71万台になると予測されています。

- その他の多くの産業と同様に、自動車産業もインダストリー4.0を最大限に活用したいと考えています。そこでは、「コネクテッド」な機械が互いに通信し、人間のオペレーターが通信することで、職場の安全性と生産性の向上を実現します。その結果、自動車産業における自動化のニーズの高まりは、労働者の安全に対する自動車メーカーの考え方に影響を与え、研究市場の急増を招いています。

- 自動車産業はまた、製造プロセスを円滑化するために協働ロボットを採用しています。北米や欧州のような地域でのCobotの増加は、エンドエフェクタの旺盛な需要を生み出すと予想されます。インダストリー4.0の動向は、自動車産業における従来の組立ラインの自動化を後押ししており、協働ロボットやエンドエフェクタの需要も増加すると予想されます。

アジア太平洋が大きな市場シェアを占める見込み

- アジア太平洋は近代化と工業化が急速に進んでおり、生産業における自動化プロセスへのシフトと手作業の必要性の減少につながっており、これが市場の成長に影響を与えています。協働ロボットは、効率と生産性を向上させるため、エレクトロニクスや自動車セグメントでますます活用されるようになっています。

- インダストリー4.0と呼ばれる最新の産業革命は、協働ロボットのような新技術の進歩をもたらしました。これらのAIを搭載したロボットによって、産業は効率を高め、ミスを最小限に抑え、さまざまなプロセスを合理化できるようになりました。職場の安全性が向上し、生産能力が高まったことで、この地域の産業はロボットシステムへの投資を促しています。

- 技術的な自動化への投資と進歩が著しい国々が、この地域におけるロボットの普及に貢献しています。日本は、その先進的なロボット産業と技術により、製造業におけるロボットとオートメーション活用の拠点とみなされています。

- 中国政府は「メイドイン・チャイナ2025」施策を開始しました。この施策は、同国の製造業にとって、最大の製造業としての地位を維持するための重要な優先事項となっています。中国の製造業者は、国際競合を強化し、将来の生き残りを確保するために、インダストリー4.0や産業用IoTなどのスマート製造戦略を実施しています。その結果、中国のエンドエフェクタ市場は成長を遂げると予想されています。

- IFRによると、2022年、中国における産業用ロボットの設置台数は過去最高の29万258台に達し、前年比5%増を記録しました。Washington Information Technology and Innovation Foundation(ITIF)によると、中国の労働人口に占めるロボットの割合は当初の予測を大幅に上回り、12.5倍となりました。

- この地域はロボットセグメントで確固たる存在感を示しており、市場全体の拡大にとって有益です。このセグメントの企業には、Omron、Kawasaki Heavy Industries Ltd、FANUC、Siasun Robot & Automationなどがあります。

ロボットエンドエフェクタ市場概要

ロボットエンドエフェクタ市場は、世界の参入企業と中小企業の両方が存在するため、非常にセグメント化されています。同市場の主要企業には、ABB Group、DESTACO Europe GmbH、Zimmer Group、Schunk GmbH、J. Schmalz GmbHなどがあります。市場の参入企業は、製品ラインナップを強化し、サステイナブル競争優位性を獲得するために、提携や買収などの戦略を採用しています。

- 2024年 3月-SCHUNKはハノーバー・メッセで自動化ソリューションを発表し、EGUとEGKという2つの新しい電動グリッパーシリーズを発表しました。これらのグリッパーはパラメーターをカスタマイズでき、さまざまな把持モードを提供することで、多様な生産現場での確実なハンドリング作業を実現します。SCHUNKは、e-モビリティやエレクトロニクスなどの新興産業向けにカスタマイズ型オートメーションソリューションの開発に積極的に取り組み、進化する製造業の情勢に対応しています。

- 2023年 10月-Schmalzが真空表面把持システムFXP-60とFMP-60を発売。FXP-60とFMP-60は、従来の130ミリ幅バージョンとは対照的に、わずか60ミリ幅で、狭いスペースでの使用や輪郭の乱れ、個々のビームのハンドリングに最適です。この新しいサーフェスグリッパーは、把持面にシーリングフォームを使用したアルミプロファイルのモジュール構造で、特に軽量です。これにより、ハンドリングプロセスにおいて高レベルの力学が可能になります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- マクロ経済動向の市場への影響

第5章 市場力学

- 市場促進要因

- 産業オペレーションの自動化

- 市場抑制要因

- 既存のプロセスや業務との統合の難しさ

第6章 市場セグメンテーション

- タイプ別

- グリッパー

- 加工ツール

- サクションカップ

- その他

- エンドユーザー産業別

- 自動車

- 飲食品

- eコマース

- 医薬品

- その他

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- ABB Group

- DESTACO Europe GmbH

- Zimmer Group

- Schunk GmbH

- J. Schmalz GmbH

- Robotiq Inc

- KUKA Robotics Corporation

- Weiss Robotics GmbH & Co. KG

- Piab AB

- Bastian Solutions, Inc.

第8章 投資分析

第9章 市場の将来展望

The Robot End Effector Market size is estimated at USD 5.54 billion in 2025, and is expected to reach USD 10.58 billion by 2030, at a CAGR of 13.8% during the forecast period (2025-2030).

Key Highlights

- The integration of various technologies, including artificial intelligence, automation, the Internet of Things, computing power, and robotics, facilitates the building of a new generation of smart factories. Robotics and automation have changed significantly over the past few years. In the continuously growing range of industries such as electronics, automotive, food and metalworking, and material handling, increasing investment in advanced automation creates ample opportunities for robots, thus driving end-effector demand.

- Robots work even more closely with humans, so they must respond to the users and adapt their behaviors. Over the next few years, researchers are expected to recognize basic human behaviors and adapt these robots' actions to respond to them. Over the next few years, this will develop into much more advanced programs adapting to complex tasks' needs. From the intelligent lift assist devices built to lift weight safely without motion power of their own to the emergence of the first cobots that came with vision-integrated systems for obstacle avoidance, the market is expected to grow even further.

- Collaborative robots are becoming increasingly affordable, less complex, and more accessible to use. This will provide multiple options to the organizations, augmenting the demand for collaborative robots in the market. Collaborative robots enable enterprises of all scales and sizes to stay competitive as these robots utilize plug-and-play technologies, advanced sensors, and automatic robot programming from CAD data. Players in the market are also expanding their operations through strategic mergers & acquisitions. Thus, the rapid adoption of collaborative robots results in the rapid growth of end-effectors.

- The main limitations of robot end-effectors have been observed in terms of their slow speed relative to human pickers, the inability of the vision system and gripper to deal with unusual items, and the reliability of being fully autonomous. The companies in the market studied have demonstrated some degree of success in picking individual items out of totes. However, the remaining half of the companies face various challenges when it comes to implementing these systems on a larger scale.

- The COVID-19 pandemic significantly impacted the robot end-effector market due to the workforce shortage, the shutdown of manufacturing facilities to restrict the spread of the virus, and nationwide lockdowns, leading to a downturn in robot manufacturing. According to IFR, Around 283,000 industrial robots were shipped worldwide in 2018 and it decreased to 250,000 in 20219 . Asia/Australia had the highest number of units installed, with an estimated 266,000 units fitted in 2020 alone. By 2024, industrial robot installations in Asia/Australia are projected to reach 370,000 units.

Robot End Effector Market Trends

Automotive End-User Segment is Expected to Hold Significant Market Share

- The automotive industry is one of the major adopters of robotics and automation. Prominent automotive manufacturers use robotics to assist in critical activities such as welding, painting, milling bits, cutters, machine tending, and parts transfer. Using robotics helps improve the product's quality while reducing the complexity of industrial operations.

- In automotive manufacturing, robot end-effectors play an important role in welding, painting, assembly, and material handling tasks. These end-effectors are designed to be versatile and precise, aiding production processes' efficiency and quality. End-effectors equipped with welding torches are used for welding components such as body panels, frames, and exhaust systems. These end-effectors ensure precise and consistent welds, improving the structure integrity of automotive parts.

- The automotive industry has the largest number of robots in factories worldwide. The International Federation of Robotics stated that the operational stock hit a record of about one million units, representing about one-third of the total number installed across all industries. According to IFR, global industrial robot shipments amounted to about 0.59 million in 2023, just a slight increase compared to 2022. Industrial robot shipments are projected to increase significantly in the coming years, and in 2026, they are expected to amount to about 0.71 million.

- Like many other industries, the auto industry wants to make the most of Industry 4.0, where "connected" machines communicate with one another and human operators to deliver workplace safety and productivity benefits. As a result, the rising need for automation in the vehicle industry affects automakers' attitudes about worker safety, resulting in a spike in the studied market.

- The automotive industry is also adopting Cobots or Collaborative robots to smoothen the manufacturing process. The increase of Cobots in regions like North America and Europe is expected to create a robust demand for end effectors. The trend of Industry 4.0 pushing the automation of traditional assembly lines in the automotive industry is also expected to increase the demand for collaborative robots and end-effectors.

Asia Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region is experiencing swift modernization and industrialization, leading to a shift toward automated processes in production industries and a decrease in the need for manual labor, which is impacting the growth of the market. Collaborative robots are increasingly utilized in the electronics and automotive sectors to improve efficiency and productivity.

- The latest industrial revolution, called Industry 4.0, has led to the advancement of new technologies, such as collaborative robots. These AI-powered robots have allowed industries to enhance efficiency, minimize mistakes, and streamline various processes. The improved safety in the workplace and increased production capabilities have encouraged industries in the area to invest in robotic systems.

- Countries with significant investments and advancements in technological automation have contributed to the widespread adoption of robots in the region. Japan is considered a hub for utilizing robotics and automation in manufacturing due to its advanced robotic industry and technology.

- The Chinese government initiated the 'Made in China 2025' policy. This policy has become a significant priority for the manufacturing industry in the country to maintain its position as the largest manufacturing sector. Chinese manufacturers are implementing smart manufacturing strategies such as Industry 4.0 and Industrial IoT to enhance global competitiveness and ensure future survival. As a result, it is anticipated that the end-effector market in China will experience growth.

- According to IFR, in 2022, the number of industrial robots installed in China reached a record high of 290,258, marking a 5% increase from the previous year. According to the Washington Information Technology and Innovation Foundation (ITIF), China's workforce has significantly more robots than predicted, with a ratio of 12.5 times higher than initially anticipated.

- The area has a solid presence in the field of robotics, which is beneficial for the overall expansion of the market. A few of the companies in this sector include OMRON Corporation, Kawasaki Heavy Industries Ltd, Fanuc Corporation, and Siasun Robot & Automation Co. Ltd.

Robot End Effector Market Overview

The robot end-effector market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are ABB Group, DESTACO Europe GmbH, Zimmer Group, Schunk GmbH, and J. Schmalz GmbH. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - SCHUNK presented automated solutions at the Hannover Messe, unveiling two novel electric gripper series, namely EGU and EGK. These grippers can customize parameters and provide various gripping modes, ensuring secure handling operations in diverse production settings. SCHUNK is actively involved in developing tailored automation solutions for emerging industries like e-mobility and electronics, thereby adapting to the evolving manufacturing landscape.

- October 2023 - Schmalz launched a vacuum surface gripping system, the FXP-60 and FMP-60. In contrast to the established 130-millimeter-wide version, the FXP-60 and FMP-60 measure just 60 millimeters and are ideal for use in tight spaces, with disruptive contours, or for handling individual beams. The new surface gripper is particularly light with its modular structure made of an aluminum profile with sealing foam as a gripping surface. This enables a high level of dynamics in the handling process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro-economic Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Automation of Industrial Operations

- 5.2 Market Restraints

- 5.2.1 Difficulty in Integration with Existing Processes and Operations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Grippers

- 6.1.2 Processing Tools

- 6.1.3 Suction Cups

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage

- 6.2.3 E-commerce

- 6.2.4 Pharmaceutical

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 DESTACO Europe GmbH

- 7.1.3 Zimmer Group

- 7.1.4 Schunk GmbH

- 7.1.5 J. Schmalz GmbH

- 7.1.6 Robotiq Inc

- 7.1.7 KUKA Robotics Corporation

- 7.1.8 Weiss Robotics GmbH & Co. KG

- 7.1.9 Piab AB

- 7.1.10 Bastian Solutions, Inc.