|

市場調査レポート

商品コード

1444942

電気通信におけるブロックチェーン:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Blockchain in Telecom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電気通信におけるブロックチェーン:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

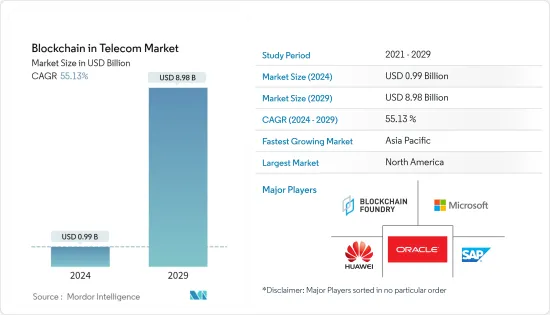

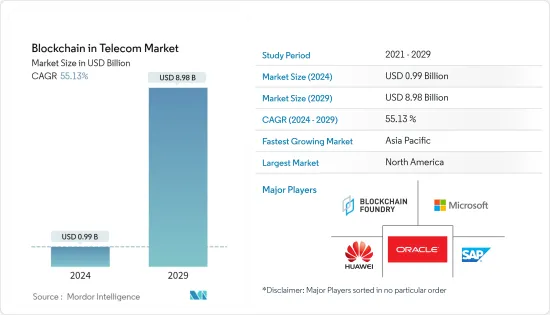

電気通信におけるブロックチェーンの市場規模は、2024年に9億9,000万米ドルと推定され、2029年までに89億8,000万米ドルに達すると予測されており、予測期間(2024年~2029年)中に55.13%のCAGRで成長する見込みです。

電気通信業界では、ブロックチェーンは詐欺の防止、ユーザーIDの保護、次世代ネットワークサービスとIoT接続ソリューションのサポートにおいて非常に重要な役割を果たしており、それが市場を大きく牽引しています。

主なハイライト

- 5Gは迅速かつ信頼性の高いブロックチェーン運用に役立っているため、5Gの採用の増加は電気通信分野でのブロックチェーン実装の促進となります。ブロックチェーンテクノロジーは、より安全で検証可能な方法でネットワーク上のデータを記録および保存するための堅牢な暗号化を提供します。これにより、情報が透明になり、改ざんが防止されます。したがって、ブロックチェーン技術は、さまざまな電気通信会社がネットワークのセキュリティを強化し、運用コストを削減し、市場の成長を促進するのに役立つと期待されています。

- さらに、遠隔通信または電気通信詐欺は、急速に成長している犯罪行為の分野です。EuropolのEuropean Cybercrime CentreとTrend Microによると、電気通信詐欺による被害額は年間約327億米ドルに上ります。これは法執行機関にとって新たな課題となります。ブロックチェーンは、電気通信サービスプロバイダーの不正行為の検出と防止に役立ち、市場の成長を飛躍的に促進します。

- さらに、インドなどの新興国では、スパムSMSを抑制するための通信規制当局によるブロックチェーン技術導入の有効性が、Aadhar認証、財産、車両所有権記録や直接税徴収などのさまざまな重要なユースケースに対して透明で信頼できるフレームワークを構築する政府の例となっています。昨年3月、電子・IT省は、公共および民間のさまざまなユースケースでの展開を規制するブロックチェーン技術に関する政策草案を発表しました。インドの電気通信規制当局(TRAI)も、ディストリビューター台帳テクノロジー(DLT)を導入しました。これは、現在、スパムSMSトラフィックを制御するためのブロックチェーンテクノロジーの最も重要な使用例の1つです。

- しかしその一方で、スケーラビリティと相互運用性は、ブロックチェーン技術の全体的な導入に必要ないくつかの重要な要素です。これは業界標準が設定されてからのみ可能であり、遅れている段階にあります。電気通信部門は、市場の成長を妨げる可能性があるブロックチェーン技術の大量導入について支援を必要としています。

- パンデミックの発生により、電気通信インフラの重要性が浮き彫りになりました。世界の健康上の緊急事態は電気通信サービスに新たな圧力をかけており、緊急事態において電気通信サービスが単純な接続を超えて果たせる重要な役割を示唆しています。コロナウイルスのパンデミックを超えて、仮想サービスやオンラインサービスに対する需要が高まるにつれ、世界では新しいフィンテックサービスに大きな関心が集まることが予想されます。電気通信業界では、パンデミックにより、デジタルインフラストラクチャとデータ駆動型サービスの拡大の必要性が高まっています。電気通信会社は、特に5Gへの投資において、ネットワークの回復力と信頼性をますます重視しています。

電気通信におけるブロックチェーン市場の動向

市場を独占するスマートコントラクト

- スマートコントラクトを使用すると、特定の条件が満たされたときにコンピューターコードを実行できます。電気通信業界では、請求、サプライチェーン管理、ローミングなどの内部業務の自動化の余地が得られるため、大幅な導入が見込まれています。

- スマートコントラクトを導入してローミングに関連するすべての請求を管理すると、不正なトラフィックを防止できるため、大幅なコスト削減につながる可能性があります。ブロックチェーンは、スマートコントラクトを通じて仲介者を排除することで、アイデンティティ管理ソリューションに付加価値を与えることもできます。これにより、ローミング詐欺の削減、コストの削減、即時決済が可能になります。これにより、電気通信事業者は、改ざん防止された検証可能なトランザクションとエンド顧客へのリアルタイムの更新を通じて紛争を迅速に解決できます。

- 2022年3月、STC Bahrainは公式のChainlinkノードを導入しました。これは、現実世界のデータの安全なソースへのアクセスと高速なオフチェーン計算を備えたスマートコントラクトを提供することを目的としています。これにより、STC Bahrainは、中東・北アフリカ(MENA)地域でチェーンリンクノードを導入した最初の大手電気通信会社となり、この地域と世界中のスマートコントラクトエコシステムの開発を強化します。

- さらに、5Gテクノロジーは、ブロックチェーンが電気通信業界をどのように変えるかを示す重要な例の1つです。たとえば、5Gテクノロジーでは、スマートコントラクトにより、ブロックチェーンベースのソリューションを使用して、エンドユーザーとネットワーク間のプロビジョニング全体を合理化できます。5Gを安全に実装するには、接続されたデバイスが受信するデータが信頼性が高く、さまざまな悪意のある干渉を受けていない必要があります。さらに、5Gがその可能性を最大限に発揮し、大規模なセキュリティ侵害から保護できるようにするために、ブロックチェーンは分散型で改ざん防止のリアルタイムのデータ送信検証を実現できます。

- 5G Americasによると、5G加入数の堅実な成長は予見可能な将来まで続き、2026年末までに50億加入に達すると予想されています。これには、現在から来年までに7億加入、来年から再来年にかけての9億加入の総合開発が含まれます。

アジア太平洋は最高の成長を遂げる

- アジア太平洋は、主にインドや中国などの国でのモバイル決済の台頭により、市場にとって大きな潜在力を誇っています。インドでは、特に収益化廃止計画以降、多くの電気通信事業者がこのモデルに移行するのを目の当たりにしました。たとえば、国内の大手通信会社であるJioとAirtelは、顧客間の支払いを可能にするデジタルウォレットを提供しています。したがって、これらの企業が取引を処理するためにブロックチェーンを採用することで、ウォレットがより安全かつ安価になり、市場が大幅に拡大する可能性があります。

- China Telecom、China Mobile、China Unicomは、電気通信業界の運営とセキュリティを強化するためにブロックチェーン技術を使用するCAICTのTrusted Blockchain Initiativeに参加しました。両社は、IoTデータ共有と顧客身元確認に関連するブロックチェーンベースのアプリに注力すると予想されています。

- さらに、現在、世界がWhatsAppのポリシー変更をめぐるプライバシー論争に巻き込まれている中、インドのサービスとしての通信プラットフォーム(CPaaS)業界は、企業とサービスプロバイダー間の商用モバイルSMS、電子メール、その他の種類のビジネスコミュニケーションのエンドツーエンド暗号化の導入に向けて準備を進めています。

- たとえば、来年、CPaaSプロバイダーであるTanla Platformsは、Microsoftと提携して、Wiselyと呼ばれるエッジツーエッジの世界ブロックチェーンネットワークを立ち上げました。これは、暗号化されたSMSを企業から通信事業者に直接送信するために作られたもので、同社はまた、商業コミュニケーションの既存のアグリゲーターモデルを破壊すると主張しています。

- 日本でもスタートアップ企業が、正式な銀行取引書類を必要とせず、スマートフォンベースの安全な送金を可能にするブロックチェーンソリューションを開発しています。たとえば、日本の新興企業Telcoinはブロックチェーンを活用して、通信事業者による送金サービスの提供を容易にしています。Ethereumブロックチェーン上に構築されたTelcoin Walletを使用すると、モバイルユーザーは、ローカルのモバイルサービスプロバイダーに関係なく、即座に世界送金を行うことができます。したがって、標準化されたブロックチェーンプラットフォームを採用することは、電気通信事業者がテクノロジーの価値を十分に認識し、地域内でのより迅速な導入への道を切り開き、市場の成長を大きく推進するのに役立ちます。

電気通信におけるブロックチェーン業界の概要

市場は集中しており、遠隔通信業界全体でブロックチェーンソリューションを提供している主要なベンダーはほとんどありません。ベンダーは投資家の資金も受け取り、革新的なブロックチェーンサービスをさらに支援しています。

- 2022年11月:情報技術(IT)サービス会社Tech Mahindraと電気通信分析ソリューションプロバイダーSubexが提携し、電気通信事業者向けにブロックチェーンベースのソリューションを世界中で展開します。これらのソリューションは、全体的なコンプライアンス問題を最小限に抑えることで、不正行為を軽減し、通信サービスプロバイダー(CSP)の運用効率を向上させます。

- 2022年2月:インドの主要な通信ソリューションプロバイダーであるBharti Airtelは、適用される法的承認を条件として、Airtel Startup Accelerator Programに基づくサービスとしてのブロックチェーン企業であるAqillizの戦略的株式を取得したと発表しました。Airtelは、急成長するアドテック、デジタルエンターテイメント、さまざまなデジタルマーケットプレース製品にわたって、Aqillizの高度なブロックチェーンテクノロジーを大規模に展開することを目指しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 業界の魅力 - ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

- COVID-19の業界への影響の評価

第5章 市場力学

- 市場促進要因

- 電気通信詐欺の検出と防止に重点を置くことが市場の成長を促進

- 市場抑制要因

- 業界標準の欠如

第6章 市場セグメンテーション

- 用途

- アイデンティティ管理

- 支払いと請求

- スマートコントラクト

- 接続プロビジョニング

- 地域

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第7章 競合情勢

- 企業プロファイル

- Blockchain Foundry Inc.

- Huawei Technologies Co. Ltd.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- ShoCard Inc.(Ping Identity)

第8章 投資分析

第9章 市場の将来

The Blockchain in Telecom Market size is estimated at USD 0.99 billion in 2024, and is expected to reach USD 8.98 billion by 2029, growing at a CAGR of 55.13% during the forecast period (2024-2029).

In the telecom industry, blockchain plays a very significant role in preventing fraud, securing user identities, and supporting next-generation network services and IoT connectivity solutions, which in turn is driving the market significantly.

Key Highlights

- The increasing adoption of 5G is a catalyst for blockchain implementation in telecom, as 5G is helping in quick and reliable blockchain operations. Blockchain technology provides robust encryption to record and store the data on the network in a more secure and verifiable way. It makes the information transparent and tamper-proof. Thus, Blockchain technology is expected to help various telecom companies boost their network security and reduce operational costs, driving the market's growth.

- Moreover, telecommunications or telecom fraud is a fast-growing field of criminal activity. According to Europol's European Cybercrime Centre and Trend Micro, telecom fraud costs around USD 32.7 billion annually. It represents a new challenge for law enforcement agencies. Blockchain can help in fraud detection and prevention for communication service providers, exponentially fueling the market's growth.

- Furthermore, in emerging countries such as India, the effectiveness of telecom regulator's deployment of blockchain technology for curbing spam SMSs has set an example for the government to build a transparent and trustworthy framework for various critical use cases such as Aadhar authentication, property, and vehicle ownership records and direct tax collection among others. In March last year, the Ministry of Electronics and IT released a draft policy on blockchain technology to regulate its deployment in various public and private use cases. The telecom regulatory authority of India (TRAI) has also deployed distributor-ledger technology (DLT), which is currently one of the most significant use cases of blockchain technology to control spam SMS traffic.

- However, on the other hand, scalability and interoperability are the several critical factors necessary for the overall adoption of blockchain technology. This is only possible when industry standards are set, which is at a lagging phase. The Telecom sector needs help with the mass adoption of blockchain technology, which can hinder the market's growth.

- The onset of the pandemic has highlighted the criticality of telecom infrastructure. The global health emergency is placing new pressures on telecom services and suggesting a pivotal role they can play beyond simple connectivity in emergency scenarios. Beyond the coronavirus pandemic, the world is expected to see substantial interest in new fintech services as the growing demand for virtual and online services continues to build. Within the telecommunications industry, the pandemic is driving the need for expanding digital infrastructure and data-driven services. Telecom companies increasingly focus on network resiliency and reliability, particularly in 5G investments.

Blockchain in Telecom Market Trends

Smart Contract to Dominate the Market

- Smart contracts allow computer code to execute when specific conditions are met. The telecom industry is expected to witness significant adoption as it provides scope for automation in its internal operations, like billing, supply chain management, and roaming.

- Deploying smart contracts to manage all the billing related to roaming can lead to significant cost savings, as it provides prevention against fraudulent traffic. Blockchain can also add value to identity management solutions by cutting out intermediaries through smart contracts. This helps reduce roaming frauds, cost savings, and instant settlements. It helps telecom players to resolve disputes quickly through tamper-proof verifiable transactions and real-time updates to end customers.

- In March 2022, STC Bahrain introduced its official Chainlink node, which intends to offer smart contracts with access to a secure source of real-world data and fast off-chain computations. This makes STC Bahrain the first major telecom in the Middle East and North Africa (MENA) region to introduce a Chainlink node, enhancing the development of the smart contract ecosystem both in the area and throughout the globe.

- Moreover, 5G technology is one of the significant instances of how blockchain would change the telecommunication industry. For instance, in 5G technology, smart contracts can streamline the overall provisioning between the end user and the networks with a blockchain-based solution. For 5G to be implemented securely, the data received by connected devices must be reliable and free from various malicious interference. Further, to enable 5G to reach its full potential and protect against large-scale security breaches, blockchain can deliver decentralized, tamper-proof, and real-time verification of data transmission.

- As per 5G Americas, Solid growth in 5G subscriptions is expected to continue into the foreseeable future, reaching 5 billion subscriptions by the end of 2026. That includes the overall development of 700 million subscriptions from the current to next year and 900 million by next-to-next year.

Asia Pacific to Witness the Highest Growth

- The Asia-Pacific region boasts tremendous potential for the market, primarily owing to the growing prominence of mobile payments in countries such as India and China. India, specifically after the demonetization scheme, has witnessed many telecom operators shifting toward this model. For instance, Jio and Airtel, the country's leading telcos, offer digital wallets to enable customer-to-customer payments. Thus, the adoption of blockchain to handle the transactions by these companies could make their wallets more secure and cheaper, driving the market significantly.

- China Telecom, China Mobile, and China Unicom have joined the CAICT's Trusted Blockchain Initiative, which would use blockchain technology to bolster operations and security in the telecom industry. The companies are expected to focus on blockchain-based apps that relate to IoT data sharing and customer identity verification.

- Further, as the world is currently embroiled in a privacy debate over WhatsApp's policy changes, India's communication platform as a service (CPaaS) industry has been gearing up for the adoption of end-to-end encryption of commercial mobile SMSes, emails, and all other types of business communication between the enterprises and service providers.

- For instance, next year, CPaaS provider Tanla Platforms, in partnership with Microsoft, launched its edge-to-edge global blockchain network called Wisely, which was made for sending encrypted SMSes directly from enterprises to the telecom operators, which the company also claims to disrupt the existing aggregator model of commercial communication.

- In Japan, too, startups are developing blockchain solutions that enable secure smartphone-based money transfers that do not require formal banking documentation. For instance, a Japanese startup Telcoin leverages blockchain to facilitate telecommunication operators to provide money transfer services. Telcoin Wallet, built on the Ethereum blockchain, allows mobile users to make global transfers instantly, irrespective of local mobile service providers. Hence, adopting a standardized blockchain platform will help operators fully realize the technology's value and pave the path for faster adoption within the region, driving the market's growth significantly.

Blockchain in Telecom Industry Overview

The market is concentrated, with few significant vendors offering blockchain solutions across the telecommunication industry. The vendors are also receiving investors' funds, further helping in innovative blockchain services.

- November 2022 - Information technology (IT) services firm Tech Mahindra and telecom analytics solutions provider Subex have joined hands to roll out blockchain-based solutions for telecom operators globally. These solutions would mitigate fraud and drive operational efficiencies for communication service providers (CSP) by minimizing overall compliance issues.

- February 2022 - Bharti Airtel, India's premier communications solutions provider, declared that it had acquired a strategic stake in Aqilliz, a Blockchain as a Service Company under the Airtel Startup Accelerator Program, subject to applicable statutory approvals. Airtel aims to deploy Aqilliz's advanced blockchain technologies at a larger scale across its fast-growing Adtech, Digital Entertainment, and various Digital Marketplace offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Focus on Telecom Fraud Detection and Prevention is Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Industry Standards

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Identity Management

- 6.1.2 Payment and Billing

- 6.1.3 Smart Contract

- 6.1.4 Connectivity Provisioning

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blockchain Foundry Inc.

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Microsoft Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 SAP SE

- 7.1.6 ShoCard Inc. (Ping Identity)