|

|

市場調査レポート

商品コード

1851753

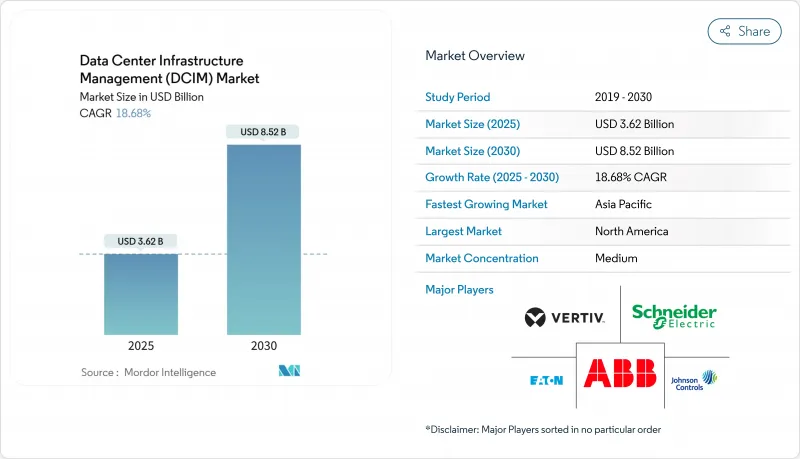

データセンターインフラ管理(DCIM):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Data Center Infrastructure Management (DCIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| データセンターインフラ管理(DCIM):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月02日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

データセンターインフラ管理市場の2025年の市場規模は36億2,000万米ドルで、2030年には85億2,000万米ドルに達し、CAGR 18.68%で拡大すると予測されています。

成長を後押しするのは、AIによる熱負荷、欧州連合(EU)におけるエネルギー使用量開示規則の義務化、キャンパス当たり500MWを超えるハイパースケールプロジェクトの世界的な波です。プロバイダーは、サイバー保険の遠隔測定要件を満たし、規制遵守を測定可能なエネルギー節約に変換するために、予測分析をますます組み込むようになっています。データセンター事業者はファシリティエンジニアの持続的な不足に直面しているため、マネージドDCIM運用にリンクしたサービスが最も急速に加速しています。競合の中心は、冷却、電力、資産利用をラックレベルで最適化する統合ハードウェア・ソフトウェア・ポートフォリオです。投資家は、融資コストを検証可能なESG指標と結びつけており、DCIMによって検証された効率性が、新設や改修の差別化要因になっています。

世界のデータセンターインフラ管理(DCIM)市場の動向と洞察

ネットゼロの追求加速とエネルギー使用量開示の義務化

EUのエネルギー効率指令は、2024年9月までに500kW以上のすべてのデータセンターに対して、電力使用効率、炭素使用効率、水使用効率を開示することを義務付けており、DCIMはオプションの最適化ソフトウェアから必須のコンプライアンスインフラへと位置づけを変えています。リアルタイムDCIMを導入した事業者は、ダイナミックな容量予測により18%のエネルギー削減を報告し、規制の支出に対する具体的なリターンを実証しています。多国籍企業は現在、持続可能性報告を合理化し、地域固有の監査を避けるために、すべての施設で同一のDCIMスタックを標準化しています。投資家が調和のとれたESG開示を求めるため、需要は欧州以外にも広がっています。この指令は、EUの電力消費量の3%近くを消費するセンターも対象としているため、効率性の向上は地域全体の送電網の緩和につながります。

500MWクラスターを超えるハイパースケールビルドアウト

Compass Datacentersの100億米ドル規模のMississippiプロジェクトのようなキャンパス規模の投資では、モジュール式の電源および冷却スキッド全体で数千のラックを調整するDCIMプラットフォームが必要です。従来のビル管理システムでは、ラックレベルの遠隔測定や、ギガワットスケールでの故障予測アラートを提供することはできません。シーメンス社との複数年にわたる供給契約に代表されるプレハブ電源モジュールとの統合は、DCIMソフトウェアと電気インフラとの連携を強化します。事業者は、資本強度が高まるにつれて、運転経費を削減するために、気流と容量をリアルタイムで可視化することを優先しています。500MW以上のフットプリントへのシフトは、このようにDCIMをプロジェクトの実現可能性調査の中心に据えることになります。

持続するOT-IT統合の複雑性とレガシーBMSの重複

レガシーなビル管理システムは、最新のDCIM APIと相互運用できない独自のプロトコルに依存していることが多いです。オペレータは、センサーとダッシュボードを重複させ、設備投資とオペレックスの両方を膨張させる一方で、統一された資産目録を欠いています。カスタムミドルウェアプロジェクトは、アップグレードを再コード化する必要があるため、導入スケジュールに数カ月を追加し、ライフサイクルコストを上昇させる。マルチベンダーの施設では、各メカニカル・コントラクターが機能を閉じたツールチェーンの中に閉じ込め、全体的なエネルギー最適化を妨げる可能性があります。

セグメント分析

事業者の58%が有能な設備エンジニアの雇用が困難であると報告しているため、サービス収入はCAGR 23.34%で増加すると予測されます。アセットマネジメントの展開は現在、プロジェクトベースの実装から、継続的な最適化をバンドルするサブスクリプションフレームワークへとシフトしています。マネージド・サービスは、AIクラスタに付随する液冷ループのチューニングの複雑さも吸収します。2024年のデータセンターインフラ管理市場シェアはソリューションが66.2%を占めたが、成果ベースの契約の台頭はサービス中心の将来を示唆しています。企業は、センサーの較正、ファームウェア管理、コンプライアンス・レポーティングをアウトソーシングすることで、人件費を抑えることを好みます。

エッジノードの拡大に伴い、ネットワークと接続性の管理機能に対する需要も増加します。ベンダーは、レガシーBMSの橋渡しをする統合アクセラレーターをパッケージ化し、顧客が単一のガラス窓を見ることができるようにしています。この進化は、単発のソフトウェア・ライセンスから、専門家によるサポートに裏打ちされた継続的な収益へと戦略的軸足を移していることを強調しています。

メガ施設は150MW以上のキャンパスと定義され、CAGR 21.96%を記録すると予想され、以前のクラウドの波を支配していたマッシブ施設を駆逐します。事業者は、GPUインターコネクトの利点がレイテンシのペナルティを上回るため、AIトレーニングクラスターを集中管理します。メガキャンパスはスケールメリットを生かし、液冷ループを複数のホールで共有できるようにし、冷却プラントの効率を1.1 PUE以下に押し上げます。このセグメントのデータセンター・インフラストラクチャ・マネジメント市場規模は、センサーの数が数百万に達し、オーケストレーションの複雑さが増すにつれて急速に拡大します。

メガ規模のキャンパスへの移行は、モジュール式の電源スキッドや、工場でテストされたDCIM統合を備えたプレハブのホールセグメントにおける技術革新の種にもなります。小規模な企業施設は、レイテンシに敏感なワークロードのための役割を維持していますが、予算の制約により、高度なデジタルツインモジュールの採用は制限されています。

データセンターインフラ管理(DCIM)市場レポートは、データセンター規模(中小規模、その他)、展開タイプ(オンプレミス、コロケーション)、コンポーネント(ソリューション、サービス)、エンドユーザー産業(IT・通信、BFSI、その他)、地域(北米、欧州、その他)で業界を分類しています。市場予測は金額(米ドル)で提供されます。

地域別分析

北米は、ハイパースケール構築とAIトレーニングセンターの早期導入により、2024年の売上高の42.4%を占めました。同地域の事業者は、ラック密度を50kW以上に高めるために液体冷却とデジタルツインを導入し、DCIMへの支出を増やしています。連邦政府および州のエネルギー効率インセンティブは、リアルタイムモニタリングのビジネスケースをさらに強化します。

アジア太平洋地域は、中国が2027年までに1,250億米ドルのデータセンター経済圏を目指し、インドがデジタル・インディア構想の下で加速していることから、2030年までCAGR 35.23%で成長すると予測されています。日本は世界で最も高い建設コストに直面しており、1平方メートルあたりから最大限の能力を引き出す自動化DCIMへの関心が高まっています。シンガポールとオーストラリアは地域のハブとして機能し、多様なコンプライアンス要件を満たす必要がある国境を越えたクラウドサービスを供給しています。

欧州では、エネルギー効率指令の後押しを受け、着実な拡大を維持しています。事業者は2024年9月の報告期限に間に合わせるため、DCIMをブラウンフィールドの改修と新築の両方に組み込んで競争しています。中東と南米市場では、地域のクラウドプロバイダーがレイテンシーを削減するためにインフラをローカライズしており、需要が高まっています。アフリカはまだ始まったばかりだが、モバイル・インターネットの利用が増加するにつれて、軽量DCIMの採用が見込まれています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 加速するネットゼロの追求とエネルギー使用量開示の義務化

- 500MWクラスターを超えるハイパースケールビルドアウト

- 5G/IoTに向けたエッジとマイクロデータセンターの普及

- リアルタイムCFD連成DCIMを要求するAI/ML駆動の熱負荷

- サイバー保険がDCIMベースのリスク遠隔測定を要求

- DCIMが検証した効率指標をスコア化したESG連動型融資

- 市場抑制要因

- 持続するOT-IT統合の複雑性とレガシーBMSの重複

- クラウドホスト型DCIMプラットフォームに対するデータ主権上の懸念

- DCIMに精通したファシリティエンジニアの不足

- AIラックの高密度化がセンサーネットワークの改修を上回る

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 市場のマクロ経済動向の評価

- 価格分析

第5章 市場規模と成長予測

- コンポーネント別

- ソリューション

- アセット&キャパシティ・マネジメント

- 電源および冷却管理

- ネットワークおよび接続管理

- サービス

- コンサルティング&インテグレーション

- マネージド&サポートサービス

- ソリューション

- データセンター規模別

- 小

- 中

- 大

- 巨大

- メガ

- 展開モード別

- オンプレミス

- コロケーション

- リテールコロケーション

- ホールセール/ハイパースケールコロケーション

- クラウド/DCIM-as-a-Service

- エンドユーザー業界別

- ITおよびテレコム

- BFSI

- ヘルスケアとライフサイエンス

- 政府および防衛

- 製造業および工業

- 小売とeコマース

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- シンガポール

- オーストラリア

- マレーシア

- その他アジア太平洋地域

- 南米

- ブラジル

- チリ

- アルゼンチン

- その他南米

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd

- Eaton Corporation plc

- Johnson Controls International plc

- IBM Corporation

- Siemens AG

- CommScope(Nlyte and iTRACS)

- Sunbird Software

- FNT GmbH

- Device42

- Panduit Corp.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd

- Raritan Inc.(Legrand)

- Siemens Smart Infrastructure

- EkkoSense Ltd

- RFcode Inc.

- Modius Inc.

- OpenDCIM(open-source)