|

市場調査レポート

商品コード

1687927

家庭用ロボット:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Household Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 家庭用ロボット:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

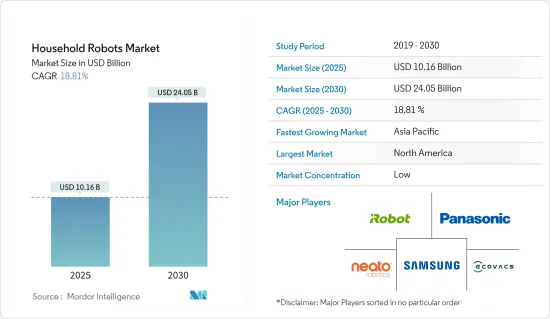

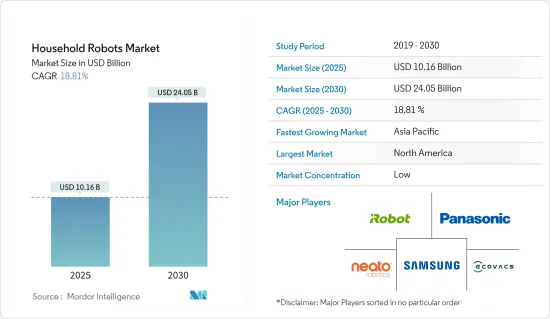

家庭用ロボット市場規模は2025年に101億6,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは18.81%で、2030年には240億5,000万米ドルに達すると予測されます。

主要ハイライト

- 家庭用ロボットは、家庭用ロボットとも呼ばれ、プール掃除、床掃除、芝刈りなどのありふれた作業を行う自律型サービスロボットです。また、エンターテインメント、教育、高齢者介護などにも利用できます。

- スマートホームのコンセプトが急速に高まる中、ロボティクスはスマートホームのエコシステム全体において重要な役割を果たすと予想されます。ロボット掃除機の使用による家事の軽減が市場成長の主要因です。現代の家庭はコンピュータ化が進み、利便性を提供し、家事に費やす時間を削減しています。掃除機は家の掃除を簡単にする一方で、騒音を発生させ、日常使用に嵩を増します。

- さらに、市場を牽引する主要因のひとつは、さまざまな用途の家庭用ロボットの開発に世界中の企業が投資を増やしていることです。例えば、英国のダイソンは2022年5月、家事をこなせる家庭用ロボットのプロトタイプを公開しました。同社はまた、英国最大のロボット研究施設の建設計画も発表しました。

- 家庭用ロボットの世界需要を牽引するその他の重要な要因としては、民生用電子機器製品の自動化の進展、先進国における人件費の上昇、健康と安全に対する懸念の高まりなどが挙げられます。AI、ロボット工学、マシンビジョンカメラなどの技術開拓の増加は、階段などの床縁を効果的にマッピングし、ケーブル、ごみ箱、ドア敷居、敷物などの障害物を認識することで、これらのロボットがよりスムーズかつ効率的に動作することを可能にし、市場の成長を助けています。

- 睡眠や水分補給、ストレスなど、高齢者の健康維持を技術で支援する取り組みが政府や独立機関によっていくつか行われていることも、家庭用ロボットの需要を押し上げています。例えば、Olympic Area Agency on Aging(O3A)とIntuition Roboticsは2023年3月、さらなる支援を必要とするグレイズハーバー郡とパシフィック郡の高齢者にAI駆動型ケアコンパニオンロボットElliQを提供する新しいプログラムを発表しました。

- しかし、これらのロボットの調達コストやメンテナンスコストが高いことが、調査対象市場の成長を妨げる大きな要因の一つとなっています。これらのロボットを効率的に操作するには、一定レベルの技術的ノウハウが必要であり、これも特に新興国市場における市場開拓の課題となっています。

- 家庭用ロボットの価格は低下しているもの、特にラテンアメリカやアフリカのような地域では、大量消費者に採用されるにはまだ十分高価です。掃除ロボットの性能が向上したことで、これらのロボットの効率的な性能に対するニーズが高まり、コストがさらに上昇しています。さらに、施策立案者や政府は、その技術が普及に値するかどうかも判断しなければならないです。例えば、ロボット掃除機やプールクリーナーの場合、低所得者層の雇用を脅かし、失業につながる可能性があります。したがって、このような動向は、調査された市場の成長にも課題を投げかけています。

家庭用ロボット市場の動向

ロボット掃除機とモップ掛けが主要シェアを占める見込み

- パンデミック(世界的大流行)の最中、高品質のプロ仕様の家庭用掃除用品は、多くの人々にとって当然の要件となりました。清掃ロボットは手作業よりも非接触でインテリジェントな清掃の利点を提供するため、パンデミックの発生は家庭用清掃ロボット産業に戦略的な開発機会をもたらしました。

- 急速な都市化などの要因も、掃除機がけやモップがけ用途の掃除ロボットの需要を増加させると予想されます。例えば、世界では急速に都市化が進んでおり、2050年までに人口の65%以上が都市に住むようになると予想されている(WHOによる)。現在のシナリオでは、北米が都市人口の83%で世界をリードし、ラテンアメリカとカリブ海諸国(81%)、欧州(75%)がこれに続く(供給源:人口問題ラボ)。

- また、新興国では働く男女の数が増加しているため、家庭での掃除の時間短縮に役立つ機器の需要も高まっています。モノのインターネット(IoT)やホームエリアネットワーク(HAN)技術の導入により、掃除ロボットの住宅用途が拡大しています。

- さらに、清掃員による危険な化学品の使用に対する安全性への懸念の高まりや、厳格な安全基準の導入が、今後数年間におけるロボット掃除機の需要を促進すると予想されます。IoTフレームワークは、正確なセンサ結果を取得し、必要なタスクを実行するのに最適であるため、IoT対応ロボットの住宅用途の増加は、セグメントの成長をサポートしています。

- 需要の高まりを受けて、市場参入企業は先進的なソリューションの提供に積極的に投資しています。例えば、2022年9月、消費者向けロボットのリーダーであるRobot Corp.は、世界で最も先進的なロボット掃除機とモップであるRoomba combo j7+をリリースし、ロボットOS 5.0のアップデートを行りました。ルンバコンボj7+は、掃除機とモップを一度に掃除することで、時間を節約しながら、床を新鮮で清潔に保ち、他の2-in-1ロボットとは一線を画しています。カーペットやラグ、硬い床を使用する忙しい家庭や、モップがけもできるロボット掃除機を求めている人向けに設計されています。

- 同様に、フィリップスR6スリムロボット掃除機は2023年1月に中国で発売されました。この掃除機には、0.4Lのゴミ箱、2,700paの吸引力、ゴミの除去や捕獲を助ける複数のブラシが搭載されています。ロボット掃除機に搭載された2つのモップヘッドは、1分間に最大120回回転し、6Nの力を発揮しながらオーナーの床を掃除することができます。予測期間中、同社の行動はロボット掃除機の需要を増加させると予想されます。

アジア太平洋の需要が大きく伸びる見込み

- アジア太平洋は、中国、日本、インドなどの経済圏で家庭用ロボットが広く普及した結果、大きく成長して市場を牽引すると予想されます。中国や日本の企業によるロボットシステムの急速な開発は、同地域における掃除ロボットの需要と消費を増加させる可能性があります。

- この地域は、技術の普及と国内生産の増加により、急速に成長している清掃ロボット市場の一つです。地域ベンダーもまた、清掃ロボットの技術革新と開発において重要な役割を果たしています。例えば、大手民生用電子機器ブランドのハイアールは、2022年5月にインドで初のワイズ掃除機を発売しました。ドライモップとウェットモップの2in1を備えたこのロボット掃除機は、2.4GHzのWi-Fi、Googleホームアシスタント、ハイアールのスマートアプリ、音声コントロール、リモコンなどのスマート管理機能を備えています。

- 同地域における家庭用ロボットの需要を促進する重要な要因としては、同地域の都市化率の上昇と人口のライフスタイルの変化が挙げられます。人口問題ラボによると、中国とインドの都市人口は2030年までに3億4,000万人以上増加すると予想されています。ラオスのような小国でさえ、2030年までに都市化率は43%にとどまるが、都市人口は約320万人増加すると予想されています。

- ロボット産業の成長を促進する政府のさまざまな取り組みや規制も、組織間の協力関係を促進することで市場成長に有利な環境を作り出しており、その結果、革新的な技術が開発されています。例えば、中国政府は第14次5ヵ年計画において、ロボット産業を経済戦略上重要な産業と位置付けています。2025年までに、中国は世界のロボット技術革新の重要な源泉となることを計画しています。

- さらに、特に中国や日本などの国々で高齢者が増加していることも、家庭用ロボットの需要を牽引する主要因のひとつであり続けると予想されています。米国国勢調査局によると、2060年までに東アジアの人口の約33.7%が65歳以上になると予測されています。一方、同時期に高齢者の割合が最も低くなると予想されるのは、南アジア(18.6%)と西アジア(17.9%)です。

- さらに、需要の高まりは新規参入企業の市場参入を促し、ベンダー間の競争を激化させています。既存の市場参入企業の参入に加え、需要の高まりがこの地域の新興企業エコシステムを後押ししています。したがって、このような動向は、掃除ロボットの需要促進から、娯楽や同伴のための人型ロボットのニーズまで、予測期間中の市場成長にプラスに寄与すると予想されます。

家庭用ロボット産業概要

家庭用ロボット市場は、iRobot Corporation、Neato Robotics Inc.、Samsung Electronics、Ecovacs Robotics Inc.、Panasonic Corporationなどの大手企業が存在し、細分化されています。同市場の参入企業は、製品ラインナップを強化し、サステイナブル競争優位性を獲得するために、提携、技術革新、買収などの戦略を採用しています。

- 2023年5月、日本の人工知能(AI)スタートアップ企業が住宅用ロボットを発売しました。新たに発売されたロボットは、調味料や食器を食卓に運んだり、飲み物や本をソファに運んだりするなど、口頭で指示された物を届けることができます。東京に本社を置く株式会社プリファード・ロボティクスが開発したこのロボットは「カチャカ」と呼ばれ、キャスター付きのテーブルの底に取り付けられます。

- 2023年1月、Roborock Technologyは、ロボロックS8プロ・ウルトラ、ロボロックS8+、ロボロックS8を含むフラッグシップロボット掃除機S8シリーズを発表しました。これらのロボットには、家庭内を簡単に移動できるインテリジェンスが搭載されており、これまで以上に手間をかけないディープクリーニング機能を記載しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

- 産業バリューチェーン分析

- マクロ動向が産業に与える影響

第5章 市場力学

- 市場促進要因

- 研究開発投資の拡大と幅広い応用範囲

- 急速な都市化

- 市場抑制要因

- 機器の高コスト

第6章 市場セグメンテーション

- 用途別

- ロボット掃除機とモップ掛け

- 芝刈り

- プール清掃

- コンパニオンとその他の用途

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- iRobot Corporation

- Neato Robotics Inc.

- Samsung Electronics Co. Ltd.

- Ecovacs Robotics Inc.

- Panasonic Corporation

- LG Electronics Inc.

- Blue Frog Robotics Inc.

- Roborock Technology Co. Ltd.

- Husqvarna Group

- ILIFE Innovation Ltd.

- bObsweep Inc.

- SharkNinja Operating LLC

- Maytronics Ltd.

第8章 投資分析

第9章 市場機会と今後の動向

The Household Robots Market size is estimated at USD 10.16 billion in 2025, and is expected to reach USD 24.05 billion by 2030, at a CAGR of 18.81% during the forecast period (2025-2030).

Key Highlights

- Household robots, also known as domestic robots, are autonomous service robots that perform mundane tasks such as pool cleaning, floor cleaning, and lawn mowing. They can also be used for other things like entertainment, education, and elderly care.

- With the rapidly growing smart home concept, Robotics is expected to play a critical role in the overall smart home ecosystem. The reduction in household activities caused by the use of robotic vacuum cleaners is the primary driver of market growth. Modern households are becoming more computerized, providing convenience and reducing time spent on housework. While vacuum cleaners have made house cleaning easier, they produce noise and add bulk to everyday use.

- Moreover, one of the major factors driving the market is the increasing investment by companies worldwide in developing household robots for various applications. For example, Dyson, a British company, revealed a prototype of home robots capable of performing domestic chores in May 2022. The company also announced plans to construct the UK's largest robotics research facility.

- Other significant factors driving global demand for household robots include increasing automation in household appliances, rising labor costs in developed countries, and rising health and safety concerns. The increasing technological development in AI, robotics, and machine vision cameras, among others, aids market growth by effectively mapping floor edges, such as a staircase, and recognizing obstacles, such as cables, dustbins, doorsills, and rugs, allowing these robots to operate more smoothly and efficiently.

- Several initiatives being undertaken by the government and independent organizations to use technology to assist elderly people in maintaining their health and wellness, such as sleep, hydration, stress, and so on, are also driving demand for household robots. For example, the Olympic Area Agency on Aging (O3A) and Intuition Robotics announced a new program in March 2023 to provide ElliQ, an AI-driven care companion robot, to older adults in Grays Harbor and Pacific Counties who require additional assistance.

- However, the higher procurement and maintenance costs of these robots are among the significant factors impeding the growth of the studied market. To operate these robots efficiently, a certain level of technological know-how is required, which also poses a challenge to the market's development, particularly in developing regions.

- Despite the prices of home robots decreasing, these are still high enough to be adopted by mass consumers, especially in regions like Latin America and Africa. The increasing capabilities of cleaning robots have propelled the need for these robots' efficient performance, which further increases the cost. Additionally, policymakers and governments must also determine whether the technology deserves widespread application. For instance, in the cases of robotic vacuum cleaners and pool cleaners, it jeopardizes the jobs of several lower-income groups, which may lead to unemployment. Hence, such trends also challenge the studied market's growth.

Household Robots Market Trends

Robotic Vacuum and Mopping is Expected to Hold Major Share

- During the pandemic, high-quality professional household cleaning products became an obvious requirement for most people. As cleaning robots provide contactless and intelligent cleaning advantages over manual services, the pandemic outbreak has presented a strategic development opportunity in the household cleaning robot industry.

- Factors such as rapid urbanization are also anticipated to increase the demand for cleaning robots for vacuuming and mopping applications. For instance, the world is rapidly urbanizing, with more than 65 percent of the population expected to live in cities by 2050 (according to the WHO). In the current scenario, North America leads the world with 83 percent of the urban population, followed by Latin America and the Caribbean (81 percent) and Europe (75 percent) (Source: Population Reference Bureau).

- The rising number of working men and women in emerging economies has also increased demand for devices that can help save time when cleaning at home. The introduction of the Internet of Things (IoT) and Home Area Networks (HAN) technologies is expanding the residential application of cleaning robots.

- Moreover, Growing safety concerns about the use of hazardous chemicals by cleaning personnel and the implementation of stringent safety standards are expected to drive demand for robotic vacuums in the coming years. As the IoT framework is best suited to obtain accurate sensor results and perform the required tasks, the increased residential application of IoT-enabled robots supports segmental growth.

- Owing to the growing demand, market participants have been actively investing in providing advanced solutions. For example, in September 2022, robot Corp., a consumer robot leader, released the Roomba combo j7+, the world's most advanced robot vacuum and mop, and thoughtful robot OS 5.0 updates. The Roomba combo j7+ stands out from other 2-in-1 robots by vacuuming and mopping in a single cleaning job, saving time while keeping floors fresh and clean. It is designed for busy households with carpets, rugs, and hard floors and those who want a robot vacuum that can also mop.

- Similarly, the Philips R6 Slim Robot Vacuum Cleaner was released in China in January 2023. The vacuum would include a 0.4 L onboard dustbin, a 2,700 pa suction power, and several brushes to help remove and capture debris. The two mop heads on the robot vacuum cleaner could rotate up to 120 times per minute and exert 6 N of force while cleaning the owners' floors. During the projection period, the company's actions are anticipated to increase demand for robotic vacuum cleaners.

Demand in Asia-Pacific is Expected to Grow Significantly

- The Asia-Pacific region is expected to drive the market by growing significantly as a result of the widespread adoption of household robots in economies such as China, Japan, and India. The rapid development of robotic systems by Chinese and Japanese companies may increase the demand for and consumption of cleaning robots in the region.

- The region is one of the rapidly growing cleaning robot markets, owing to widespread technology adoption and rising domestic production. Regional vendors also play an essential role in cleaning robot innovation and development. For example, Haier, a leading consumer electronics brand, launched its first-ever wise vacuum cleaner in India in May 2022. The robot vacuum cleaner with a 2-in-1 dry and wet mop has 2.4 GHz Wi-Fi, Google Home Assistant, and smart management features such as the Haier smart app, voice control, and remote control.

- Among the significant factors driving demand for household robots in the region are the region's growing urbanization rate and the changing lifestyle of the population. According to the Population Reference Bureau, China and India's urban populations are expected to grow by more than 340 million by 2030. Even a small country like Laos is expected to add about 3.2 million people to its urban population while remaining only 43 percent urbanized by 2030.

- Various government initiatives and regulations promoting the growth of the robotics industry are also creating a favorable environment for market growth by facilitating inter-organizational collaboration, which results in the development of innovative technologies. For example, the Chinese government has identified the robotics industry as critical to its economic strategy in its 14th Five-Year Plan. By 2025, China plans to become a significant source of global robotics innovation.

- Moreover, A rising elderly population, especially in countries such as China and Japan, is also expected to remain among the major factors driving the demand for household robots. According to the U.S. Census Bureau, by 2060, about 33.7 percent of Eastern Asia's population is projected to be 65 and older. In contrast, Southern Asia (18.6 percent) and Western Asia (17.9 percent) are expected to have the lowest proportions of older people during the same period.

- Additionally, the rising demand encourages new players to enter the market, increasing competition between the vendors. In addition to the entry of established market players, rising demand is boosting the region's startup ecosystem. Hence, such trends are expected to contribute positively to market growth during the forecast period, from driving demand for cleaning robots to the need for humanoid robots for entertainment and companionship.

Household Robots Industry Overview

The household robots market is fragmented with the presence of major players like iRobot Corporation, Neato Robotics Inc., Samsung Electronics Co. Ltd, Ecovacs Robotics Inc., and Panasonic Corporation. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In May 2023, A Japanese artificial intelligence (AI) startup firm launched a robot for residential applications. The newly launched robot is capable of delivering items when given verbal commands, such as bringing condiments and dishes to the dining room table or drinks or books to the sofa. Developed by Tokyo-based Preferred Robotics Inc., the robot is called "Kachaka" and attaches to the bottom of tables fitted with caster wheels.

- In January 2023, Roborock Technology Co. Ltd. introduced its S8 Series of flagship robot vacuums, including the Roborock S8 Pro Ultra, Roborock S8+, and the Roborock S8. These robots come with the intelligence to easily move around the home, offering hands-off deep cleaning capabilities better than ever before.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Research and Development Investments and Wide Range of Applications

- 5.1.2 Rapid Urbanization

- 5.2 Market Restraints

- 5.2.1 High Cost of Equipment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Robotic Vacuum and Mopping

- 6.1.2 Lawn Mowing

- 6.1.3 Pool Cleaning

- 6.1.4 Companionship and Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 iRobot Corporation

- 7.1.2 Neato Robotics Inc.

- 7.1.3 Samsung Electronics Co. Ltd.

- 7.1.4 Ecovacs Robotics Inc.

- 7.1.5 Panasonic Corporation

- 7.1.6 LG Electronics Inc.

- 7.1.7 Blue Frog Robotics Inc.

- 7.1.8 Roborock Technology Co. Ltd.

- 7.1.9 Husqvarna Group

- 7.1.10 ILIFE Innovation Ltd.

- 7.1.11 bObsweep Inc.

- 7.1.12 SharkNinja Operating LLC

- 7.1.13 Maytronics Ltd.