|

市場調査レポート

商品コード

1404544

航空機制御面:市場シェア分析、産業動向・統計、成長予測、2024~2029年Aircraft Control Surfaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機制御面:市場シェア分析、産業動向・統計、成長予測、2024~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

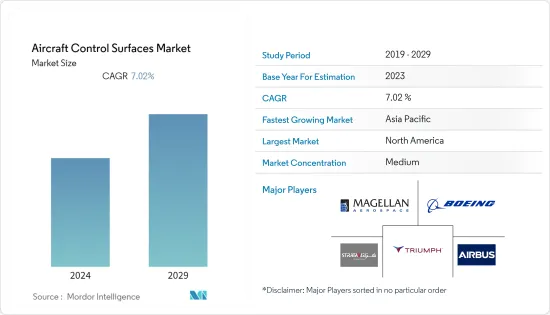

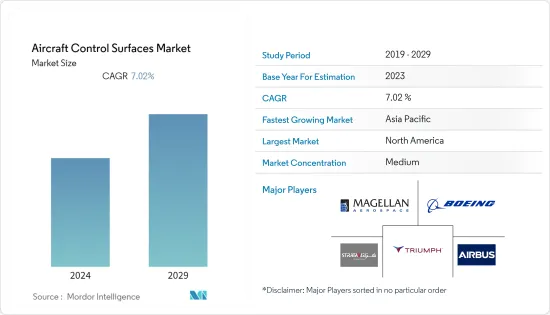

航空機制御面市場は2024年に36億7,000万米ドルと評価され、2029年には51億5,000万米ドルに達すると予測され、予測期間中のCAGRは7.02%で成長すると予想されます。

新型航空機の受注拡大が市場の主な成長要因です。新しい航空機の調達は、予測期間中に制御面のような航空機部品やコンポーネントの需要を生み出す可能性があります。

非従来型の航空機設計の研究の増加は、今後数年間、市場に新たな機会を生み出すと予想されます。先進的な航空機管理システムの高価格は、世界市場における低予算航空会社の市場抑制要因となっています。適切な安全性と制御システムの導入に対する公的機関と航空機関の一貫した遵守は、予測期間における世界の航空機制御面市場の成長に大きく貢献すると予想されます。

航空機制御面市場の動向

民間航空機セグメントが最も高い市場シェア

民間航空機セグメントの市場シェアが圧倒的に高いのは、軍用機に比べ民間航空機の納入数が多いことが主な要因です。民間航空機に比べ、一般航空機の固定翼機の制御面の平均サイズと平均製造コストが低いため、一般航空機の固定翼機の制御面のコストは低いです。民間航空機の納入数は増加の一途をたどっています。

アジア太平洋地域が予測期間中に最も高いCAGRを示す見込み

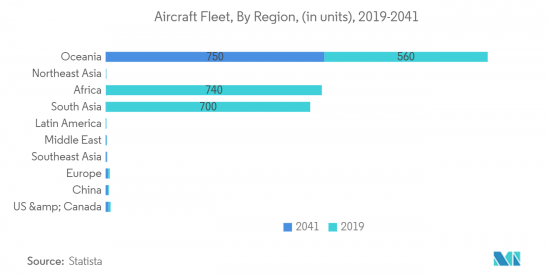

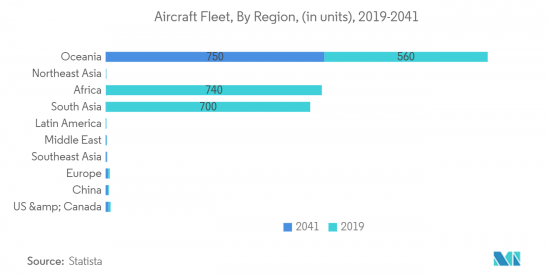

航空機制御面市場は、主にアジア太平洋地域における航空機調達の増加により、高い成長が見込まれています。同地域は、民間航空機、軍用航空機、一般航空機の出荷量全体で最も急成長している市場になると予測されています。中国が同地域の航空機制御面市場の成長をリードし、インドがそれに続くと予想されます。この2カ国は、さまざまな航空機の近代化計画と相まって、世界で最も急成長している航空市場です。同地域における一般航空機の需要拡大が成長を後押ししています。また、この地域は、特に中国と日本における航空機の国産化の進展からも恩恵を受けています。

航空機制御面産業の概要

航空機制御面市場は、市場プレーヤーが特定の航空機モデルについて航空機OEMと長期的に提携しているため、適度に断片化されています。Triumph Group, Inc.、Magellan Aerospace Corporation、Strata Manufacturing PJSC、The Boeing Company、Airbus SEなどが、この市場における著名なプレーヤーです。航空機メーカーは、全体としての収益性を高めるために、重量を軽くし、抵抗を減らし、燃料節約を増やす制御面技術の革新を歓迎しています。そのため、今後数年間は、異なる材料やわずかな設計変更を施した、より新しいタイプの制御面が発売される見込みです。製造コストの削減、品質の向上、納期の効率化を目指すボーイングの重点工場構想のような取り組みは、プレーヤーが新たな契約を獲得するのに役立っています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- 主要飛行制御面

- エルロン

- エレベーター

- ラダー

- 副制御面

- フラップ

- スポイラー

- スラット

- その他

- 主要飛行制御面

- エンドユーザー

- 民間航空機

- 軍用機

- 一般航空機

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- エジプト

- 南アフリカ

- その他中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Magellan Aerospace Corporation

- Strata Manufacturing PJSC

- The Boeing Company

- Airbus SE

- Triumph Group, Inc.

- Spirit AeroSystems, Inc.

- RUAG International Holding Ltd.

- Aernnova Aerospace S.A.

- FACC AG

- Melrose Industries PLC

- Unitech Composites Inc.

- Patria Group

- Sealand Aviation Ltd.

第7章 市場機会と今後の動向

The Aircraft Control Surfaces Market is valued at USD 3.67 billion in 2024 and is forecasted to reach USD 5.15 billion by 2029, growing at a CAGR of 7.02% during the forecast period.

Growing orders for new aircraft are the primary growth driver for the market. The procurements of new aircraft may generate demand for aircraft parts and components, like the control surfaces, during the forecast period.

Innovations in aircraft designs gave rise to technologies like dual-purpose flight control surfaces. The growing research in non-conventional aircraft designs is expected to generate new opportunities for the market in the coming years. The high price of advanced aircraft management systems is a market restraint for low-budget air carriers on the global market. Consistent adherence between public authorities and aviation agencies to installing adequate safety and control systems is expected to contribute significantly to the growth in the global aircraft control surfaces market over the forecast period.

Aircraft Control Surfaces Market Trends

Commercial Aircraft Segment had the Highest Market Share

The dominant market share of the commercial aircraft segment is primarily attributed to the high number of deliveries of commercial aircraft compared to the military. The cost of control surfaces for general aviation fixed-wing aircraft is less due to the lower average size and average manufacturing costs associated with the control surfaces in general aviation aircraft compared to those of commercial aircraft. The deliveries of commercial aircraft are continually increasing. For instance, Airbus delivered 661* commercial aircraft to 84 customers in 2022 and registered 1,078 gross new orders. Airbus' end December 2022 backlog stood at 7,239 aircraft. The aircraft delivered is 8% higher compared to 2021. Airbus equally won 802 new orders across all programs and market segments, including several high-profile commitments from some of the world's leading carriers.

Similarly, Boeing delivered 480 airplanes and won 774 net new orders after allowing for cancellations in 2022. Moreover, the Boeing Company secured a USD 796 million contract from the US Army Contracting Command supply aircraft. The contract is expected to be concluded by 2027.

Asia-Pacific Region to Witness the Highest CAGR in the Forecast Period

The aircraft control surfaces market is expected to witness high growth in the Asia-Pacific, mainly due to the growth in aircraft procurements in the region. The region is projected to be the fastest-growing market in terms of the shipments of commercial, military, and general aviation aircraft altogether. China is expected to lead the growth of the aircraft control surfaces market in the region, followed by India. The two countries are the fastest-growing aviation markets in the world, coupled with the various aircraft fleet modernization programs. The growing demand for general aviation aircraft in the region is fuelling the growth. Also, the region benefitted from the growing indigenous manufacturing of aircraft, particularly in China and Japan. Aircraft models under development, like the Space Jet M90 and M100, Xian MA700, Comac C919, and CRAIG CR929, are expected to propel the growth in procurements of aircraft components like the control surfaces in the region. For C919, Xi'an Aircraft Company Limited supplies the control surfaces, whereas, for the Space Jet M90, Aerospace Industrial Development Corporation (AIDC) supplies the control surfaces. All these factors are projected to boost the market growth of the region in the future.

Aircraft Control Surfaces Industry Overview

The aircraft control surfaces market is moderately fragmented due to the long-term associations of market players with aircraft OEMs for specific aircraft models. Triumph Group, Inc., Magellan Aerospace Corporation, Strata Manufacturing PJSC, The Boeing Company, and Airbus SE are some of the prominent players in the market. Aircraft manufacturers are welcoming innovations in control surface technologies that weigh less, reduce drag, and increase fuel savings to increase their profitability on the whole. Hence, newer types of control surfaces with different materials and slight design changes are expected to be launched in the years to come. Initiatives like the focused factory initiative from Boeing, which aims at lowering manufacturing costs, improving quality, and increasing delivery efficiencies, are helping the players gain new contracts. For instance, in June 2023, Joby Aviation, Inc. and GKN Aerospace entered a multi-year agreement for the supply of thermoplastic flight control surfaces for Joby aircraft. The flight control surfaces will be comprised of a lightweight thermoplastic structure assembly manufactured using an advanced out-of-autoclave production method. This cutting-edge manufacturing process will enable high-rate production while delivering on the high-performance requirements of Joby's aircraft.

Similarly, in January 2023, DARPA awarded Boeing a contract to build a full-scale demonstration aircraft for the experimental Control of Revolutionary Aircraft with Novel Effectors (CRANE) project. The X-plane relies on active flow control (AFC), or the use of strategically placed actuators and effectors to alter the flow of air on the aircraft's surface to alter aerodynamic performance. These mechanisms replace traditional rudders, ailerons, and flaps. They also reduce drag and weight, generate lift at a high angle of attack, and allow for a change in the thickness of the structure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Flight Control Surfaces

- 5.1.1.1 Ailerons

- 5.1.1.2 Elevators

- 5.1.1.3 Rudders

- 5.1.2 Secondary Flight Control Surface

- 5.1.2.1 Flaps

- 5.1.2.2 Spoilers

- 5.1.2.3 Slats

- 5.1.2.4 Other Secondary Flight Control Surfaces

- 5.1.1 Primary Flight Control Surfaces

- 5.2 End-User

- 5.2.1 Commercial Aircraft

- 5.2.2 Military Aircraft

- 5.2.3 General Aviation Aircraft

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Magellan Aerospace Corporation

- 6.2.2 Strata Manufacturing PJSC

- 6.2.3 The Boeing Company

- 6.2.4 Airbus SE

- 6.2.5 Triumph Group, Inc.

- 6.2.6 Spirit AeroSystems, Inc.

- 6.2.7 RUAG International Holding Ltd.

- 6.2.8 Aernnova Aerospace S.A.

- 6.2.9 FACC AG

- 6.2.10 Melrose Industries PLC

- 6.2.11 Unitech Composites Inc.

- 6.2.12 Patria Group

- 6.2.13 Sealand Aviation Ltd.