|

市場調査レポート

商品コード

1687744

AIOps:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)AIOps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| AIOps:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 250 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

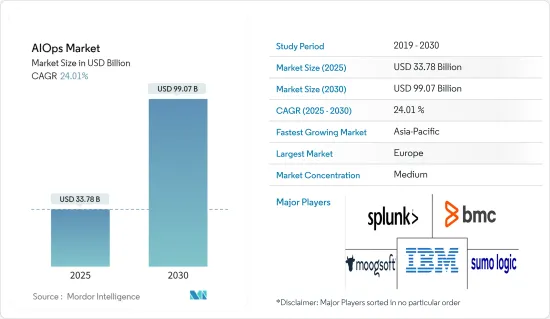

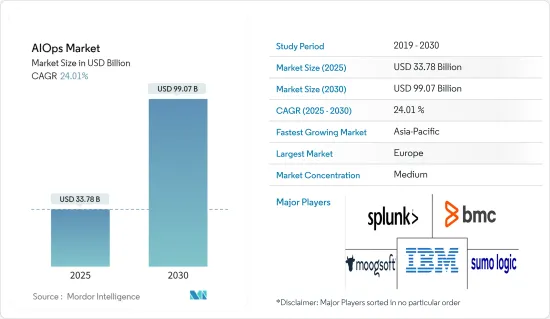

AIOps市場規模は2025年に337億8,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは24.01%で、2030年には990億7,000万米ドルに達すると予測されます。

在宅勤務者の増加に伴い、企業が在宅勤務(WFH)施策を導入したことで、情報セキュリティの焦点は企業インフラからクラウドや仮想化インフラに移りました。

主要ハイライト

- DevOpsの専門家は、大量の警告、膨大なITノイズ、多様な技術に広がるシグナルに阻まれています。その一方で、ITインフラのパフォーマンスを向上させ、イベントをより正確かつ迅速に管理したいという企業のニーズは拡大しています。

- 企業は、AIがどのように困難に対処し、IT運用を支援できるかを認識するようになり、AIベースのソリューションに移行しつつあります。さらに、在宅勤務をする個人の増加により、AIOps産業は増加すると考えられます。世界経済フォーラムによると、米国の従業員の在宅勤務日数は、2021年1月の週1.58日から昨年6月には2.37日に増加しました。

- さらに、デバイスがインテリジェンスを獲得するにつれて、ネットワークはより複雑になり、データ量は増加し、AIOpsの利用を後押ししています。クラウドコンピューティングの世界の利用拡大も、多くの業務の自動化を後押ししています。クラウドに移行する企業が増えるにつれ、AIOpsプラットフォームのニーズは急増すると予測されます。

- IT運用管理(ITOM)産業は、SaaS型ITOMの出現にすでに反応しています。ITヘルプデスクやインフラモニタリングの提供モデルとしてのSaaSは、有益であることが証明されています。これらのソリューションには通常、買収したSaaSベンダーによるログ管理、ウェブサイトモニタリング、サーバーモニタリング、クラウド管理が組み込まれています。しかし、認知度の低さは、予測期間中の市場成長を抑制する重大な懸念事項の1つです。

- 企業全体における在宅勤務施策の増加により、COVID-19の流行は人工知能を含む次世代技術セグメントの市場成長を刺激しました。例えば、クラウドとSaaSベースのリモート接続と顧客対話サービスのプロバイダーであるLogMeIn, Inc.(米国)は、このアウトブレイク期間中、すべてのサービスポートフォリオで新規登録数を大幅に伸ばしました。

- ハッキング、フィッシング、オンライン個人情報窃盗、ランサムウェアによる攻撃など、ビジネスの中断や金銭的損失を引き起こすサイバー犯罪が世界中で増加しているため、多くの企業がデータセキュリティに対する懸念を抱いています。昨年のgov.ukの世論調査によると、英国企業の39%が過去12ヶ月間にサイバー攻撃を認知しており、これは例年の調査と同じです。さらに、小規模であっても企業で自動化技術が受け入れられるようになったことで、AIベースのプラットフォームの展開が促進されており、AIOps市場の成長を後押しすると期待されています。

AIOps市場の動向

BFSIが大きなシェアを占める見込み

- 銀行業務には、従業員、顧客、外部機関によって実行される多くの定期的・非定期的な活動や取引が含まれます。これらの活動は複雑であるため、モニタリングが不可欠となります。リアルタイムの情報と自動化された問題解決を提供するAIOpsは、予測期間中の市場成長を押し上げると予想されます。C.A.技術のAIOpsプラットフォーム、すなわちC.A. Digital Experience Insightsは、金融機関がパフォーマンス、キャパシティ、設定の問題を含む複雑なI.T.問題を解決することを可能にします。

- 銀行やその他の金融機関は、主に過去数年にわたる数々のデータ流出事件を受け、生成するデータのセキュリティ確保に注力しています。

- 多くの銀行やその他の金融機関は、効率性を高めるためにAIOpsを利用しています。例えば、インドのある中央銀行は、デジタル加盟店のオンボーディングプロセスの成功率を高め、新規顧客の取引を合理化・簡素化することを目的としていました。QualityKioskのAIOpsベースの分析ソリューションAnaBotは、米国内と米国外のトランザクションをより適切に処理することで、収益を7%増加させ、加盟店のオンボーディングの成功率を向上させました。

- BAE Systems Applied Intelligenceによると、米国と英国の金融機関の約4分の3(74%)でサイバー犯罪が増加しました。サイバー犯罪は、認識されている金銭的損失に加え、株価の暴落、風評被害、法的措置など、企業にとって深刻な財務的影響を及ぼす可能性があります。AIOpsは、このような犯罪に対する防御に役立ちます。AIOpsソリューションは、影響を受けやすいシステムを保護するために、24時間体制のモニタリング、不審な活動の検出、防御操作の開始を記載しています。

- さらに、金融機関全体のオペレーションサービスにA.I.を統合することで、サービスデスクシステムに組み込まれた機能が強化されました。このため、既存の商品やプロセスに悪影響を及ぼす前に、上層部が業務動向を把握するのに必要なモニタリング機能や重要業績評価指標が提供されます。

欧州は著しい成長を遂げる

- 欧州のAIOps市場が成長する主要理由の1つは、大規模なデジタルトランスフォーメーションが進み、最新の運用ソリューションを必要とする企業に包括的なサービスを提供しようとする同地域のMSPです。

- 同地域の企業は、競合を獲得するためにさまざまな戦略を採用しています。例えば、英国に本社を置くMicro Focusは昨年10月、Operations BridgeがResearch in Action(RIA)Vendor Evaluation MatrixTM調査のAIOps Platforms部門でLeaderに認定されたと発表しました。この栄誉に加え、Micro FocusはOperations Bridge ReportsとCloud Observabilityという2つの新しいSaaSソリューションも発表しました。

- さらに、AIの導入が最も多く報告されたのはIT/技術部門で47%、次いで研究開発部門で36%、カスタマーサービス部門で24%でした。これは、IT業務セグメントでAIの重要性が高まっていることを意味しています。

- 日常業務における人工知能の認知度を高める上で、政府の果たす役割は大きいです。AIを主要な戦略的優先事項として宣言することで、いくつかの加盟国とEU機関は、AIリーダーシップに対するこの地域の野望を前進させるための措置を講じています。これには、国レベルとEUレベルのAI戦略文書の献身的な展開、研究開発と技術革新の促進、AIの開発と利用を管理するための新たな規制アプローチの模索などが含まれます。

- さらに、欧州委員会は、Horizon EuropeとDigital Europeプログラムを通じて、AIに年間10億ユーロ(10億7,000万米ドル)を投資する意向です。デジタル化された10年間で、欧州委員会は民間企業や加盟国からの投資をさらに増やし、年間200億ユーロ(213億9,000万米ドル)の投資規模を達成する予定です。

- 欧州は最近の動向として、中国や米国に対する競合優位性を獲得するため、新技術に倫理的なアプローチを取ろうとしており、人工知能の開発と使用に関する一連の厳格な規則と保護措置を発表しました。市場に参入する前に、すべての「リスクの高い」AI用途は強制的な評価の対象となります。これは、AIOpsを使用して機密データを扱う医療やBFSI部門にとって特に有益です。

AIOps産業概要

AIOps市場の主要企業は、Moogsoft Inc.、IBM Corporation、Splunk Inc.、BMC Software Inc.、Sumo Logic Inc.などが存在し、競争企業間の敵対関係は高くなっています。製品とサービスを継続的に革新する能力により、彼らは市場における他の参入企業に対して競争優位性を獲得することができました。これらの参入企業は、戦略的パートナーシップ、合併・買収、研究開発活動を通じて、より大きな市場シェアを獲得することができます。

- 2022年11月-ネットワークインテリジェンスのプロバイダーであるAprecommは、Edgecore ecCloudコントローラ向けのAIOpsソリューション、Aprecomm Virtual Wireless Expertを発表しました。リリースによると、両社が共同で発表したEdgecore Wi-Fi AIOpsソリューションにより、Edgecore Wi-Fi 6アクセスポイントの全ユーザーはネットワークパフォーマンスを向上させることができます。

- 2022年6月-HCL TechnologiesDRYiCEは、企業のフルスタックAIOpsとワークフロー観測性の要求に対応するソリューション、DRYiCE IntelliOps(IntelliOps)を発表しました。企業は、IT環境を近代化し、常に利用可能なデジタルサービスを求める消費者の期待に応えるべく、先進的デジタル化への取り組みに多大な投資を行ってきました。しかし、まだいくつかの障害を克服する必要があります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- IT運用におけるAIベースのサービスへの需要の高まり

- エンドツーエンドのビジネス用途保証とアップタイムの増加

- 市場抑制要因

- IT運用における変更の増加

- 市場機会と主要開発

- 中小企業のクラウドインフラへの移行

- 各国におけるAI導入に向けた政府の取り組み

- 過去2年間にリリースされたAIOpsツールと考慮すべき主要なAIOpsプラットフォーム機能

- 用途のライフサイクルを通じたさまざまな使用事例におけるAIOpsの適用

- AIOpsの進化段階と使用事例

第6章 主要な用途の状況

- 根本原因の分析

- ネットワークの可用性と最適化

- 問題の割り当て

- 異常検知とサイバーセキュリティ

- ストレージ管理の改善

第7章 市場セグメンテーション

- 組織タイプ

- 中小企業

- 大企業

- 展開

- オンプレミス

- クラウド/SaaS

- エンドユーザー産業

- メディアエンターテイメント

- IT・通信

- 小売

- 医療

- BFSI

- その他

- 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 競合情勢

- 企業プロファイル

- Bigpanda Inc.

- BMC Software Inc.

- Broadcom Inc

- Elasticsearch B.V

- IBM Corporation

- Logz.Io(Logshero Ltd.)

- Loom Systems Ltd.(Service Now Inc)

- Moogsoft Inc.

- Splunk Inc

- Appdynamics LLC(Cisco Systems Inc)

- Dynatrace LLC

- Extrahop Networks Inc.

- New Relic Inc.

- Resolve Systems LLC

- Stackstate BV

第9章 投資分析

第10章 市場の将来

The AIOps Market size is estimated at USD 33.78 billion in 2025, and is expected to reach USD 99.07 billion by 2030, at a CAGR of 24.01% during the forecast period (2025-2030).

With the increase in the number of people working from home, enterprise-instituted work-from-home (WFH) policies shifted information security focus from enterprise infrastructure to cloud and virtualized infrastructure.

Key Highlights

- DevOps professionals are hampered by large amounts of warnings, substantial IT noise, and signals spread across diverse technologies. Meanwhile, companies need to increase IT infrastructure performance and manage events more precisely and quickly is expanding.

- Enterprises are moving toward AI-based solutions as they become more aware of how AI can handle difficulties and assist operating IT operations. Furthermore, the growing number of individuals working from home will likely increase the AIOps industry. According to the World Economic Forum, the number of days US employees work from home climbed from 1.58 per week in January 2021 to 2.37 in June last year.

- Furthermore, as devices gain intelligence, networks have become more complex, and data volumes have increased, boosting AIOps usage. The growing global use of cloud computing is also pushing the automation of many operations. As more businesses transition to the cloud, the need for AIOps platforms is projected to surge.

- The IT Operations Management (ITOM) industry is already reacting to the emergence of SaaS ITOM. SaaS as a delivery model for IT helpdesks and infrastructure monitoring is proven beneficial. These solutions typically incorporate log management, website monitoring, server monitoring, and cloud management from acquired SaaS vendors. However, lack of awareness is one of the significant concerns restraining market growth during the forecast period.

- Due to the increasing work-from-home policy across companies, the COVID-19 outbreak stimulated market growth in next-generation tech sectors, including artificial intelligence. For example, during the outbreak, LogMeIn, Inc. (US), a provider of cloud and SaaS-based remote connection and customer interaction services, substantially increased the number of new sign-ups across all its service portfolios.

- The rising number of cybercrimes, such as hacking, phishing, online identity theft, and ransomware assaults, which cause business disruptions and financial losses worldwide, generated concerns for many companies about their data security. According to a last year's gov.uk poll, 39% of UK firms recognized a cyber assault in the preceding 12 months, consistent with prior years of the study. Furthermore, the increased acceptance of automation technologies in enterprises, even on a small scale, is driving the deployment of AI-based platforms, which is expected to boost AIOps market growth.

AIOps Market Trends

BFSI is Expected to Hold Significant Share

- Banking operations include many periodic and aperiodic activities and transactions performed by employees, customers, and external agencies. These activities are complex, which makes monitoring essential. AIOps delivering real-time information and automated problem-solving are expected to boost market growth over the forecast period. The AIOps platform from C.A. technologies, i.e., C.A. Digital Experience Insights, enables financial firms to solve complex I.T. problems, including performance, capacity, and configuration issues.

- Banks and other financial institutions focus on ensuring the security of the data they generate, primarily due to the numerous high-profile data breaches over the past few years.

- Many banks and other financial institutions are using AIOps to increase their efficiency. For instance, a central Indian bank intended to increase the success rate of its digital merchants' onboarding process and streamline and simplify transactions for its new clients. By better servicing ON-US & OFF-US transactions, QualityKiosk's AIOps-based analytics solution AnaBot boosted revenue by 7% and enhanced the success percentage of merchant onboarding.

- According to BAE Systems Applied Intelligence, cybercrime increased at about three-fourths (74%) of financial institutions in the U.S. and the United Kingdom. In addition to the recognized financial losses, cybercrime can have severe financial implications for enterprises, including collapsing stock prices, reputational damage, and legal action. AIOps can help in the defense against this crime. AIOps solutions offer round-the-clock monitoring, suspicious activity detection, and defense operation initiation to safeguard susceptible systems.

- Furthermore, the integration of A.I. in operation services across financial institutions enhanced the capabilities built into the service desk systems. It thus provides the oversight and critical performance indicators necessary for the higher management to identify operational trends before adversely impacting the existing products and processes.

Europe to Witness Significant Growth

- One of the primary reasons for the European AIOps market growth is the region's MSPs seeking to offer comprehensive services to enterprises undergoing large-scale digital transformation and requiring modern operations solutions.

- Companies in the region employ various strategies to achieve a competitive edge. For instance, in October last year, Micro Focus, a business with headquarters in the UK, declared that Operations Bridge had been recognized as a Leader in the Research in Action (RIA) Vendor Evaluation MatrixTM study for AIOps Platforms. In addition to receiving this honor, Micro Focus also unveiled Operations Bridge Reports and Cloud Observability, two new SaaS solutions.

- Moreover, the most widely reported adoption of AI (47%) was in the IT/technology function, followed by R&D with 36% and customer service with 24%. It signifies the growing importance given to AI in the IT operations field.

- The government plays a significant role in increasing awareness about artificial intelligence in daily operations. By declaring AI as a major strategic priority, several member states and EU institutions are taking steps to advance the region's ambitions for AI leadership. It includes rolling out devoted national and EU-level AI strategy documents, boosting research and innovation, and exploring new regulatory approaches for managing the development and use of AI.

- Additionally, the European Commission intends to invest EUR 1 billion (USD 1.07 billion) annually in AI through Horizon Europe and Digital Europe programs. Over the digital decade, it will mobilize further investment from the private industry and the Member States to reach an annual capital volume of Euro 20 billion (USD 21.39 billion), predicted to propel the AIOps industry in the region.

- Europe recently released a set of strict rules and safeguards for the development and artificial intelligence use as it tries to make an ethical approach to the new technology to gain a competitive advantage over China and the United States. Before entering the market, all 'high-risk' AI applications will be subject to a compulsory assessment. It will be especially beneficial for the healthcare and BFSI sectors which handle sensitive data using AIOps.

AIOps Industry Overview

The competitive rivalry amongst the players in the market is high owing to the presence of some key players such as Moogsoft Inc., IBM Corporation, Splunk Inc., BMC Software Inc., and Sumo Logic Inc., amongst others. The ability to continually innovate its products and services allowed them to gain a competitive advantage over other players in the market. These players can attain a more significant market footprint through strategic partnerships, mergers & acquisitions, and research and development activities.

- November 2022- Aprecomm, a provider of network intelligence, unveiled their AIOps solution for Edgecore ecCloud controllers, the Aprecomm Virtual Wireless Expert. According to a release, all users of Edgecore Wi-Fi 6 access points can increase network performance due to the Edgecore Wi-Fi AIOps solution that the two firms jointly introduced.

- June 2022- The HCL Technologies DRYiCE introduced DRYiCE IntelliOps (IntelliOps), a solution that addresses an enterprise's full-stack AIOps and workflow observability demands. Businesses have made significant investments in sophisticated digital efforts to modernize their IT environment and strive to meet consumer expectations for constantly available digital services. However, a few obstacles still need to be overcome.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for AI-based services in IT operations

- 5.1.2 Increasing end-to-end business application assurance and uptime

- 5.2 Market Restraints

- 5.2.1 Increasing number of changes in IT operations

- 5.3 Market Opportunities and Key Developments

- 5.3.1 SMEs Moving Towards Cloud Infrastructure

- 5.3.2 Government Initiatives For AI Adoption in Various Countries

- 5.4 AIOps Tools Released in Past Two Years and Key AIOps Platform Capabilities To be Considered

- 5.5 Application of AIOps across various Use Cases Over the Life Cycle of an Application

- 5.6 Evolution of AIOps Stages and Use Cases

6 KEY APPLICATION LANDSCAPE

- 6.1 Root Cause Analysis

- 6.2 Network Availability and Optimization

- 6.3 Problem Assignment

- 6.4 Anomaly Detection and Cybersecurity

- 6.5 Improved Storage Management

7 MARKET SEGMENTATION

- 7.1 Organization Type

- 7.1.1 Small and Medium Enterprises

- 7.1.2 Large Enterprise

- 7.2 Deployment

- 7.2.1 On-Premise

- 7.2.2 Cloud/SaaS

- 7.3 End-User Industry

- 7.3.1 Media and Entertainment

- 7.3.2 IT and Telecom

- 7.3.3 Retail

- 7.3.4 Healthcare

- 7.3.5 BFSI

- 7.3.6 Other End-User Industries

- 7.4 Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia Pacific

- 7.4.4 Latin America

- 7.4.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Bigpanda Inc.

- 8.1.2 BMC Software Inc.

- 8.1.3 Broadcom Inc

- 8.1.4 Elasticsearch B.V

- 8.1.5 IBM Corporation

- 8.1.6 Logz.Io (Logshero Ltd.)

- 8.1.7 Loom Systems Ltd. (Service Now Inc)

- 8.1.8 Moogsoft Inc.

- 8.1.9 Splunk Inc

- 8.1.10 Appdynamics LLC (Cisco Systems Inc)

- 8.1.11 Dynatrace LLC

- 8.1.12 Extrahop Networks Inc.

- 8.1.13 New Relic Inc.

- 8.1.14 Resolve Systems LLC

- 8.1.15 Stackstate BV