|

市場調査レポート

商品コード

1687832

MEMSセンサ-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)MEMS Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MEMSセンサ-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

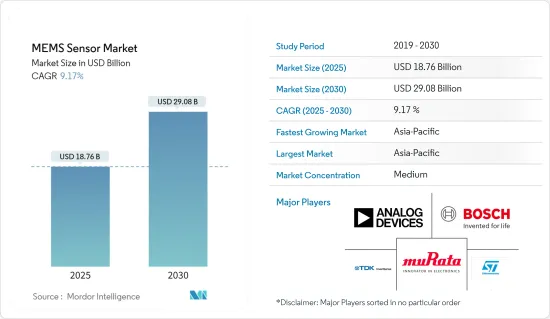

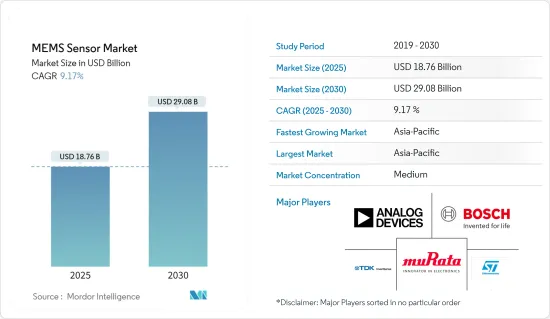

MEMSセンサ市場規模は2025年に187億6,000万米ドルと推計され、予測期間(2025年~2030年)のCAGRは9.17%で、2030年には290億8,000万米ドルに達すると予測されます。

半導体におけるIoTの人気の高まり、スマート家電やウェアラブルデバイスのニーズの高まり、産業や住宅における自動化の採用強化などが、調査対象市場の成長に影響を与える重要な要因です。

主なハイライト

- MEMSセンサは、精度、信頼性、電子機器の小型化など、複数の利点を備えています。その結果、MEMSセンサはここ数年で大きな支持を得ています。IoTコネクテッドデバイスやウェアラブルデバイスなど、小型化されたコンシューマーデバイスは、MEMSセンサの新興アプリケーションです。

- IFRの予測によると、今後数年間で、全世界の工場で稼働する産業用ロボットは51万8,000台となり、世界の普及が大幅に進むと予想されています。産業用ロボット市場のプラス成長軌道は、同期間中のMEMSセンサ需要を牽引すると予想されます。

- さらに、可処分所得の増加、5Gの登場、通信インフラの開発などの要因により、スマートフォンの需要が急増しています。例えば、エリクソンによると、世界のスマートフォン契約数は今後数年間で76億9,000万に達すると予想されています。

- さらに、圧力センサは、生物医学、車載エレクトロニクス、小型家電、ウェアラブルおよびフィットネスエレクトロニクスなど、数多くの応用分野で使用されているため、最も速い成長率を記録すると予想されています。マイクロフォンや超音波MEMSセンサ、環境センサ、マイクロボロメータなど、その他のMEMSセンサも市場調査において大きなシェアを占めると予想されています。

- 米国を拠点とする半導体テスト・ハンドラ企業のボストン・セミ・イクイップメント(BSE)は最近、MEMSハイパワーおよび圧力ICテスト・アプリケーション用に構成された複数のゼウス・グラビティ・テスト・ハンドラのリピート・オーダーを自動車関連顧客から受注しました。Zeusハンドラーは、MEMS圧力検出テストセル用の柔軟なレンジを持ち、IGBT、MOSFET、ゲートドライバ、GaN、SiCパワー半導体をテストするための生産ハンドラーで高電圧レベルを提供します。

- また、市場成長の課題として、インターフェース設計の考慮によるMEMSセンサの実装コストの上昇や、MEMSの製造プロセスが標準化されていないことなどが挙げられます。MEMSの標準化は、従来の半導体プロセスやモデル環境よりも進んでいないのは間違いないです。しかし、標準化手順は今後数年で実現するはずであり、今後数年間は課題の影響が徐々に小さくなります。

- COVID-19の流行により、ある種のMEMSセンサの需要が大幅に急増しました。例えば、温度銃やサーモグラフィに使用されるサーモパイルやマイクロボロメーターの需要は、人の体温を非接触でモニタリングする必要性から増加しました。さらに、COVID-19を検出するためのリアルタイム・ポリメラーゼ連鎖反応(PCR)診断テストや、DNA配列決定のためのマイクロ流体工学が、市場で大きな関連性を獲得しました。

- さらに、病院の集中治療室(ICU)のために人工呼吸器の圧力計と流量計が成長しました。したがって、パンデミックは、堅牢なヘルスケアインフラを持つことの重要性を浮き彫りにし、業界のその後の開拓は、予測期間にわたって市場需要を促進すると予想されます。

MEMSセンサ市場動向

自動車分野が市場成長を牽引すると予測

- MEMSセンサは、自動車産業やインテリジェント自動車に使用されています。MEMSセンサの開発は、自動車産業に焦点を当てると予想されます。エンジンE(ABS)、エレクトロニック・スタビリティ・プログラム(ESP)、エレクトロニック・コントロール・サスペンション(ECS)、電動ハンドブレーキ(EPB)、スロープスターター補助(HAS)、タイヤ空気圧モニタリング(EPMS)、自動車エンジンの安定化、角度測定、心拍検出、アダプティブ・ナビゲーション・システムなどに広く使用されています。

- 自動車の安全・安心に対する需要の高まりは、市場成長に重要な役割を果たす主な要因のひとつです。WHOによると、年間135万人以上が交通事故で死亡しています。MEMSセンサは、自動車の安全機能を向上させる上で重要な役割を果たしており、市場成長の触媒として機能しています。

- オムロンは、ロボットアーム用のFH-SMDビジョンセンサシリーズを新たにリリースしました。これらをロボットに搭載することで、従来のロボットでは難しかった3サイズのランダム(バルク)な自動車部品を認識し、生産性を向上させることで、省スペース、検査、ピックアンドプレースを実現します。

- 例えば、タタ・モーターズは2022年4月、乗用車事業で今後5年間に24,000カロールインドルピー(30億8,000万米ドル)を融資するプロジェクトを発表しました。さらに2022年3月には、中国の上海汽車傘下のMGモーターズが、EVの拡大を含む将来の必要資金を賄うため、インドで3億5,000万~5億米ドルの内密出資を拡大する計画を発表しました。このような自動車の開発は、調査された市場の成長をさらに促進すると思われます。

- さらに、新エネルギー車や無人運転車などの新しいインテリジェントカーの市場開拓により、MEMSセンサは将来、自動車センサ市場でより大きなシェアを占める可能性があります。最近、インベンセンスは革新的なMEMSセンサ技術の膨大なポートフォリオをCESで発表しました。例えば、IMU IAM-20685高性能車載用6軸モーショントラッキングセンサプラットフォーム(ADASおよび自律走行システム用)や、TCE-11101(家庭、産業、車載、ヘルスケア、その他のアプリケーションでCO2を直接かつ正確に検出するための小型化された超低消費電力MEMSプラットフォーム)などが発表されました。

アジア太平洋が大きな市場シェアを占める見込み

- アジア太平洋は、インド、日本、中国などの経済成長に加え、民生用電子機器や自動車分野の成長により、MEMSセンサの最も広範な市場になると予想されています。Ciscoによると、今年はアジア太平洋で約3億1,100万台、北米で約4億3,900万台のウェアラブルデバイスが販売される見込みです。このことが、同地域におけるMEMSセンサの需要をさらに押し上げています。

- 中国は、自動車市場と消費者市場の上昇、スマートフォン、タブレット、ドローン、その他のマイクロシステムおよび半導体対応製品の輸出により、ここ数年でMEMSセンサの使用量が大幅に増加しています。加速度計、ジャイロスコープ、圧力センサ、無線周波数(RF)フィルターなど複数のMEMSセンサが、製品組み立てのために中国に輸入されています。

- さらに、中国政府は自動車部品部門を含む自動車産業を主要産業のひとつとみなしています。中央政府は、中国の自動車生産台数が今後数年で3,500万台に達すると見込んでいます。このため、自動車産業は中国におけるMEMSセンサの顕著な用途の1つになると見られています。

- インド・ブランド・エクイティ財団(IBEF)によると、インドの家電・民生用電子機器(ACE)市場はCAGR9%を記録し、今年3兆1,500億インドルピー(約483億7,000万米ドル)を達成しました。政府はこの製品を推進するためにいくつかのイニシアチブをとっており、その中には、国内の電子機器製造を促進し、完全なバリューチェーンを輸出して、今後数年間で約4,000億米ドルの売上高を達成することを目的とした「エレクトロニクスに関する国家政策2019」が含まれています。このような地域政府のイニシアチブは、調査された市場を強化すると推定されます。

- インドの自動車産業は、経済的にも人口統計学的にも成長しやすい位置にあり、国内の関心と輸出の可能性を高めています。メイク・イン・インディア構想の一環として、インド政府は自動車製造をこの構想の主要な推進力にすることを目指しています。この制度は、2016-26年オート・ミッション・プラン(AMP)で強調されているように、乗用車市場を今後数年間で940万台まで増加させる構えです。この要因によって、同地域の自動車セクターにおけるMEMSセンサの採用が高まると予想されます。

- さらに、日本を拠点とするミンベアミツミ株式会社は最近、同社の子会社であるミツミ電機株式会社が、オムロン株式会社との間で、オムロンの野洲事業所のMEMS製品開発機能としての半導体・MEMS製造工場をミツミを通じて買収することで合意したと発表しました。MEMSセンサ事業を買収することで、ミツミの最重要事業の一つであるセンサ事業を強化します。

MEMSセンサ業界の概要

MEMSセンサ市場は比較的競争が激しく、多数の重要な企業で構成されています。市場シェアの面では、STMicroelectronics NV、Invensense Inc.(TDK株式会社)、Bosch Sensortec GmbH(Robert Bosch GmbH)、Analog Devices Inc.、村田製作所など、少数の重要な企業が現在大きなシェアを占めています。さらに、これらの企業は市場シェアと収益性を高めるために継続的に製品を革新しています。

- 2022年4月:ボッシュ・センサテックは初の静電容量式気圧センサBMP581を発表しました。エネルギー効率に優れたこの気圧センサは、高精度の高度追跡ICで、屋内ローカライゼーション、フロア検出、ナビゲーション・アプリケーション向けに正確な位置情報を提供できます。このセンサは、I2C、I3C、SPIデジタル・シリアル・インターフェースなど、複数の通信インターフェースをサポートしています。小型で低消費電力であるため、スマートウェアラブル、ヒアラブル、IoTアプリケーションに最適です。

- 2022年1月:TDKは、SoundWire機能を搭載した最新のMEMSマイクロホンを発表しました。新しいT5828 MEMS(微小電気機械システム)マイクロホンは、MIPI SoundWireプロトコルに準拠しています。68dBA SNR(信号対雑音比)および常時オン超低消費電力モードの音響活動検出素子を搭載しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 自動車産業における安全性への関心の高まり

- 自動化とインダストリー4.0の出現

- 市場の課題

- 複数のインターフェース設計の複雑さによるMEMSセンサの総コストの上昇

- MEMSの標準化された製造プロセスの欠如

第6章 市場セグメンテーション

- タイプ別

- 圧力センサ

- 慣性センサ

- その他のタイプ

- エンドユーザー産業別

- 自動車

- ヘルスケア

- 家電

- 産業用

- 航空宇宙・防衛

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 世界のその他の地域

- 北米

第7章 競合情勢

- 企業プロファイル

- STMicroelectronics NV

- InvenSense Inc.(TDK Corp.)

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- Analog Devices Inc.

- Murata Manufacturing Co. Ltd

- Kionix Inc.(ROHM Co Ltd)

- Infineon Technologies AG

- Freescale Semiconductors Ltd(NXP Semiconductors NV)

- Panasonic Corporation

- Omron Corporation

- First Sensor AG(TE Connectivity)

第8章 投資分析

第9章 市場の将来

The MEMS Sensor Market size is estimated at USD 18.76 billion in 2025, and is expected to reach USD 29.08 billion by 2030, at a CAGR of 9.17% during the forecast period (2025-2030).

The rising popularity of IoT in semiconductors, the growing need for smart consumer electronics and wearable devices, and the enhanced adoption of automation in industries and residences are some significant factors influencing the growth of the studied market.

Key Highlights

- MEMS sensors deliver multiple advantages, such as accuracy, reliability, and the prospect of making smaller electronic devices. As a result, they have gained considerable traction in the past few years. Miniaturized consumer devices, such as IoT-connected devices and wearables, are emerging applications of MEMS sensors in the market.

- According to the IFR forecasts, global adoption is expected to increase significantly to 518,000 industrial robots operational across factories all around the globe in the next few years. The positive growth trajectory of the industrial robots market is expected to drive the demand for MEMS sensors during the same period.

- Moreover, the demand for smartphones has been witnessing an upsurge owing to several factors increasing disposable income, the advent of 5G, and the development of telecom infrastructure. For instance, according to Ericsson, worldwide smartphone subscriptions are expected to reach 7,690 million in the next few years.

- Furthermore, pressure sensors are anticipated to witness the fastest growth rate as they are used in numerous application areas, such as biomedicine, automotive electronics, small home appliances, and wearable and fitness electronics. Other MEMS sensors, such as microphones and ultrasonic MEMS sensors, environmental sensors, and microbolometers, are expected to hold a significant share of the market studied.

- The US-based Boston Semi Equipment (BSE), a semiconductor test handler company, recently received repeat orders from automotive customers for multiple Zeus gravity test handlers configured for MEMS high-power and pressure IC testing applications. Zeus handlers have a flexible range for MEMS pressure sensing test cells and offer high voltage levels in a production handler for testing IGBT, MOSFET, gate drivers, GaN, and SiC power semiconductors.

- In addition, the factors challenging the market's growth include the increase in the cost of MEMS sensors implementation due to interface design considerations and the lack of a standardized fabrication process of MEMS. The standardization in MEMS is undoubtedly less advanced than it is for conventional semiconductor processes and model environments. However, the standard procedure is bound to happen in the next few years, making the impact of the challenge gradually low in the next few years.

- Due to the COVID-19 pandemic, certain types of MEMS sensors significantly spiked in demand. For instance, the demand for thermopiles and microbolometers used in temperature guns and thermal cameras increased because of the need for contactless monitoring of people's temperatures. Moreover, real-time polymerase chain reaction (PCR) diagnostic tests for detecting COVID-19 and microfluidics for DNA sequencing gained substantial market relevance.

- Furthermore, pressure and flowmeters in ventilators grew because of hospital intensive care units (ICUs). Therefore, the pandemic highlighted the criticality of having a robust healthcare infrastructure, and the industry's subsequent developments are expected to propel market demand over the forecast period.

MEMS Sensor Market Trends

Automotive Sector Expected to Drive the Market Growth

- MEMS sensors are used in the automobile industry and intelligent automobiles. MEMS sensor development is expected to focus on the automotive industry. It is widely used in engine e(ABS), electronic stability program (ESP), electronic control suspension (ECS), electric hand brake (EPB), slope starter auxiliary (HAS), tire pressure monitoring (EPMS), car engine stabilization, angle measure, and heartbeat detection, as well as adaptive navigation systems.

- The increasing demand for safety and security in automobiles is one of the main factors that play a vital role in the market's growth. According to the WHO, more than 1.35 million people yearly are killed in road accidents. MEMS sensors play a critical role in improving the safety features of vehicles and act as a catalyst for the market's growth.

- OMRON has newly released the FH-SMD Vision Sensor series for robot arms, which can be used for fast detection for humans and flexibility for auto-selection of the compartment. These can be mounted on a robot to recognize random (bulk) automotive parts in three sizes that are hard to use with conventional robots and improve productivity, thereby saving space, inspection, and pick and place.

- For instance, in April 2022, Tata Motors announced projects to finance INR 24,000 crores (USD 3.08 billion) in its passenger motorcar business over the next five years. Furthermore, in March 2022, MG Motors, owned by China's SAIC Motor Corp., declared plans to expand USD 350-500 million in confidential equity in India to fund its future requirements, including EV expansion. Such developments in automobiles will further drive the studied market growth.

- Furthermore, with the development of new intelligent vehicles, such as new energy vehicles and driverless vehicles, MEMS sensors may occupy a more significant share of the automotive sensor market in the future. Recently, InvenSense presented its vast portfolio of innovative MEMS sensor technologies at CES. For instance, it released the IMU IAM-20685 high-performance automotive 6-Axis MotionTracking sensor platform for ADAS and autonomous systems and TCE-11101, a miniaturized ultra-low-power MEMS platform for direct and accurate detection of CO2 in home, industrial, automotive, healthcare, and other applications.

Asia-Pacific Expected to Hold Significant Market Share

- Asia-Pacific is anticipated to be the most extensive market for MEMS sensors due to economies, such as India, Japan, and China, along with the increasing growth of the consumer electronics and automobile segments. According to Cisco, this year, around 311 million and 439 million wearable device units are expected to be sold in Asia-Pacific and North America, respectively. This is further driving the demand for MEMS sensors in the region.

- China has witnessed a significant increase in the usage of MEMS sensors in the past couple of years due to the rise in its automotive and consumer markets and the export of smartphones, tablets, drones, and other microsystem and semiconductor-enabled products. Multiple MEMS sensors, such as accelerometers, gyroscopes, pressure sensors, and radio frequency (RF) filters, have been imported into China for product assembly.

- Moreover, the Chinese administration also views its automotive industry, including the auto parts sector, as one of the major industries. The Central Government expects China's automobile output to reach 35 million units in the next few years. This is posed to make the automotive sector one of the prominent uses of MEMS sensors in China.

- According to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market has registered a CAGR of 9% to achieve INR 3.15 trillion (USD 48.37 billion) this year. The government has taken several initiatives to propel this product, including the National Policy on Electronics 2019, which aims to promote domestic electronic manufacturing and export a complete value chain to achieve a turnover of approximately USD 400 billion in the next few years. Such regional government initiatives are estimated to bolster the studied market.

- The Indian automotive industry is well-positioned for growth economically and demographically, serving domestic interest and export possibilities, which will rise shortly. As a part of the Make in India scheme, the Government of India aims to make automobile fabricating the main driver for the initiative. The system is poised to make the passenger vehicles market rise to 9.4 million units in the next few years, as underlined in the 2016-26 Auto Mission Plan (AMP). This factor is expected to raise the adoption of MEMS sensors in the region's automotive sector.

- Furthermore, Minbea Mitsumi Inc., based in Japan, recently announced that Mitsumi Electric Co. Ltd, a company subsidiary, has reached an agreement with Omron Corporation to acquire the semiconductor and MEMS Manufacturing plant as the MEMS product development function at OMRON's Yasu facility through MITSUMI. Acquiring the MEMS sensor business will strengthen Mitsumi's sensor business, which is one of its most important.

MEMS Sensor Industry Overview

The MEMS sensors market is relatively competitive and consists of numerous significant players. In terms of market share, a few crucial players, such as STMicroelectronics NV, Invensense Inc. (TDK Corp), Bosch Sensortec GmbH (Robert Bosch GmbH), Analog Devices Inc., and Murata Manufacturing Co. Ltd, currently hold a significant market share. Additionally, these companies continuously innovate their products to increase their market share and profitability.

- April 2022: Bosch Sensortec released its first capacitive barometric pressure sensor, the BMP581. The energy-efficient barometric is a highly accurate altitude-tracking IC that can provide precise location information for indoor localization, floor detection, and navigation applications. The sensor supports multiple communication interfaces, including I2C, I3C, and SPI digital serial interfaces. Its small size and low power consumption create it ideal for smart wearables, hearables, and IoT applications.

- January 2022: TDK introduced the most recent MEMS microphone with SoundWire functionality. The new T5828 MEMS (micro-electromechanical system) microphone complies with the MIPI SoundWire protocol. It includes 68dBA SNR (signal-to-noise ratio) and acoustic activity detect elements with always-on ultra-low power mode.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Concerns in the Automotive Industry

- 5.1.2 Emergence of Automation and Industry 4.0

- 5.2 Market Challenges

- 5.2.1 Increase in Overall Cost of MEMS Sensors due to Multiple Interface Design Complexity

- 5.2.2 Lack of Standardized Fabrication Process for MEMS

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensors

- 6.1.2 Inertial Sensors

- 6.1.3 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Industrial

- 6.2.5 Aerospace and Defense

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of the Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 InvenSense Inc. (TDK Corp.)

- 7.1.3 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 7.1.4 Analog Devices Inc.

- 7.1.5 Murata Manufacturing Co. Ltd

- 7.1.6 Kionix Inc. (ROHM Co Ltd)

- 7.1.7 Infineon Technologies AG

- 7.1.8 Freescale Semiconductors Ltd (NXP Semiconductors NV)

- 7.1.9 Panasonic Corporation

- 7.1.10 Omron Corporation

- 7.1.11 First Sensor AG (TE Connectivity)