|

市場調査レポート

商品コード

1851756

サービスとしてのAI:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Artificial Intelligence As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| サービスとしてのAI:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月09日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

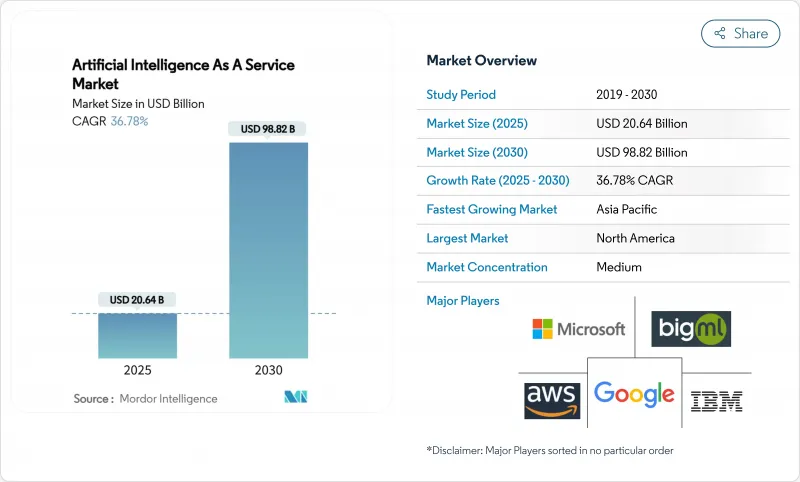

サービスとしてのAIの市場規模は2025年に206億4,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは36.78%で、2030年には988億2,000万米ドルに達すると予測されます。

企業が顧客向けシステムやバックオフィスシステムにジェネレーティブAI APIを組み込むにつれて、パイロットプロジェクトから本番ワークロードへの移行が急速に進み、この上昇を後押ししています。サブスクリプション価格は小規模企業の参入コストを下げ、カスタムAIアクセラレータは推論費用を最大80%削減し、プロバイダーの利幅を拡大します。日本の650億米ドルのAI計画のような政府の景気刺激策が勢いを増し、ハイパースケールデータセンターの建設は、当面の電力制約にもかかわらず、計算能力を拡大し続ける。こうした力が相俟って、サービスとしてのAI市場は業界を超えた広範な浸透へと向かっています。

世界のサービスとしてのAI市場の動向と洞察

予測分析と処方分析の需要の高まり

企業は現在、後知恵よりも先見性を重視しています。AI主導のアナリティクスを利用する製造業は61%の収益増を記録し、サプライチェーンの最適化は物流コストを15%削減しました。ヘルスケアシステムは、放射線ワークフローを自動化することで、5年間で451%のROIを得た。銀行はAI予測により不正検知の精度を高め、2028年までに1,700億米ドルの追加利益を見込みます。リアルタイムのデータ取り込みとエージェント型AIシステムがこの勢いを維持し、予測分析をサービスとしてのAI市場の中核的な成長エンジンとして位置づけています。

中小企業のTCOを削減するサブスクリプション・ベースのAIツール

低コミットメント価格設定により、歴史的な参入障壁が取り払われます。世界の中小企業におけるジェネレーティブAIツールの導入率は18%に達しました。米国では、従業員数4人の企業におけるAI利用率は、1年間で4.6%から5.8%に上昇しました。小売企業は実用的なリターンを示している:ターゲットは、400の店舗にAI従業員支援ツールを導入し、大規模な資本支出なしに生産性を向上させました。サブスクリプション・プラットフォームは、AIを設備投資から固定資産投資へと転換させることで、零細企業向けサービスとしてのAI市場を拡大します。

クラウド・コンピューティング・コストの高騰

AIのワークロードはインフラ経済に負担をかける。データセンターは2030年までに米国の電力の9%を消費する可能性があります。AIのエネルギー需要は、2025年にはビットコインのマイニングを上回り、23GWに達します。フォーチュン2000企業の47%は現在、オンプレミスでジェネレーティブAIを開発し、電気代の高騰を抑えています。電力価格の上昇とチップ供給の逼迫は、当面の値ごろ感を低下させ、サービスとしてのAI市場の成長を抑制します。

セグメント分析

パブリッククラウドの2024年のシェアは78%を維持し、Artificial Intelligence as a Service市場は引き続きハイパースケールインフラに固定されます。しかし、ハイブリッド・クラウドは明らかな成長エンジンであり、2025年から2030年にかけてCAGR 32.1%を記録します。フォーチュン2000社の多くは、大規模なモデルをクラウドでトレーニングしながら、推論はオンプレミスで実行し、スケールと主権のバランスをとっています。

ハイブリッドの導入は調達の方向性を変えます。病院はクラウドバーストアーキテクチャを採用し、個人を特定できる医療データをローカルサーバー内に保持する一方で、モデルのトレーニングには弾力的な計算能力を活用することで、Time-to-Valueを損なうことなくHIPAAルールを遵守しています。製造メーカーもこのパターンを踏襲し、レイテンシに敏感なビジョン・タスクにはエッジ・ノードを確保する一方、バルク解析は地域のクラウド・ゾーンにプッシュしています。このように、コンプライアンスと予算の確実性という2つの優先事項が、ハイブリッドモデルをArtificial Intelligence as a Service市場の展望の中心に据えています。

機械学習プラットフォームは2024年の売上高の42%を占めるが、AIインフラサービスはCAGR44.5%と成長が加速しています。このシフトにより、コンピューティングに最適化されたクラスタとネットワーキング・ファブリックが、バックボーン・ワークロード向けのArtificial Intelligence as a Service市場規模拡大の中心に据えられます。カスタムチップの採用がこの動向を支えている:グーグルのTPUやアマゾンのTrainiumは、数倍の価格性能向上を実現するため、顧客はこうしたシリコンを提供するプロバイダーを選好します。

ソフトウェアレイヤーは歩調を合わせて進化します。マネージド・ディストリビューション・バンドルは現在、最適化されたカーネルとオーケストレーション・ツールを組み合わせ、マルチクラウドのスケーリングを容易にしています。ベンダーは自己修復機能、自動パッチ適用、パフォーマンス・ダッシュボードを組み込み、運用の手間を軽減しています。これらの機能強化により、生のインフラと開発者の生産性との結びつきが強化され、サービスとしてのAI市場のこのセグメントにおける収益軌道が強化されます。

サービスとしてのAI市場は、展開モデル(パブリッククラウド、プライベートクラウド、ハイブリッドクラウド)、サービスタイプ(機械学習プラットフォームサービス、コグニティブサービス(NLP、CV、音声)、その他)、組織規模(中小企業、大企業)、エンドユーザー産業(BFSI、小売・eコマース、製造業、その他)、地域によってセグメンテーションされます。

地域分析

北米は、ハイパースケールデータセンターの設置ベースと深い新興企業エコシステムに支えられ、2024年の世界売上高の38%を占めました。クラウドメジャー各社は2025年に2,500億米ドル以上の新たな生産能力を約束したが、2030年には米国のデータセンターの消費電力が国内供給の9%に達する可能性があり、送電網の制約が迫っています。クラウドとAIの協定に関するFTCの調査も、競争の境界を再調整する可能性があります。

アジア太平洋地域はCAGR 27.9%で最速の上昇を記録。日本はAIとチップに650億米ドルを計上し、ソフトバンクはジェネレーティブAIのバックボーンに9億6,000万米ドルを投資しました。中国のアリババは3,800億元をクラウド・モデル・サービスに割り当て、バイトダンスのボルケーノ・エンジンは国内のパブリック・モデル・コールの半分近くを処理しました。企業調査によると、APAC企業の54%が現在、長期的なAIの支払いを目標としており、試験的な活動を超えた深みを示しています。

欧州は、AI規制案の下、イノベーションと厳格な監視のバランスを取りながら着実に成長しています。中東とアフリカはソブリンAI戦略に乗る:マイクロソフトがG42に15億米ドルを注入するように、UAEは2030年までにセクターの価値が463億3,000万米ドルになると見込んでいます。サウジアラビアの1,000億米ドルのAIファンドは地域の野心を強調し、GCC企業の75%がジェネレーティブ・モデルを導入しており、世界平均を上回っています。手ごろなエネルギーへのアクセスと積極的な政策枠組みにより、この地域は欧州、アフリカ、南アジアを結ぶ架け橋市場として、サービスとしてのAI市場展開に適しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件および市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 予測的・処方的アナリティクスに対する需要の高まり

- 中小企業のTCOを削減するサブスクリプション型AIツール

- カスタムAIアクセラレータ(TPU/Trainium)が推論コストを削減

- 規制分野向けAIaaSバンドルの垂直化

- ローコードプラットフォームに組み込まれたジェネレーティブAI API

- 市場抑制要因

- クラウド・コンピューティング・コストの高騰

- 根強いMLOpsの人材不足

- モデルの出所に関する規制当局の監視の強化

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 展開モデル別

- パブリック・クラウド

- プライベートクラウド

- ハイブリッド・クラウド

- サービスタイプ別

- 機械学習プラットフォームサービス

- コグニティブ・サービス(NLP、CV、スピーチ)

- AIインフラサービス(GPU/TPU)

- マネージド&プロフェッショナルAIサービス

- 企業規模別

- 中小企業

- 大企業

- エンドユーザー業界別

- BFSI

- 小売・Eコマース

- ヘルスケア・ライフサイエンス

- IT・通信

- 製造業

- エネルギー・ユーティリティ

- その他(メディア、農業、公共)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア、ニュージーランド

- 東南アジア

- 中東・アフリカ

- 中東

- GCC(サウジアラビア、UAE、カタール)

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Amazon Web Services(AWS)

- Microsoft Corporation

- Google LLC(Google Cloud)

- IBM Corporation

- Oracle Corporation

- Salesforce Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- DataRobot Inc.

- Dataiku SAS

- BigML Inc.

- OpenAI LP

- Anthropic PBC

- C3.ai Inc.

- NVIDIA Corp.(DGX Cloud)

- Alibaba Cloud

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- Craft AI