|

市場調査レポート

商品コード

1910535

ロボティック・プロセス・オートメーション(RPA)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Robotic Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ロボティック・プロセス・オートメーション(RPA)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

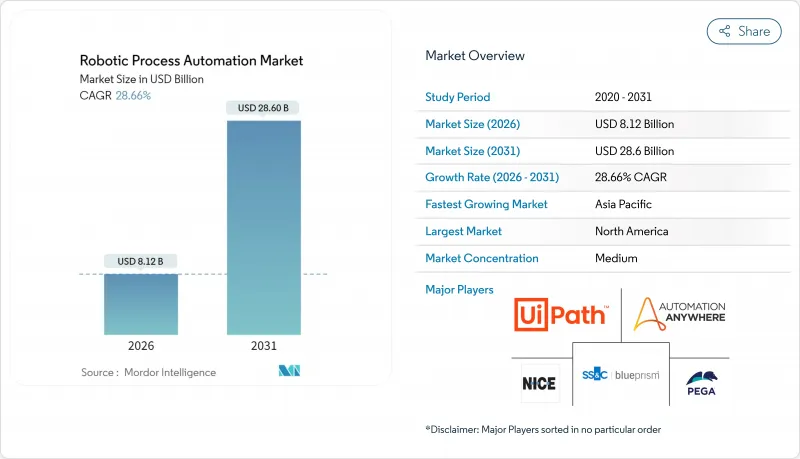

ロボティック・プロセス・オートメーション(RPA)市場は、2025年に63億1,000万米ドルと評価され、2026年には81億2,000万米ドルから成長し、予測期間(2026-2031年)においてCAGR28.66%で推移し、2031年までに286億米ドルに達すると推定されております。

生成AIと既存のRPAプラットフォームの統合が進むことで、自動化可能なタスクの範囲が広がり、従来は人的介入を必要としていた非構造化プロセスにも企業が対応できるようになります。また、導入サイクルを短縮し、支出を運用予算へ移行させるクラウドネイティブ展開も市場拡大を後押ししています。2024年時点で北米は厳格なコンプライアンス要件と成熟した技術エコシステムに支えられ、ロボットプロセスオートメーション市場で39.6%の最大シェアを占めました。一方、アジア太平洋地域は政府による自動化プログラムの支援や中小企業による従量課金型ボットの導入により、地域別で最も高い34.5%のCAGRを記録しています。ベンダー間の競合は激化しており、AIに焦点を当てた買収や提携を通じて、インテリジェントな文書処理、ローコード設計、自律型エージェント機能をプラットフォームのロードマップに統合する動きが進んでいます。

世界のロボティックプロセスオートメーション市場の動向と洞察

小売オムニチャネル注文履行の自動化

小売業者は、リアルタイムの消費者期待に応えるため、在庫照合、出荷調整、返品管理の自動化を進めています。Grupo Exito社は、ECフロントエンドとレガシーERPデータを連携する全社的なRPAプログラムを導入後、注文処理時間を最大75%短縮しました。コンピュータビジョンモジュールの統合により繁忙期でも98%以上の精度を維持し、AI支援型需要予測はサプライチェーン変動下での利益率管理を支援します。したがって、成熟したeコマース市場と新興市場の両方で、小売業者は自動化を物流混乱や労働力不足に対する必須の対策と捉えています。

中小企業におけるクラウドネイティブRPAプラットフォームの導入

従量課金型SaaSモデルは中小企業の参入障壁を低下させています。ジャナ・スモール・ファイナンス銀行は、オンプレミスインフラ不要のUiPathクラウドサービスへ移行後、重要プロセスの処理時間を約70%短縮しました。ハイパースケールプロバイダーがRPAをマーケットプレースに組み込むことで、中小企業は数日で安全なボットを導入でき、取引量増加時のみライセンスを拡張可能です。アナリストは、市民開発者向けツールの成熟と業界特化型テンプレートの普及に伴い、2027年までに新規ボット導入の40%以上を中小企業が牽引すると予測しています。

UI変更によるボットの継続的な不具合

企業向けアプリケーションやSaaSアプリケーションにおける頻繁なインターフェース更新は、セレクターを無効化しボットを動作不能に陥らせ、年間自動化予算の最大40%を事後対応的なメンテナンスに消費しています。ターサス・ディストリビューション社では、サプライヤーのフォーマット変更に伴い請求書ワークフローの再設計を余儀なくされ、従来のスクリーンスクレイピング型ボットの脆弱性が浮き彫りとなりました。新世代プラットフォームではオブジェクトベースのセレクターや自己修復機能が追加されていますが、変更管理の不足がスケール計画の遅延や初期段階プログラムへの信頼低下を引き続き招いています。

セグメント分析

2025年時点のロボティックプロセスオートメーション市場では、規制の厳しい業界がローカル管理を必要としたため、オンプレミス導入が53.62%で依然として主流でした。しかしながらクラウド導入は36.95%という最高CAGRを記録し、セキュリティ認証の拡大に伴いその差を縮める見込みです。UiPath社によれば、新規契約の80%以上がクラウドサブスクリプションに由来し、顧客はオンプレミス環境に比べ50%速い展開を実現しています。欧州の銀行が機密性の高い決済ワークフローを自社内に保持しつつ、設計・テスト・分析にはクラウドテナントを活用するハイブリッド形態が普及しつつあります。この柔軟性により、企業は居住要件を満たしつつ、拡張性を犠牲にすることなく運用が可能です。

エッジコンピューティングが成熟する中、ベンダーはローカルで実行されつつクラウドからのオーケストレーションを受ける軽量ランタイムを提供しています。このようなアーキテクチャは、工場現場のボットの遅延を低減すると同時に、サーバー管理のオーバーヘッドを最小限に抑えます。その結果、多くの製造業者は、パッチ適用が簡素化され、AIアップグレードに即時アクセスできることを理由に、3年以内に非生産用ロボットをSaaSに移行する計画です。この移行により、サブスクリプション収益が永久ライセンスを上回り、ロボティックプロセスオートメーション市場は引き続き拡大する見込みです。

2025年にはソフトウェアプラットフォームが収益の51.05%を占めましたが、組織が人的要素を重視した変更管理が成功の鍵であると認識するにつれ、サービス分野はCAGR34.1%で拡大しています。導入企業は発見、再設計、市民開発者向けコーチングを統合するケースが増加しており、これらは変革予算全体の約60%を占めています。SS&Cテクノロジーズ社は、Blue Prismソフトウェアとアドバイザリーサービスを組み合わせることでボット数を3倍に増やし、1億米ドルのコスト削減を実現しました。

継続的改善リテーナー契約の需要も高まっております。インテリジェントオートメーションにはAIモデルの継続的な調整が不可欠であるためです。ベンダー各社は現在、個別プロジェクトのマイルストーンではなく、SLAに基づく成果を保証するマネージドサービスを提供しております。この転換により、サービス分野に割り当てられるRPA市場規模はさらに拡大し、ツール導入から全社的な業務モデル再設計へと進化する業界の動向が浮き彫りとなっております。

ロボティック・プロセス・オートメーション市場は、導入形態(オンプレミス/クラウド・SaaS)、ソリューション構成要素(ソフトウェア/サービス)、企業規模(中小企業/大企業)、技術タイプ(有人RPA/無人RPA/インテリジェント/コグニティブRPA)、エンドユーザー業界(金融・保険・証券/IT・通信/医療など)、地域別にセグメンテーションされます。市場予測は金額(米ドル)で提供されます。

地域別分析

北米は2025年に39.12%のシェアで首位を維持しました。これは政府機関や金融サービス業界における早期導入の傾向と厳格なコンプライアンス要件に後押しされたものです。米国住宅都市開発省などの機関では、給付金処理の近代化のためにRPAと機械学習を組み合わせた手法を採用しています。カリフォルニア州車両管理局(DMV)などの州機関は、パンデミックによる混乱時にも業務を継続できるよう、デジタルライセンシングサービス加速のためにボットを活用しました。ベンダー情勢は、豊富なシステムインテグレーター能力と熟練した自動化専門家により恩恵を受けており、継続的なパイプラインの成長が保証されています。

アジア太平洋地域は33.6%のCAGRで最も急速に成長する地域です。日本のRPA「Robopat DX」は中小企業向け導入件数が1,700件を突破し、人手不足市場における草の根的な需要を示しています。インドのマニパル病院では、拡大するデジタル医療規制への対応のため財務ワークフローを自動化しました。政府の補助金制度や現地言語インターフェースのサポートにより、製造業やアウトソーシング拠点における導入がさらに拡大し、同地域のロボティックプロセスオートメーション市場を拡大させる見込みです。

欧州の動向は「デジタル業務レジリエンス法」によって形作られており、同法は銀行に対し自動化ワークフローの文書化とストレステストを義務付けています。金融機関は2025年のコンプライアンス期限に間に合わせるため、1機関あたり最大1,500万ユーロに上る複数年予算を確保しています。ドイツの製造業者はバックオフィス業務の高度な自動化を推進し、北欧の医療システムでは地域横断的な共有ボットライブラリを導入しています。データをオンプレミスに保持しつつクラウドコンソールで統合管理するハイブリッド展開構造が標準となりつつあり、欧州連合加盟国全体でロボティックプロセスオートメーション市場のプレゼンスが着実に拡大しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 小売オムニチャネルにおける注文履行の自動化

- 中小企業におけるクラウドネイティブRPAプラットフォームの導入状況

- ジェネレーティブAI搭載ボット設計アシスタント

- ハイパースケールマーケットプレースにおける従量課金型ボット

- DORAおよびHIPAA施行後のコンプライアンス主導型自動化

- 世界の共有サービスセンターにおける人材不足

- 市場抑制要因

- UI変更に伴うボットの継続的な不具合

- 無人ボットのガバナンスと倫理的監視

- レガシーRPAスイートからの高い切り替えコスト

- 新興市場におけるプロセスの標準化が低い

- 業界バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- 業界の魅力度- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済要因が市場に与える影響

第5章 市場規模と成長予測

- 展開別

- オンプレミス

- クラウド/SaaS

- ソリューションコンポーネント別

- ソフトウェア(プラットフォームおよびライセンス)

- サービス(導入、センター・オブ・エクセレンス、サポート)

- 企業規模別

- 中小企業(SMEs)

- 大企業

- 技術タイプ別

- アテンド型RPA

- 無人RPA

- インテリジェント/コグニティブRPA

- エンドユーザー産業別

- BFSI

- ITおよび通信

- ヘルスケア

- 小売業および消費財(CPG)

- 製造業

- その他のエンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- シンガポール

- マレーシア

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- UiPath Inc.

- Automation Anywhere Inc.

- SS&C Blue Prism Ltd.

- NICE Ltd.(Robotic Automation)

- Pegasystems Inc.

- Kofax Inc.

- WorkFusion Inc.

- Kryon Systems Ltd.

- EdgeVerve Systems Ltd.

- AntWorks Pte Ltd.

- Laiye Technology Ltd.

- Cyclone Robotics Co. Ltd.

- AutomationEdge Technologies Inc.

- Datamatics Global Services Ltd.

- Nividous Software Solutions

- Soroco

- Redwood Software Inc.

- Microsoft Corp.(Power Automate)

- Servicetrace GmbH

- Jidoka(Novayre Solutions)

- Fortra LLC(ex-HelpSystems)

- ElectroNeek Robotics Inc.

- Robocorp Technologies Inc.

- Robiquity Ltd.

- Rocketbot SpA

- OpenConnect Systems Inc.

第7章 投資分析

第8章 市場機会と将来の動向

- 空白領域と未充足ニーズの評価