|

市場調査レポート

商品コード

1687876

法律業界におけるAIソフトウェア-市場シェア分析、業界動向・統計、成長予測(2025年~2030年)AI Software In Legal Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 法律業界におけるAIソフトウェア-市場シェア分析、業界動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

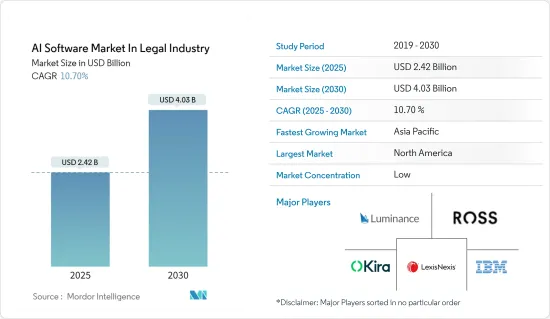

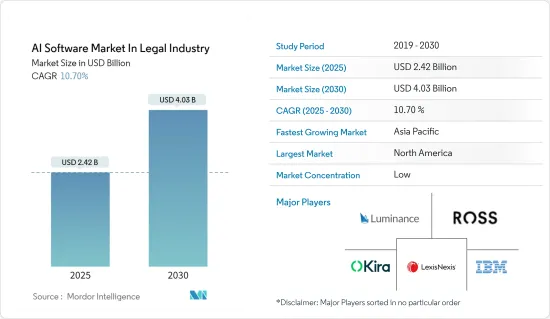

法律業界におけるAIソフトウェア市場は、予測期間中(2025~2030年)のCAGR10.7%で、2025年の24億2,000万米ドルから2030年には40億3,000万米ドルに成長すると予測されます。

人工知能(AI)は、法律業界における生産性と効率性の向上のために新たな技術的ブレークスルーを活用する最前線に常にいます。また、NLP、ニューラルネットワーク、チップの進歩や処理能力の向上により、法律セグメントではその応用価値が向上しています。

主要ハイライト

- 法律業界は、法律業務を効率的に処理するためにAI技術を頻繁に導入し始めています。例えば、社内の法務部門は、秘密保持契約書のような簡単なものであっても、契約書の審査に時間の50%を費やすことが多く、業務が滞り、不必要なボトルネックとなっています。弁護士が各契約書の該当箇所に集中して検討できるようにすることで、AIは数え切れないほどの時間を節約することができます。

- eDiscovery、契約書のレビューと管理、案件予測、コンプライアンスなどのセグメントで自動化の需要が高まっているため、市場は拡大しています。企業が具体的な価値を生み出すために、契約管理の自動化はチームの契約締結能力を向上させ、顧客とのつながりを強化し、組織の他の多くのセグメントにプラスの影響を与えます。

- HIPAA、PCI DSS、GDPR、その他の金融規制のような拡大する基準に準拠しない場合、より多くのコストがかかります。Globalscapeによると、金融セクターの企業がデータ保護のためのITルールを遵守するためには、およそ547万米ドルのコストがかかり、企業が罰金、生産性の損失、利益を考慮すると、コンプライアンス違反のコストは1,500万米ドル近くになります。

- AIと法律の接点は、予測期間を通じて大幅に増加すると予想されます。人工知能(AI)は、デューデリジェンス(契約書の見直し、法的調査、デューデリジェンスを行うための電子証拠開示機能)、予測技術(法廷で判断される可能性の高い結果を予測する)、法的分析(弁護士が現在の訴訟で使用できる過去の判例や先例法からデータポイントを提供する)、ドキュメンテーションの自動化、知的財産、その他のさまざまなタスクなど、さまざまなタスクにも使用できます。

- 法的調査には複雑さが伴うため、時間がかかり、退屈な作業となる可能性があります。AIの必要性は、多くの法律事務所が効率的で正確な法律リサーチ業務を達成するために得られる納期が短くなっていることでさらに浮き彫りになっています。AIソフトウェアは生産性と正確性を飛躍的に向上させ、裁判官の迅速な判断を助けることができます。例えば、ROSS Intelligenceは、自動化された技術を使って契約書を迅速に調査します。このプログラムは適切な文書を強調します。法律調査は、適切なソフトウェアによって大幅に強化され、合理化されます。

- いくつかの国内法の枠組みに加え、欧州連合(EU)でも、2022年に最終決定される見込みの新しい人工知能法によって、リスクの高いAIシステムが明確かつ徹底的に規制されることになります。多くのAI関連法制の提案が出されているが、米国は欧州委員会が提案するAI規制への包括的なアプローチを受け入れていないです。

- その一方で、COVID-19の発生により、企業の法務部や法律事務所が法律図書館用にAI/機械学習ソリューションを購入するケースも広がっています。eディスカバリーソフトウェアやその他の人工知能プラットフォームは、COVID-19との戦いで恩恵を受けました。このようなソフトウェアは、COVID-19を治療する方法に関する医療研究者の調査を加速させる可能性を秘めており、訴訟弁護士がより迅速に事件の核心に迫れるよう支援するために作成されています。

法律AIソフトウェア市場動向

クラウドが大きなシェアを占める見込み

- クラウドベースの業務管理ソフトウェアは、オンプレミスシステムと比較して、一貫した可用性、効率性、シンプルな拡大性など数多くの利点があることが証明されており、これらすべてが弁護士の法律業務の生産性と収益性を高めるのに役立っています。

- さらに、AIソリューションは、法律事務所のMicrosoft ActiveDirectoryによって確立された安全なユーザーログインとアクセス許可と同期することによって、機密データを保護しなければならないです。機密保持のため、これらのAIシステムは通常、法律事務所のファイアウォールの向こう側にオンプレミスでインストールされるか、プライベートクラウドにインストールされます。

- 迅速な適応と柔軟性という点では、クラウドソリューションはオンプレミスの代替案よりも優れています。クラウドソリューションは、規模に合わせて拡大できるプラクティスマネジメントシステムを必要とする小規模な法律事務所にとって、理想的な選択肢として浮上してきました。法律事務所は、既存のソリューションに最も関連性の高いモジュールや機能を統合することができます。

- さらに、クラウドソリューションは、一元化された情報システムを利用することで、同僚、クライアント、第三者間での安全なコミュニケーションやファイル共有を可能にします。電子メールだけに頼ることの本質的な危険性を軽減することができます。

- Casepointの技術は、迅速かつエンタープライズクラスのソリューションで、法的証拠開示の全領域を記載しています。単一のプラットフォームを評価することで、クライアントは法的保留から本番までの証拠開示プロセス全体を管理・モニタリングすることができ、異なるプログラムへのログイン・ログアウトや手作業による情報移動の必要性を回避できます。

北米が主要シェアを占める見込み

- AIの利用が増加しています。さらに、この地域では、法律業界に人工知能のプラットフォームやツールを提供する企業が大きな存在感を示しています。例えば、OpenText Corporation、IBM Corporation、Ross Intelligence Inc.、Veritone Inc.、Neota Logic Inc.などが挙げられます。

- 近年、北米では最も重要な法律技術系新興企業への投資が行われています。米国を拠点に法務・契約管理のための企業ワークフローソリューションを提供するOnitは、2億米ドルの戦略的投資を受けました。カナダにあるクラウド法務管理の新興企業Clioは、2億5,000万米ドルのシリーズD資金調達ラウンドを受けました。これは、法務とカナダの技術企業に対する最も重要な投資のひとつです。

- 世界の法務部門は最近大きな変化を遂げ、北米の法律事務所もそれに追随しています。デューデリジェンス、契約分析、不動産分析、知的財産、紛争解決はすべて人工知能機能の恩恵を受けています。技術ツールは企業の効率と競合を改善します。

- 企業のインキュベーターやイノベーションラボが利用できることは、この地域のAIベースの法律ソフトウェアの開発を助ける。法律技術の出現を促進するために、既存の法律事務所、ALSP(Thomson Reutersなど)、ビッグ4、金融企業(Barclaysなど)が協力したり、インキュベーターを設立したりしました。これらのインキュベーターは、革新的な企業が市場で成功するために必要な指導、知識、場合によっては融資へのアクセスを提供するとともに、法律技術の新興企業を支援し、成長を拡大するためのスペースを提供しています。

法律AIソフトウェア産業概要

法律業界のAIソフトウェア市場は市場浸透率が低く、既存企業やこのセグメントへの参入を目指す部外者にとって大きな可能性を生み出しています。しかし、現在の市場参入企業は、新規参入企業に対して圧倒的な優位性を持っています。優れた将来性、投資の増加、支援活動により、現在の市場参入企業間の競争は過熱すると予想されます。

- 2023年5月-LexisNexis Group Inc.は、あらゆる調査ワークフローをサポートし合理化する新しいツール、Nexis Hubの発売を発表しました。多忙な専門家のニーズに応えるために開発されたこの革新的な新ソリューションは、Google ChromeやMicrosoft Wordと統合され、ユーザーが複雑で時間のかかる調査収集やレポート作成のプロセスを効率化するのに役立ちます。

- 2023年5月-Luminance Technologies Ltdは、同社の専門家向け大規模言語モデル(LLM)の最新の最先端用途、AIを搭載した「Ask Lumi」チャットボットを発表しました。Ask Lumi」は、この法律グレードのAIに支えられた初のチャットボットです。ユーザーはMicrosoft Wordで契約書を開き、AIに契約書に関する質問をし、即座に回答を得ることができます。対照的に、LuminanceのLegal Pre-Trained Transformer(LPT)技術は、法的に検証された文書のみから学習します。コンテンツを生成し、第三者によって作成または編集されたものであってもコンテンツを分析し理解することができます。この生成的AIと分析的AIの強力な組み合わせにより、最大限の法的厳密性が保証されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の想定と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 法律業界における自動化需要の高まりと訴訟件数の増加

- 法的案件を完了させるための法務会社によるAI活用の成長

- 市場抑制要因

- 機密データや法的データのプライバシーに関する懸念

第6章 市場セグメンテーション

- コンポーネント別

- ソリューション

- サービス別

- 展開別

- オンプレミス

- クラウド

- 用途別

- 法務調査

- 契約書のレビューと管理

- 電子請求

- Eディスカバリー

- コンプライアンス

- ケース予測

- その他

- エンドユーザー別

- 法律事務所

- 企業法務部門

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Luminance Technologies Ltd

- Ross Intelligence Inc.

- Kira Inc.

- IBM Corporation

- Lexisnexis Group Inc.(RELX Group Plc)

- Cs Disco Inc.

- Thomson Reuters Corporation

- Veritone Inc.

- Casetext Inc.

- Neota Logic Inc.

- Brainspace Corporation

- Smokeball Inc.

- Text IQ Inc.

- Opentext Corporation

第8章 投資分析

第9章 市場の将来

The AI Software Market In Legal Industry is expected to grow from USD 2.42 billion in 2025 to USD 4.03 billion by 2030, at a CAGR of 10.7% during the forecast period (2025-2030).

Artificial intelligence (AI) has always been at the forefront of utilizing new technical breakthroughs for productivity and efficiency improvements in the legal industry. Also, due to the advancements and the increase in processing power in NLP, neural networks, and chips, the legal sector is observing improved value in its application.

Key Highlights

- The legal industry has started implementing AI technologies more frequently to handle legal operations effectively. For instance, an internal legal department often spends 50% of its time examining contracts, even those as simple as non-disclosure agreements, slows down operations and causes unnecessary bottlenecks. By enabling lawyers to concentrate their review on the pertinent sections of each contract, AI can save countless hours.

- The market is expanding due to the growing demand for automation in fields including eDiscovery, contract review and management, case prediction, and compliance. In order to help businesses generate tangible value, automation in contract management improves a team's capacity to close agreements, strengthens connections with clients, and positively impacts many other areas of the organization.

- It costs more money to not comply with growing standards like HIPAA, PCI DSS, GDPR, and other financial regulations. According to Globalscape, it costs firms in the financial sector roughly USD 5.47 million to comply with IT rules for data protection, and when a company takes into account fines, lost productivity, and profits, the cost of non-compliance is close to USD 15 million.

- The intersection of AI and law is anticipated to increase significantly throughout the forecast time period. Artificial intelligence (AI) can also be used for a variety of tasks, including due diligence (to review a contract, conduct legal research, or perform electronic discovery functions to do due diligence), prediction technology (to predict the likely outcome of cases being decided before a court of law), legal analytics (to provide data points from previous case laws and judgments and precedent law that lawyers can use in their present cases), automation of documentation, Intellectual property, a variety of other tasks, and several others.

- Due to the complexity involved in legal research, it can be time-consuming and tedious. The necessity for AI is further highlighted by the shorter deadlines that most law firms get to achieve efficient and precise legal research work. AI software can dramatically increase productivity and accuracy, helping judges make quick decisions. For instance, the ROSS Intelligence company uses automated technologies to examine contracts quickly. The program emphasizes pertinent documents. Legal research can be substantially enhanced and streamlined with the appropriate software.

- In addition to several domestic legislative frameworks, high-risk AI systems will be clearly and thoroughly regulated in the European Union with the new Artificial Intelligence Act, which is anticipated to be finalized in 2022. Although many AI-related legislation suggestions have been put out, the United States has not embraced the European Commission's suggested all-encompassing approach to AI regulation.

- On the other hand, a wide range of corporate legal departments and law firms bought AI/machine learning solutions for their law libraries due to the outbreak of COVID-19. In law libraries, technology has a significant role. eDiscovery software and other artificially intelligent platforms have benefited in the fight against COVID-19. Such software, which has the potential to speed up medical researchers' investigations into how to cure COVID-19, is created to assist litigation attorneys in getting to the heart of a case more rapidly.

Legal AI Software Market Trends

Cloud is Expected to Hold Significant Share

- Cloud-based practise management software has been proven to have numerous advantages over on-premise systems, including consistent availability, efficiency, and simple scalability, all of which assist attorneys boost the productivity and profitability of their law business.

- Furthermore, AI solutions must protect sensitive data by synchronising with the secure user logins and permissions established by the law firm's Microsoft Active Directory or maybe configured for something like their Box cloud storage. To preserve secrecy, these AI systems are typically installed on-premise behind a law firm's firewall or in a private cloud.

- When it comes to quick adaption and flexibility, cloud solutions outperform on-premise alternatives. Cloud solutions have emerged as the ideal option for small law firms in need of a practise management system that will scale with them. Law firms can integrate the modules or features that are most relevant to them into their existing solution.

- Furthermore, cloud solutions enable safe communication and file sharing among colleagues, clients, and third parties by utilising a centralised information system. It mitigates the inherent hazards of depending entirely on email.

- Casepoint's technology provides full-spectrum legal discovery with quick, enterprise-class solutions. through evaluate its single platform, their clients can manage and monitor the whole discovery process from legal hold through production, avoiding the need to log in and out of different programmes or manually move information.

North America is Expected to Hold a Major Share

- Rising usage of AI. Furthermore, there is a considerable presence in the region among firms that provide platforms and tools for artificial intelligence to the legal industry. Examples include OpenText Corporation, IBM Corporation, Ross Intelligence Inc., Veritone Inc., and Neota Logic Inc.

- In recent years, North America has seen some of the most important legal, technical startup investments. Onit, a US-based firm that provides corporate workflow solutions for legal and contract administration, has received a USD 200 million strategic investment. Clio, a cloud legal management startup located in Canada, has received a USD 250 million Series D fundraising round. This was one of the most significant investments in a legal and Canadian technology firms.

- The worldwide legal department has seen significant changes recently, and North American law firms are following suit. Due diligence, contract analysis, real estate analysis, intellectual property, and conflict resolution all benefit from artificial intelligence capabilities. Technology tools improve the company's efficiency and competitiveness.

- The availability of company incubators and innovation laboratories aids the region's development of AI-based legal software. To promote the emergence of legal technology, established law firms, ALSPs (such as Thomson Reuters), the Big Four, and financial corporations (such as Barclays) cooperated or founded their incubators. These incubators give access to the guidance, knowledge, and, in some cases, financing that innovative enterprises require to flourish in the market, as well as space to assist legal tech startups and scale-up growth.

Legal AI Software Industry Overview

The legal industry's AI software market has a low market penetration rate, creating tremendous potential for incumbent companies and outsiders looking to enter the sector. However, current market participants have a tremendous edge over any new entrants. Due to the outstanding prospects, rising investments, and supporting activities, competition among present market participants is expected to heat up.

- May 2023 - LexisNexis Group Inc has announced the launch of Nexis Hub, a new tool that supports and streamlines any research workflow to accelerate time to insight. The innovative new solution, created to meet the needs of busy professionals, integrates with Google Chrome and Microsoft Word to help users streamline the complicated and time-consuming process of collecting research and creating reports.

- May 2023 - Luminance Technologies Ltd has launched the latest cutting-edge application of its specialist legal large language model (LLM), the AI-powered 'Ask Lumi' chatbot. 'Ask Lumi' represents the first chatbot underpinned by this legal-grade AI. It allows users to open any contract in Microsoft Word, ask the AI questions about their agreement, and receive instant responses. In contrast, Luminance's Legal Pre-Trained Transformer (LPT) technology learns solely from legally verified documents. It is able to produce content and analyze and understand the content, even that created or edited by third parties. This powerful combination of both generative and analytical AI ensures the utmost legal rigor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Consumers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Automation And Increasing Number Of Litigations In The Legal Industry

- 5.1.2 Growth In The Utilization Of AI By Legal Companies To Complete Legal Cases

- 5.2 Market Restraints

- 5.2.1 Data Privacy Concerns Of The Confidential And Legal Data

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Legal Research

- 6.3.2 Contract Review and Management

- 6.3.3 E-billing

- 6.3.4 E-discovery

- 6.3.5 Compliance

- 6.3.6 Case Prediction

- 6.3.7 Other Applications

- 6.4 By End-User

- 6.4.1 Law Firms

- 6.4.2 Corporate Legal Departments

- 6.4.3 Other End-users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Luminance Technologies Ltd

- 7.1.2 Ross Intelligence Inc.

- 7.1.3 Kira Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Lexisnexis Group Inc. (RELX Group Plc)

- 7.1.6 Cs Disco Inc.

- 7.1.7 Thomson Reuters Corporation

- 7.1.8 Veritone Inc.

- 7.1.9 Casetext Inc.

- 7.1.10 Neota Logic Inc.

- 7.1.11 Brainspace Corporation

- 7.1.12 Smokeball Inc.

- 7.1.13 Text IQ Inc.

- 7.1.14 Opentext Corporation