|

|

市場調査レポート

商品コード

1851755

戦術UAV:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Tactical UAV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 戦術UAV:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月31日

発行: Mordor Intelligence

ページ情報: 英文 133 Pages

納期: 2~3営業日

|

概要

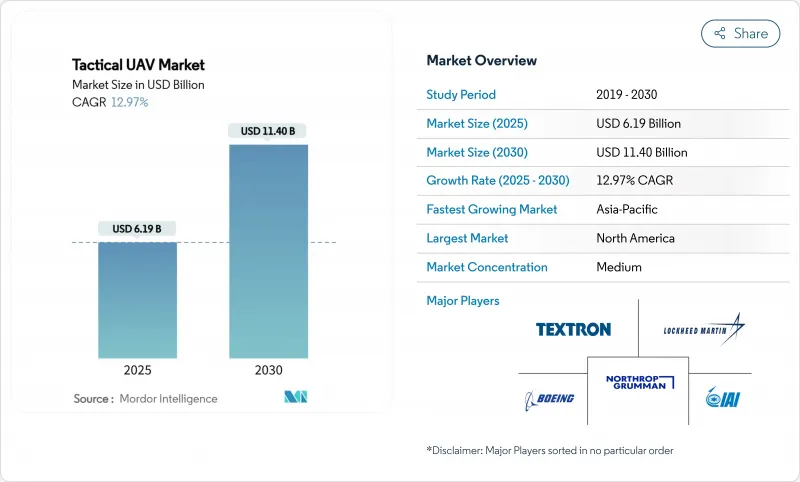

戦術UAV市場規模は2025年に61億9,000万米ドル、2030年には114億米ドルに拡大すると予測され、CAGRは12.97%となります。

この上昇軌道は、情報収集、精密打撃、戦力増強の役割に無人システムを優先させる世界的な防衛近代化プログラムを反映しています。自律型プラットフォームへの配分の増加、最近の激烈な紛争から学んだ教訓、航空機乗組員のリスク軽減の推進が需要を強化しています。戦術ドローンのライフサイクル・コスト・プロファイルは、同等の有人航空機に比べて低く、電気推進、小型化センサー、AI対応自律性の急速な進歩も軍事バイヤーを引き付けています。同時に、サプライヤーは、レアアース・コンポーネント・チェーンを確保し、サイバー脆弱性とスペクトル輻輳が運用の拡張性を脅かすため、電子戦に対するコマンド・アンド・コントロール・リンクを強化するために競争しています。

世界の戦術UAV市場の動向と洞察

高まる防衛近代化予算

主要国防軍は、搭乗員のリスクを最小限に抑えながら戦闘力を増強する無人システムへと調達をシフトしています。米国国防総省の2025年ドローン取得加速路線は、この再優先化を示すものであり、新たな資金を国内プログラムに振り向けるものです。最近のロシアとウクライナの交戦の教訓から、目標捕捉と精密打撃のための小型戦術ドローンの価値が強化され、欧州の同盟諸国は搭乗員のいない空中システムを能力ロードマップに追加するよう促されています。戦術プラットフォームは、有人航空機に比べて参入コストが低いにもかかわらず、同等の監視範囲を提供するため、新興市場もこのパターンを反映しています。セキュアなデータリンクと弾力性のあるサプライチェーンへの並行投資は、単一ソースの部品リスクにさらされる機会を減らし、強化される国家安全保障規制に準拠することを目的としています。これらの近代化プロジェクトは、総体として10年後まで2桁台の需要成長を維持するはずです。

ISRとリアルタイム・データに対する需要の急増

指揮官は、意思決定サイクルを短縮するために、持続的な情報、監視、偵察に依存しています。戦術無人偵察機隊は現在、暗号化された映像を移動司令部に直接ストリーミングするマルチスペクトル・センサーを搭載しており、観測ー方向指示ー決定ー行動のループを数時間から数分に短縮しています。NATO加盟国数カ国におけるスウォーム・イニシアチブは、自律的にターゲット・データを共有する何百機もの相互運用可能なドローンを模索し、分散した戦場での状況認識を広げています。民間機関は、大規模イベントの群衆監視や自然災害の評価に同様のISR能力を採用し、顧客基盤をさらに拡大しています。搭載プロセッサーの改良により、エッジレベルでの物体認識が可能になり、帯域幅のニーズとオペレーターの作業負荷が軽減されます。その結果、戦術UAV市場の需要は、中核的な防衛ニッチ分野以外でも持続的に拡大することになります。

混雑する周波数帯と輸出規制の限界

戦術UAVの運用には、信頼性の高いコマンド、制御、データリンクの帯域幅が必要です。5Gネットワーク、マイクロ波通信、電子戦用妨害電波の普及は、すでに混雑している周波数割り当てを混雑させ、ミッションの途中でリンクを切断しかねない干渉リスクを高めています。規制上の障壁は輸出をさらに複雑にしています。国際武器取引規制は多くの先進的なUAV技術を防衛品に分類しており、ベンダーは個別のライセンスを確保し、海外のバイヤー向けに異なるバリエーションを設計することを義務付けられています。周波数帯の不足と規制の監視という2つの圧力は、取引サイクルを遅らせ、コンプライアンス・コストを膨張させ、一部の小規模サプライヤーは特定の海外市場から撤退せざるを得ないです。

セグメント分析

2024年の戦術UAV市場は、国境パトロールや劇場全体のISRミッションに適した長耐久プロファイルにより、固定翼ドローンが61.32%を占め、支配的でした。オペレータは、空中給油なしで8~12時間の出撃を可能にする巡航効率を高く評価しています。しかし、ハイブリッドVTOL設計は、滑走路のない垂直揚力と固定翼の航続距離性能を兼ね備えているため、15.62%のCAGRで最速の上昇を記録しています。これらの航空機は、即席の空き地や海軍の甲板から発進し、効率的な前方飛行に移行できるため、特殊作戦部隊や海上タスクグループにとって魅力的です。回転翼のドローンは、リーチが短いため、主に近接戦術的な戦闘に限定されるもの、人質救出や市街地での戦闘支援任務における精密なホバリングに不可欠な存在であり続けています。サプライヤーは、プラグアンドプレイのペイロードを受け入れるモジュラー機体を強調し、顧客が新しい航空機を購入することなく、偵察、電子戦、および小口径弾薬のミッション間で資産を再タスクすることを可能にします。

ハイブリッドVTOLの動向は、成熟しつつあるバッテリーのエネルギー密度と、ペイロード重量比を高めるコンパクトなギアード・タービン・エンジンから恩恵を受けています。海軍のプランナーは、固定翼のカタパルト運用が不可能な海域での垂直発進能力の重要性を強調しています。一方、陸軍は滑走路に依存しないドローンを活用し、確立された飛行場を越えて分散した部隊にISRを提供します。その結果、戦術UAV市場は2030年まで、レガシーな固定翼資産からハイブリッドコンセプトへの持続的なシェア移行が予想されます。

150kgから600kgの中型モデルは、2024年の戦術UAV市場規模の42.25%を占め、ペイロード容量と遠征ロジスティクスのバランスを取っています。これらの車両は、マルチセンサー砲塔、合成開口レーダー、暗号化中継ノードを搭載し、旅団レベルの状況認識を最大18時間サポートします。しかし、5kg未満のマイクロ/ナノ航空機は最もダイナミックなサブセットであり、分隊レベルで画像を共有し、内部空間をマッピングし、防空に対して囮作戦を実行する群れを軍が実験しているため、16.32%のCAGRで進歩しています。小型ジンバルと低SWaP無線機の技術的飛躍により、かつては大型ドローンに限られていたISR機能が解放され、インテリジェンスが小隊まで拡大します。

軽戦術カテゴリ(20~150キロ)は、密集した地形で有機偵察を必要とするヘリコプター搭載の挿入ユニットのためのニッチな要件を満たしています。ハイエンドでは、600kgを超える重戦術ドローンが、長時間の海上パトロールやスタンドオフ攻撃を行う。しかし、そのサイズは前方の場所からの展開を複雑にし、群戦術への適性を制限します。すべてのクラスで、バッテリーの革新と軽量複合構造により、ステルス性や積載量を犠牲にすることなく耐久性が向上しています。小型化の動向は、戦力設計の原則を再定義し、意思決定品質のデータを接点に近づけ、戦術UAV市場の各指揮官レベルへの浸透を促進します。

地域分析

北米は、世界最大の国防予算、成熟した航空宇宙サプライチェーン、国内ドローン製造を優先する規制環境に支えられ、2024年の世界戦術UAV市場収益の31.87%を維持した。この地域の複数年にわたる調達プログラムは、機体メーカー、センサーハウス、データリンクベンダーに予測可能な需要を提供する一方、民間機関はインフラ点検や山火事監視のためにBVLOS運用を拡大しています。カナダの次世代監視ドローンへの投資とメキシコの南部国境の監視は、大陸の量をさらに強化する必要があります。

アジア太平洋は、13.39%のCAGRで最も速い成長を示しており、中国、インド、韓国における防衛予算の増加、国境の小競り合い、固有の研究開発に後押しされています。現地のプライム企業は、コスト競争力のある機体と地域固有のセンサー・スイートを統合し、国内契約を獲得して欧米の輸出企業に課題しています。日本のエレクトロニクス企業と防衛省とのパートナーシップは、AIベースのナビゲーション・ソリューションを加速させ、オーストラリアの広大な海洋アプローチは、長耐久性の海洋パトロールドローンの需要を維持します。このように、この地域の戦術UAV市場は、安全保障上の要請と産業政策上のインセンティブの両方から勢いを増しています。

欧州では、欧州防衛基金の下での共同プログラムが技術主権を促進し、着実な拡大を維持しています。加盟国は、都市偵察や対UAS専門に超小型UAVを調達し、外部サプライヤーへの依存を軽減しています。中東とアフリカは、領土紛争や反乱作戦が活発化する新興フロンティアであり、多くの場合、エネルギー収入や多国間援助によって資金が調達されます。トルコやイスラエルのメーカーは、地域紛争での作戦経験を生かし、砂漠環境に合わせた費用対効果の高いシステムを供給しています。このような地理的力学は、販売チャネルを多様化し、世界の戦術UAV市場の長期的な回復力を支えています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 拡大する防衛近代化予算

- ISRとリアルタイム・データに対する需要の急増

- 国境警備と対テロ作戦

- 有人資産に比べ低いライフサイクルコスト

- AIを活用した群れとチーミングのドクトリン

- 海軍甲板での打上げと回収のニーズ

- 市場抑制要因

- 混雑する周波数帯と輸出規制の制限

- 高い初期調達コストとMROコスト

- GPSスプーフィング/サイバーEWへの感受性

- レアアース集約型センサーの供給リスク

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- プラットフォーム別

- 固定翼

- 回転翼

- ハイブリッドVTOL

- 重量クラス別

- マイクロ/ナノ(5kg未満)

- ミニ(5~20kg)

- 軽重量タクティカル(20~150kg)

- 中重量タクティカル(150~600 kg)

- 重重量タクティカル(600kg以上)

- 範囲別

- 近距離(50km未満)

- 中距離(50~200km)

- 拡大範囲(200km以上)

- 推進タイプ別

- 電気

- ハイブリッド

- 従来型(ICE)

- 用途別

- ミリタリー

- 法執行

- 災害・緊急対応

- 環境モニタリング

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- SZ DJI Technology Co. Ltd.

- Aeronautics Ltd.

- General Atomics

- BAYKAR A.S.

- BlueBird Aero Systems Ltd.

- Elbit Systems Ltd.

- AeroVironment, Inc.

- Israel Aerospace Industries Ltd.

- The Boeing Company

- Safran

- Leonardo S.p.A.

- Textron Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Saab AB

- Kratos Defense & Security Solutions, Inc.

- Thales Group