|

市場調査レポート

商品コード

1556133

防衛用UAVの世界市場 (2024~2034年)Global Defense UAV Market 2024-2034 |

||||||

|

|||||||

| 防衛用UAVの世界市場 (2024~2034年) |

|

出版日: 2024年09月16日

発行: Aviation & Defense Market Reports (A&D)

ページ情報: 英文 150+ Pages

納期: 3営業日

|

全表示

- 概要

- 図表

- 目次

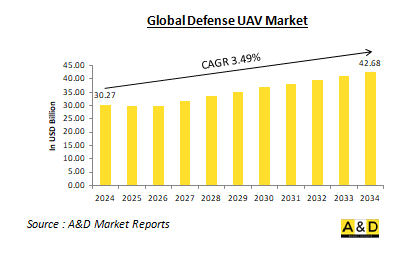

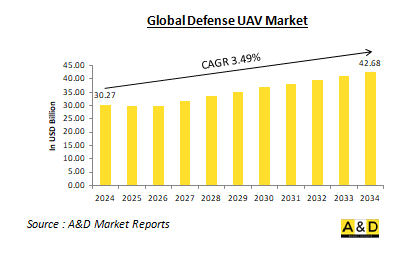

世界の防衛用UAV市場は、2024年に302億7,000万米ドルと推計され、2024~2034年のCAGRは3.49%に達し、2034年までに426億8,000万米ドルに成長すると予測されています。

世界の防衛用UAV市場の概要

無人航空機 (UAV) は一般にドローンとして知られ、現代の軍事作戦の要となり、世界中の防衛戦略と戦術に革命をもたらしています。人間のパイロットを搭載せずに運用されるこの航空機は、偵察・監視から標的攻撃・後方支援まで、幅広い防衛用途への配備が進んでいます。世界の防衛用UAV市場は、技術進歩、軍事ニーズの進化、地政学的緊張の高まりを背景に急速に拡大しています。UAVは、多用途性、コスト効率、運用の柔軟性というユニークな組み合わせを提供し、現代の戦争や防衛活動に不可欠な存在となっています。

世界の防衛用UAV市場における技術の影響

世界の防衛用UAVに対する技術の影響は、深遠かつ多面的であり、さまざまな次元でその開発と配備に大きな影響を与えています。最も顕著な進歩の1つは、高度なセンサー技術です。最新の防衛用UAVには、高解像度カメラ、赤外線センサー、レーダーシステムが装備され、偵察・監視能力が大幅に向上しています。これらのセンサーにより、UAVは詳細な情報収集、広範な偵察、正確な照準が可能となり、状況認識と作戦の有効性が向上しています。

もうひとつの重要な影響分野は自律能力です。人工知能 (AI) と機械学習のUAVシステムへの統合は、その運用機能に革命をもたらしています。自律型UAVは現在、航行・目標識別・脅威検知など、人間の介入を最小限に抑えながら複雑な任務を遂行できます。AI主導のシステムはUAVの運用効率と精度を高め、環境の変化に適応し、より高い精度でタスクを実行することを可能にします。通信およびデータリンクシステムもまた、防衛用UAVの有効性において重要な役割を果たしています。衛星通信、セキュアデータリンク、リアルタイムデータ伝送技術の進歩により、UAVと地上管制ステーション間の継続的な通信が確保されています。この接続性により、重要な情報の軍司令部への中継が容易になり、遠隔操縦やリアルタイムのミッション管理がサポートされるため、全体的な作戦効果が高まります。

さらに、防衛用UAVは、紛争環境での運用を成功させるため、ステルス技術や回避技術をますます取り入れるようになっています。これには、レーダー断面積を小さくする設計機能、赤外線シグネチャーを最小化する高度な素材、敵のレーダーや通信システムを混乱させる電子対策などが含まれます。このような技術により、UAVは敵軍による発見や交戦のリスクを最小限に抑えながら、敵地で任務を遂行することができます。最後に、現代の防衛戦略では、群れとネットワーク化された作戦という概念が注目されています。UAVスワーミングは、協調して行動する複数の無人機を配備することで、複雑なミッションを集団で遂行することを可能にします。ネットワーク化されたオペレーションは、これらのUAVがリアルタイムで情報を共有し、行動を調整することを可能にすることで、その有効性を高め、より強固な防衛・攻撃能力を提供します。

世界の防衛用UAV市場の主な促進要因

世界の防衛用UAV市場の成長と発展を後押ししている主な要因はいくつかあります。地政学的緊張と地域紛争は、先進的な防衛UAVの需要増加に大きく寄与しています。各国は軍事能力を強化し、情報を収集し、正確な攻撃を行うためにUAV技術に多額の投資を行っています。中東や東欧のような紛争が起こりやすい地域での戦略的優位性を求めるこのニーズが、UAV技術への多額の投資につながっています。技術の進歩も市場成長の主な要因の一つです。センサー技術、人工知能 (AI)、通信システム、材料科学の革新は、防衛用UAVの能力を拡大し、より効果的で汎用性の高いものにしています。これらの技術が進化するにつれ、UAVは複雑な任務を遂行し、より厳しい環境でも活動できるようになってきています。コスト効率もUAVの採用を促進する上で重要な役割を果たしています。有人航空機や従来の軍事資産に比べ、UAVは運用コストやメンテナンスコストが低いため、より費用対効果の高いソリューションを提供します。このため、高い作戦効果を維持しながら予算の最適化を目指す防衛軍にとって、UAVは魅力的な選択肢となります。有人航空機に関連する費用をかけずに、さまざまな任務にUAVを展開できるため、さまざまな軍事・防衛用途での採用がさらに加速しています。非対称戦の台頭もUAVの需要を煽る要因の一つです。小規模で機敏な部隊が、技術的に進んだ大規模な敵対勢力に挑む紛争において、UAVは優れた偵察、監視、精密打撃能力を提供することで戦略的優位をもたらします。UAVは、小規模な部隊が、より大規模な通常の敵対勢力に効果的に対抗し、戦術的・戦略的目標をより効率的に達成することを可能にします。最後に、防衛予算の増加は、UAVを含む先端技術への投資を促進しています。多くの国が、新たな脅威に対処し、軍事力を強化するために国防費を増やしています。このような防衛予算の増加により、各国政府は最先端のUAVシステムの開発・取得に資金を割り当てるようになり、さまざまな防衛シナリオで競合優位に立てるようになっています。

世界の防衛用UAV市場の地域別動向

世界の防衛用UAV市場は、地域の防衛優先事項、技術進歩、地政学的要因の影響を受け、明確な地域動向を示しています:北米、特に米国では、先進的なUAVシステムへの大規模な投資が市場を独占しています。米国は、偵察・監視・戦闘作戦に重点を置いたUAVの開発と配備で最先端を走ってきました。General AtomicsやNorthrop Grummanなどの大手防衛関連企業が、最先端のUAV技術開発を主導しています。多額の防衛予算に支えられた米軍のUAVの広範な使用は、この地域の市場リーダーとしての地位を強化しています。欧州では、英国・フランス・ドイツなどの国々が、防衛力を強化するためにUAV技術に多額の投資を行っています。欧州諸国は、情報収集・偵察・戦術作戦用の高度なUAVシステムの開発に注力しています。欧州防衛基金 (EDF) などのイニシアチブが次世代UAV技術の開発を促進し、欧州の防衛産業間の協力を促しています。アジア太平洋地域は、防衛予算の増加と地政学的緊張の高まりに後押しされて、防衛用UAV市場の急成長を目の当たりにしています。中国・インド・日本などの国々は、軍事力の近代化と戦略的能力の強化のため、UAV技術に多額の投資を行っています。特に中国は、攻撃・防衛用途の両方に重点を置いてUAV能力を向上させています。一方、インドと日本は、地域の安全保障上の課題に対処するため、UAVフリートを拡大しています。中東では、地域の紛争や安全保障問題に取り組むために防衛用UAVの活用が進んでいます。イスラエル・サウジアラビア・アラブ首長国連邦などの国々は、諜報・監視・攻撃任務のためにUAV技術に投資しています。この地域におけるUAVの配備は、不安定な地政学的環境において脅威に対処し戦略的優位性を維持するための高度な能力の必要性を強調しています。アフリカでは、防衛用UAV市場は、他の地域と比較してペースは遅いもの、成長しています。南アフリカやエジプトなどの国々は、防衛能力を強化し、安全保障上の懸念に対処するためにUAV技術を模索しています。アフリカにおけるUAVの採用は、進行中の紛争や安全保障上の課題を管理するための効果的な監視・偵察ソリューションの必要性によって推進されています。

防衛用UAVの主要プログラム

米国陸軍はEAGLSから初めてのレーザー誘導対ドローンシステムを受領しました。ノースカロライナ州に拠点を置く同社によると、6つのシステムが「出現しつつある永続的な非搭乗型空中システムの脅威に直面する前方展開部隊」を支援するために契約されました。米国防総省の契約通知書によると、この企業は中東、中央アジア、南アジアの一部を含む米国中央軍責任地域に5機のEAGLSを提供する契約を結んでいます。

イタリア政府はMQ-9 Reaper 無人機6機を7億3,800万米ドルで購入することを承認しました。7億3,800万米ドル相当の外国軍事売却には、3基の移動式地上管制ステーションと6基のブロック5リーパー・ドローンの納入が含まれます。 取引が進めば、同国政府は9基のAN/APY-8合成開口レーダーと12基のマルチスペクトル標的システムも受け取ることになります。米国国防安全保障協力局によると、この売却計画は「NATOの同盟国の安全保障を向上させることで、米国の外交政策目標と国家安全保障目標を支援」します。

目次

防衛用UAV市場:レポートの定義

防衛用UAV市場の内訳

- 地域別

- 推進方式別

- エンドユーザー別

防衛用UAV市場の分析 (今後10年間)

防衛用UAV市場のマーケットテクノロジー

世界の防衛用UAV市場の予測

防衛用UAV市場:地域別の動向と予測

- 北米

- 促進・抑制要因、課題

- PEST分析

- 市場予測とシナリオ分析

- 主要企業

- サプライヤー階層の情勢

- 企業のベンチマーク

- 欧州

- 中東

- アジア太平洋

- 南米

防衛用UAV市場:国別分析

- 米国

- 防衛計画

- 最新動向

- 特許

- この市場における現在の技術成熟レベル

- 市場予測とシナリオ分析

- カナダ

- イタリア

- フランス

- ドイツ

- オランダ

- ベルギー

- スペイン

- スウェーデン

- ギリシャ

- オーストラリア

- 南アフリカ

- インド

- 中国

- ロシア

- 韓国

- 日本

- マレーシア

- シンガポール

- ブラジル

防衛用UAV市場:市場機会マトリックス

防衛用UAV市場:調査に関する専門家の見解

結論

Aviation and Defense Market Reportsについて

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Propulsion, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Propulsion, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By End User, 2022-2032

List of Figures

- Figure 1: Global Defense UAV Market Market Forecast, 2022-2032

- Figure 2: Global Defense UAV Market Market Forecast, By Region, 2022-2032

- Figure 3: Global Defense UAV Market Market Forecast, By Propulsion, 2022-2032

- Figure 4: Global Defense UAV Market Market Forecast, By End User, 2022-2032

- Figure 5: North America, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 6: Europe, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 7: Middle East, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 8: APAC, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 9: South America, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 10: United States, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 11: United States, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 12: Canada, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 13: Canada, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 14: Italy, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 15: Italy, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 16: France, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 17: France, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 18: Germany, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 19: Germany, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 20: Netherlands, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 21: Netherlands, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 22: Belgium, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 23: Belgium, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 24: Spain, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 25: Spain, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 26: Sweden, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 27: Sweden, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 28: Brazil, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 29: Brazil, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 30: Australia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 31: Australia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 32: India, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 33: India, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 34: China, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 35: China, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 36: Saudi Arabia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 37: Saudi Arabia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 38: South Korea, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 39: South Korea, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 40: Japan, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 41: Japan, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 42: Malaysia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 43: Malaysia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 44: Singapore, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 45: Singapore, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 46: United Kingdom, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 47: United Kingdom, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 48: Opportunity Analysis, Defense UAV Market Market, By Region (Cumulative Market), 2022-2032

- Figure 49: Opportunity Analysis, Defense UAV Market Market, By Region (CAGR), 2022-2032

- Figure 50: Opportunity Analysis, Defense UAV Market Market, By Propulsion (Cumulative Market), 2022-2032

- Figure 51: Opportunity Analysis, Defense UAV Market Market, By Propulsion (CAGR), 2022-2032

- Figure 52: Opportunity Analysis, Defense UAV Market Market, By End User (Cumulative Market), 2022-2032

- Figure 53: Opportunity Analysis, Defense UAV Market Market, By End User (CAGR), 2022-2032

- Figure 54: Scenario Analysis, Defense UAV Market Market, Cumulative Market, 2022-2032

- Figure 55: Scenario Analysis, Defense UAV Market Market, Global Market, 2022-2032

- Figure 56: Scenario 1, Defense UAV Market Market, Total Market, 2022-2032

- Figure 57: Scenario 1, Defense UAV Market Market, By Region, 2022-2032

- Figure 58: Scenario 1, Defense UAV Market Market, By Propulsion, 2022-2032

- Figure 59: Scenario 1, Defense UAV Market Market, By End User, 2022-2032

- Figure 60: Scenario 2, Defense UAV Market Market, Total Market, 2022-2032

- Figure 61: Scenario 2, Defense UAV Market Market, By Region, 2022-2032

- Figure 62: Scenario 2, Defense UAV Market Market, By Propulsion, 2022-2032

- Figure 63: Scenario 2, Defense UAV Market Market, By End User, 2022-2032

- Figure 64: Company Benchmark, Defense UAV Market Market, 2022-2032

The Global Defense UAV Market is estimated at USD 30.27 billion in 2024, projected to grow to USD 42.68 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 3.49% over the forecast period 2024-2034

Introduction to Global Defense UAV Market:

Unmanned Aerial Vehicles (UAVs), commonly known as drones, have become a cornerstone of modern military operations, revolutionizing defense strategies and tactics across the globe. These aircraft, which operate without onboard human pilots, are increasingly being deployed for a wide range of defense applications, from reconnaissance and surveillance to targeted strikes and logistical support. The global defense UAV market is expanding rapidly, driven by technological advancements, evolving military needs, and increasing geopolitical tensions. UAVs offer a unique combination of versatility, cost-efficiency, and operational flexibility, making them indispensable in contemporary warfare and defense operations.

Technology Impact in Global Defense UAV Market:

Technology's impact on global defense UAVs is both profound and multifaceted, significantly influencing their development and deployment across various dimensions. One of the most notable advancements is in advanced sensor technologies. Modern defense UAVs are outfitted with high-resolution cameras, infrared sensors, and radar systems that greatly enhance their reconnaissance and surveillance capabilities. These sensors allow UAVs to gather detailed intelligence, conduct extensive surveillance, and perform precise targeting, thereby improving situational awareness and operational effectiveness.

Another critical area of impact is autonomous capabilities. The integration of artificial intelligence (AI) and machine learning into UAV systems is revolutionizing their operational functionality. Autonomous UAVs are now capable of executing complex missions with minimal human intervention, such as navigation, target identification, and threat detection. AI-driven systems boost the efficiency and accuracy of UAV operations, enabling them to adapt to changing environments and perform tasks with greater precision. Communication and data link systems also play a crucial role in the effectiveness of defense UAVs. Advances in satellite communication, secure data links, and real-time data transmission technologies ensure continuous communication between UAVs and ground control stations. This connectivity facilitates the relay of critical information back to military command centers and supports remote piloting and real-time mission management, thereby enhancing overall operational effectiveness.

Furthermore, to operate successfully in contested environments, defense UAVs are increasingly incorporating stealth and evasion technologies. These include design features that reduce radar cross-sections, advanced materials that minimize infrared signatures, and electronic countermeasures that disrupt enemy radar and communication systems. Such technologies allow UAVs to carry out missions in hostile areas while minimizing the risk of detection and engagement by enemy forces. Lastly, the concept of swarming and networked operations is gaining prominence in modern defense strategies. UAV swarming involves deploying multiple drones that operate in coordinated groups, allowing for the execution of complex missions collectively. Networked operations enable these UAVs to share information and coordinate actions in real time, thereby enhancing their effectiveness and providing more robust defensive and offensive capabilities.

Key Drivers in Global Defense UAV Market:

Several key factors are driving the growth and development of the global defense UAV market. Geopolitical tensions and regional conflicts are significantly contributing to the increased demand for advanced defense UAVs. Nations are investing heavily in UAV technology to enhance their military capabilities, gather intelligence, and carry out precise strikes. This need for strategic advantages in conflict-prone areas like the Middle East and Eastern Europe is leading to substantial investments in UAV technology. Technological advancements are another major driver of market growth. Innovations in sensor technology, artificial intelligence (AI), communication systems, and materials science are expanding the capabilities of defense UAVs, making them more effective and versatile. As these technologies evolve, UAVs are becoming increasingly capable of executing complex missions and operating in more challenging environments. Cost efficiency also plays a crucial role in driving the adoption of UAVs. Compared to manned aircraft and traditional military assets, UAVs offer a more cost-effective solution due to their lower operational and maintenance costs. This makes them an attractive option for defense forces aiming to optimize their budgets while maintaining high operational effectiveness. The ability to deploy UAVs for a range of missions without the expense associated with manned aircraft is further accelerating their adoption in various military and defense applications. The rise of asymmetric warfare is another factor fueling UAV demand. In conflicts where smaller, agile forces challenge larger, technologically advanced opponents, UAVs provide a strategic advantage by offering superior reconnaissance, surveillance, and precision strike capabilities. They enable smaller forces to effectively counter larger, conventional adversaries and achieve tactical and strategic objectives more efficiently. Finally, increased defense budgets are driving investments in advanced technologies, including UAVs. Many countries are boosting their defense spending to address emerging threats and enhance their military capabilities. This increase in defense budgets is leading governments to allocate funds for the development and acquisition of cutting-edge UAV systems, providing a competitive edge in various defense scenarios.

Regional Trends in Global Defense UAV Market:

The global defense UAV market displays distinct regional trends, influenced by local defense priorities, technological advancements, and geopolitical factors: In North America, particularly the United States, the market is dominated by significant investments in advanced UAV systems. The U.S. has been at the forefront of UAV development and deployment, focusing on reconnaissance, surveillance, and combat operations. Major defense contractors, such as General Atomics and Northrop Grumman, are leading the charge in developing state-of-the-art UAV technologies. The U.S. military's extensive use of UAVs, supported by substantial defense budgets, reinforces the region's position as a market leader. In Europe, countries like the United Kingdom, France, and Germany are making considerable investments in UAV technology to bolster their defense capabilities. European nations are focusing on developing sophisticated UAV systems for intelligence gathering, surveillance, and tactical operations. Initiatives such as the European Defence Fund (EDF) are promoting the development of next-generation UAV technologies and encouraging collaboration among European defense industries. The Asia-Pacific region is witnessing rapid growth in the defense UAV market, fueled by increased defense budgets and escalating geopolitical tensions. Nations such as China, India, and Japan are heavily investing in UAV technology to modernize their military forces and strengthen their strategic capabilities. China, in particular, is advancing its UAV capabilities with a focus on both offensive and defensive applications. Meanwhile, India and Japan are expanding their UAV fleets to address regional security challenges. In the Middle East, defense UAVs are increasingly being utilized to tackle regional conflicts and security issues. Countries including Israel, Saudi Arabia, and the United Arab Emirates are investing in UAV technology for intelligence, surveillance, and strike missions. The deployment of UAVs in this region underscores the need for advanced capabilities to address threats and maintain strategic advantages in a volatile geopolitical environment. In Africa, the defense UAV market is growing, though at a slower pace compared to other regions. Countries such as South Africa and Egypt are exploring UAV technology to enhance their defense capabilities and address security concerns. The adoption of UAVs in Africa is driven by the need for effective surveillance and reconnaissance solutions to manage ongoing conflicts and security challenges.

Key Defense UAV Programs:

US Army Receives First EAGLS Laser-Guided Counter-Drone System.The US Army has received the first EAGLS counter-drone system from MSI Defence Solutions.According to the North Carolina-based company, six systems have been contracted to help "forward deployed forces facing emerging and persistent uncrewed aerial systems threats."The Naval Air Systems Command, acting through the Rapid Acquisition Authority, granted the contract, which included related engineering and maintenance assistance. The business was contracted to provide five EAGLS to the US Central Command Area of Responsibility, which includes the Middle East, Central Asia, and portions of South Asia, according to an earlier US Department of Defence contract notice.

Italy Cleared to Buy Six MQ-9 Reaper Drones for $738M.The prospective foreign military sale, valued at $738 million, includes the delivery of three mobile ground control stations and six Block 5 Reaper drones.Should the deal proceed, Rome will also receive nine AN/APY-8 synthetic aperture radars and twelve multispectral target systems.Additionally, General Atomics will offer staff training, related spare parts, and essential maintenance support services.The planned sale "will support the foreign policy goals and national security objectives of the US by improving the security of a NATO ally," according to the US Defence Security Cooperation Agency.The announcement of the overseas military sale had no timeframe.

Table of Contents

Defense UAV Market Report Definition

Defense UAV Market Segmentation

By Region

By Propulsion

By End-User

Defense UAV Market Analysis for next 10 Years

The 10-year Defense UAV Market analysis would give a detailed overview of Defense UAV Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense UAV Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense UAV Market Forecast

The 10-year Defense UAV Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense UAV Market Trends & Forecast

The regional Defense UAV Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense UAV Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense UAV Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense UAV Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports