|

市場調査レポート

商品コード

1910458

プロバイオティクス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Probiotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プロバイオティクス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

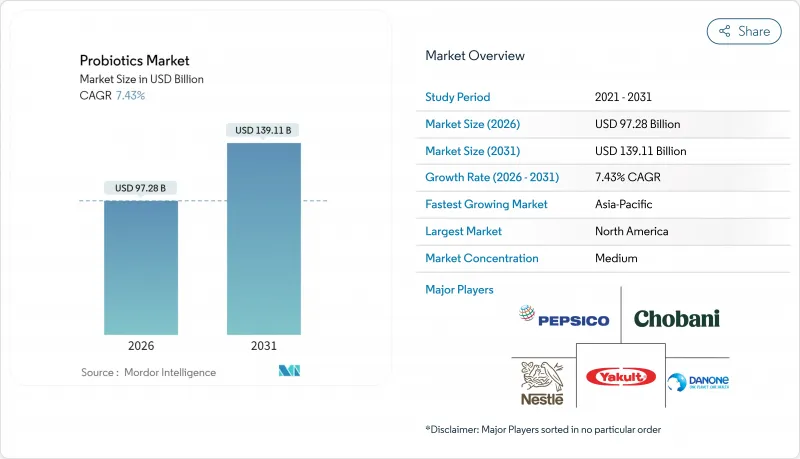

プロバイオティクス市場は2025年に905億6,000万米ドルと評価され、2026年の972億8,000万米ドルから2031年までに1,391億1,000万米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは7.43%と見込まれます。

予防医療への消費者関心の高まり、2024年にFDAがヨーグルトに対して認めた適格健康表示、精密マイクロバイオーム研究の急速な進展が、食品・サプリメント・臨床分野における普及を促進しております。メーカー各社は、プレミアムマージンの獲得に向け、菌株特異的な研究開発、AIを活用したパーソナライゼーションプラットフォーム、ECフルフィルメント効率化への投資を拡大しております。クリス・ハンセンとノボザイムズの合併に代表される多国籍企業の統合は、競合構造を再構築し技術普及を加速させております。地域別では、北米は進歩的な規制動向の恩恵を受けており、アジア太平洋地域のCAGR9.23%は、中産階級の消費拡大と規制調和を反映しています。戦略的機会は、次世代治療形態、有機・非遺伝子組み換え認証、家畜用抗生物質削減政策に集中しており、これらはプロバイオティクス市場の潜在的規模を拡大します。

世界のプロバイオティクス市場の動向と洞察

機能性飲食品への需要増加

「食品としての医薬品」志向の高まりを受け、発酵企業は非乳製品への胞子形成プロバイオティクス菌株の統合を進め、シリアル・スナック・スポーツドリンクなど常温保存可能な製品群を創出しています。腸内微生物叢パターンの研究からは、特殊プロバイオティクス配合がプレミアム価格設定を可能にすることが示されており、この動向が消費財メーカーと研究機関の製品開発協業を促進しています。市場調査によれば、米国消費者の85%がサプリメントよりもプロバイオティクス食品を好んでおり、小売業者は機能性製品の棚スペース拡大を推進しています。乳糖不耐症やビーガン志向の増加により、メーカーは植物由来の担体素材の探索を進めています。こうした機能性食品の革新が、プロバイオティクス市場の成長を支え続けています。

消化器疾患の増加が市場成長を牽引

胃腸疾患、炎症性腸疾患、抗生物質関連合併症の増加に伴い、プロバイオティクスの治療応用範囲が全年齢層に拡大しております。臨床試験では有効性の向上が確認され、多施設共同研究により高用量プロバイオティクス配合剤が成人の抗生物質関連下痢を予防することが実証されました。これは年間数百万人の患者に影響する重大な医療課題を解決するものです。小児領域では、オメプラゾールとプロバイオティクスの併用療法が、機能性消化不良を有する小児において、薬物療法単独と比較し炎症マーカーの低減と症状スコアの改善をもたらしました。予防的プロバイオティクス療法の採用は、医療費の観点から増加傾向にあります。臨床的エビデンスが、慢性胃腸疾患における入院率の低下や薬物依存の軽減に有効であることを示しているからです。

研究開発の高コスト

プロバイオティクス製品の開発には、臨床試験、規制順守、菌株特性評価への多大な投資が必要であり、中小企業にとっては大きな障壁となっています。強固な研究開発能力と財務資源を有する既存企業は競争優位性を維持しています。新規菌株の開発と検証には、毒性試験や自己GRAS経路承認を含む包括的な安全性評価のための資本要件が通常1,000万米ドルを超えます。マイクロバイオーム研究には、高度な分析能力、専門機器、ならびに微生物学、免疫学、臨床研究における学際的な専門知識が求められます。確立された研究インフラを持たない企業は、重大な運営上の課題に直面します。管轄区域ごとに異なる規制要件により、異なる市場向けに複数の研究と別個の文書化システムが必要となり、開発コストの増加と市場投入までの期間の延長を招きます。さらに、プロバイオティクス応用における複雑な特許状況は、広範な知的財産調査と潜在的なライセンシング契約を必要とし、製品開発における追加的な法的費用と戦略的制約をもたらします。

セグメント分析

2025年にはプロバイオティクス食品が売上高の53.88%を占め、日常食に健康効果を求める消費者のニーズを裏付けました。一方、サプリメントは7.99%のCAGRで最も急速に成長しています。このカテゴリーの基幹製品であるヨーグルトは、FDAの糖尿病リスクに関する表示承認後、さらに注目を集め、低糖質や植物由来のバリエーションへのライン拡張が進んでいます。飲料分野では多様化が進み、ケフィア、コンブチャ、オート麦ベースのスムージーに常温保存可能なバチルス胞子が配合され、冷蔵不要の流通経路が開拓されています。サプリメントは精密投与の利点を活かし、徐放性カプセルや胞子ベースのブレンドが、特定の効果を求めるアスリートや高齢層の関心を集めています。

EUの抗生物質禁止措置に後押しされた動物栄養分野では、家禽・水産養殖業者が飼料転換率と疾病抵抗性向上のため多菌株飼料添加物を採用し、販売量が漸増しています。多様な形態の拡大が相まって、プロバイオティクス市場の回復力を支えています。機能性スナックも増加傾向にあります。チョコレートコーティングされたプロバイオティクス製品、常温保存可能な焼き菓子、噛み応えのあるグミなどが、衝動買いの機会を提供しつつ、保護マイクロカプセル化技術により生菌数を維持しています。スーパーマーケットにおけるプライベートブランドの革新は、既存ブランドに価格面での圧力をかける一方、カテゴリー全体の市場規模を拡大しています。並行して、医薬品グレードのシンバイオティクス医療食品が、マイクロバイオームサポートを必要とする腫瘍学および集中治療患者向けに病院チャネルへ参入し、プロバイオティクス市場の規模をさらに拡大しています。

地域別分析

北米は2025年時点で世界プロバイオティクス市場の34.55%を占めており、高度な規制枠組み、情報通の消費者、医療提供者による持続的な推奨が基盤となっています。同地域はハイエンド製品のポジショニングと多様な機能性応用により成長を維持。最近の動向として、2024年3月にヨーグルト摂取と糖尿病リスク低減の関連性を認めたFDAの承認は、北米メーカーの競争力を強化し研究投資を促進しています。米国は、健康関連消費支出の規模、広範な小売流通網、確立された調査能力により市場支配力を維持しています。カナダは先進的な規制と機能性食品の受容拡大により貢献し、メキシコは健康意識の高まりと中産階級の拡大を背景に有望な市場として台頭しています。

欧州は規制上の制約があるもの、ドイツ、英国、フランス、イタリアにおいて戦略的なマーケティング施策や製品改良を実施し、依然として大きな市場存在感を維持しています。欧州食品安全機関(EFSA)の厳格な健康表示要件は、他の地域と比較してマーケティングの柔軟性を制限する一方で、大規模な臨床調査投資を必要としています。北欧諸国では、健康志向の文化的価値観に支えられ、機能性食品やプロバイオティクスの受容性が非常に高い傾向にあります。地中海市場では消化器健康ソリューションへの関心が高まっています。欧州オンブズマンによるプロバイオティクスの分類に関する継続的な審査は、既存の市場障壁を取り除く可能性のある規制調整を示唆しています。

アジア太平洋地域は2031年までCAGR9.02%という最も強い成長軌道を示しており、中国、インド、日本、東南アジア市場における中産階級の拡大、健康意識の高まり、規制の標準化がこれを牽引しています。中国は大きな成長可能性を秘めており、セルバイオテック社が12年間にわたり韓国のプロバイオティクス輸出をリードし、技術的優位性とプレミアムポジショニングを通じてタイやフィリピン市場に浸透した事例がこれを裏付けています。日本の包括的な機能性食品規制(特定保健用食品制度を含む)は、エビデンスに基づくプロバイオティクス開発を促進します。インド市場は、インフラ課題があるもの、膨大な人口基盤と可処分所得の増加により拡大しています。南米および中東・アフリカ地域は成長の可能性を示していますが、消費者教育、流通ネットワーク、規制の整合性への投資が必要です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 機能性飲食品への需要増加

- 消化器疾患の発生率増加が市場成長を牽引

- 天然・有機・非遺伝子組み換えプロバイオティクスへの需要

- 小売および電子商取引流通の拡大

- 調査と臨床検証の進展

- マイクロバイオームに基づく個別化栄養プログラム

- 市場抑制要因

- 研究開発コストの高さ

- 代替健康製品からの競合

- 一部地域における消費者認知度の不足

- 規制上の課題と製品表示の制限

- サプライチェーン分析

- 規制の見通し

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- プロバイオティクス食品

- ヨーグルト

- ベーカリー&朝食用シリアル

- 乳児用調製粉乳・ベビーフード

- スナック菓子・菓子類

- プロバイオティクス飲料

- 乳製品ベース

- 非乳製品

- 栄養補助食品

- 動物飼料および栄養

- プロバイオティクス食品

- 機能別

- 消化器系と腸の健康

- 免疫力向上

- メンタルヘルスと気分(腸脳軸)

- スポーツ・代謝パフォーマンス

- その他

- 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- 薬局およびドラッグストア

- コンビニエンスストア/食料品店

- オンラインストア

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランキング分析

- 企業プロファイル

- Danone SA

- Nestle SA

- Yakult Honsha Co. Ltd

- Gujarat Cooperative Milk Marketing Federation Limited(Amul)

- Bio-K Plus International

- Bright Dairy & Food Co., Ltd

- Fonterra Co-op Group Ltd

- Suja Life LLC

- Harmless Harvest

- Lifeway Foods Inc.

- Chobani LLC

- PepsiCo Inc.

- Morinaga Milk Industry Co. Ltd

- Now Foods

- NextFoods, Inc(Good Belly)

- Evonik Industries

- BioGaia AB

- Church & Dwight Co. Inc

- Amway Corp.

- Archer Daniels Midland Company(Bio-Kult)