|

市場調査レポート

商品コード

1851022

プライベートLTE:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Private LTE - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プライベートLTE:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

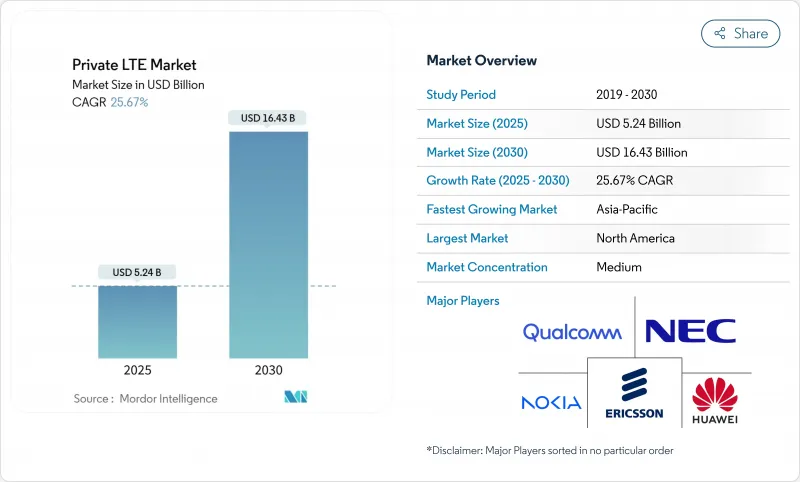

プライベートLTE市場の2025年の市場規模は52億4,000万米ドル、2030年には164億3,000万米ドルに達し、CAGR 25.67%で拡大すると予測されています。

企業が業務をデジタル化し、ミッションクリティカルなワークロードを専用のセルラーインフラストラクチャに配置するにつれて、セキュリティ重視の決定論的パフォーマンスが採用を後押ししています。共有周波数帯の早期商用化、インダストリー4.0プログラムの急速な進展、過酷な環境における超高信頼性低遅延通信(URLLC)のニーズの高まりは、いずれも成長を後押ししています。産業現場は現在、予測可能なカバレッジ、合理化されたサービス品質管理、機密性の高い運用データの完全な管理オプションを提供するため、公共の代替サービスよりもプライベートLTEを支持しています。エッジコンピューティングの統合はもう一つの促進要因であり、ラウンドトリップ遅延なしに巨大なセンサーストリームのローカル分析を可能にします。エコシステムの革新、特にオープンRAN、スモールセルフォームファクター、CBRSデバイスの普及は、参入障壁を下げ、プライベートLTE市場の対応可能ベースを広げています。

世界のプライベートLTE市場動向と洞察

周波数帯域の自由化により企業導入が急増

主なハイライト

- 規制当局はミッドバンド周波数を再割り当てし、CBRSのようなフレームワークの下で、企業が高品質な周波数帯にかつてないほどアクセスできるようにしています。2023年末までに約37万台のCBRSデバイスが導入され、共有帯域がいかにライセンス取得のハードルを下げ、ネットワーク所有の民主化を実現しているかを浮き彫りにしています。手頃な価格で干渉管理されたアクセスにより、これまで独占ライセンスを取得するリソースがなかった中堅企業にもプライベートLTE市場が開放されました。米国以外では、ドイツ、日本、オーストラリアが、工場、港湾、公共施設に特注のカバレッジ・フットプリントを導入できるローカル・ライセンスを発行しています。この政策転換は、ベンダーのエコシステムを拡大し、スモールセルのイノベーションを刺激し、今後3年間でプライベートLTEネットワークの導入が期待される新しい産業用サイトのパイプラインを形成しています。

産業用IoTが製造業の変革を促進

スマートファクトリーへの導入は、30ミリ秒以下のレイテンシーで数千のセンサーを維持できる信頼性の高い無線バックボーンにかかっています。プライベートLTEの早期導入企業の約79%は、自動誘導車、ARアシストメンテナンス、デジタルツインをサポートするためにプライベートLTEを導入した後、6ヶ月以内にプラスのROIを達成したと回答しています。低バランス接続は、ラインバランス効率を改善し、予知保全、品質分析、工場全体のエネルギー最適化を促進します。メーカー各社は、最初のネットワークが稼動すると、ヤード管理や作業員の安全性を確保するウェアラブルなどの使用事例を次々と発見し、プライベートLTE市場に自己強化的な採用曲線を生み出しています。

資本集約が採用障壁を生む

プライベートLTEの展開には、無線機器やコア機器、弾力性のあるバックホール、サイト工事、地域によっては周波数帯域使用料がかかります。特に中堅企業では、初期費用が社内のハードルレートを上回ることが多いです。ネットワーク・アズ・ア・サービス契約への関心が高まっているのは、OPEXサブスクリプションが資本ショックを軽減し、支出を生産性向上に一致させるからです。サイバーハードニングやダウンタイムの回避といった無形のメリットを定量化することは依然として難しく、予算サイクルを長引かせています。オープンRANハードウェアは単価の低減を約束するが、セルラーの専門知識を持たない組織にとっては、統合にかかるオーバーヘッドが節約分を消し去る可能性があります。

セグメント分析

2024年の市場セグメンテーションでは、スモールセル、パケットコア、トランスポート機器への多額の支出を反映して、インフラ部門が市場の63%を占めています。しかし、サービス収入はCAGR 18.4%で急速に増加しています。これは、企業が社内のスキル不足を回避するためにシステムインテグレータに依存しているためです。マネージド・サービスは、設計、統合、24時間365日の運用をバンドルしており、工場や公益事業者に予測可能な予算を提供すると同時に、Time-to-Valueを早めています。プロフェッショナル・サービスの需要は、グリーンフィールド・プロジェクトでは依然として高いが、定期的なマネージド契約は新規予約の大きなシェアを占めています。

無線アクセス・ネットワークが依然として最大の資本を占めているが、企業はセキュリティ・ポリシーを実施するためにオンサイトのコア・システムを重視する傾向が強まっています。複数のプラントゾーンをクラウドダッシュボードに接続する場合、トランスポートバックホールのアップグレードは譲れないです。ベンダーは現在、「ネットワーク・イン・ア・ボックス」キット(設定済みのコアにスモールセルを加えたもの)を推進しており、即日アクティベーションが可能です。Pente Networks社のそのようなキットは、2025年のロサンゼルスの山火事の際、緊急隊員の通信を維持し、ターンキーパッケージングが技術に精通したバイヤー以外にもプライベートLTE市場を広げることを強調しています。

時分割二重通信は2024年の売上高の55%を占め、CAGRは17.1%と最も高くなると予測されています。ビデオ監視やテレメトリの非対称トラフィックは、TDDの動的割り当てに有利であり、希少なミッドバンド・チャネル内のスループットを最大化します。また、TDDはCBRS帯域の割り当てにも合致するため、新しいプライベートLTE市場の展開におけるデフォルトとしての地位も強化されます。

周波数分割二重通信は、アップリンクとダウンリンクの厳密な分離が重視される、遅延に敏感な制御システムにおいて足場を保っています。しかし、最新のスケジューラはTDDのジッターを10ミリ秒以下まで削減し、歴史的なギャップを縮めています。今後リリースされる5Gでは、TDDの数値がさらに洗練され、企業が5G NRキャリアアグリゲーションに移行しても、今日の投資が適切であり続けることが保証されます。

地域分析

北米は、CBRSフレームワークと、無線、デバイス、インテグレーター・パートナーの成熟したエコシステムにより、2024年の売上の38%を占め、首位に立ちました。2024年末までに世界中で4,700を超えるプライベートLTEと5Gネットワークが運用開始され、かなりのシェアが米国にありました。製造業、ヘルスケア、公益事業におけるローカル5Gパイロットが需要を拡大し、ハイパースケーラのエッジゾーンが主要都市における低遅延ワークロードのオフロードを容易にします。

アジア太平洋地域は、2025年から2030年までのCAGRが最速の12.8%を記録。中国は国家が支援する工場と鉱山のネットワークを展開し、日本はミリ波とミッドバンドでローカル5Gライセンスを発行し、韓国は高密度のファイバーバックボーンを活用してキャンパスコアをホストします。インドの最近の周波数政策変更により、自動車工場や製薬工場でのトライアルが解禁されました。オーストラリアでは、主に遠隔地の鉄鉱石やリチウムの採掘を合理化するために、すでに50以上のプライベートLTEシステムが運用されており、ACMAによると、その市場は2027年までに6億9,500万豪ドルに達すると予測されています。

GSMAによると、欧州は展開数で第2位で、2023年半ばまでに世界の個人設置数の約40%を占める。ドイツの3.7~3.8GHz帯ローカル・ライセンスは製造業の導入に拍車をかけており、英国のシェアード・アクセス・フレームワークは港湾や農場向けのライセンスを簡素化しています。European 5G Observatoryによると、2024年3月までにパイオニアバンドの73%が割り当てられ、産業用ネットワークの強固なスペクトル基盤が形成されました。ボーダフォンが2,500カ所でオープンRANを展開すると表明したことで、欧州大陸全体で設備コストが削減され、ターンキー・プロジェクトを求める企業バイヤーに間接的な恩恵がもたらされると期待されています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 周波数自由化とCBRS商用化

- 産業用IoTとインダストリー4.0の普及

- 過酷な現場でのミッションクリティカルなURLLCの需要

- 5G SAへのシームレスな移行経路

- オンプレミスのエッジAI帯域幅要件

- オープンRANスモールセルエコシステムによるTCO削減

- 市場抑制要因

- 高いCAPEXと不確実なROI

- 統合人材の不足

- 細分化されたデバイス・バンド・サポート

- 民間の5Gパイロット事業による予算のカニバリゼーション

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力/消費者

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

第5章 市場規模と成長予測

- コンポーネント別

- インフラ

- 無線アクセス(RAN)

- コア(EPC/5GC)

- バックホールと輸送

- サービス

- プロフェッショナルサービス

- マネージドサービス

- インフラ

- 技術別

- 周波数分割複信方式(FDD)

- 時分割複信(TDD)

- 展開モデル別

- 集中型(C-RAN)

- 分散型

- スペクトラム別

- ライセンシング

- アンライセンス(MulteFire、5GHz)

- シェアード(CBRS、LAA)

- エンドユーザー業界別

- 製造業

- エネルギーと公益事業

- 鉱業・石油・ガス

- 輸送と物流

- 公共安全と防衛

- ヘルスケア

- 企業/キャンパス

- その他

- 地域別

- 北米

- 米国

- カナダ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- カタール

- イスラエル

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Nokia

- Ericsson

- Huawei Technologies

- NEC Corp.

- Qualcomm

- Druid Software

- Sierra Wireless

- JMA Wireless

- Ruckus Networks(CommScope)

- Celona

- Airspan Networks

- Cisco Systems

- ZTE Corp.

- Samsung Electronics

- Airspan Networks

- Athonet(HPE)

- Motorola Solutions

- Mavenir Systems

- Amazon AWS Private 5G

- Verizon Business

- General Dynamics Mission Systems