|

市場調査レポート

商品コード

1910461

パーソナルケア化学品:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Personal Care Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| パーソナルケア化学品:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

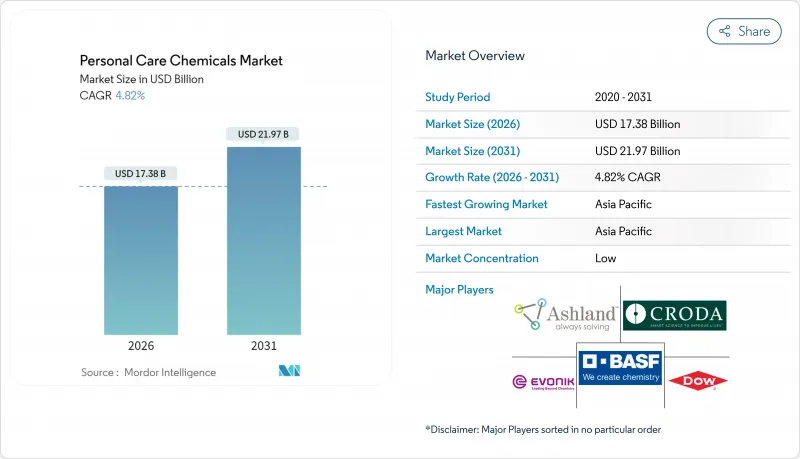

パーソナルケア化学品市場は、2025年に165億8,000万米ドルと評価され、2026年の173億8,000万米ドルから2031年までに219億7,000万米ドルに達すると予測されています。

予測期間(2026年~2031年)におけるCAGRは4.82%と見込まれます。

需要は臨床的に実証された有効成分に傾いていますが、非有効成分が依然として量を占めており、データに裏打ちされた有効性を有するサプライヤーは価格決定力を享受しています。中国とインドにおける可処分所得の増加により、家計予算が高級スキンケア製品へとシフトしているため、アジア太平洋地域が絶対的な成長を主導しています。欧州におけるマイクロプラスチック規制とAIを活用した処方ツールの普及が相まって、大手既存企業の製品ポートフォリオ刷新が加速しています。高成長地域における原料価格の変動性や水不足の継続は、原油価格変動リスクや洗い流し型製品の依存度を低減するバイオベースおよび無水システムの採用を、処方開発者に促しています。

世界のパーソナルケア化学品市場の動向と洞察

プレミアムスキンケア有効成分への需要拡大

ペプチド複合体やカプセル化レチノイドは汎用エモリエントよりも高価格ですが、配合コスト全体に占める割合は小さく、有効性を実証できるサプライヤーにとって魅力的な利益率を生み出しています。レチノイドに敏感なユーザーがよりマイルドな選択肢を求める中、バクチオールの採用は2023年から2025年にかけて3倍に増加し、シテノールAは現在120を超える世界のSKUに採用されています。メラノソーム転送を阻害する明確なメカニズムに裏付けられたナイアシンアミドの効能主張は、サプライヤーに臨床データへの投資を促し、ジェネリック参入の障壁を高めています。一時的な独占権を提供する共同開発契約が急増しており、エスティローダーはDSMとの協業により発酵酵母エキスで24ヶ月の先行権を獲得しました。皮膚科学試験センターと特許取得済みデリバリープラットフォームを保有するサプライヤーは、実証済み有効成分に対してブランドがプレミアム価格を支払い続ける中、持続的な優位性を獲得しています。

アジア太平洋地域における中産階級の消費拡大

2024年、中国では都市部の中産階級世帯が大幅に増加し、スキンケア製品が年間予算に占める割合は2019年と比較して拡大しました。プロヤなどの現地ブランドは、高麗人参やクコの実などの漢方エキスと現代的な有効成分を組み合わせ、中国のプレミアムスキンケア市場において顕著なシェアを獲得しています。2024年、インドでは第2・第3都市圏における所得増加を背景に大幅な成長が見られました。これらの地域では紫外線対策や汚染防止機能への関心が高まっております。韓国発の乳酸菌発酵技術を活用したガラクチモイセスやビフィダエキスを強みとするコスマックスBTIは、世界のブランドによるK-ビューティー原料の調達増加に伴い、2024年に大幅な売上増を記録いたしました。インドネシアとベトナムでは、ハラール認証化粧品が着実な年間成長を遂げており、サプライヤーはイスラム教徒の消費者のニーズに応えるため、JAKIM認証の取得を進めています。

マイクロプラスチック及び特定防腐剤の厳格な禁止

欧州連合(EU)は2023年10月、意図的に添加された5ミリメートル未満のマイクロプラスチックを禁止し、ポリエチレンやポリプロピレンビーズに依存していた多数のSKUに影響を与えました。禁止された角質除去剤の代替としてセルロースビーズやホホバエステルが採用されていますが、これにより原材料コストが増加しています。アクリレート共重合体ベースのレオロジー調整剤も規制対象となり、配合設計者は粘着性の高い使用感を提供するキサンタンガムやグアーガムへの移行を迫られています。残留型製品におけるメチルイソチアゾリノン禁止により、低コストで広域スペクトルの防腐剤が失われ、安定性試験を複雑化する多成分システムの使用が余儀なくされています。アシュランド社はこれに対応し、エモリエントとしても機能する多機能防腐剤「スペクトラスタット」を開発。これによりブランドは成分リストの簡素化を維持できます。コンプライアンス監査と再配合費用は、独立系ブランドにとって大きな負担となっています。

セグメント分析

2025年時点で、不活性成分はパーソナルケア化学品市場の61.68%を占めております。これは製品の重量の大半を水、乳化剤、増粘剤が占めるためです。しかしながら、有効成分は2031年までに5.27%の成長が見込まれており、ブランドが臨床的証拠をもってプレミアム価格を正当化するにつれ、不活性成分を上回る成長が予想されます。界面活性剤は、プレミアム価格が付く再生可能原料由来の製品による利益率の低下に直面していますが、プレミアムブランドのみが手頃な価格で提供できる状況です。エモリエント剤と乳化剤は、テクスチャーと使用感の観点から依然として不可欠ですが、イノベーションは新たな化学技術よりも触感の改良に焦点が移っています。着色剤と防腐剤は規制強化に直面しており、天然ガムがカルボマーに取って代わりつつあります。ただし、天然ガムは粘度安定性が低いという課題があります。

ペプチド、鉱物系UVフィルター、抗酸化剤が有効成分市場の急成長を牽引し、ヘア用コンディショニング剤が有効成分売上高の重要な割合を占めています。皮膚科医が日常的な保護の重要性を強調したことで、UV有効成分のパーソナルケア化学品市場は拡大しました。レチノイドとパルミトイルペプチドは試験において顕著なしわ深さの減少効果を示し、これによりブランドは高価格帯の美容液を販売可能となりました。パパインなどの酵素系角質除去剤は敏感肌向けに穏やかな効果を提供しますが、コスト増加要因となるコールドチェーン物流を必要とします。消費者はブランドストーリーよりも成分表示を厳しく精査するため、サプライヤーは特許保護と臨床プログラムへの投資を迫られ、パーソナルケア化学品市場における利益率維持が求められています。

地域別分析

アジア太平洋地域は2025年の収益の30.18%を占め、2031年までにCAGR6.05%で拡大が見込まれます。これは中国などスキンケア支出が増加している国々の都市部中産階級世帯に牽引されています。発酵由来の有効成分を輸出する企業は、世界の買い手が効果的なソリューションを大規模に求める中、成長を遂げています。インドでは、国内化学品生産を支援し主要企業の投資を誘致する政府の奨励策のもとで成長を遂げています。ASEAN諸国は、大規模なイスラム教徒消費者層に対応するハラール認証化粧品に注力しています。一方、日本は人口高齢化による課題に直面しており、サプライヤーは域内他国の若年層市場へ注力先を移しています。

北米は依然として主要市場です。FDAによる有機紫外線吸収剤の再分類など規制変更は、日焼け止めの発売に影響を与え、鉱物由来の代替品への需要シフトを促す可能性があります。カナダでは化粧品原料への追加規制が導入され、多数の製品処方の更新が求められています。ニアショアリングの取り組みによりメキシコの生産能力が増強され、米国ブランドがより強靭なサプライチェーンを構築する上で支援となっています。欧州ではマイクロプラスチックの段階的廃止を含む、世界で最も厳しい化粧品化学物質規制が施行されており、これに伴い製品処方の見直しが進められています。ドイツ、フランス、英国などの主要市場では、認証を受けた持続可能な原料の使用が引き続き優先されています。

南米では成長が見られ、ブラジルのブランドは持続可能性を重視する消費者に訴求するアマゾンの植物原料の使用を強調しています。アルゼンチンは経済的課題により自由裁量支出に影響が出ていますが、チリは都市部の富裕層による需要拡大の恩恵を受けています。中東・アフリカ地域も成長市場ですが、水不足などの課題に直面しています。サウジアラビアでは、洗い流すタイプの化粧品に対する消費税導入が予定されており、無水製品の採用を促進し、高濃度製品の機会を創出しています。南アフリカは統合されたサプライチェーンにより界面活性剤コストが安定している一方、アラブ首長国連邦では高所得のイスラム教徒消費者層を背景に、ハラール認証製品の需要が増加しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- プレミアムスキンケア有効成分への需要拡大

- アジア太平洋地域における中産階級の消費拡大

- 天然・持続可能な原料への移行

- ニッチ美容ブランドのeコマース加速

- AIを活用した処方プラットフォームが研究開発サイクルを短縮します

- 市場抑制要因

- マイクロプラスチック及び特定防腐剤の厳格な禁止

- 石油由来原料の価格変動性

- 水不足による洗い流すタイプの製剤への制約

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 原料別

- 非有効成分

- 界面活性剤

- 乳化剤

- エモリエント

- 着色料および保存料

- レオロジー制御剤

- その他の非有効成分

- 有効成分

- コンディショニング剤

- 紫外線防止成分

- アンチエイジング剤

- 角質除去剤

- その他の有効成分

- 非有効成分

- 用途別

- スキンケア

- ヘアケア

- メイクアップ

- フレグランス

- オーラルケア

- トイレタリー

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN諸国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- 北欧諸国

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- Ashland

- BASF

- Clariant

- Croda International Plc

- Dow

- DSM

- Evonik Industries AG

- GALAXY

- Innospec

- Kao Corporation

- Lonza

- Merck KGaA

- Momentive

- Nouryon

- Sasol

- Solvay

- Stepan Company

- Symrise

- The Lubrizol Corporation

- Wacker Chemie AG