|

市場調査レポート

商品コード

1640381

医療用X線装置とイメージングソフトウェア:市場シェア分析、産業動向、成長予測(2025年~2030年)Medical X-Ray Equipment And Imaging Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医療用X線装置とイメージングソフトウェア:市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 127 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

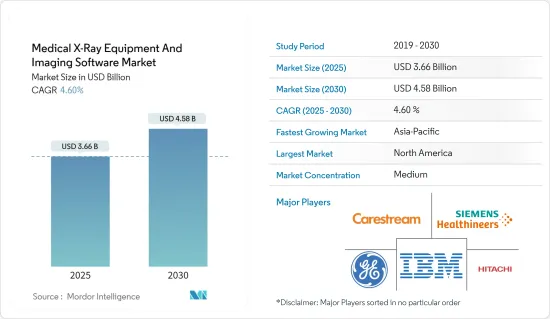

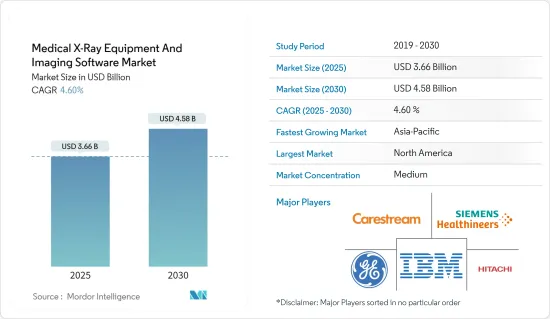

医療用X線装置とイメージングソフトウェア市場規模は、2025年に36億6,000万米ドルと推定され、予測期間中(2025~2030年)のCAGRは4.6%で、2030年には45億8,000万米ドルに達すると予測されます。

医療用X線装置とイメージングソフトウェア市場は、昨年32億米ドルと評価され、予測期間中に4.60%のCAGRで推移することにより、予測期間終了までに43億2,000万米ドルに達すると予測されます。予測期間中、高齢者の増加と医療環境への投資の増加が市場全体の成長を後押しすると予想されます。新興諸国は、高齢者が利用しやすい医療システムを提供するために投資を行っており、これが市場を押し上げています。

主要ハイライト

- 多くの病院や医療施設で使用されている基本的な医療システムの1つに、X線装置とイメージングソフトウェアがあります。X線画像は、痛みを伴わず非侵襲的な診断や治療モニタリングが可能なため、医療現場で広く利用されています。

- 骨折、感染症(肺炎を含む)、石灰化、腫瘍、関節炎、歯科、心臓、血管の閉塞、消化器、嚢胞、がん、喘息、肺疾患など、X線の用途の多様性は、市場の需要を支えているX線の診断・治療用途の広さを示しています。

- さらに、医療セグメントにおける歯科用途では、より迅速でコンパクトなスキャンが必要とされています。Listerine Professionalによると、口腔障害は全世界で39億人を苦しめており、最も全般的健康問題です。そのため、X線画像診断の主要ニーズは、今後数年間で歯科セグメントで高まると予想されます。

- さらに、医療セグメントのデジタル化が進んでいるため、チップ技術の採用が医療装置市場の成長を促進する重要な要因の1つとなっています。この傾向により、センサやモーション・マイクロエレクトロ機械式システム、マイクロコントローラ、アナログデバイス、メモリーパワーマネージメントデバイスなどの使用が増加しています。X線装置とイメージング市場では、遠隔患者モニタリングシステムの使用増加、診断と治療手法の進歩、非伝染性疾患の高い蔓延などの要因も半導体成長を促進すると予想されます。

- このような状況にもかかわらず、製品メーカーは、画像装置、デジタル技術アプリケーション、自動化などの技術改善により、競合の一歩先を行くことが期待されます。また、3D医療用イメージングデバイスの需要増加も市場を拡大します。サプライヤーや政府は、安全性、信頼性、手頃な価格を保証するため、最先端のイメージング技術への投資を強化する見込みです。

- 国連の世界人口展望(World Population Prospects)のデータによると、65歳以上の人口は着実に増加しています。2050年までに、60歳以上の人口は20億人に達すると予測されており、そのうちの80%は低・中所得国に住む可能性があります。したがって、高齢者の増加と整形外科や心臓血管系の手術件数の急増は、医療アプリケーションにおける医療用画像の採用をさらに促進する可能性があります。

- 医療用X線画像診断・装置の国際市場の成長は、医療用画像診断にかかる高額な検査費用や必要不可欠なインフラへのアクセス制限によって阻害されると予想されます。さらに、開発途上国では、医療装置の使用経験を持つ専門家の不足が引き続き深刻な問題となっています。

医療用X線装置とイメージングソフトウェアの市場動向

診断センターが市場需要を牽引

- 医療用X線装置とイメージングソフトウェア産業は、放射線診断検査への注目の高まりや、医療装置市場の合併・統合による慢性疾患負担の増加など、さまざまな要因により、年間画像診断検査件数の増加を目の当たりにしています。

- 診断センターは、可能な限り最良の治療を提供し、患者のニーズを満たすために、徹底的なスクリーニングと診断を行っています。感染症や非感染症の罹患率が上昇する中、患者を正確に診断するために、より多くの診断施設が開設されつつあります。

- 診断用X線写真の作成能力は、いくつかの変数に左右されます。その一つは、X線管電圧や電流のような特定のX線撮影技術変数に対するX線露光の再現性です。X線管電流の変化に対するX線量の「線形」応答も、X線画像の質に大きく影響する要素です。X線画像を確実に作成するには、X線管電流とX線発生量の関係が"直線的 "でなければなりません。

- さらに、多くの企業がCTスキャナーやX線装置などの医療診断装置の電源に使用されるIGBT(絶縁ゲートバイポーラトランジスタ)に投資しています。IGBTベースの電源は、X線管に与える電圧を見事に管理し、画質を向上させています。日本統計局の推定によると、2024年までに日本のX線装置からの収益は35億米ドルを超え、2022年の33億米ドルから増加します。医療セグメントにおけるこのような進歩は、市場拡大にさらに拍車をかける可能性があります。

- ほとんどの国は医療産業に多額の支出を行い、健康増進のために診断センターを最新の装置やソリューションにアップグレードしています。しかし、米国のような一部の国では、医療のパフォーマンスが低いです。例えば、米国は他の類似国よりも約7%から10%多く医療費を費やしているが、平均寿命は低いです。そのため、企業は先進的な装置やイメージングソフトウェアに投資し、医療のエコシステムを改善するという新たな道が生まれます。

- さらに、欧州全体の医療費が急速に上昇していることから、同地域のX線管市場は過去5年間よりもはるかに急速に拡大すると予測されています。プーチン大統領は、2024年までにロシア人の平均寿命を73歳から78歳に延ばし、がんと心血管疾患による死亡率を低下させることを目指す国家プロジェクト「医療」を発表しました。このプロジェクトには年間400億ユーロの投資が見込まれています。政府は、医療装置(画像診断:歯科製品、整形外科、その他の医療装置)の輸出を制限する意向です。

- さらに、多くの地域で医療診断のニーズが高まっていることが、市場拡大にさらに寄与する可能性があります。また、心血管疾患の増加によりX線装置が必要となっています。例えば、Population Reference Bureau(PRB)の最近の分析によると、2030年までにラテンアメリカ死亡者の81%は、4つの主要な非伝染性疾患(心血管疾患、ほとんどの悪性腫瘍、糖尿病、慢性呼吸器疾患)に起因すると予想されています。このため、2022年8月、International Finance Corporationは、ラテンアメリカ・カリブ海諸国(LAC)全域の低所得者層が高品質でリーズナブルな医療を受けられるようにするため、製薬会社Laboratorios Siegfriedに3,000万米ドルの資金を提供しました。

大きなシェアを占めるアジア太平洋

- アジア太平洋は、予測期間中にかなりの割合で拡大すると予想されます。成長を支える重要な要因は、研究・イノベーションセンターへの投資の増加、政府プログラム、IT医療装置・装置市場を優遇する施策です。

- 慢性疾患の頻度が上昇し、質の高い医療に対するニーズが高まっていることから、アジア太平洋は他の地域よりも急速に発展すると予想されます。また、画質の向上や処理の高速化などのメリットから、デジタルX線システムにおけるPACS(画像保存通信システム)の採用が増加していることも、同市場を大きく後押ししています。

- アジア太平洋では高齢者が急増し、座りっぱなしのライフスタイルや不健康な食習慣が原因で慢性疾患が増加しています。さらに、医療施設の増加に伴う医療インフラ開発の高まりが、医療用X線装置の需要を押し上げると予想されます。

- 中国政府はまた、医療構造全体を改善するための支援施策を次々と実施しています。Health China 2030計画は、2030年までにすべての人にサービスを拡大するための包括的なガイドラインであり、公衆衛生に焦点を当てています。このような医療水準の向上に向けた取り組みが、中国のX線管市場の成長を後押ししています。

- さらに、X線CT(コンピュータ断層撮影)画像の構造工学への応用も進んでいます。X線トモグラフィを使用してコンクリートサンプルをスキャンすれば、サンプルを破壊することなく内部構造に関する洞察を得ることができます。セメント系材料の内部設計を研究することは、その耐久性に影響を与える輸送現象を理解しモデル化する上で極めて重要です。

- さらに、魅力的な収益源を生み出すため、医療用画像診断装置の世界市場におけるアジア太平洋企業は、高品質で技術的に先進的な装置の製造に注力しています。疾患、慢性疾患、神経疾患、悪性腫瘍の有病率の増加が医療用画像装置の世界市場を牽引しています。このような需要の増加は医療部門からもたらされています。

医療用X線装置とイメージングソフトウェア産業概要

医療用X線装置とイメージングソフトウェア市場は、複数の大手企業によって構成されており、競争は中程度です。多くの企業が新製品の投入や戦略的M&Aによって市場での存在感を高めています。

2023年7月、Radon Medical ImagingはTristate Biomedical Solutions, LLC(TBS)を買収したと発表しました。TBSは、新品、中古品、再生品の画像診断装置や生物医療装置の販売とサービスを提供する企業で、Cアーム、X線、その他の画像診断装置を専門としています。この戦略的決定は、医療用イメージング市場における産業リーダーになるというRadonの戦略を強化するものです。新しいソリューションと技術へのアクセスを提供することで事業を強化し、地理的なフットプリントをさらに拡大することで、顧客により良いサービスを記載しています。

2023年5月、Siemens HealthineersとCommonSpirit Healthは、Block Imagingの買収に合意しました。これにより、よりサステイナブル選択肢を提供し、米国の病院、医療システム、その他の医療現場からのマルチベンダーの画像部品やサービスに対する需要の増加をサポートすることが期待されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- バリューチェーン/サプライチェーン分析

第5章 市場力学

- 市場促進要因

- 疾病の増加と高齢者の増加

- 医療産業への投資の増加と政府の積極的な取り組み

- 市場抑制要因

- 厳しい規制とバリデータガイドライン

- ソフトウェアに関連するセキュリティ問題

- COVID-19の市場への影響評価

第6章 市場セグメンテーション

- タイプ別

- 装置

- ソフトウェア

- 技術別

- X線撮影/マンモグラフィ

- コンピュータ断層撮影

- 透視/血管造影

- 画像タイプ別

- 2次元

- 3次元

- エンドユーザー別

- 病院

- 診断センター

- 研究センター

- ***地域別

- 北米

- 欧州

- アジア

- オーストラリアとニュージーランド

- 中東・アフリカ

- ラテンアメリカ

第7章 競合情勢

- 企業プロファイル

- GE Healthcare Inc.

- Koninklijke Philips NV

- Hitachi Ltd

- Canon Inc.

- Siemens Healthcare GmbH

- Shimazdu Corporation

- Carestream Health Inc.

- Fujifilm Holdings Corporation

- Konica Minolta Inc.

- Varex Imaging Corporation

- IBM Corporation

- Hologic Inc.

第8章 投資分析

第9章 市場機会と今後の動向

The Medical X-Ray Equipment And Imaging Software Market size is estimated at USD 3.66 billion in 2025, and is expected to reach USD 4.58 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

The medical X-ray equipment and imaging software market was valued at USD 3.20 billion last year and is expected to reach USD 4.32 billion by the end of the forecast period by registering a CAGR of 4.60 percent during the forecast period. Over the projected period, it is anticipated that an older population on the rise and increasing investments in the healthcare environment will favorably boost market growth overall. Developed countries have been investing in providing these individuals with accessible healthcare systems, which has boosted the market.

Key Highlights

- One of the fundamental healthcare systems used in many hospitals and other medical facilities is X-ray equipment and imaging software. X-ray imaging is widely used in medical settings because it enables painless and non-invasive diagnosis and therapy monitoring.

- The variety of uses for X-rays, including those for bone fractures, infections (including pneumonia), calcifications, tumors, arthritis, dental, heart, blood vessel blockages, digestive, cysts, cancer, asthma, lung diseases, etc., demonstrates the wide range of diagnostic and therapeutic uses for x-rays that have sustained market demand.

- Moreover, dental applications in the medical field necessitate quicker and more compact scans. According to Listerine Professional, oral disorders afflict 3.9 billion individuals worldwide, making them the most common health problems. Consequently, it is anticipated that the primary need for X-ray imaging will rise in the dental sector in the following years.

- Additionally, since the healthcare sector has been increasingly digitalized, chip technology adoption has emerged as one of the critical drivers of the growth of the medical equipment market. This tendency has led to increased use of sensors and motion micro-electromechanical systems, microcontrollers, analog devices, memory power management devices, etc. In the X-ray equipment and imaging market, factors including rising usage of remote patient monitoring systems, advancements in diagnostic and treatment methodologies, and a high prevalence of non-communicable diseases are also anticipated to propel semiconductor growth.

- Despite this, Product makers are expected to stay one step ahead of the competition owing to technological improvements in imaging equipment, digital technology applications, automation, etc. Increased demand for 3D medical imaging devices also expands the market. Suppliers and governments are expected to boost their investments in cutting-edge imaging technology to assure security, dependability, and affordability.

- According to the UN data of World Population Prospects, the number of people above 65 years is steadily increasing. By 2050, the world's population aged 60 years and more is predicted to touch 2 billion, of which 80 percent may live in low- and middle-income countries. Hence, the growing geriatric population and the surging number of orthopedic and cardiovascular procedures may further drive the adoption of medical imaging in healthcare applications.

- The growth of the international market for medical X-ray imaging and equipment is expected to be hampered by high test costs for medical imaging and limited access to essential infrastructure. Furthermore, the lack of professionals with experience in the use of medical equipment continues to be a severe issue in developing nations.

Medical X-Ray Equipment and Imaging Software Market Trends

Diagnostic Centers Majorly Drive the Market Demand

- The medical X-ray equipment and imaging industry is witnessing a growth in the number of imaging and diagnostic tests performed per year owing to various factors, such as increasing focus on radiological diagnostic tests and rising chronic disease burden through mergers and consolidation in the medical devices market.

- Diagnostic centers offer thorough screening and diagnostics to give the best possible care and meet the patient's needs. More diagnostic facilities are opening up to accurately diagnose patients as the incidence of infectious and non-communicable diseases rises.

- A diagnostic radiograph's ability to be produced depends on several variables. One of those variables is the reproducibility of X-ray exposure to specific radiographic technique variables, like X-ray tube voltage and current. The "linear" response of the X-ray dose to changes in the X-ray tube current is another element that significantly impacts the quality of X-ray images. To create the radiographic image reliably, the relationship between tube current and X-ray production must be "linear."

- Moreover, many companies are investing in insulated gate bipolar transistors (IGBT), which are used to power CT scanners and X-ray machines, among other medical diagnostic devices. The IGBT-based power supply's superb management of the voltage given to the X-ray tube enhances the image quality. The Statistics Bureau of Japan estimates that by 2024, the revenue from X-ray equipment in Japan will be over 3.5 billion USD, up from 3.3 billion in 2022. Such advancements in the medical field may further fuel market expansion.

- Most countries spend highly on the healthcare industry and upgrade to the latest equipment and solutions in their diagnostic centers to improve health. However, a few countries, such as the United States, underperform in healthcare. For instance, the United States spends approximately 7 percent to 10 percent more than other similar countries; however, life expectancy is low. This creates a new avenue for companies to invest in advanced equipment and imaging software to improve the healthcare ecosystem.

- In addition, with healthcare costs in all of Europe rising quickly, the X-ray tube market in that region is predicted to expand much more rapidly than it did over the previous five years. President Vladimir Putin unveiled the national "Health Care" project, which seeks to extend Russians' life expectancy from 73 to 78 years and lower the mortality rate from cancer and cardiovascular disease by 2024. The expected annual investment in this project is 40 billion euros. The government intends to limit the export of medical equipment (diagnostic imaging: dental products, orthopedics, and other medical devices).

- Furthermore, a growing need for medical diagnostics across numerous regions may further contribute to market expansion. X-ray machines are also necessary due to the rise in cardiovascular disorders. For instance, According to a recent analysis by the Population Reference Bureau (PRB), by 2030, 81 percent of fatalities in Latin America will be attributable to the four main non-communicable diseases: cardiovascular disease, most malignancies, diabetes, and chronic respiratory disorders. Due to this, in August 2022, the International Finance Corporation funded USD 30 million to the pharmaceutical firm Laboratorios Siegfried to improve access to high-quality, reasonably priced healthcare for lower-income communities throughout Latin America and the Caribbean (LAC).

Asia-Pacific to Account for a Significant Share

- The Asia-Pacific region is expected to expand at a considerable rate during the forecast period. Significant factors supporting the growth are rising investments in research and innovation centers, government programs, and policies favoring the IT healthcare equipment and devices markets.

- Owing to the rising frequency of chronic diseases and the increased need for high-quality healthcare, Asia-Pacific is anticipated to develop faster than other areas. The market will also be significantly supported by the increasing PACS (Picture Archiving and Communication System) adoption in digital X-ray systems due to the benefits of greater image quality and faster processing.

- The APAC region is witnessing a surge in the geriatric population and an increase in chronic diseases due to sedentary lifestyles and unhealthy eating habits. Moreover, rising medical infrastructure developments with increased medical facilities are expected to propel the demand for medical X-ray equipment.

- The Chinese government has also been implementing a stream of supportive policies to improve the overall healthcare structure. The Health China 2030 plan is a comprehensive set of guidelines to extend the services to all by 2030 and focuses on public health. Such initiatives for improving healthcare standards are driving the growth of the Chinese X-ray tube market.

- Moreover, x-ray computed tomography (CT) imaging is increasingly used in structural engineering. Scanning a concrete specimen using X-ray tomography provides insights into the inner structure without destroying the specimen. Studying the internal design of cement-based materials is extremely important for understanding and modeling the transport phenomena that affect its durability.

- Additionally, To generate attractive revenue streams, APAC firms in the global market for medical imaging equipment are concentrating on producing high-quality, technologically advanced gadgets. The growing prevalence of diseases, chronic and neurological conditions, and malignancies is driving the global market for medical imaging equipment. This increased demand is coming from the healthcare sector.

Medical X-Ray Equipment and Imaging Software Industry Overview

The medical X-ray equipment and imaging software market is moderately competitive and consists of several major players. Many companies are increasing their market presence by introducing new products or by entering into strategic mergers and acquisitions.

In July 2023, Radon Medical Imaging announced it had acquired Tristate Biomedical Solutions, LLC (TBS), a provider of medical equipment sales and services for new, used, and refurbished imaging and biomedical equipment, with a specialty in C-Arms, X-Ray, as well as other imaging equipment. This strategic decision reinforces Radon's strategy to be an industry leader in the medical imaging market. It strengthens its business by providing access to new solutions and technology and further expands its geographic footprint to better serve its customers.

In May 2023, Siemens Healthineers and CommonSpirit Health collectively agreed to acquire Block Imaging, which is expected to provide more sustainable options and support increasing demand from U.S. hospitals, health systems, and other care sites for multi-vendor imaging parts and services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Incidences of Diseases and Growing Geriatric Population

- 5.1.2 Rising Investments in Healthcare Industry and Favorable Government Initiatives

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations and Validator Guidelines

- 5.2.2 Security Issues Associated with the Software

- 5.3 Assessment of COVID-19 Impact on the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Equipment

- 6.1.2 Software

- 6.2 By Technology

- 6.2.1 Radiography/Mammography

- 6.2.2 Computed Tomography

- 6.2.3 Fluoroscopy/Angiography

- 6.3 By Image Type

- 6.3.1 2-Dimensional

- 6.3.2 3-Dimensional

- 6.4 By End-user

- 6.4.1 Hospitals

- 6.4.2 Diagnostic Centers

- 6.4.3 Research Centers

- 6.5 ***Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Middle East and Africa

- 6.5.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GE Healthcare Inc.

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Hitachi Ltd

- 7.1.4 Canon Inc.

- 7.1.5 Siemens Healthcare GmbH

- 7.1.6 Shimazdu Corporation

- 7.1.7 Carestream Health Inc.

- 7.1.8 Fujifilm Holdings Corporation

- 7.1.9 Konica Minolta Inc.

- 7.1.10 Varex Imaging Corporation

- 7.1.11 IBM Corporation

- 7.1.12 Hologic Inc.