|

市場調査レポート

商品コード

1433793

ハイエンド加速度センサー:市場シェア分析、産業動向・統計、成長予測(2024年~2029年)High-end Accelerometer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ハイエンド加速度センサー:市場シェア分析、産業動向・統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

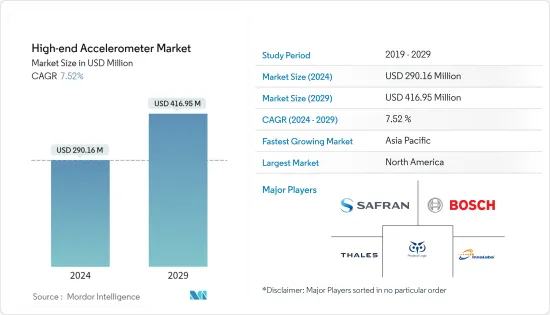

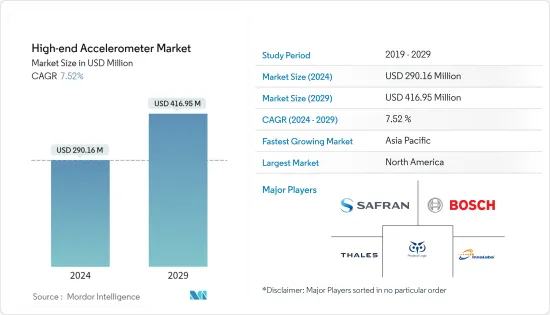

ハイエンド加速度センサーの市場規模は、2024年に2億9,016万米ドルと推定され、2029年までに4億1,695万米ドルに達すると予測されており、予測期間(2024年~2029年)中に7.52%のCAGRで成長する見込みです。

ハイエンド加速度センサー市場は、COVID-19パンデミックの初期段階でサプライチェーンの困難を目の当たりにしました。 2020年上半期には一部の業界の需要も減少しました。自動車や製造などの業界は大きな影響を受けました。しかし、COVID-19パンデミックにより、ハイエンド加速度センサーなど、多くの新しいアプリケーション向けにMEMSセンサーの範囲も拡大しました。

主なハイライト

- MEMSテクノロジーの採用の増加は、性能指標を犠牲にすることなくデバイスのサイズと消費電力をスケールダウンすることにより、ハイエンド加速度センサーのアプリケーションベースを拡大する上でも重要な役割を果たしています。

- ハイエンド加速度センサーは、高速鉄道や自動運転車のナビゲーションシステムでも使用されることが増えています。自動車の強制的な性能を評価するための衝撃・振動試験に広く使用されています。

- 車載アプリケーション用のハイエンド加速度センサーは、産業グレードのアプリケーションよりも重要なバイアス安定範囲を備えており、動作範囲は対象となる最終アプリケーションによって異なります。たとえば、衝突回避システムの場合、動作範囲は最大40gになる可能性があります。

- 切断やフライス加工などのハイエンド産業用途の自動機械の高速動作中の振動レベルの増加は、重要な材料に損傷を与え、精度を低下させることが予想されます。このような場合、より高度な機械制御を実現するには、より高い安定性が必要です。したがって、これらのアプリケーションにはハイエンド加速度センサーが大幅に採用されています。

ハイエンド加速度センサーの市場動向

ナビゲーションアプリケーションが大きなシェアを握る

- 高感度の加速度センサーは、既存のGPSエンジン、圧力センサー、宇宙用途のプラットフォームの安定化との緊密な結合など、次世代のナビゲーションおよび誘導システムにとって不可欠です。

- ナビゲーション用途向けのMEMSベースの慣性加速度センサーのインセンティブは、既存のマクロスケールのアプローチに代わる、小型、低コスト、軽量、高感度の代替手段を実現するという期待に基づいています。低コスト、高感度のMEMS加速度センサーの製造に成功したことで、現在の技術では実現不可能な、消費者ユーザーと軍事ユーザーの両方に新しいアプリケーションが生まれました。

- たとえば、軍事および民生用アプリケーションの個人用ハンドヘルドナビゲータや、渓谷、市街地、建物や洞窟内などのGPSが使用できないナビゲーションアプリケーションでは、ハイエンド加速度センサーが使用されています。

- 最近、2019年9月に、先進的なMEMSセンサーソリューションの設計および製造を行うSensonorは、最新の慣性IMU、STIM318 IMUの発売を発表しました。高精度の戦術グレードのIMUであるこの新しいソリューションは、加速度センサーの性能を向上させ、防衛および商業市場における要求の厳しい誘導およびナビゲーションアプリケーションをサポートするように設計されています。さらに、STIM318は、光ファイバージャイロ(FOG)を競合的に置き換えることにより、STIM300(SensonorのIMU)をすでに使用しているアプリケーションや他の多くのアプリケーションに追加機能を提供できます。

北米が最大のシェアを占める

- 北米地域では、この地域の企業が高度で革新的な加速度センサーの導入に向けて投資を行っており、新しい高性能加速度センサーの開発が増加しています。米国国防総省による高性能機器の購入への支出増加が、同国のハイエンド加速度センサーの成長を促進する主な要因となっています。

- 米国は世界最大の国防予算を持っています。これに伴い、同国はレーザー誘導爆弾や巡航ミサイルなどの精密誘導兵器(PGM)にも注力しており、これらは広範囲にわたる巻き添え被害を回避しながら高い精度を提供する米国軍の選択兵器となっています。これらのアプリケーションでは、GPSなしで長時間の誘導を行うための戦術 IMUを改善するために、高性能、コンパクトなフォームファクター、耐久性の高い加速度センサーが必要です。

- 米国軍は、Northrop Grummanが開発した航行グレードの慣性測定装置を使用しています。この小型ユニットはMEMSテクノロジーに基づいており、加速度と角運動を感知してナビゲーションを可能にし、車両制御システムが誘導のために使用するデータ出力を提供します。

ハイエンド加速度センサー業界の概要

ハイエンド加速度センサー市場はいくつかの大手企業で構成されており、市場シェアの観点から見ると、現在市場を独占している大手企業はほとんどありません。市場で卓越したシェアを持つこれらの大手企業は、海外への顧客ベースの拡大に注力しています。これらの企業は、市場シェアを拡大し、収益性を高めるために、戦略的な協力イニシアチブを活用しています。

- 2020年12月 - TDK Corporationは、安全関連以外の自動車アプリケーション向けのInvenSense IAM-20680HP高性能車載モノリシック 6軸MotionTrackingセンサープラットフォームを発表しました。これには、IAM-20680HP IMU MEMSセンサーとDK-20680HP開発者キットが含まれます。 InvenSenseのIAM-20680HPは、3軸ジャイロスコープと3軸加速度センサーを薄型3 x 3 x 0.75 mm(16ピンLGA)パッケージに組み合わせており、AEC-Q100 Grade 2に基づいて車載認定を受けています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 業界の魅力度 - ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 産業バリューチェーン分析

- 市場促進要因

- MEMS技術の採用拡大

- 防衛・航空宇宙分野への成長の傾斜

- ナビゲーションシステムの技術進歩

- 市場抑制要因

- 運用の複雑さとメンテナンスコストの高さ

- COVID-19が市場に与える影響の評価

第5章 市場セグメンテーション

- 用途別

- 戦術用途

- ナビゲーション用途

- 産業用途

- 自動車用途

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第6章 競合情勢

- 企業プロファイル

- Secret SA

- Safran Colibrys

- Physical Logic Ltd

- Innalabs Limited

- Sensonor AS

- Tronics Microsystems(EPCOS)

- Bosch GmbH

- Thales Group

- Analog Devices Inc.

- Honeywell International Inc.

- STMicroelectronics NV

- TE Connectivity Ltd

第7章 投資分析

第8章 市場機会と今後の動向

The High-end Accelerometer Market size is estimated at USD 290.16 million in 2024, and is expected to reach USD 416.95 million by 2029, growing at a CAGR of 7.52% during the forecast period (2024-2029).

The high-end accelerometer market witnessed supply chain difficulties in the initial phase of the COVID-19 pandemic. The demand from some industries was also down during the first half of 2020. Industries like automotive and manufacturing were significantly affected. However, the COVID-19 pandemic has also expanded the scope of MEMS sensors, like high end accelerometers, for many new applications.

Key Highlights

- The increasing adoption of MEMS technology has also played a significant role in expanding the application base for high-end accelerometers by scaling down the size and power consumption of these devices, without compromising on the performance metrics.

- High-end accelerometers are also being increasingly used in navigation systems for high-speed trains and autonomous vehicles. These devices are widely used for performing shock and vibrational test for evaluating the performance of automobiles in duress.

- High-end accelerometers for automotive applications possess a bias stability range more significant than that of industrial grade applications, and the working range is dependent on the intended end-applications. For instance, the working range could be as high as 40g for crash avoidance systems.

- The increased vibration levels of automated machinery in high-end industrial applications during high-speed operations, such as cutting or milling, are expected to damage critical materials and reduce precision. Such cases require higher stability to have higher machine control. Thus, high-end accelerometers are being adopted significantly for these applications.

High-End Accelerometer Market Trends

Navigational Applications to Hold a Major Share

- High sensitivity accelerometers are crucial for the next generation navigation and guidance systems, including tight coupling to existing GPS engines, pressure sensors, and platform stabilization for space applications.

- The incentive for a MEMS-based inertial accelerometer for navigational applications is based upon the hopes of realizing a small, low cost, lightweight, and highly-sensitive alternative to existing macro-scale approaches. The successful fabrication of a low cost, high-sensitivity MEMS accelerometer results in new applications for both consumer and military users that aren't feasible with current technologies.

- For instance, personal handheld navigators for military and consumer applications, as well as GPS-denied navigation applications, such as in valleys, urban areas, and within buildings and caves, utilize high-end accelerometers.

- Recently, in September 2019, Sensonor, a designer and manufacturer of advanced MEMS sensor solutions, announced the launch of its latest inertial IMU - the STIM318 IMU. A high-accuracy tactical-grade IMU, the new solution is designed to offer increased accelerometer performance to support demanding guidance and navigation applications within the defense and commercial markets. Furthermore, the STIM318 can deliver additional capability to applications already using the STIM300 (Sensonor's IMU) and many other applications by competitively replacing the fiber-optic gyros (FOGs).

North America to Account for the Largest Share

- The North American region is witnessing growth in the development of new high-performance accelerometers, as companies in the region are investing toward introducing advanced and innovative accelerometers. The increased spending by the US defense department to acquire high performance equipment is the major factor driving growth of high-end accelerometers in the country.

- The United States has the world's largest defense budget. With this rise, the country also focusses on precision guided munitions (PGMs), such as laser-guided bombs and cruise missiles, that have become the weapons of choice for the US military, providing a high degree of accuracy, while avoiding widespread collateral damage. These applications demand high performance, compact form factor, ruggedized accelerometers to improve tactical IMUs for long-duration guidance without GPS.

- The US military uses a navigation-grade inertial measurement unit developed by Northrop Grumman. This miniaturized unit is based on MEMS technology to enable navigation by sensing acceleration and angular motion, and providing data outputs used by vehicle control systems for guidance.

High-End Accelerometer Industry Overview

The high-end accelerometer market consists of some major players, and in terms of market share, few of the major players currently dominate the market. These major players with prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- December 2020 - TDK Corporation introduced the InvenSense IAM-20680HP high-performance automotive monolithic 6-axis MotionTracking sensor platform for non-safety relevant automotive applications, which includes the IAM-20680HP IMU MEMS sensor and the DK-20680HP developer kit. InvenSense's IAM-20680HP combines a 3-axis gyroscope and a 3-axis accelerometer in a thin 3 x 3 x 0.75mm (16-pin LGA) package and is automotive qualified based on AEC-Q100 Grade 2.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of MEMS Technology

- 4.4.2 Inclination of Growth Toward Defense and Aerospace

- 4.4.3 Technological Advancements in Navigation Systems

- 4.5 Market Restraints

- 4.5.1 Operational Complexity Coupled With High Maintenance Costs

- 4.6 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Tactical Applications

- 5.1.2 Navigational Applications

- 5.1.3 Industrial Applications

- 5.1.4 Automotive Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Secret SA

- 6.1.2 Safran Colibrys

- 6.1.3 Physical Logic Ltd

- 6.1.4 Innalabs Limited

- 6.1.5 Sensonor AS

- 6.1.6 Tronics Microsystems (EPCOS)

- 6.1.7 Bosch GmbH

- 6.1.8 Thales Group

- 6.1.9 Analog Devices Inc.

- 6.1.10 Honeywell International Inc.

- 6.1.11 STMicroelectronics NV

- 6.1.12 TE Connectivity Ltd