|

|

市場調査レポート

商品コード

1444959

歯のホワイトニング:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Teeth Whitening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 歯のホワイトニング:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 112 Pages

納期: 2~3営業日

|

- 全表示

- 概要

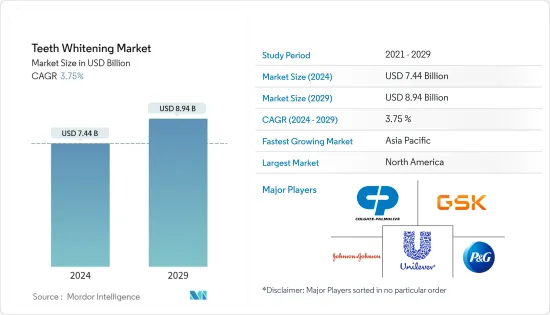

- 目次

歯のホワイトニング市場規模は、2024年に74億4,000万米ドルと推定され、2029年までに89億4,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に3.75%のCAGRで成長します。

歯科外科医は、救急救命士、看護師、その他のヘルスケアスタッフと同様に、COVID-19感染症に感染し伝播する最も重大なリスクにさらされていました。パンデミックは、世界の人々が歯科医療を含むヘルスケアにアクセスする方法を変えました。パンデミックの第一段階では世界中の歯科医院が閉鎖されました。世界中で社会的距離の確保が続く中、人々は定期的な歯科治療や審美歯科治療のために地元の歯科医を訪れることができませんでした。そのため、2020年の第2四半期と第3四半期には、汚れや変色した歯のためのホワイトニングソリューションの需要が減少しました。しかし、COVID-19感染症のパンデミックにより、個人の衛生と家庭での歯科美学への注目が高まっています。歯磨き粉、デンタルフィルム、ジェルなどの幅広い店頭製品がオンラインプラットフォームで入手可能になったことで、製品の採用が増加し、パンデミック中の市場の成長にプラスの影響を与えました。 SmileDirectClub Inc.によると、2021年には歯のホワイトニングと歯列矯正の処置が47%増加しました。したがって、市場はパンデミック中に大幅な成長を示し、予測期間中に同様の成長を示すと予想されます。

歯のホワイトニング市場の成長の主な要因には、口腔衛生に対する意識の高まり、歯のホワイトニングOTC製品の入手の容易さ、歯の変色に関連する偏見などが含まれます。現代社会では歯科審美の人気が高まっており、歯科審美治療に対する需要が高まっています。若者は中高年層よりもメディアの影響を強く受けています。その結果、美的意識が高まり、完璧な歯に対するニーズが高まっています。 MDPIジャーナルが2022年7月に掲載した記事によると、一般の人々は歯科顔面の美しさの改善に関心が高まっており、それが歯のホワイトニングなどの審美歯科治療を求める人の数の増加につながったといいます。人々は自分の歯の色を非常に重要視しており、先行調査によると、多くの人が歯の色に満足しておらず、歯の色を変えたいと考えています。その結果、歯のホワイトニングは、近年最も人気のある歯科処置の1つとして浮上しています。より白く明るい歯を求める人々の要望により、審美歯科治療における歯科への関心が再び高まっています。

歯を白くする製品の拡大が市場の成長を促進すると予想されます。たとえば、2022年 1月、SmileDirectClub Inc.は、新しい速溶性ホワイトニングストリップでホワイトニング製品ラインを拡大することを計画しました。したがって、歯顔面の美しさの向上と製品の発売に対する意識と関心の高まりにより、歯のホワイトニング製品の全体的な需要が促進され、その結果、予測期間中に市場が高度に成長すると予想されます。

しかし、地方での認知度の低さと歯のホワイトニング製品に伴う副作用により、市場が抑制されることが予想されます。

歯のホワイトニング市場動向

ホワイトニング歯磨き粉セグメントは、予測期間中に最大の市場シェアを占めると予想されます

歯磨き粉には粗い研磨剤が含まれており、歯の表面の汚れを削り取ることでホワイトニング効果をもたらします。ホワイトニング歯磨き粉は、その即効性と手頃な価格により大きな需要があり、市場の成長に貢献しています。たとえば、WebMDエディトリアルコントリビューターが2021年10月に公開した記事によると、ホワイトニング歯磨き粉の価格帯は1米ドルから20米ドルの間です。市販の歯磨き粉オプションやプロのホワイトニングソリューションが入手可能であるのとは対照的に、過酸化水素または過酸化カルバミドを使用して歯の色を内側から明るくします。ホワイトニング歯磨き粉は表面の汚れを除去し、漂白剤は含まれません。ホワイトニング歯磨き粉の価格と比較すると、薬局、歯科医、またはオンラインプラットフォームで購入できるホワイトニングストリップとジェルの価格は10米ドルから55米ドルの間です。したがって、その価格が低いため、ホワイトニング歯磨き粉の需要は今後も続くと予想されます。を増加させ、大幅な成長に貢献します。

テクノロジーの進歩によって製品の有効性が向上したことで、プレミアムブランドは優れた製品機能と治療効果を提供することで効果的に競争できるようになりました。たとえば、2022年 3月にコルゲートパルモライブカンパニーは、3日以内に歯を内側から白くする独自の活性酸素技術を配合したビジブルホワイト 02を発売しました。この製品の発売により、同社は市場における既存の歯を白くする歯磨き粉のポートフォリオを拡大しました。

このように、市場はホワイトニング歯磨き粉の効果的な利点と新製品の増加によって牽引されています。

北米は歯のホワイトニング市場を独占しており、予測期間中もこの傾向が続くと予想されます

北米は審美歯科への傾向が高まっているため、歯のホワイトニング市場で大きなシェアを占めています。たとえば、2021年1月にThe Village Dentistryが掲載した記事によると、アメリカ人は歯を白くする製品や治療に毎年数十億米ドルを費やしています。米国労働統計局によると、2022年6月の歯科サービスは1.9%増加しました。このような歯科サービスと歯のホワイトニング製品への支出の増加は、予測期間中に市場を牽引すると予想されます。

いくつかの企業が歯のホワイトニング製品を継続的に発売しており、これも市場成長の原動力の1つです。たとえば、2022年 3月、プロクター・アンド・ギャンブルは、一晩中便利な製品であるクレストホワイトニングエマルジョン+ オーバーナイトフレッシュネスを発売しました。 2022年 1月、オーラルBは、2022コンシューマーエレクトロニクスショー(CES)で、究極の口腔健康コーチとして機能するiOSenseを搭載した、CESイノベーション賞を受賞したオーラルB iO10を含む、最新のデジタルヘルスイノベーションを発表しました。したがって、このような要因により、歯のホワイトニング市場は、予測期間中に北米で大幅な成長を記録すると予想されます。

歯のホワイトニング業界の概要

歯のホワイトニング市場は、世界的および地域的に事業を展開する少数の企業の存在により、本質的に統合されています。競合情勢には、コルゲート・パルモリーブ、ユニリーバ、プロクター・アンド・ギャンブル、グラクソ・スミスクラインなどの有名な国際企業と地元企業の分析が含まれています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 口腔衛生に対する意識の高まり

- 歯のホワイトニングOTC製品が簡単に入手可能

- 歯の変色に伴うスティグマ

- 市場抑制要因

- 地方における意識の低さ

- 歯のホワイトニング製品に伴う副作用

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品タイプ

- ホワイトニング歯磨き粉

- ホワイトニングジェルとストリップ

- 白色光による歯のホワイトニング装置

- その他の製品タイプ

- 流通チャネル

- オフライン販売

- オンライン販売

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東およびアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Creightons plc

- Church &Dwight Co. Inc.

- Colgate-Palmolive Company

- Dr. Fresh LLC

- GlaxoSmithKline PLC

- GLO Science

- Henkel AG &Co. KGaA

- Johnson &Johnson

- Unilever

- Proctor &Gamble

- GoSmile LLC

- Ultradent Products Inc.

第7章 市場機会と将来の動向

The Teeth Whitening Market size is estimated at USD 7.44 billion in 2024, and is expected to reach USD 8.94 billion by 2029, growing at a CAGR of 3.75% during the forecast period (2024-2029).

Dental surgeons, along with paramedics, nurses, and other healthcare staff, were at the most significant risk of contracting and transmitting COVID-19 disease. The pandemic changed the way the global population has been accessing healthcare, including dental care. Dental clinics worldwide were shut down during the first phase of the pandemic. As social distancing continued across the world, people were unable to visit their local dentists for routine or cosmetic dental procedures. Hence, the demand for teeth whitening solutions for stained and discolored teeth decreased in the second and third quarters of 2020. However, the COVID-19 pandemic increased the focus on personal hygiene and home-based dental aesthetics. The availability of a wide range of over-the-counter products on online platforms, such as toothpaste, dental films, and gels, resulted in increased adoption of the products, which positively impacted the market's growth during the pandemic. According to SmileDirectClub Inc., in 2021, there was a 47% increase in teeth whitening and teeth straightening procedures. Thus, the market showed significant growth during the pandemic and is expected to show similar growth over the forecast period.

The major factors responsible for the growth of the teeth whitening market include the rising awareness about oral hygiene, easy availability of teeth whitening OTC products, and stigma associated with discoloration of teeth. Dental aesthetics are gaining more popularity in modern society and have caused an increased demand for dental aesthetic treatments. Young people are influenced by media, more than the middle or older-aged groups. As a result, their aesthetic awareness has increased, boosting the need for perfect teeth. According to an article published by MDPI Journal, in July 2022, the general public showed increasing interest in improving dentofacial aesthetics, which led to a rise in the number of individuals seeking cosmetic dental treatments like tooth whitening. People place a lot of significance on their tooth color, and prior research has indicated that many of them are not happy with them and want to change them. As a result, tooth whitening has emerged as one of the most popular dental procedures in recent years. People's desire for whiter, brighter teeth has consequently revived the interest in dentistry in aesthetic dental treatment.

The increasing expansion of teeth-whitening products is expected to drive the market's growth. For instance, in January 2022, SmileDirectClub Inc. planned to expand its whitening product line with its new fast-dissolving whitening strips. Thus, the increasing awareness and interest in improving dentofacial aesthetics and product launches are expected to propel the overall demand for teeth whitening products, resulting in the high growth of the market over the forecast period.

However, low awareness in rural areas and side effects associated with teeth whitening products are expected to restrain the market.

Teeth Whitening Market Trends

The Whitening Toothpaste Segment is Expected to Account for the Largest Market Share During the Forecast Period

Toothpaste contains coarse abrasives that function by abrading the stains on the tooth surface, giving a whitening effect. The whitening toothpaste is in huge demand due to its quick results and affordable price, which is contributing to the market's growth. For instance, according to an article published by WebMD Editorial Contributors in October 2021, the price range for whitening toothpaste is between USD 1 and USD 20. In contrast to the availability of over-the-counter toothpaste options and professional whitening solutions, which use hydrogen peroxide or carbamide peroxide to lighten the color of the tooth from the inside out, whitening toothpaste removes surface stains and does not include bleach. Compared to the price of whitening toothpaste, the price of whitening strips and gels from a pharmacy, dentist, or through an online platform is between USD 10 and USD 55. Hence, due to its lower price, the demand for whitening toothpaste is expected to increase and contribute to significant growth.

Improvements in product efficacy achieved through advancements in technology are enabling premium brands to compete effectively by offering superior product features and therapeutic benefits. For instance, in March 2022, the Colgate-Palmolive Company launched Visible White 02, formulated with unique active oxygen technology that whitens teeth inside out within three days. With the launch of this product, the company expanded its existing teeth whitening toothpaste portfolio in the market.

Thus, the market is being driven by the efficient advantages of whitening toothpaste and increasing product launches.

North America Has Been Dominating the Teeth Whitening Market and is Expected to Continue the Trend During the Forecast Period

North America holds a major share of the teeth whitening market due to the growing inclination toward cosmetic dentistry. For instance, according to an article published by The Village Dentistry in January 2021, Americans spend billions of dollars every year on teeth whitening products and treatments. According to the US Bureau of Labor Statistics, dental services increased by 1.9% in June 2022. Such an increase in dental services and expenditure on teeth whitening products is expected to drive the market over the forecast period.

Several companies are continuously launching teeth whitening products, which is also one of the driving factors for the market's growth. For example, in March 2022, Procter & Gamble launched Crest Whitening Emulsions + Overnight Freshness, a product that provides overnight convenience. In January 2022, Oral-B unveiled its latest digital health innovations at the 2022 Consumer Electronics Show (CES), including its CES Innovation Award Honoree Oral-B iO10 with iOSense, which serves as the ultimate oral health coach. Thus, due to such factors, the teeth whitening market is expected to record significant growth in North America during the forecast period.

Teeth Whitening Industry Overview

The teeth whitening market is consolidated in nature due to the presence of a few companies operating globally and regionally. The competitive landscape includes an analysis of well-known international and local companies, including Colgate-Palmolive, Unilever, Proctor & Gamble, and GlaxoSmithKline.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Awareness of Oral Hygiene

- 4.2.2 Easy Availability of Teeth Whitening OTC Products

- 4.2.3 Stigma Associated with Discoloration of Teeth

- 4.3 Market Restraints

- 4.3.1 Low Awareness in Rural Areas

- 4.3.2 Side Effects Associated with Teeth Whitening Products

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Product Type

- 5.1.1 Whitening Toothpastes

- 5.1.2 Whitening Gels and Strips

- 5.1.3 White Light Teeth Whitening Devices

- 5.1.4 Other Product Types

- 5.2 Distribution Channel

- 5.2.1 Offline Sales

- 5.2.2 Online Sales

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Creightons plc

- 6.1.2 Church & Dwight Co. Inc.

- 6.1.3 Colgate-Palmolive Company

- 6.1.4 Dr. Fresh LLC

- 6.1.5 GlaxoSmithKline PLC

- 6.1.6 GLO Science

- 6.1.7 Henkel AG & Co. KGaA

- 6.1.8 Johnson & Johnson

- 6.1.9 Unilever

- 6.1.10 Proctor & Gamble

- 6.1.11 GoSmile LLC

- 6.1.12 Ultradent Products Inc.