|

市場調査レポート

商品コード

1642020

レーザー直接構造化(LDS)アンテナ-市場シェア分析、産業動向、成長予測(2025年~2030年)Laser Direct Structuring (LDS) Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| レーザー直接構造化(LDS)アンテナ-市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

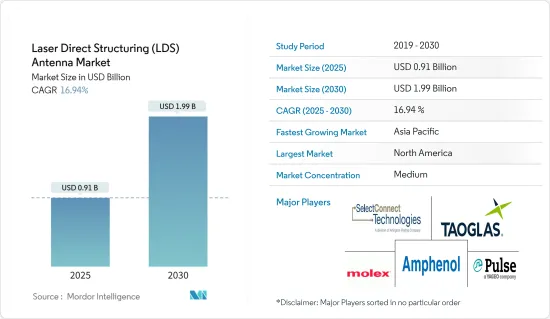

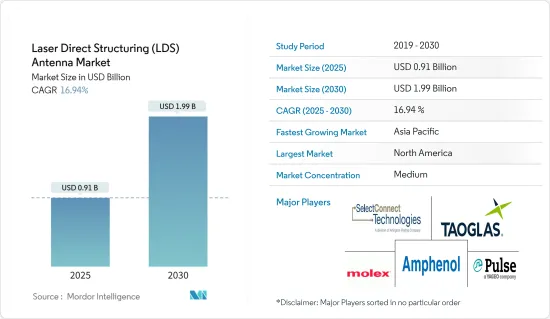

レーザー直接構造化(LDS)アンテナ市場規模は、2025年に9億1,000万米ドルと予測され、予測期間中(2025~2030年)のCAGRは16.94%で、2030年には19億9,000万米ドルに達すると予測されています。

主要ハイライト

- 様々な産業で小型化の動きが顕著になる中、LDS市場が人気を集めています。LDS技術により、機能を統合した小型設計が可能になります。現代のエレクトロニクスは、メーカーにいくつかの困難をもたらしました。しかし、LDSアンテナ技術の採用は、メタライゼーション形態の高い自由度を提供することで、これらの課題を克服する効果的な方法を記載しています。

- デジタル技術をベースとしたオーディオ、ビデオ、情報技術の融合は、コンシューマーエレクトロニクス産業の形を変え、消費者の注目を集めることができる全く新しい電子ガジェットの世界を作り出しています。消費者の消費動向は、民生用電子機器産業における先行的な経済指標であり、経済成長と強い相関関係があります。

- 技術の進歩は、コンピューター、通信、民生用電子機器の融合をもたらし、小型化によって製品革新の新たな機会が多くもたらされ、産業にとって好都合です。コンシューマー・エレクトロニクス産業における小型化の動向は、包装部品のサイズを初期技術の設計ルールレベルまで押し下げました。

- 特にスマートフォンでは、この技術が急速に普及し、過去10年間で生産量は約倍増しています。これとは別に、スマートデバイス、ウェアラブル、コネクテッド医療機器の採用が増加し、世界中の現代医療におけるイノベーションが、世界の医療の提供に大きな進歩をもたらしました。

- さらに、軍事・防衛産業におけるエレクトロニクスセグメントも、無人航空機(UAV)、全地球測位システム/全地球航法衛星システム(GPS/GNSS)ナビゲーション、コンフォーマル通信アンテナなどの台頭を背景に、LDSアンテナ市場に潜在的なビジネス機会をもたらしています。

- ティールグループによると、2013~2027年の間に開発されると予測される2万8,912台のUAVのうち、約95%が軍事目的で使用されるといいます。UAVの運用は世界中の軍事に定着しつつあり、世界の安全保障に影響を与えています。この動向を後押しするように、TE接続性などの企業は、航空宇宙・防衛セグメントの過酷な環境でも維持できる軽量・小型アンテナの提供に注力しています。

- しかし、高い設備コスト、耐高温材料の必要性、長いメッキプロセス、薄いメタライゼーション層やレーザー構造化プロセスのビーズによる手順の複雑さなどが市場成長の妨げになると予想されます。

- COVID-19は、LDS技術が広範なアンテナ用途を持つ多くの産業の製造業務に悪影響を及ぼしました。スマートフォンやパッド端末、ノートパソコン、車両追跡システム、ゲーム機、在庫追跡システム、ワイヤレスプリンター、ルーター、UAVなどの販売や生産はすべて、物流や労働力の確保の制限によって影響を受けました。

レーザー直接構造化(LDS)市場動向

自動車が大きな成長を記録する見込み

- 3Dモールドコネクティングデバイス(3D MID)のレーザー直接構造化(LDS)は、軽量化と信頼性向上のために自動車用途で広く使用されています。次世代(未来)自動車の生産は、多種多様なサービスにワイヤレスで接続する自動車の能力強化に大きく依存しています。コネクテッドビークルのビジョンは、無線通信リソースを効果的に利用して、効果的な交通管理、インフォテインメント、ドライバーの安全確保などの先進的機能を提供することを目指しています。

- 放送やテレマティクスの多様なアプリケーションの要件を満たすため、車載機器はますます多くの無線サービスに統合されています。一般的に、車載アンテナは、一体型ルーフトップアンテナ、オンガラスアンテナ、ロッドアンテナのように、すべての無線通信規格をカバーするために主に使用されています。

- LDSは、一般的にほとんどの自動車がステアリングに取り付けられたコントロールを装備しているため、ステアリングホイールのハブに主に使用されています。さらに、LDSは前進制御スイッチ、位置決めセンサ、ブレーキセンサにも広く使用されています。LDSは、自動運転車のADAS(先進運転支援システム)に広く使用されています。さらに、自動運転車は輸送セグメントで急速に普及すると予想されています。ブリュッセルの非営利アドボカシー団体である欧州交通安全評議会(ETSC)は、自動ブレーキによって交通事故死率を20%も抑えることができると予測しています。

- 例えば、2022年6月、Teslaは中国と米国でエンハンスド・オートパイロットを構築しました。米国ではEnhanced Autopilotの価格は6,000米ドル。一方、中国では4,779米ドルです。Enhanced Autopilotに含まれる機能は、Navigate on autopilot、Auto lane change、Autopark、Summon、Smart summonです。TeslaはニュージーランドとオーストラリアでもEnhanced Autopilotをリリースしました。ニュージーランドではEnhanced Autopilotは3,615米ドル、オーストラリアでは3,579米ドルです。Enhanced Autopilotは4カ国すべてで同じ機能を記載しています。

- NASDAQによれば、2030年までに自律走行車が市場を独占することになると考えられます。さらに、世界のいくつかの政府はADAS機能の使用を推進しています。例えば、米国運輸省道路交通安全局(NHTSA)は、高度自動運転車(HAV)に関する連邦自動運転車施策(FAVP)を制定しました。

北米が主要シェアを占める見込み

- 北米地域のほぼすべてのエンドユーザー部門は、LDSアンテナソリューションを強く求めています。しかし、この地域のLDSアンテナの主要需要源は、民生用電子機器、ネットワーキング、自動車産業であると考えられます。

- この地域の自動車産業の力強い成長は、市場の成長と拡大に貢献しています。乗員の快適性と安全性を高めるため、現代の自動車はさまざまなセンサや電子アシスタントを組み合わせる必要があります。しかし、これらのセンサやコンポーネントを配備するのに伴い、コンポーネントの数を減らす要求が高まっている

- LDS技術を取り入れることで、適切な接続技術や組み立て技術とともに使用すれば、小型化を促進し、部品点数を減らすことができると予想されます。LDS技術はまた、製造プロセスにおける費用対効果の面でも役立ち、設計の選択肢を広げるのに役立ちます。

- 米国は主要民生用電子機器市場で大きなシェアを占めています。消費者技術協会(CTA)によると、米国では過去5年間、スマートフォンが消費者向け電子機器/技術の販売で最も大きな収益を上げました。米国で販売されたスマートフォンの販売額は、前年の747億米ドルから2022年には17億米ドル増加し、754億米ドルとなりました。

レーザー直接構造化(LDS)アンテナ産業概要

レーザー直接構造化(LDS)アンテナの市場競争は激しいものとなっています。Taoglas Limited、Molex LLC、SelectConnect Technologies、TE Connectivity Ltd、Pulse Electronics Corporation(Yageo Corporation)のような大手企業が参入しています。市場シェアの面では、現在、少数の主要企業が市場を支配しています。同市場で大きなシェアを持つこれらの大手企業は、海外における顧客基盤の拡大に非常に注力しています。これらの企業は、市場シェアを最大化し、収益性を高めるために、さまざまな戦略的共同イニシアティブを活用しています。

2022年7月、センサの世界プロバイダーであるTE Connectionは、モノのインターネット(IoT)市場における無線周波数(RF)コンポーネントのサプライヤーであるLinx Technologiesを買収しました。この戦略的買収により、TEの製品ポートフォリオとIoTにおける競合はさらに強化されます。TEがIoT市場への投資を強化し続ける中、今回の買収は、特にIoT向けのアンテナやRFコネクターなど、TEのサプライチェーンの拡大に貢献します。また、2021年のレアード・接続性のアンテナ事業買収に続く、TEにとって重要な戦略でもあります。

さらに、2022年7月には、IoTによるデジタル変革を実現するリーディングカンパニーであるTaoglasと、4G/5GセルラーIoT電子部品販売とソリューションプロバイダーのリーディングカンパニーであるNovotechが、産業をリードするアンテナを含むタオグラスの先端部品の販売、セルラーIoT接続ソリューションの販売と技術サポートを組み合わせた新たなカナダでのパートナーシップ契約を締結しました。この新しいパートナーシップはNovotechのポートフォリオを拡大し、公共安全、輸送、eチャージ、固定ワイヤレス、5Gモバイルネットワーキングソリューションをサポートするタオグラスの革新的な4G/5Gセルラーポートフォリオへのアクセスを同社のパートナーと顧客に記載しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響

第5章 市場力学

- 市場促進要因

- 民生用電子機器産業における小型化需要の高まり

- IoTと高アンテナ距離デバイスの成長

- 市場課題

- モールド相互接続デバイスに関する認識不足と製造の複雑さ

第6章 市場セグメンテーション

- エンドユーザー産業

- 医療

- コンシューマー・エレクトロニクス

- 自動車

- ネットワーキング

- その他

- 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Taoglas Limited

- Molex LLC

- Multiple Dimensions AG

- SelectConnect Technologies

- TE Connectivity Ltd

- Pulse Electronics Corporation(Yageo Corporation)

- Amphenol Corporation

- Tongda Group Holdings Limited

- Shenzhen Sunway Communication Co. Ltd

- Luxshare Precision Industry Co. Ltd

- HARTING KGaA

- Huizhou Speed Wireless Technology Co. Ltd

- LPKF Laser & Electronics AG

第8章 投資分析

第9章 市場機会と今後の動向

The Laser Direct Structuring Antenna Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.99 billion by 2030, at a CAGR of 16.94% during the forecast period (2025-2030).

Key Highlights

- With the miniaturization trend gaining prominence across various industries, the LDS market is gaining popularity. LDS technology allows smaller designs with integrated functionalities. Modern electronics have brought several difficulties for manufacturers. However, the introduction of the LDS antenna technology offers an effective way to overcome these challenges by offering a high degree of freedom in terms of metallization shape, thus, allowing improved radiation performance.

- The convergence of digital-based audio, video, and information technology is changing the shape of the consumer electronics industry, creating a whole new world of electronic gadgets that can grab consumers' attention. The consumer-spending trend is a leading economic indicator in the consumer electronics industry, strongly correlated with economic growth.

- Technological advancements are bringing convergence of computer, communication, and consumer electronics, auguring well for the industry, with many new opportunities for product innovations, with miniaturization. The trend towards miniaturization in the consumer electronics industry has driven package component sizes down to the design-rule level of early technologies.

- Specifically, smartphones have observed a robust uptake of this technology, nearly doubling production volumes over the past decade. Apart from this, the rising adoption of smart devices, wearables, and connected medical equipment, innovations in the modern medical sciences across the world has bought a massive advancement into the global healthcare offerings as most consumers are now leveraging the advantages offered by smart medical devices to address critical health needs.

- Furthermore, the electronics segment in the military and defense industry also presents potential opportunities for the LDS antenna market, buoyed by the rising number of unmanned aerial vehicles (UAVs), global positioning system/global navigation satellite system (GPS/GNSS) navigation, and conformal communication antennas, among others.

- According to Teal Group, approximately 95% of the 28,912 UAVs projected to be developed between 2013 and 2027 will be employed for military purposes. UAV operations are becoming well-embedded in the armed forces worldwide, affecting global security. Aiding this trend, players, such as TE Connectivity, are focused on delivering lighter, smaller antennas that can sustain in harsh environments in the aerospace and defense sector.

- However, the market growth is expected to be hindered by the high equipment costs, need for high temperature-resistant materials, long plating process, and complexity in procedure due to thin metallization layers and beads of the laser structuring process.

- COVID-19 adversely affected manufacturing operations in numerous industries where LDS technology has a wide range of antenna uses. The sales, as well as production of smartphone and pad devices, laptop and notebook computers, vehicle tracking systems, gaming consoles, inventory tracking systems, wireless printers, and routers, UAVs, etc., were all affected by restrictions on logistics and the availability of the workforce.

Laser Direct Structuring (LDS) Market Trends

Automotive is expected to register a Significant Growth

- Laser direct structuring of 3D molded connecting devices (3D MIDs) is widely used in automotive applications to reduce weight and boost reliability. The production of next-generation (future) vehicles depends mostly on enhancing vehicles' abilities to connect wirelessly to a wide variety of services. The vision for connected vehicles aims to effectively use wireless communication resources to deliver advanced functionalities for effective traffic management, infotainment, and ensuring the driver's safety.

- To fulfill the requirements for a wide variety of applications in broadcasting and telematics, onboard automobile equipment is integrated into an increasing number of wireless services. Typically, automotive onboard antennas, like integrated rooftop antennas, on-glass antennas, and rod antennas, are mostly used to cover all wireless communication standards.

- LDS is majorly used in steering wheel hubs, as most automobiles generally come equipped with steering-mounted controls. In addition, LDS is widely used in forwarding control switches, positioning sensors, and brake sensors. LDS finds its applications vastly in advanced driver-assistance systems (ADAS) for self-driving cars. Moreover, self-driving cars are anticipated to see rapid adoption in the transportation sector. The European Transport Safety Council (ETSC), a not-for-profit advocacy group in Brussels, projected that automatic braking could minimize traffic death rates by as much as 20%.

- For example, in June 2022, Tesla built its Enhanced Autopilot in China and the United States. In the United States, Enhanced Autopilot costs USD 6,000. Meanwhile, in China, it costs USD 4,779. The features included in Enhanced Autopilot are navigate on autopilot, auto lane change, autopark, summon, and smart summon. Tesla also released Enhanced Autopilot in New Zealand and Australia. In New Zealand, Enhanced Autopilot costs USD 3,615, and in Australia, it costs USD 3,579. Enhanced Autopilot offers the same features in all four countries.

- By 2030, autonomous automobiles will probably rule the market, as per NASDAQ. In addition, several governments worldwide are promoting the use of ADAS features. For instance, the National Highway Traffic Safety Administration (NHTSA) of the United States Department of Transportation (USDT) established the Federal Automated Vehicles Policy (FAVP) in relation to highly automated vehicles (HAVs), which can range from cars with advanced driver-assistance features to autonomous vehicles.

North America is Expected to Hold Major Share

- Nearly all the end-user sectors in the North American region greatly demand LDS Antenna solutions. However, the region's main source of demand for LDS antennas is likely to come from the consumer electronics, networking, and automotive industries.

- The region's strong automobile industry growth helps the market grow and expand. For the enhancement of the comfort and safety of passengers, modern automobiles need to combine a variety of sensors and electronic assistants. However, the requirement to reduce the number of components is growing along with deploying these sensors and components.

- Incorporating LDS technology is anticipated to promote miniaturization and lower the number of components when used with appropriate connection and assembly technology. LDS technology also assists in terms of cost-effectiveness in the manufacturing process and aids in the extension of design alternatives.

- The United States has a significant share of the major consumer electronics markets. According to the Consumer Technology Association (CTA), smartphones generated the most revenue in consumer electronics/technology sales in the United States during the previous five years. The sales value of smartphones sold in the United States increased by 1.7 billion USD in 2022 to USD 75.4 billion compared to USD 74.7 billion in the previous year.

Laser Direct Structuring (LDS) Industry Overview

The market for laser direct structuring (LDS) antenna is hugely competitive. It contains several leading players such as Taoglas Limited, Molex LLC, SelectConnect Technologies, TE Connectivity Ltd, Pulse Electronics Corporation (Yageo Corporation), etc. In terms of market share, few significant players currently dominate the market. These major players with a substantial stake in the market are highly focused on expanding their customer base across foreign countries. These companies leverage various strategic collaborative initiatives to maximize their market share and increase their profitability.

In July 2022, TE Connection, a global provider of sensors, bought Linx Technologies, a supplier of radio frequency (RF) components in the Internet of Things (IoT) markets. The strategic acquisition will further strengthen Te's product portfolio and competitiveness in the IoT. As TE continues to strengthen its investment in the IoT market, the acquisition will help expand TE's supply chain, particularly in antennas and RF connectors for the IoT. It is also an important strategy for TE following the acquisition of Laird Connectivity's antenna business in 2021.

Moreover, in July 2022, Taoglas, a leading enabler of digital transformation through IoT, and Novotech, a leading 4G/5G cellular IoT electronics components distributor and solutions provider, entered into a new Canadian partnership agreement combining the distribution of Taoglas' advanced components, including industry-leading antennas, sales and technical support for cellular IoT connectivity solutions. This new partnership will expand Novotech's portfolio, providing the company's partners and customers access to Taoglas' innovative 4G/5G cellular portfolio for supporting public safety, transportation, e-charging, fixed wireless, and 5G mobile networking solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For Miniaturization In Consumer Electronics Industry

- 5.1.2 Growth of IoT and Devices With Higher Antenna Ranges

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Manufacturing Complexities Associated With Molded Interconnect Devices

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Healthcare

- 6.1.2 Consumer Electronics

- 6.1.3 Automotive

- 6.1.4 Networking

- 6.1.5 Other End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Taoglas Limited

- 7.1.2 Molex LLC

- 7.1.3 Multiple Dimensions AG

- 7.1.4 SelectConnect Technologies

- 7.1.5 TE Connectivity Ltd

- 7.1.6 Pulse Electronics Corporation (Yageo Corporation)

- 7.1.7 Amphenol Corporation

- 7.1.8 Tongda Group Holdings Limited

- 7.1.9 Shenzhen Sunway Communication Co. Ltd

- 7.1.10 Luxshare Precision Industry Co. Ltd

- 7.1.11 HARTING KGaA

- 7.1.12 Huizhou Speed Wireless Technology Co. Ltd

- 7.1.13 LPKF Laser & Electronics AG