|

市場調査レポート

商品コード

1444930

ケトジェニックダイエット食品:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Ketogenic Diet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ケトジェニックダイエット食品:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

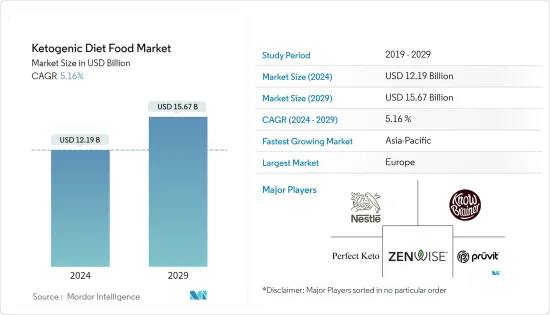

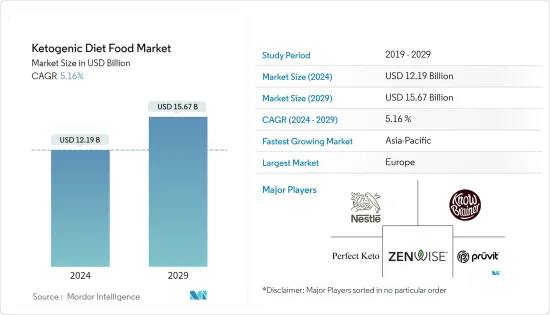

ケトジェニックダイエット食品の市場規模は、2024年に121億9,000万米ドルと推定され、2029年までに156億7,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.16%のCAGRで成長します。

COVID-19感染症のパンデミックにより、人々の働き方が変化しました。多くの国で在宅勤務文化が発展しました。そのため、人々の間で肥満、心血管疾患、高血圧、その他多くの慢性疾患の罹患率が増加し始めました。ケトジェニック食品市場は、人々の健康とフィットネスに対する意識の高まりにより、長期的に成長すると予想されています。ケトジェニックダイエットを続けると、体重減少、片頭痛の軽減、心臓の健康状態の改善、コレステロールの減少など、多くの利点が得られます。消費者に知られているこれらすべての利点により、市場は長期的に成長すると予想されます。

さらに、その利便性からオンラインによるフードデリバリーサービスやEコマースサイトが世界中で成長しています。その結果、消費者はより多くの食品の選択肢と選択肢を得ることができます。ケトダイエットは、より少ないカロリー摂取でより多くのエネルギーを与え、最終的には体重管理に役立つため、特にミレニアル世代の間で非常に人気があります。アスリートやスポーツ愛好家も、長期間にわたって健康で活動的な状態を維持するために、ケトジェニックダイエットに移行しています。したがって、消費者の間でケトダイエットに対するニーズが高まっていることにより、メーカーはケト製品、特に高脂肪、低炭水化物の配合で、特に不足しがちな栄養素やビタミンを追加したサプリメントやスナックを導入する道を切り開いています。ケトダイエット中。いくつかの市場関係者がケト食品市場をサポートする製品や材料を発売しています。たとえば、2022年6月、King Arthur Baking Co.はケトフレンドリーなベーキングミックスの新しいコレクションを発売しました。非遺伝子組み換え認証原料を使用して作られたケトミックスは、イエローケーキミックス、チョコレートケーキミックス、多目的マフィンミックス、ピザクラストミックスで入手可能です。各ミックスの正味炭水化物量は1食分あたり2グラム以下で、砂糖は添加されていません。

ケトジェニックダイエット食品市場動向

肥満の増加が市場の成長を牽引

肥満は今日世界の主要な健康問題の1つです。 2022年 9月のTrust for America's Healthレポートによると、アメリカ成人の10人に4人が肥満です。このため、消費者は健康的な食習慣に移行し、ケトに優しい食品を食事療法に取り入れています。彼らは健康を維持するためにフィットネスセンターやジムにも通っています。ジムのトレーナーや医師は、断続的な断食の代わりにケトジェニックダイエットを推奨しています。高脂肪および低炭水化物の飲料は、持続的なエネルギーを提供し、ケトーシスの代謝状態を促進するように設計されており、体が脂肪をエネルギーとして燃焼する際の効率が高まります。多くの地域での子供の肥満を考慮して、市場関係者はケーキ、チョコレート、プロテインバーなどケトフレンドリーな製品を革新しています。たとえば、2022年4月、Jimmy's Healthy Foods Inc.はケトフレンドリーなチョコレートファッジプディングを発売しました。さらに、Amazon、Walmartなどのオンラインショッピングアプリでさまざまなケトフレンドリーな製品が入手できることも、市場を牽引しています。

アジア太平洋は最も急成長する市場として台頭中

中国では、ケトジェニックダイエット食品は錠剤、錠剤、スナック、粉末、または液体の形で広く入手可能です。また、Certified KetogenicやPaleo Foundation Certified Ketoなどのケト認定資格も登場しています。これらの認定は、ケトダイエットをパレオダイエットまたはクリーンラベルダイエットの延長と考えるライフスタイルユーザーにアピールすると予想されます。中国には若い人口が多く、ケトジェニック食品の消費に貢献しています。ケトジェニック飲料は、アルコール飲料やノンアルコール飲料と同様に、この地域では非常に有名です。環境、ライフスタイル、都市化の変化により、消費者は食品が健康的で、持ち運びが容易で、栄養価が豊富であることを必要としています。オーストラリアの消費者も健康に対する意識が高く、オーストラリアの市場関係者はケトフレンドリーなスナックやスナックバーを発売しています。たとえば、2021年3月、オーストラリアの食品会社マイマッスルシェフは、植物ベースの原料で作られた新しい健康的なケトバーを発売しました。

ケトジェニックダイエット食品業界の概要

世界のケトジェニックダイエット食品市場は競争が激しく、地域内および国際的な競合企業で構成されています。この市場は、Perfect Keto, LLC、Glanbia PLC、Nestle、Pruvit Ventures Inc.などの企業によって独占されています。これらの企業は、新興市場がもたらす機会を活用して製品ポートフォリオを拡大し、さまざまな製品セグメント、特にサプリメントの要件に応えることに重点を置いています。また、企業は顧客ベースと地理的範囲を拡大するための主な方法として戦略的パートナーシップに目を向けています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品タイプ

- サプリメント

- 飲料

- おやつ

- その他の製品タイプ

- 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- 薬局・ドラッグストア

- 専門店

- オンライン小売店

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- 南アフリカ

- アラブ首長国連邦

- その他中東およびアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市況分析

- 企業プロファイル

- Nestle SA

- Zenwise Health

- Know Brainer Foods LLC

- Pruvit Ventures Inc.

- Perfect Keto LLC

- TDN Nutrition

- NOW Foods

- Glanbia PLC

- Atrium Innovations Inc.(Garden Of Life)

- Keto and Co.

- Keto Krisp

- American Licorice LLC(Zing Bars)

第7章 市場機会と将来の動向

The Ketogenic Diet Food Market size is estimated at USD 12.19 billion in 2024, and is expected to reach USD 15.67 billion by 2029, growing at a CAGR of 5.16% during the forecast period (2024-2029).

Because of the COVID-19 pandemic, people's working styles changed. Many countries developed work-from-home cultures.Because of this, the prevalence of obesity, cardiovascular diseases, high blood pressure, and many more chronic diseases started to rise among people. The ketogenic food market is going to grow over the long term owing to increased awareness among people about their health and fitness. Following the keto diet can have plenty of benefits, like helping with weight loss, reducing migraines, improving heart health, reducing cholesterol, and many more. Due to all these benefits known to consumers, the market is expected to grow over the long term.

Furthermore, online food delivery services and e-commerce websites are growing all over the world owing to their convenience. As a result, consumers have more food options and selections. Especially among millennials, keto diets are very popular as they give more energy with less calorie intake, which eventually helps with weight management. Athletes and sports enthusiasts are also shifting to a ketogenic diet in order to stay fit and active for a longer period of time. Therefore, the increasing need for the keto diet among consumers is paving the way for manufacturers to introduce keto products, particularly supplements and snacks that deliver on the high-fat, low-carb formula, especially with added nutrients and vitamins, which are often lacking in a keto diet. Several market players are launching products and ingredients to support the keto food market. For instance, in June 2022, King Arthur Baking Co. launched a new collection of keto-friendly baking mixes. The keto mixes, which are made using non-GMO certified ingredients, are available in a yellow cake mix, a chocolate cake mix, an all-purpose muffin mix, and a pizza crust mix. Each mix has 2 grams or less of net carbs per serving and no added sugar.

Ketogenic Diet Food Market Trends

Increasing Obesity is Driving the Market Growth

Obesity is one of the major health problems in the world today. According to the Trust for America's Health report from September 2022, 4 in 10 American adults have obesity. Because of this, consumers are shifting towards healthy food habits and incorporating keto-friendly foods into their diet regimen. They are also going to fitness centers and gyms to stay fit. The gym trainers and doctors recommend the ketogenic diet instead of intermittent fasting. The high-fat and low-carb beverages are designed to provide sustained energy and help accelerate the metabolic state of ketosis, which makes the body more efficient when burning fat for energy. Considering children's obesity in many regions, the market players are innovating products like cakes, chocolates, protein bars, and many more that are keto-friendly. For instance, in April 2022, Jimmy's Healthy Foods Inc. launched Keto-Friendly Chocolate Fudge Pudding. Additionally, the availability of different keto-friendly products on online shopping apps like Amazon, Walmart, and many more is also driving the market.

Asia-Pacific is Emerging as the Fastest-growing Market

In China, ketogenic diet food is widely available in the form of tablets, pills, snacks, powder, or liquid. Also, keto certifications are emerging, including Certified Ketogenic and Paleo Foundation Certified Keto. These certifications are expected to appeal to lifestyle users who see keto as an extension of the Paleo diet or a clean-label diet. China has a large young population, which contributes to the consumption of ketogenic foods. Ketogenic beverages, like alcoholic and non-alcoholic beverages, are quite famous in the region. Because of changes in environment, lifestyle, and urbanization, consumers need their food to be healthy, easy to carry, and nutrient-rich. Australian consumers are also very conscious of their health, and the market players there have been launching snacks and snack bars that are keto-friendly. For instance, in March 2021, an Australian food company, My Muscle Chef, launched new healthy keto bars that are made from plant-based ingredients.

Ketogenic Diet Food Industry Overview

The global ketogenic diet food market is highly competitive and comprises regional and international competitors. The market is dominated by players like Perfect Keto, LLC, Glanbia PLC, Nestle, and Pruvit Ventures Inc. These players focus on leveraging the opportunities posed by emerging markets to expand their product portfolios to cater to the requirements of various product segments, especially supplements and beverages. Also, companies have turned to strategic partnerships as their main way to expand their customer base and geographic reach.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Supplements

- 5.1.2 Beverages

- 5.1.3 Snacks

- 5.1.4 Other Product Types

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Pharmacy/Drug Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Position Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle S.A.

- 6.3.2 Zenwise Health

- 6.3.3 Know Brainer Foods LLC

- 6.3.4 Pruvit Ventures Inc.

- 6.3.5 Perfect Keto LLC

- 6.3.6 TDN Nutrition

- 6.3.7 NOW Foods

- 6.3.8 Glanbia PLC

- 6.3.9 Atrium Innovations Inc. (Garden Of Life)

- 6.3.10 Keto and Co.

- 6.3.11 Keto Krisp

- 6.3.12 American Licorice LLC (Zing Bars)