|

市場調査レポート

商品コード

1850384

自動車用ワイヤーハーネス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用ワイヤーハーネス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月17日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

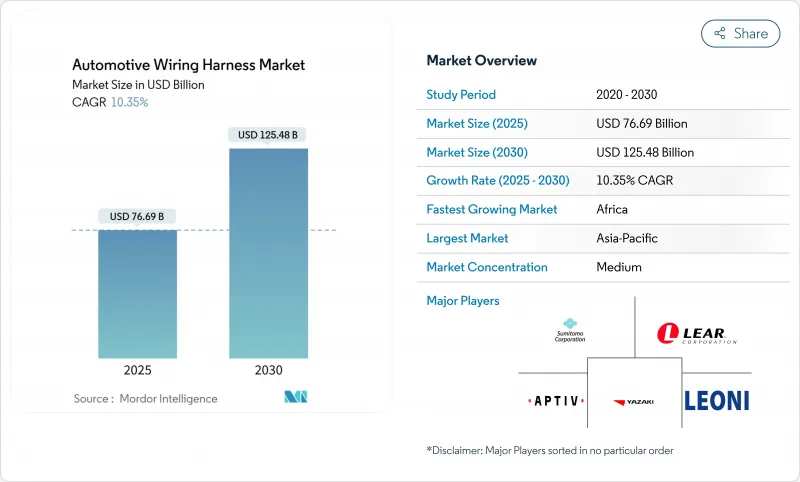

自動車用ワイヤーハーネス市場規模は2025年に766億9,000万米ドル、2030年には1,254億8,000万米ドルに達すると推定・予測され、予測期間(2025-2030年)のCAGRは10.35%です。

この市場は、自動車1台当たりの電子部品搭載量の増加を背景に順調に拡大しているが、その見出しの成長には2つの対照的な流れが隠されています。すなわち、バッテリー電気自動車に使用される高電圧ハーネスの需要が2桁のペースで増加している一方で、従来の低電圧内燃機関車用ハーネスは価格圧縮が進んでいます。地域的には、アジアが生産と消費の中心であり続け、アフリカは有利な労働経済と現地調達ルールのおかげで新たな生産能力を誘致しており、北米と欧州の成熟市場は、ケーブルの引き回しを短縮しながらも残りの各ラインの価値を高めるゾーン電気アーキテクチャに軸足を移しています。

世界の自動車用ワイヤーハーネス市場の動向と洞察

電動化に伴う高電圧ハーネス需要の急増

バッテリーパックの電圧は800 V、さらには1000 Vまで上昇し、厳しい電磁両立性(EMC)目標を満たしながら、より大きな熱負荷を伝送する新しいクラスのケーブルアセンブリに拍車がかかっています。多くの中国ブランドは現在、主要な牽引線にアルミニウム・ベースの導体を指定しており、材料の革新がEVのコスト削減に直結しています。アルミニウムは接合技術を見直す必要があるため、サプライヤーは5年前には見られなかったペースで摩擦溶接やレーザー溶接セルに投資しています。溶接のノウハウが、やがて銅の調達をしのぐ重要な競争障壁になるだろうというのが、新たな推論です。

軽量アルミと光ハーネスのOEM推移

自動車メーカーは1g単位の軽量化を追い求め続け、高級車では配線が20kg以上を占めることもあります。アルミの導線は銅に比べ、質量を約60%削減し、銅の価格変動の影響も受けます。導電率の低下というマイナス面は、マルチストランド設計とバイメタル端子によって相殺され、接触抵抗は仕様の範囲内に抑えられています。接続技術が成熟するにつれ、いくつかのOEMはアルミの電力線とデータ用の光ファイバーをペアにした混合導体織機を導入しています。

銅と樹脂の価格変動によるマージン圧迫

銅は従来の織機の総材料費の半分以上を占めているため、最近の価格変動はサプライヤーの粗利率を圧迫しています。ほとんどのライン・フィット契約にはパス・スルー条項が含まれているが、自動車メーカーはサイクル半ばでの価格上昇を受け入れることにますます消極的になっています。そのため、サプライヤーはリスク分散策として、商品取引所でのヘッジやアルミへの多角化を進めています。このような状況は、収益性を確保する上で、コア・エンジニアリングと同様に、ファイナンシャル・エンジニアリングと調達の高度化が重要になってきていることを浮き彫りにしています。

セグメント分析

2024年の自動車用ワイヤーハーネス市場規模では、ボディ、照明、キャビンコンフォートシステムが35.90%を占め、最大のシェアを占める。高いLED採用率、パワーリフトゲート、マルチゾーン空調モジュールが、根強い需要を説明しています。興味深い観察によると、販売台数を押し上げる同じ快適性機能が、最終的な車両組立を複雑にし、OEMにダッシュボードやドアパネルにはめ込む設定済みのサブルームを要求するよう促しています。

充電および電源システム用ハーネスは、2030年までの予測CAGRが26.50%と最も速く、より多くの電気自動車モデルがショールームに並ぶにつれて10%台半ばで拡大します。これらのハーネスはバッテリーパック周辺の温度上昇や機械的振動に耐えなければならないため、よりグレードの高い絶縁材料が主流になりつつあります。液冷スリーブや薄型シールドを得意とするサプライヤーは、おそらくプレミアム価格を要求すると思われます。やがて、高電圧配線に関する専門知識は、バッテリー管理システムへのクロスセリングにつながるかもしれません。

銅は、比類のない導電性と1世紀にわたるプロセス・ノウハウに支えられ、今日、自動車用ワイヤーハーネス市場シェアの93.90%を占めています。しかし、その密度と不安定なコスト・プロファイルは、OEMの購買部門に代替品を求めるプレッシャーを与え続けています。新しいパターンとしては、銅のデータ・ペアとアルミのパワー・コアを同じ幹線にバンドルすることで、シグナル・インテグリティを犠牲にすることなく軽量化を実現しています。

アルミニウムの2030年までの予想CAGRは12.13%で、より広い自動車用ワイヤーハーネス業界の軌跡を軽々と凌駕しています。防錆端子と摩擦溶接スプライス技術の進歩により、以前の信頼性への懸念は取り除かれました。アルミは銅に比べて価格が安定しているため、金融チームはヘッジとしてアルミを使うモデルをますます増やしています。このシフトは、材料科学の選択が、大手サプライヤーの財務リスク管理戦略と直結していることを示しています。

地域分析

アジア太平洋地域はほぼ48.83%のシェアを持ち、絶対的な収益拡大が最も速い地域です。中国は、その膨大な軽自動車生産量と深いEVサプライチェーンを通じてこの地域を支え、日本と韓国は、データおよび高電圧アプリケーションのための高品位の研究開発に貢献しています。インドと東南アジアでは、電化に向けた政府の優遇措置があり、世界的な成長が正常化しても、この地域の需要は底堅く推移すると思われます。注目すべき開発は、中国の複数のOEMが欧州にEVを輸出していることで、欧州連合の規制基準を満たす調和のとれた配線仕様が必要とされ、その結果、アジアに拠点を置くサプライヤーがグローバルなコンプライアンス基準に昇格しています。

アフリカは、2025~2030年のCAGRが11.97%と最も高いです。競争力のある人件費、欧州連合(EU)への貿易協定によるアクセス、政府の工業団地政策が相まって、新たなハーネス投資を誘致しています。欧州のティア1企業数社は、労働集約度の高いサブアセンブリーをこの地域に立地させ、自動化プロセスのために自国工場を解放しています。ケーブルの圧着や品質検査における地元労働者のスキルアップ・プログラムが台頭しており、人的資本戦略が地域の成長と結びついていることを示しています。

北米と欧州の成長はより緩やかだが、技術のフロントランナーであることに変わりはないです。ゾーナル・アーキテクチャーのパイロットはドイツの高級ブランドと北米の電気系新興企業に集中しているため、ミュンヘン、シュトゥットガルト、シリコンバレーのデザイン・オフィスが次世代織機のコンセプトの中枢として機能しています。このパターンは、知的財産の創造が労働集約的な生産から切り離されていることを意味しています。これは、OEM本社の近くにR&Dクラスターを形成し、大量ロットの組み立てはコストの最適化された地域に移行するという、2スピードのグローバル・フットプリントを強化するものです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場促進要因

- 電化による高電圧ハーネス需要の急増(アジア)

- 軽量アルミと光ハーネスのOEM推進

- プレミアムカーにおける集中型ゾーンE/Eアーキテクチャへの移行(EU)

- ADAS配線冗長性に関する規制義務(米国、日本)

- ワイヤーハーネスの現地調達化を促進する現地調達ルールの強化(インド、メキシコ)

- 冗長回路アーキテクチャを推進する自動運転車開発

- 市場抑制要因

- 銅と樹脂価格の変動によるマージン圧迫

- EV特有の熱およびEMCの課題が検証コストを増大させる

- 設計の複雑さと熟練労働力の可用性のミスマッチ(ASEAN)

- 製造自動化の限界が生産性向上を阻害

- バリュー/サプライチェーン分析

- 規制と技術の見通し

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 用途別

- 点火システム

- 充電・電源システム

- ドライブトレインとパワートレイン(ICE)

- 高電圧トラクションハーネス(xEV)

- インフォテインメント、コックピット、テレマティクス

- ADASと安全制御

- ボディ、照明、キャビンの快適性

- 導体材料別

- 銅

- アルミニウム

- 定格電圧別

- 低電圧(60 V未満)

- 高電圧(60~1,000 V)

- 推進タイプ別

- 内燃機関車

- バッテリー電気自動車

- プラグインハイブリッド車とハイブリッド車

- 車両タイプ別

- 乗用車

- 小型商用車

- 大型トラックとバス

- 販売チャネル別

- OEM

- アフターマーケット

- 地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- GCC

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 戦略イニシアチブ

- 市場シェア分析

- 企業プロファイル

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group(Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou(China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.