|

|

市場調査レポート

商品コード

1724768

閉鎖式薬物移送システム(CSTD)の世界市場:閉鎖機構別、タイプ別、コンポーネント別、技術別、エンドユーザー別 - 予測(~2030年)Closed Systems Transfer Devices Market by Closing Mechanism, Type, Component, Technology, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 閉鎖式薬物移送システム(CSTD)の世界市場:閉鎖機構別、タイプ別、コンポーネント別、技術別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年05月08日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の閉鎖式薬物移送システム(CSTD)の市場規模は、2025年の14億9,000万米ドルから2030年までに20億9,000万米ドルに達すると予測され、CAGRで7.0%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | コンポーネント、閉鎖機構、タイプ、技術、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

医療従事者の安全に対する意識と関心の高まりに伴い、閉鎖式薬物移送システム(CSTD)に対する市場需要が増加しています。医療機関は、安全処置を進め、安全でない薬物を扱う危険性から医療従事者を守るため、これらのデバイスに多くの費用を費やすようになっています。したがって、このような需要の高まりは、医療施設が労働力を確保するために安全対策を講じることを優先するため、閉鎖式薬物移送システム(CSTD)市場の成長を後押しすることになります。

閉鎖機構別では、カラーツーカラーアライメントシステムセグメントが閉鎖システム移送装置市場でもっとも高いCAGRで増加します。

コンポーネント別では、バイアルアクセスセグメントが閉鎖式薬物移送システム(CSTD)市場で最大の市場シェアを占めました。バイアルアクセスコンポーネントは、医療従事者の針刺し損傷のリスクを低減し、移送中の薬物汚染を回避する上で重要な機能を有します。さらに、取り扱いが容易なため、迅速な医薬品の調製が可能になり、オープンシステムに関連するエラーのリスクを最小化することができます。このように、安全性と効率性の要件に対応し、バイアルアクセスコンポーネントセグメントが市場を牽引する可能性が高いです。

エンドユーザー別では、病院・診療所が閉鎖式薬物移送システム(CSTD)市場を独占しています。その他の医療施設とは対照的に、病院・診療所は医療機器に対する予算が大きいです。そのため、規制やベストプラクティスに対応しながら、最新のCSTD技術に投資することができます。さらに、病院や診療所では、薬物の取り扱いや従業員の保護に関して、より厳格な規制が設けられています。CSTDは、危険な薬物にさらされるリスクを低減し、投薬ミスを回避することで、こうしたニーズを満たすのに役立っています。

北米が予測期間に閉鎖式薬物移送システム(CSTD)市場の最大のシェアを占めると予測されます。これは、薬物の安全な取り扱いの重要性に対する医療従事者の意識の向上に加え、確立された医療インフラや、厳格な規制要件に起因します。この地域は、患者のケアと安全性を向上させる精巧な医療技術の採用でリードしています。

当レポートでは、世界の閉鎖式薬物移送システム(CSTD)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 閉鎖式薬物移送システム(CSTD)市場の概要

- アジア太平洋の閉鎖式薬物移送システム(CSTD)市場:国別、技術別(2024年)

- 閉鎖式薬物移送システム(CSTD)市場:地域構成

- 閉鎖式薬物移送システム(CSTD)市場:新興国市場 vs. 先進国市場

- 閉鎖式薬物移送システム(CSTD)市場:地理的成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格の動向:コンポーネント別

- 平均販売価格の動向:主要企業別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- 調査と製品開発

- 材料成分の調達と製造

- マーケティング、セールス、出荷、アフターサービス

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 産業動向

- 閉鎖式薬物移送システム(CSTD)へのフィルターの統合

- 移送プロセスの自動化

- 耐久性と複雑な薬物の処方への適合性を実現する先進材料

- 特許分析

- 貿易データ分析

- 輸入データ

- 輸出データ

- 主な会議とイベント(2025年~2026年)

- ケーススタディ分析

- ケーススタディ1:マウントサイナイ病院における単回投与バイアルの使用期限延長

- ケーススタディ2:ネブラスカのメソジスト病院における薬物調合の安全性と効率性の向上

- ケーススタディ3:最悪のシナリオを想定した微生物汚染の防止

- 規制情勢

- 規制基準と承認

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- アンメットニーズ/エンドユーザーの期待

- 閉鎖式薬物移送システム(CSTD)市場に対する生成AIの影響

- 閉鎖式薬物移送システム(CSTD)市場に対する米国の関税規制の影響

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 閉鎖式薬物移送システム(CSTD)市場:閉鎖機構別

- イントロダクション

- ルアーロックシステム

- プッシュツーターンシステム

- クリックツーロックシステム

- カラーツーカラーアライメントシステム

第7章 閉鎖式薬物移送システム(CSTD)市場:タイプ別

- イントロダクション

- メンブレンツーメンブレンシステム

- ニードルレスシステム

第8章 閉鎖式薬物移送システム(CSTD)市場:コンポーネント別

- イントロダクション

- バイアルアクセスコンポーネント

- オスルアー

- バッグスパイク

- メスコンポーネント

- その他のコンポーネント

第9章 閉鎖式薬物移送システム(CSTD)市場:技術別

- イントロダクション

- ダイアフラムベースのデバイス

- コンパートメントデバイス

- 空気清浄/ろ過デバイス

第10章 閉鎖式薬物移送システム(CSTD)市場:エンドユーザー別

- イントロダクション

- 病院・診療所

- 腫瘍センター

- その他のエンドユーザー

第11章 閉鎖式薬物移送システム(CSTD)市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- オーストラリア・ニュージーランド

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- コロンビア

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 主要企業のR&Dの評価

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- BD

- ICU MEDICAL, INC.

- B. BRAUN MELSUNGEN AG

- JMS CO. LTD.

- BAXTER

- WEST PHARMACEUTICAL SERVICES, INC.

- TERUMO CORPORATION

- CARDINAL HEALTH

- EQUASHIELD

- SIMPLIVIA HEALTHCARE LTD.

- YUKON MEDICAL

- CODAN MEDIZINISCHE GERATE GMBH

- VYGON

- ELCAM MEDICAL

- PRACTIVET, INC.

- その他の企業

- CARAGEN

- CORVIDA MEDICAL

- VICTUS

- EPIC SYSTEMS CORPORATIONS

- ERASER MEDICAL

- NEEDLELESS CORPORATION

- AMSINO INTERNATIONAL, INC.

- INSUNG MEDICAL CO., LTD.

- ADVCARE MEDICAL, INC.

- SHANDONG ANDE HEALTHCARE APPARATUS CO., LTD.

第14章 付録

List of Tables

- TABLE 1 CLOSED SYSTEM TRANSFER DEVICES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES, 2021-2024

- TABLE 3 CLOSED SYSTEM TRANSFER DEVICES MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 NATIONAL/LOCAL REGULATORY BODIES RECOMMENDING CLOSED SYSTEM TRANSFER DEVICES FOR MEDICATION HANDLING, BY COUNTRY

- TABLE 5 CLOSED SYSTEM TRANSFER DEVICES MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 AVERAGE SELLING PRICE TREND OF CLOSED SYSTEM TRANSFER DEVICES, BY COMPONENT, 2022-2024

- TABLE 7 AVERAGE SELLING PRICE TREND OF CLOSED SYSTEM TRANSFER DEVICES, BY KEY PLAYER, 2022-2024

- TABLE 8 AVERAGE SELLING TREND OF CLOSED SYSTEM TRANSFER COMPONENTS, BY REGION, 2022-2024

- TABLE 9 CLOSED SYSTEM TRANSFER DEVICES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 INNOVATIONS AND PATENT REGISTRATIONS, 2022-2024

- TABLE 11 IMPORT DATA FOR HS CODE 901890 BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 CLOSED SYSTEM TRANSFER DEVICES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 NATIONAL INSTITUTE FOR OCCUPATIONAL SAFETY AND HEALTH: CLASSIFICATION OF HAZARDOUS DRUGS

- TABLE 15 NATIONAL INSTITUTE FOR OCCUPATIONAL SAFETY AND HEALTH: HAZARDOUS DRUG ADMINISTRATION RECOMMENDATIONS AND USP 800 REQUIREMENTS

- TABLE 16 NATIONAL INSTITUTE FOR OCCUPATIONAL SAFETY AND HEALTH AND AMERICAN SOCIETY OF HEALTH-SYSTEM PHARMACISTS: DEFINITIONS FOR HAZARDOUS DRUGS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 CLOSED SYSTEM TRANSFER DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

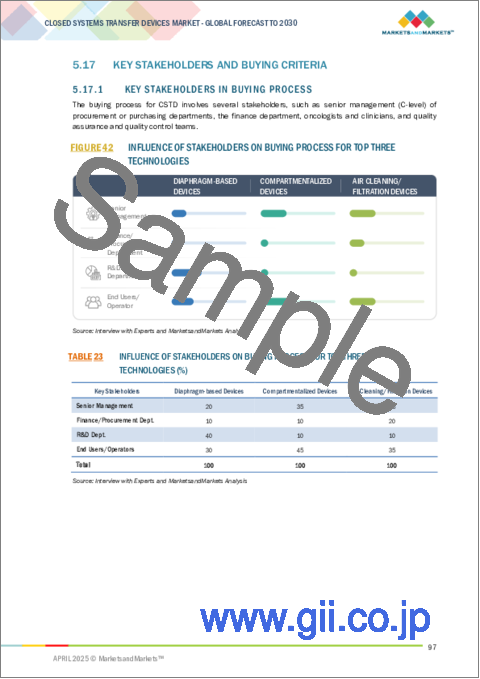

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

- TABLE 25 KEY COMPANIES IMPLEMENTING AI

- TABLE 26 CLOSING MECHANISMS AVAILABLE IN CLOSED SYSTEM TRANSFER DEVICES

- TABLE 27 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 28 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR LUER LOCK SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR PUSH-TO-TURN SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR CLICK-TO-LOCK SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR COLOR-TO-COLOR ALIGNMENT SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 33 LEADING MANUFACTURERS OF MEMBRANE-TO-MEMBRANE SYSTEMS

- TABLE 34 MEMBRANE-TO-MEMBRANE CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 LEADING MANUFACTURERS OF NEEDLELESS SYSTEMS

- TABLE 36 NEEDLELESS CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 38 VIAL ACCESS COMPONENTS FOR CLOSED SYSTEM TRANSFER DEVICES

- TABLE 39 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR VIAL ACCESS COMPONENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR VIAL ACCESS COMPONENTS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 41 MALE LUERS FOR CLOSED SYSTEM TRANSFER DEVICES

- TABLE 42 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR MALE LUERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR MALE LUERS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 44 BAG SPIKE COMPONENTS FOR CLOSED SYSTEM TRANSFER DEVICES

- TABLE 45 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR BAG SPIKES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR BAG SPIKES, BY REGION, 2021-2029 (THOUSAND UNITS)

- TABLE 47 FEMALE COMPONENTS FOR CLOSED SYSTEM TRANSFER DEVICES

- TABLE 48 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR FEMALE COMPONENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR FEMALE COMPONENTS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 50 OTHER COMPONENTS FOR CLOSED SYSTEM TRANSFER DEVICES

- TABLE 51 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR OTHER COMPONENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 53 DIAPHRAGM-BASED DEVICES AVAILABLE IN MARKET

- TABLE 54 DIAPHRAGM-BASED CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 COMPARTMENTALIZED DEVICES AVAILABLE IN MARKET

- TABLE 56 COMPARTMENTALIZED CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 AIR CLEANING/FILTRATION DEVICES AVAILABLE IN MARKET

- TABLE 58 AIR CLEANING/FILTRATION CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 60 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR ONCOLOGY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 CLOSED SYSTEM TRANSFER DEVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 US: KEY MACROECONOMIC INDICATORS

- TABLE 71 US: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 72 US: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 US: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 74 US: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 75 US: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: KEY MACROECONOMIC INDICATORS

- TABLE 77 CANADA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 88 GERMANY: KEY MACROECONOMIC INDICATORS

- TABLE 89 GERMANY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 94 UK: KEY MACROECONOMIC INDICATORS

- TABLE 95 UK: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 96 UK: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 UK: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 98 UK: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 99 UK: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 FRANCE: KEY MACROECONOMIC INDICATORS

- TABLE 101 FRANCE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 SPAIN: KEY MACROECONOMIC INDICATORS

- TABLE 107 SPAIN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 108 SPAIN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 SPAIN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 110 SPAIN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 111 SPAIN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: KEY MACROECONOMIC INDICATORS

- TABLE 113 ITALY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 117 ITALY: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 118 REST OF EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 129 JAPAN: KEY MACROECONOMIC INDICATORS

- TABLE 130 JAPAN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 131 JAPAN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 JAPAN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 133 JAPAN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 134 JAPAN: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 135 CHINA: KEY MACROECONOMIC INDICATORS

- TABLE 136 CHINA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 137 CHINA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CHINA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 139 CHINA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 140 CHINA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 141 INDIA: KEY MACROECONOMIC INDICATORS

- TABLE 142 INDIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 143 INDIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 INDIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 145 INDIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 146 INDIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 AUSTRALIA: KEY MACROECONOMIC INDICATORS

- TABLE 148 NEW ZEALAND: KEY MACROECONOMIC INDICATORS

- TABLE 149 AUSTRALIA AND NEW ZEALAND: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 150 AUSTRALIA AND NEW ZEALAND: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 AUSTRALIA AND NEW ZEALAND: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 152 AUSTRALIA AND NEW ZEALAND: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 153 AUSTRALIA AND NEW ZEALAND: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: KEY MACROECONOMIC INDICATORS

- TABLE 155 SOUTH KOREA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 156 SOUTH KOREA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 158 SOUTH KOREA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 159 SOUTH KOREA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 165 LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 171 BRAZIL: KEY MACROECONOMIC INDICATORS

- TABLE 172 BRAZIL: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 173 BRAZIL: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 BRAZIL: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 175 BRAZIL: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 176 BRAZIL: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 MEXICO: KEY MACROECONOMIC INDICATORS

- TABLE 178 MEXICO: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 179 MEXICO: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 MEXICO: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 181 MEXICO: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 182 MEXICO: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 COLOMBIA: KEY MACROECONOMIC INDICATORS

- TABLE 184 COLOMBIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 185 COLOMBIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 COLOMBIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 187 COLOMBIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 188 COLOMBIA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 GCC COUNTRIES: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 201 GCC COUNTRIES: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 GCC COUNTRIES: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 203 GCC COUNTRIES: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 204 GCC COUNTRIES: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2023-2030 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 210 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CLOSED SYSTEM TRANSFER DEVICES MARKET, JANUARY 2022-MARCH 2025

- TABLE 211 CLOSED SYSTEM TRANSFER DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 212 CLOSED SYSTEM TRANSFER DEVICES MARKET: REGION FOOTPRINT

- TABLE 213 CLOSED SYSTEM TRANSFER DEVICES MARKET: CLOSING MECHANISM FOOTPRINT

- TABLE 214 CLOSED SYSTEM TRANSFER DEVICES MARKET: TYPE FOOTPRINT

- TABLE 215 CLOSED SYSTEM TRANSFER DEVICES MARKET: COMPONENT FOOTPRINT

- TABLE 216 CLOSED SYSTEM TRANSFER DEVICES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 217 CLOSED SYSTEM TRANSFER DEVICES MARKET: END-USER FOOTPRINT

- TABLE 218 CLOSED SYSTEM TRANSFER DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 219 CLOSED SYSTEM TRANSFER DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 220 CLOSED SYSTEM TRANSFER DEVICES MARKET: PRODUCT LAUNCHES A ND APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 221 CLOSED SYSTEM TRANSFER DEVICES MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 222 CLOSED SYSTEM TRANSFER DEVICES MARKET: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 223 BD: COMPANY OVERVIEW

- TABLE 224 BD: PRODUCTS OFFERED

- TABLE 225 BD: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 226 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 227 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 228 ICU MEDICAL, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 229 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

- TABLE 230 B. BRAUN MELSUNGEN AG: PRODUCTS OFFERED

- TABLE 231 B. BRAUN MELSUNGEN AG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 232 B. BRAUN MELSUNGEN AG: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 233 JMS CO. LTD.: COMPANY OVERVIEW

- TABLE 234 JMS CO. LTD.: PRODUCTS OFFERED

- TABLE 235 BAXTER: COMPANY OVERVIEW

- TABLE 236 BAXTER: PRODUCTS OFFERED

- TABLE 237 BAXTER: DEALS, JANUARY 2021-MARCH 2025

- TABLE 238 WEST PHARMACEUTICAL SERVICES, INC: COMPANY OVERVIEW

- TABLE 239 WEST PHARMACEUTICAL SERVICES, INC.: PRODUCTS OFFERED

- TABLE 240 WEST PHARMACEUTICAL SERVICES, INC.: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 241 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 242 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 243 TERUMO CORPORATION: EXPANSIONS, JANUARY 2021-MARCH 2024

- TABLE 244 CARDINAL HEALTH: COMPANY OVERVIEW

- TABLE 245 CARDINAL HEALTH: PRODUCTS OFFERED

- TABLE 246 EQUASHIELD: COMPANY OVERVIEW

- TABLE 247 EQUASHIELD: PRODUCTS OFFERED

- TABLE 248 EQUASHIELD: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-MARCH 2025

- TABLE 249 EQUASHIELD: DEALS, JANUARY 2021-MARCH 2025

- TABLE 250 SIMPLIVIA HEALTHCARE LTD.: COMPANY OVERVIEW

- TABLE 251 SIMPLVIA HEALTHCARE LTD.: PRODUCTS OFFERED

- TABLE 252 SIMPLVIA HEALTHCARE LTD.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 253 YUKON MEDICAL: COMPANY OVERVIEW

- TABLE 254 YUKON MEDICAL: PRODUCTS OFFERED

- TABLE 255 CODAN MEDIZINISCHE GERATE GMBH: COMPANY OVERVIEW

- TABLE 256 CODAN MEDIZINISCHE GERATE GMBH: PRODUCTS OFFERED

- TABLE 257 VYGON: COMPANY OVERVIEW

- TABLE 258 VYGON: PRODUCTS OFFERED

- TABLE 259 VYGON: DEALS, JANUARY 2021-MARCH 2025

- TABLE 260 ELCAM MEDICAL: COMPANY OVERVIEW

- TABLE 261 ELCAM MEDICAL: PRODUCTS OFFERED

- TABLE 262 PRACTIVET, INC.: COMPANY OVERVIEW

- TABLE 263 PRACTIVET, INC.: PRODUCTS OFFERED

- TABLE 264 CARAGEN: COMPANY OVERVIEW

- TABLE 265 CORVIDA MEDICAL: COMPANY OVERVIEW

- TABLE 266 VICTUS: COMPANY OVERVIEW

- TABLE 267 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 268 ERASER MEDICAL: COMPANY OVERVIEW

- TABLE 269 NEEDLELESS CORPORATION: COMPANY OVERVIEW

- TABLE 270 AMSINO INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 271 INSUNG MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 272 ADVCARE MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 273 SHANDONG ANDE HEALTHCARE APPARATUS CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CLOSED SYSTEM TRANSFER DEVICES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION OF ICU MEDICAL, INC., 2024

- FIGURE 9 CLOSED SYSTEM TRANSFER DEVICES MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION

- FIGURE 10 CLOSED SYSTEM TRANSFER DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 11 CLOSED SYSTEM TRANSFER DEVICE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH FOR US MARKET

- FIGURE 12 CLOSED SYSTEM TRANSFER DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 13 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS, 2024-2029

- FIGURE 14 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 15 DATA TRIANGULATION METHODOLOGY

- FIGURE 16 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM, 2025 VS. 2030 (USD MILLION)

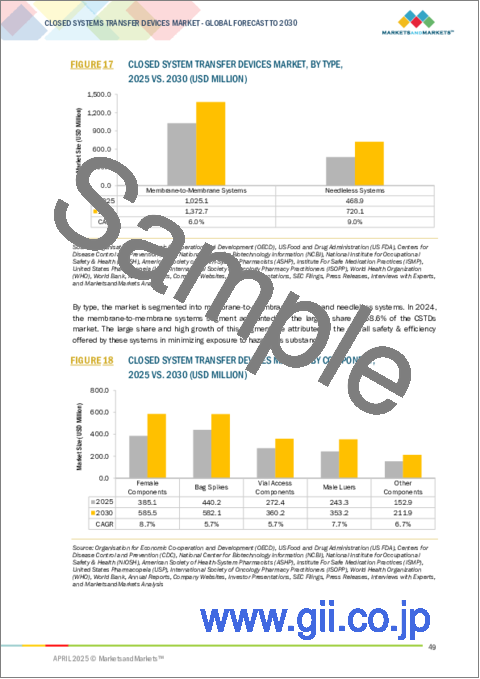

- FIGURE 17 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 GEOGRAPHIC SNAPSHOT OF CLOSED SYSTEM TRANSFER DEVICES MARKET

- FIGURE 22 RISING INCIDENCE OF CANCER AND SUBSEQUENT USE OF CHEMOTHERAPY TO DRIVE MARKET

- FIGURE 23 DIAPHRAGM-BASED DEVICES SEGMENT AND JAPAN LED ASIA PACIFIC CLOSED SYSTEM TRANSFER DEVICES MARKET IN 2024

- FIGURE 24 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 25 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 26 CHINA TO GROW AT HIGHEST GROWTH CAGR DURING FORECAST PERIOD

- FIGURE 27 CLOSED SYSTEM TRANSFER DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 NEW REVENUE POCKETS FOR PLAYERS IN CLOSED SYSTEM TRANSFER DEVICES MARKET

- FIGURE 29 AVERAGE SELLING PRICE TREND OF CLOSED SYSTEM TRANSFER DEVICES, BY COMPONENT, 2022-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF CLOSED SYSTEM TRANSFER DEVICES, BY KEY PLAYER, 2022-2024 (USD)

- FIGURE 31 AVERAGE SELLING PRICE OF CLOSED SYSTEM TRANSFER COMPONENTS, BY REGION, 2022-2024 (USD)

- FIGURE 32 CLOSED SYSTEM TRANSFER DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 33 CLOSED SYSTEM TRANSFER DEVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 ASSISTED REPRODUCTIVE TECHNOLOGY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 36 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 37 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 38 PATENT ANALYSIS, JANUARY 2015-MARCH 2025

- FIGURE 39 IMPORT DATA FOR HS CODE 901890 COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 40 EXPORT DATA FOR HS CODE 901890 COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 41 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- FIGURE 43 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

- FIGURE 44 AI USE CASES

- FIGURE 45 CLOSED SYSTEM TRANSFER DEVICE PRICING PER UNIT, BY VENDOR

- FIGURE 46 CLOSED SYSTEM TRANSFER DEVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 47 NORTH AMERICA: CLOSED SYSTEM TRANSFER DEVICES MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET SNAPSHOT

- FIGURE 49 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN CLOSED SYSTEM TRANSFER DEVICES MARKET, 2020-2024

- FIGURE 50 CLOSED SYSTEM TRANSFER DEVICES MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 51 R&D EXPENDITURE OF KEY PLAYERS IN CLOSED SYSTEM TRANSFER DEVICES MARKET, 2022 VS. 2023

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 53 EV/EBITDA OF KEY VENDORS

- FIGURE 54 CLOSED SYSTEM TRANSFER DEVICES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 55 CLOSED SYSTEM TRANSFER DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 CLOSED SYSTEM TRANSFER DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 57 CLOSED SYSTEM TRANSFER DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 BD: COMPANY SNAPSHOT (2024)

- FIGURE 59 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 60 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2023)

- FIGURE 61 JMS CO. LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 62 BAXTER: COMPANY SNAPSHOT (2024)

- FIGURE 63 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 64 TERUMO CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 65 CARDINAL HEALTH: COMPANY SNAPSHOT (2024)

The closed system transfer devices (CSTDs) market is projected to reach USD 2.09 billion by 2030, from USD 1.49 billion in 2025, at a CAGR of 7.0%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Component, Closing Mechanism, Type, Technology, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

With the increased consciousness and interest in the safety of healthcare workers, there is an increasing market demand for closed system transfer devices. Healthcare institutions are spending more on these devices to advance safety procedures and shield their workers against the dangers of working with unsafe drugs. This rising demand will, therefore, boost the growth of the closed system transfer devices market as healthcare facilities prioritize taking safety measures to secure their workforce.

Depending on the closing mechanism, the color-to-color alignment system segmented shall increase at the highest CAGR in the closed system transfer devices market.

On the basis of components, the vial access segment held the largest market share of the closed system transfer devices market. Vial access components have a crucial function in reducing the risk of needlestick injury among healthcare professionals and avoiding drug contamination while transferring. Additionally, ease of handling enables quick medication preparation and minimizes the risk of errors related to open systems. Thus, addressing safety and efficiency requirements, the vial access components segment is likely to drive the market.

Based on the end-user segment, the hospitals & clinics subsegment is dominated the closed system transfer devices market. In contrast to other medical facilities, hospitals and clinics have a bigger budget for medical equipment. This gives them the capability to spend on the newest CSTD technology while keeping abreast with regulations and best practices. Further, hospitals and clinics are under more rigid regulations on handling medication and employee protection. CSTDs assist them in fulfilling these needs by reducing the risk of exposure to dangerous drugs and avoiding medication errors.

North America is expected to account for the largest share of the closed system transfer devices market during the forecast period. This is due to the increased awareness by healthcare professionals towards the significance of the safe handling of drugs as well as a well-established infrastructure of healthcare and rigorous regulatory requirements. The region has been leading in the adoption of sophisticated medical technology to improve patient care and safety.

A breakdown of the primary participants (supply-side) for the closed system transfer devices market referred to for this report is provided below:

- By Company Type: Tier 1: 42%, Tier 2: 37%, and Tier 3: 21%

- By Designation: C-level: 39%, Director Level: 33%, and Others: 28%

- By Region: North America: 64%, Europe: 17%, Asia Pacific: 7%, Latin America: 6%, Middle East & Africa: 6%

Prominent players in the closed system transfer device market are BD (US), ICU Medical, Inc. (US), EQUASHIELD (US), JMS Co. Ltd. (Japan), Baxter (US), B Braun Melsungen AG (Germany), West Pharmaceuticals Services, Inc. (US) and Terumo Corporation (Japan).

Research Coverage

The report evaluates the closed system transfer devices market and estimates the market size and future growth potential based on various segments, including closing mechanism, type, component, technology, end user, and region. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leaders/new entrants with data on the nearest approximations of the revenue numbers for the overall closed system transfer devices market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gain further insights to better place their businesses and make appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (growing incidence of cancer and subsequent use of chemotherapy, Increasing regulatory approvals for oncology therapeutics, rising awareness about risks associated with handling antineoplastic drugs, stringent regulatory guidelines for handling hazardous medication), restraints (high implementation costs and limited reimbursements, Inconsistent regulatory compliance), opportunities (growth potential across therapeutic applications, rising healthcare expenditure in emerging economies) and challenges (impact of closed system transfer devices on drug quality, low awareness and poor implementation of protective measures)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global closed system transfer devices market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by closing mechanism, type, component, technology, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global closed system transfer devices market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global closed system transfer devices market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 CLOSED SYSTEM TRANSFER DEVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY AND COUNTRY, 2024

- 4.3 CLOSED SYSTEM TRANSFER DEVICES MARKET: REGIONAL MIX

- 4.4 CLOSED SYSTEM TRANSFER DEVICES MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS

- 4.5 CLOSED SYSTEM TRANSFER DEVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing incidence of cancer and subsequent use of chemotherapy

- 5.2.1.2 Increasing regulatory approvals for oncology therapeutics

- 5.2.1.3 Rising awareness about risks associated with handling antineoplastic drugs

- 5.2.1.4 Stringent regulatory guidelines for handling hazardous medication

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs and limited reimbursements

- 5.2.2.2 Inconsistent regulatory compliance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential across therapeutic applications

- 5.2.3.2 Rising healthcare expenditure in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of closed system transfer devices on drug quality

- 5.2.4.2 Low awareness and poor implementation of protective measures

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY COMPONENT

- 5.4.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.5.2 MATERIAL COMPONENT PROCUREMENT AND MANUFACTURING

- 5.5.3 MARKETING & SALES, SHIPMENT, AND AFTERSALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Needle-free systems

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Integration of sensors

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Advancements in containments

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 INTEGRATION OF FILTERS IN CLOSED SYSTEM TRANSFER DEVICES

- 5.10.2 AUTOMATION OF TRANSFER PROCESSES

- 5.10.3 ADVANCED MATERIALS FOR DURABILITY AND COMPATIBILITY WITH COMPLEX DRUG FORMULATIONS

- 5.11 PATENT ANALYSIS

- 5.12 TRADE DATA ANALYSIS

- 5.12.1 IMPORT DATA

- 5.12.2 EXPORT DATA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: EXTENSION OF BEYOND-USE DATE OF SINGLE-DOSE VIALS AT MOUNT SINAI HOSPITAL

- 5.14.2 CASE STUDY 2: ENHANCED SAFETY AND EFFICIENCY OF DRUG COMPOUNDING AT NEBRASKA METHODIST HOSPITAL

- 5.14.3 CASE STUDY 3: PREVENTION OF MICROBIAL CONTAMINATION DURING SIMULATED WORST-CASE SCENARIOS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY STANDARDS AND APPROVALS

- 5.15.1.1 US

- 5.15.1.1.1 USP <800> Regulations

- 5.15.1.1.2 National Institute for Occupational Safety and Health

- 5.15.1.1.3 American Society of Health-System Pharmacists

- 5.15.1.1.4 International Society of Oncology Pharmacy Practitioners

- 5.15.1.2 European Union

- 5.15.1.1 US

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.1 REGULATORY STANDARDS AND APPROVALS

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 IMPACT OF GEN AI ON CLOSED SYSTEM TRANSFER DEVICES MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 MARKET POTENTIAL OF AI IN ASSISTED REPRODUCTIVE TECHNOLOGY MARKET

- 5.19.3 AI USE CASES

- 5.19.4 KEY COMPANIES IMPLEMENTING AI

- 5.19.5 FUTURE OF GENERATIVE AI IN CLOSED SYSTEM TRANSFER DEVICES MARKET

- 5.20 IMPACT OF US TARIFF REGULATION ON CLOSED SYSTEM TRANSFER DEVICES MARKET

- 5.20.1 NORTH AMERICA

- 5.20.2 EUROPE

- 5.20.3 ASIA PACIFIC

- 5.20.4 LATIN AMERICA

- 5.20.5 MIDDLE EAST & AFRICA

6 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY CLOSING MECHANISM

- 6.1 INTRODUCTION

- 6.2 LUER LOCK SYSTEMS

- 6.2.1 GROWING PREVALENCE OF INJECTABLE DRUGS TO PROPEL MARKET

- 6.3 PUSH-TO-TURN SYSTEMS

- 6.3.1 INCREASING FOCUS ON COMPLYING WITH REGULATIONS AND GUIDELINES FOR SAFE HANDLING OF DRUGS TO AID GROWTH

- 6.4 CLICK-TO-LOCK SYSTEMS

- 6.4.1 LOW IMPLEMENTATION COST TO CONTRIBUTE TO GROWTH

- 6.5 COLOR-TO-COLOR ALIGNMENT SYSTEMS

- 6.5.1 GROWING FOCUS ON CURBING RISK OF MEDICATION ERRORS TO FUEL MARKET

7 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MEMBRANE-TO-MEMBRANE SYSTEMS

- 7.2.1 INCREASING FOCUS ON SAFEGUARDING HEALTH AND WELL-BEING OF HEALTHCARE PROVIDERS TO EXPEDITE GROWTH

- 7.3 NEEDLELESS SYSTEMS

- 7.3.1 EVOLVING MEDICAL DEVICE TECHNOLOGY LANDSCAPE TO STIMULATE GROWTH

8 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 VIAL ACCESS COMPONENTS

- 8.2.1 GROWING CONCERNS SURROUNDING HEALTHCARE-ASSOCIATED INFECTIONS TO DRIVE MARKET

- 8.3 MALE LUERS

- 8.3.1 NEED TO PREVENT AIR EMBOLISM AND PRESERVE INTEGRITY OF INTRAVENOUS SYSTEMS TO PROMOTE GROWTH

- 8.4 BAG SPIKES

- 8.4.1 GROWING FOCUS ON ENHANCED SAFETY, EFFICIENCY, AND PRECISION IN HANDLING AND ADMINISTRATING HAZARDOUS DRUGS TO BOOST MARKET

- 8.5 FEMALE COMPONENTS

- 8.5.1 NEED TO PREVENT CONTAMINATION OF DRUGS AND EQUIPMENT TO ENCOURAGE GROWTH

- 8.6 OTHER COMPONENTS

9 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 DIAPHRAGM-BASED DEVICES

- 9.2.1 INCREASING USE OF DIAPHRAGM-BASED DEVICES IN CHEMOTHERAPY AND OTHER ONCOLOGY TREATMENTS TO FOSTER GROWTH

- 9.3 COMPARTMENTALIZED DEVICES

- 9.3.1 NEED TO MAINTAIN INTEGRITY OF MEDICATIONS DURING TRANSFER TO SUSTAIN GROWTH

- 9.4 AIR CLEANING/FILTRATION DEVICES

- 9.4.1 NEED FOR CLEAN AND STERILE ENVIRONMENT WITHIN PHARMACEUTICAL AND HEALTHCARE FACILITIES TO FACILITATE GROWTH

10 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS & CLINICS

- 10.2.1 GROWING FOCUS ON ENHANCED STAFF AND PATIENT SAFETY IN HEALTHCARE SETTINGS TO BOOST MARKET

- 10.3 ONCOLOGY CENTERS

- 10.3.1 NEED TO MINIMIZE RISK OF OCCUPATIONAL EXPOSURE TO AUGMENT GROWTH

- 10.4 OTHER END USERS

11 CLOSED SYSTEM TRANSFER DEVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Rising focus on best practice recommendations and mandates for healthcare workers to aid growth

- 11.2.3 CANADA

- 11.2.3.1 Increasing demand for antineoplastic drugs to assist growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growing emphasis on healthcare protocols to propel market

- 11.3.3 UK

- 11.3.3.1 Strict guidelines for handling hazardous drugs to promote growth

- 11.3.4 FRANCE

- 11.3.4.1 High healthcare expenditure to accelerate growth

- 11.3.5 SPAIN

- 11.3.5.1 Increasing incidence of cancer to favor growth

- 11.3.6 ITALY

- 11.3.6.1 Rising geriatric population and subsequent prevalence of chronic diseases to aid growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Established healthcare system and rising geriatric population to drive market

- 11.4.3 CHINA

- 11.4.3.1 Large target patient population to stimulate growth

- 11.4.4 INDIA

- 11.4.4.1 Rising adoption of chemotherapy procedures to facilitate growth

- 11.4.5 AUSTRALIA AND NEW ZEALAND

- 11.4.5.1 Rising incidence of chronic diseases to speed up growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Shift to aging demography to spur growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Booming healthcare and pharmaceutical sectors to amplify growth

- 11.5.3 MEXICO

- 11.5.3.1 Rising initiatives on universal healthcare coverage to support growth

- 11.5.4 COLOMBIA

- 11.5.4.1 Growing prioritization of patient and worker safety to bolster growth

- 11.5.5 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Higher disposable incomes to expedite growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 R&D ASSESSMENT OF KEY PLAYERS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICES

- 12.7 BRAND/PRODUCT COMPARISON

- 12.7.1.1 BD

- 12.7.1.2 ICU Medical, Inc.

- 12.7.1.3 B. Braun Melsungen AG

- 12.7.1.4 JMS Co. Ltd.

- 12.7.1.5 Baxter

- 12.7.1.6 EQUASHIELD

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.8.5.1 Company footprint

- 12.8.5.2 Region footprint

- 12.8.5.3 Closing mechanism footprint

- 12.8.5.4 Type footprint

- 12.8.5.5 Component footprint

- 12.8.5.6 Technology footprint

- 12.8.5.7 End-user footprint

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Competitive benchmarking of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES AND APPROVALS

- 12.10.2 DEALS

- 12.10.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BD

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ICU MEDICAL, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 B. BRAUN MELSUNGEN AG

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches and approvals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 JMS CO. LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 BAXTER

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 WEST PHARMACEUTICAL SERVICES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 TERUMO CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 CARDINAL HEALTH

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 EQUASHIELD

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches and approvals

- 13.1.9.3.2 Deals

- 13.1.10 SIMPLIVIA HEALTHCARE LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 YUKON MEDICAL

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 CODAN MEDIZINISCHE GERATE GMBH

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 VYGON

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 ELCAM MEDICAL

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 PRACTIVET, INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.1 BD

- 13.2 OTHER COMPANIES

- 13.2.1 CARAGEN

- 13.2.2 CORVIDA MEDICAL

- 13.2.3 VICTUS

- 13.2.4 EPIC SYSTEMS CORPORATIONS

- 13.2.5 ERASER MEDICAL

- 13.2.6 NEEDLELESS CORPORATION

- 13.2.7 AMSINO INTERNATIONAL, INC.

- 13.2.8 INSUNG MEDICAL CO., LTD.

- 13.2.9 ADVCARE MEDICAL, INC.

- 13.2.10 SHANDONG ANDE HEALTHCARE APPARATUS CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS