|

市場調査レポート

商品コード

1438112

オーガニックスキンケア製品:市場シェア分析、業界動向と統計、成長予測(2024-2029)Organic Skincare Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オーガニックスキンケア製品:市場シェア分析、業界動向と統計、成長予測(2024-2029) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 172 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

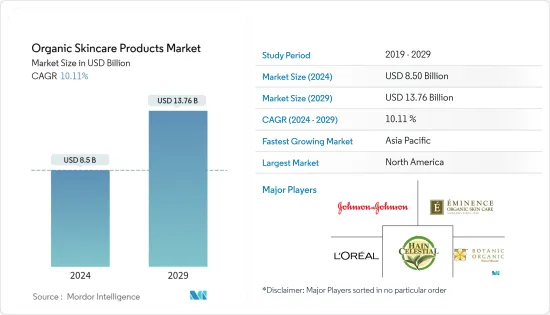

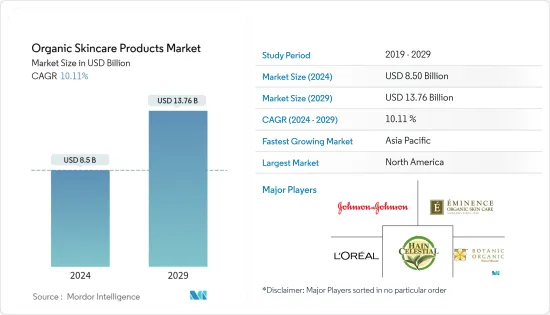

オーガニックスキンケア製品の市場規模は、2024年に85億米ドルと推定され、2029年までに137億6,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に10.11%のCAGRで成長します。

スキンケアはパーソナルケアの重要な部分です。メイクの修正から予防までを網羅しています。美容業界の革新と発展により、健康に優しい、改良された製品の提供が約束されています。スキンケア効果を備えたメイクアップは、かなり前から市場で普及しています。皮膚の過敏症と化学製品や合成製品の有害な影響についての認識は、オーガニックおよびナチュラルスキンケア製品市場の成長を促進するいくつかの要因です。ほとんどの消費者は、天然またはオーガニックという用語を連想して製品を購入する傾向があります。彼らは通常、製品の製造に使用される成分に焦点を当てません。

美容クリームやフェイスクリームに有害な化学物質が含まれていると、皮膚の過敏性の問題により発疹やアレルギーを引き起こす可能性があります。毎日の過剰なメイクは肌にしわの原因となり、肌が荒れて天然のヒアルロン酸が失われることがあります。これらは、有害な化学物質が少なく、天然成分の恩恵がより多く含まれるオーガニック製品の選好を高めるいくつかの要因です。市場には女性用スキンケア製品が豊富にありますが、男性用スキンケア製品の意識も高まり需要も高まっています。汚染や紫外線などの環境要因は、皮膚細胞にダメージを与え、ニキビを引き起こす可能性があります。オーガニック製品はニキビを軽減し、有害な紫外線から肌を守ります。このような要因により、今後5年間でオーガニックスキンケア製品市場の成長が促進されると予想されます。

オーガニックスキンケア製品の市場動向

パラベンフリーの製品が続々と発売されています

パラベンは、化粧品や医薬品に最も広く使用されている防腐剤です。パラベンには多くの副作用があるため、消費者はスキンケア製品の成分としてパラベンを避けることをより懸念するようになっています。それらは体内のホルモンを乱し、皮膚の炎症を引き起こす可能性があります。オーガニック製品の増加に伴い、プロピルパラベンやブチルパラベンなどの合成化合物は安全とは考えられなくなりました。製品がパラベンを含まない場合、ラベルには通常「パラベンを含まない」と表示されます。イソプロピルパラベンとイソブチルパラベンを記載したラベルも、パラベンが含まれていないことを示しています。美容業界では、依然としてパラベンやその他の望ましくない成分を含む製品が多くのカテゴリーで売上の大きなシェアを占めています。しかし、これらのカテゴリーはパラベンフリーのスキンケア製品に移行しつつあります。 2021年1月、ルネコスメティックスからプレミアムフェイスオイルが発売されました。この製品はFDAの承認を受けており、クルティフリー、パラベンフリー、オーガニックであると主張しています。

アジア太平洋が最高の成長率を記録

アジア太平洋は、スキンケア、サンケア、ヘアケア、カラー化粧品、デオドラント、フレグランスなどの多くの人気カテゴリーの点で、世界中の化粧品業界で最も多様でダイナミックな市場の1つです。この地域で使われています。したがって、この地域は依然として世界中のオーガニックスキンケア製品の潜在的な市場です。アジア太平洋地域は、予測期間中に最も急速な成長を遂げると予想されます。人口の高齢化、オーガニック製品への意識の高まり、ミレニアル世代の増加、働く女性の増加が、この地域におけるオーガニックスキンケアの促進要因となっています。市場関係者も広告やプロモーションを通じて消費者にオーガニック製品の購入を奨励しています。彼らは需要を考慮して市場でのポートフォリオを拡大しています。たとえば、2022年 6月、大手スキンケアブランドのサミシャオーガニックはインド市場で新しいスキンケア製品を発売しました。製品には、保湿剤、フットケアクリーム、洗顔料、ヘア&ネイルケアクリームが含まれます。また、この地域でのオーガニックスキンケア製品のブランディングと広告への投資が増加しているため、この市場は予測期間中に繁栄すると予想されます。さらに、アジア太平洋地域では、中国が調査市場を独占しており、日本、韓国などがそれに続きます。

オーガニックスキンケア製品業界の概要

世界のオーガニックスキンケア製品市場は競争が激しいです。同社は、The Hain Celestial Group(Avalon Natural Products Inc.)、L'Oreal SA、Johnson &Johnsonなどの地域および国際的な競合企業で構成されています。企業が採用する主な市場戦略は、新製品の発売、契約/パートナーシップ、拡張、合併、買収です。企業は、ポートフォリオを強化し、未開拓の市場を獲得し、オーガニックスキンケア製品市場をさらに推進するために、集中的な研究開発活動、販売ネットワーク、新製品の開発など、それぞれの主要な強みを活用するために合併および買収戦略を採用しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- タイプ

- フェイシャルケア

- クレンザー

- 保湿剤およびオイル/セラム

- その他のフェイシャルケア製品

- ボディケア

- ボディローション

- ボディウォッシュ

- その他のボディケア製品

- フェイシャルケア

- 流通経路

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア

- 専門店

- オンライン小売店

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 北米のその他の地域

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- アラブ首長国連邦

- 南アフリカ

- その他中東およびアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- The Hain Celestial Group(Avalon Organics)

- Jhonson &Jhonson

- Starflower Essential Organic Skin Care

- Thesis Beauty

- Eminence Organic Skin Care

- Botanic Organic LLC

- Phyt's USA

- L'Oreal SA(Garnier)

- Forrest Essentials

- Honasa Consumer Pvt. Ltd(Ayuga, Mamaearth)

- Naturals Skincare(Pearl)

第7章 市場機会と将来の動向

The Organic Skincare Products Market size is estimated at USD 8.5 billion in 2024, and is expected to reach USD 13.76 billion by 2029, growing at a CAGR of 10.11% during the forecast period (2024-2029).

Skincare is an essential part of personal care. It includes everything from correction to prevention in the makeup process. The innovations and developments in the beauty industry promise to deliver improved products with a health-friendly touch. Makeup with skincare benefits has been prevalent in the market for quite a while now. Skin sensitivity and awareness about the harmful effects of chemicals and synthetic products are some factors driving the growth of the organic and natural skincare products market. Most of the consumer base tends to buy products with the terms natural or organic associated with them. They generally do not focus on the ingredients used in the product's manufacturing.

The presence of harmful chemicals in beauty and face creams can cause rashes and allergies because of skin sensitivity issues. Excessive use of makeup daily may cause wrinkles on the skin, and it becomes rough and loses natural hyaluronic acid. These are some factors increasing the preference for organic products containing less harmful chemicals and more benefits from natural ingredients. Although women's skin care products are abundant in the market, the demand for men's skincare products is also gaining traction with growing awareness. Environmental factors, like pollution and UV rays, can damage skin cells and causes acne. Organic products reduce acne and protect the skin from harmful UV rays. Such factors are expected to augment the growth of the organic skincare products market over the next five years.

Organic Skincare Products Market Trends

Paraben-free Products are Being Increasingly Launched

Parabens are the most widely used preservatives in cosmetics and pharmaceutical products. Consumers are becoming more concerned about avoiding parabens as an ingredient in their skincare products as they have many side effects. They can disrupt hormones in the body and also cause skin irritation. With the growth of organic products, synthetic compounds like propylparaben and butylparaben are not considered safe. If a product is paraben-free, the label will typically show "free from parabens." Labels stating Isopropylparaben and isobutylparaben also indicate the absence of parabens. For the beauty industry, many categories still derive a significant share of sales from products with parabens and other undesirable ingredients. However, those categories are shifting to paraben-free skincare products. In January 2021, Renee Cosmetics launched premium face oils. the product is FDA- approved and claims to be crulty-free, paraben-free, and organic.

Asia-Pacific Registering the Highest Growth Rate

Asia-Pacific is one of the most diverse and dynamic markets in the cosmetic industry across the world in terms of many popular categories, such as skin care, sun care, hair care, color cosmetics, deodorants, and fragrances, which are the most commonly used in this region. Hence, the region remains a potential market for organic skincare products worldwide. The Asia-Pacific region is expected to witness the fastest growth during the forecast period. An aging population, increasing awareness of organic products, an increasing number of millennials and more working women are the driving factors for organic skincare in this region. The market players are also encouraging consumers to buy organic products through advertising and promotions. They are expanding their portfolios in the market considering the demand for it. For instance, in June 2022, a leading skin care brand Samisha Organic launched new skin care products in Indian market. The products include moisturizers, foot care creams, face wash, and hair & nail care creams. Also, with increasing investments toward branding and advertising organic skincare products in the region, this market is expected to flourish during the forecast period. Moreover, in Asia-Pacific, China dominates the market studied, followed by Japan, South Korea, and others.

Organic Skincare Products Industry Overview

The global organic skincare products market is highly competitive. It comprises regional and international competitors such as The Hain Celestial Group (Avalon Natural Products Inc.), L'Oreal SA, Johnson & Johnson, and others. The major market strategies adopted by the companies are new product launches, agreements/partnerships, expansions, mergers, and acquisitions. Companies are adopting merger and acquisition strategies to utilize their respective key strengths, such as intense R&D activities, distribution network, and the development of new products to enhance the portfolio, capture the untapped markets and drive the organic skincare products market further.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Facial Care

- 5.1.1.1 Cleansers

- 5.1.1.2 Moisturizers and Oils/Serums

- 5.1.1.3 Other Facial Care Products

- 5.1.2 Body Care

- 5.1.2.1 Body Lotions

- 5.1.2.2 Body Wash

- 5.1.2.3 Other Body Care Products

- 5.1.1 Facial Care

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Specialist Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 The Hain Celestial Group (Avalon Organics)

- 6.3.2 Jhonson & Jhonson

- 6.3.3 Starflower Essential Organic Skin Care

- 6.3.4 Thesis Beauty

- 6.3.5 Eminence Organic Skin Care

- 6.3.6 Botanic Organic LLC

- 6.3.7 Phyt's USA

- 6.3.8 L'Oreal SA (Garnier)

- 6.3.9 Forrest Essentials

- 6.3.10 Honasa Consumer Pvt. Ltd (Ayuga, Mamaearth)

- 6.3.11 Naturals Skincare (Pearl)