|

市場調査レポート

商品コード

1910524

薬局自動化:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Pharmacy Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 薬局自動化:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 153 Pages

納期: 2~3営業日

|

概要

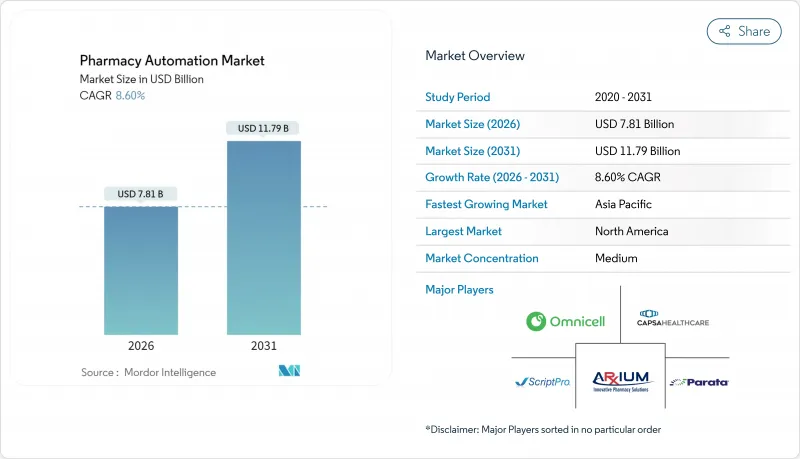

薬局自動化市場は、2025年の71億9,000万米ドルから2026年には78億1,000万米ドルへ成長し、2026年から2031年にかけてCAGR8.6%で推移し、2031年までに117億9,000万米ドルに達すると予測されております。

処方箋数の増加、慢性疾患の蔓延、高齢化、そして持続的な労働力不足が相まって、自動調剤、調合、在庫管理に対する需要が高まっています。2023年11月に施行される米国薬局方(USP)797に基づく新たな無菌調剤規則は、医療従事者と患者双方を保護するロボットソリューションへの移行を促進しています。従来型医療機器メーカーとニッチな自動化専門企業が、病院・小売・通信販売の同一購買層を争うことで競合激化が進んでいます。BDによる2024年9月のパラタ・システムズ買収に代表される業界再編は、規模拡大とエンドツーエンド能力の競争を示しています。ロボットに組み込まれた人工知能(AI)は、単なる調剤ハードウェアをデータ駆動型資産へと変革し、エラー率の低減、薬局業務の自動化、そして2023年の米国承認薬の80%以上を占めた専門薬の増加分管理を実現します。

世界の薬局自動化市場の動向と洞察

処方箋数量と薬剤処理量の増加

世界の処方箋数は増加を続けており、多くの病院薬局では現在、1日あたり数千件の注文を処理しています。スイスログ社のPillPickのような高密度ロボット保管システムは5万単位以上の薬剤を保管可能で、調剤工程における人的接触を複数回削減し、急増する処理量に対応します。セントラルフィルプログラムはさらなる規模拡大をもたらします。CoverMyMeds社の「Central Fill-as-a-Service」プラットフォームは、現場の人員削減を図りながら処方箋あたりのコストを30%削減可能です。これらの技術は、処理量が増加する中でもコンプライアンスを確保し、追跡可能性のためにUSP 797で要求されるデジタルログを提供します。

高齢化人口の拡大と慢性疾患の負担増加

65歳以上の高齢者は急速に増加する層であり、5種類以上の処方箋を管理しているケースが少なくありません。長期療養施設(LTC)薬局では、時間指定投与量をポーチ包装する自動化を導入し、誤投与を減らし服薬遵守率を向上させています。FrameworkLTCの報告によれば、ワークフローロボティクスによりスタッフの業務時間が予防接種やポイントオブケア検査に振り向けられ、収益源を拡大しながら慢性疾患ケア計画を支援しています。米国医薬品サプライチェーン安全保障法もバーコードベースの追跡を加速させ、LTC環境では自動検証が不可欠となっています。

初期資本投資と維持コストの高さ

ロボット本体、設置、ソフトウェアへの先行投資は薬局の予算を圧迫します。CoverMyMeds社のCFaaS(処方箋単位課金型)のようなファイナンスモデルは、費用を運営経費に転換することで資本障壁を解消します。独立系薬局ではQx-Dextronのようなコンパクトロボットが採用されており、1年未満で投資回収が可能で、1日あたり1kWh未満の電力消費により光熱費を最小限に抑えます。しかしながら、2010年頃に導入された多くのロボットが寿命を迎えつつあり、運営者は更新サイクルの予算計上が必要となっています。

セグメント分析

自動調剤システムは、単回投与量保管、バーコードチェック、電子健康記録と連携する安全引き出し機能により、2025年時点で薬局自動化市場の47.07%のシェアを維持しました。一方、無菌調剤ロボットプラットフォームは、USP 797基準の厳格化に対応するため、医療機関が有害薬剤調製を自動化する動きを受け、2031年までの予測で最高となる10.28%のCAGRを記録しました。ロボット調剤の薬局自動化市場規模は、AIビジョンと重量測定による汚染リスク低減により、着実な成長が見込まれます。

自動包装・ラベリングソリューションは技術者の作業時間を半減させ、自動錠剤カウンターは地域薬局に1分未満のサイクルタイムをもたらします。保管・取り出しモジュールは垂直カルーセルで設置面積を圧縮し、分析ダッシュボードは薬剤リスト合理化に資する需要パターンを可視化します。薬剤師ワークフローソフトウェアには現在、在庫基準量を提案し滞留品を警告するAIが組み込まれ、業務データを臨床意思決定支援と連動させています。

2025年の医薬品処理量の大半は病院環境で処理され、救急対応・慢性疾患管理導入・急性期医療需要に後押しされ、薬局自動化市場シェアの61.94%を占めました。BD社のPyxis MedStation ESなどのシステムは、閉鎖型調剤とリアルタイム在庫テレメトリーを提供し、病棟への取り出し回数を削減します。大規模学術センターに接続された中央薬局調剤ハブは、さらに処理能力と一貫性を拡大します。

通信販売およびe薬局事業者は、最も高い11.29%のCAGR見通しを示しています。Amazon Pharmacyは当日配送と価格透明性アプリケーションを組み合わせ、CVS Healthのデジタル処方箋管理ツールは慢性疾患治療の継続的な処方箋更新を確保します。プラハのDr. Maxにおけるトート・トゥ・パーソンシステムのような高層自動倉庫は、毎時数千件の注文を事前仕分けし、ロボット包装ステーションに供給します。小売チェーンは、待ち時間を2分未満に抑えるコンパクトカウンターとピック・トゥ・ライト棚を備えたPOS拠点の改修を継続しています。

地域別分析

北米の収益シェア41.12%は、成熟した電子健康記録(EHR)接続性、支払者による誤り削減圧力、自動化プロセスの承認を加速するFDAの先進製造技術指定プログラムなどに支えられています。大規模医療システムはUSP 797改訂を受けて無菌調剤ロボットへ資本を集中させ、カナダ各州では薬剤師不足対策として自動化投資を助成しています。

アジア太平洋地域は9.39%という最高CAGRを記録しており、インド、中国、韓国が病院とサプライチェーンのデジタル化を急速に進めています。ISPEは、国境を越えた製造パートナーシップが自動充填・検査ラインへの資本流入を支えていると指摘しています。AI需要予測とベンダー管理在庫を導入した中国のパイロット事業では、在庫回転率が二桁の向上を記録しました。インドネシアとベトナムは医薬品検査協力機構(PICS)を通じた地域規制の整合性に依存し、外国ベンダーの参入を容易にし品質保証(QA)を標準化しています。

EUは北米に比べ総額では遅れをとっていますが、規制の確実性という利点があります。2024年8月から施行されているEU AI法は、医療用AIのリスク階層を規定しており、病院が調剤ロボット、クラウド分析、AI安全チェックを薬局業務に導入する際の法的明確性を提供しています。北欧諸国やイベリア半島の遠隔地域では、テレファーマシーを介して運用される分散型キャビネットが採用され、厳格なデータプライバシー法に準拠しながら薬剤へのアクセスを拡大しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 処方箋量の増加と薬剤処理量の拡大

- 高齢化人口の拡大と慢性疾患の負担増加

- 患者安全性の向上と誤り削減の要請

- 中央調剤・ハブ薬局への移行

- 在庫最適化のための人工知能の統合

- 専門薬調剤の複雑性急増

- 市場抑制要因

- 初期資本投資額と維持管理コストの高さ

- 業務フローの混乱とスタッフ研修の障壁

- 接続システムにおけるデータセキュリティとプライバシーに関する懸念

- ロボットによる無菌調剤に関する規制の曖昧さ

- 規制情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品別

- 自動調剤システム

- 自動包装・ラベリングシステム

- 自動卓上タブレットカウンター

- 自動倉庫システム

- ロボット式無菌調剤システム

- 薬剤師向けワークフロー・分析ソフトウェア

- エンドユーザー別

- 病院薬局(入院患者向け、外来患者向け)

- 小売薬局・チェーン薬局

- 通信販売/オンライン薬局

- 長期療養・専門薬局

- 展開モデル別

- 集中型自動化ハブ

- 分散型ポイント・オブ・ケアユニット

- 薬局規模別

- 500床以上/250店舗以上

- 100~499床/50~249店舗

- 100床未満/ 独立店舗

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Accu-Chart Plus Healthcare Systems

- ARxIUM

- Baxter International Inc.

- Capsa Healthcare

- BD(Becton, Dickinson & Co.)

- Grifols(LogiFill)

- ICU Medical(IntelliMix)

- Innotech Espana(Rowa)

- McKesson Corporation

- NewIcon Oy

- Omnicell Inc.

- Oracle Health(Cerner Rx)

- Parata Systems LLC

- Pearson Medical Technologies

- RxSafe LLC

- ScriptPro LLC

- Swisslog Healthcare

- Talyst Systems(Swisslog)

- TouchPoint Medical

- Yuyama Co. Ltd.