|

市場調査レポート

商品コード

1852091

貨物追跡ソリューション:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Track And Trace Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 貨物追跡ソリューション:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年08月01日

発行: Mordor Intelligence

ページ情報: 英文 134 Pages

納期: 2~3営業日

|

概要

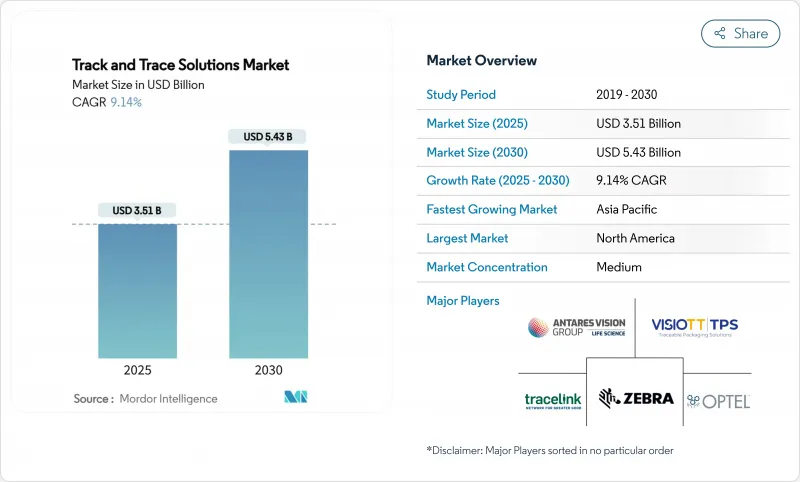

貨物追跡ソリューション市場は、2025年には35億1,000万米ドルと評価され、2030年には54億3,000万米ドルに達すると予測され、CAGRは9.14%となります。

医薬品サプライチェーン全体における規制圧力の高まりにより、シリアライゼーションはコンプライアンス上の課題から戦略的差別化要因へと変化しており、企業はより洗練されたデータリッチなプラットフォームへの投資を促しています。シリアライゼーションとアグリゲーションがクラウドアーキテクチャに集約されるにつれ、ベンダーは新たなデータ収益化の道を模索すると同時に、新たなサイバーセキュリティリスクに直面しています。一方、小規模なニッチ・ベンダーの貨物追跡ソリューション市場シェアは、新興地域で拡大しています。これは、モジュール式のクラウド・アーキテクチャにより、グローバルな販売拠点を持たずに競争できるためです。

世界の貨物追跡ソリューション市場の動向と洞察

世界的な医薬品トレーサビリティ規制の収束

標準の調和に向けた機運の高まりにより、企業は単一の展開で複数の管轄区域を満たすシステムを設計する必要に迫られています。そのためベンダーは、国コードを共通のコアにマッピングする柔軟なデータモデルに多額の投資を行い、多国籍工場のライフタイム統合コストを静かに削減しています。その明らかな結果のひとつは、メーカーが地域ごとの入札の代わりにグローバルな提案依頼書を発行し、購買力を集中させ、ベンダーの統合を加速させていることです。このような規制の収束は、同時に、コンフィギュレーションがカスタムコーディングに取って代わるため、ロールアウトのサイクルを短縮し、投資回収期間を短縮し、高度な分析のための予算を確保することを可能にします。

深刻化する偽造医薬品の脅威が患者安全の重要性を高める

偽造ネットワークの巧妙化に伴い、ブランドオーナーはシリアル化の枠を超え、改ざん防止包装、認証アルゴリズム、リアルタイム認証ポータルを組み合わせた多層セキュリティを採用する必要に迫られています。層構造のパッケージの内側に一意の識別子を埋め込むことで、企業は不正な再包装を阻止し、事件発生時のリコール範囲を最小化する新たな抑止力となっています。医療機関は、偽造品の抑制を治療アドヒアランスの向上につなげており、そのことが、より厳格なシリアル化監査を政治的に支持する原動力となっています。その直接的な結果として、ソリューションベンダーは、現場スタッフが毎回コードを検証できるモバイル検査アプリの需要が高まっていると報告しています。

投資の不確実性を生む国レベルのタイムラインの相違

規制のスケジュールが不均等であるため、企業は資本配分を慎重に行わざるを得ず、収益源を守るために国内市場よりも輸出市場を優先することが多いです。財務チームは、実オプション分析を通じてシリアライゼーション・プロジェクトを評価するようになっており、各地域での展開を決定論的な計画ではなく、逐次的なオプションとして扱うようになっています。ソリューションプロバイダーは、販売サイクルを短縮する価格革新である、国の期限が近づいたときにのみ有効になるモジュール式ライセンシングを提供することで対応しています。

セグメント分析

2024年の貨物追跡ソリューション市場規模はソフトウェアが52.64%を占め、2030年までのCAGRは8.63%と予測されます。この加速は、企業が単なるコンプライアンス記録ではなく、業務上の洞察を求めるようになり、シリアライゼーションデータから価値を抽出する方向にシフトしていることを反映しています。プラットフォームベンダーはプロフェッショナルサービスをバンドルする傾向が強まっており、中堅メーカーのスキルギャップを相殺し、スイッチングコストを増加させています。注目すべきパターンは、導入の成功がデータガバナンス・ワークショップから始まっていることで、これは製薬企業におけるITと品質機能の融合を示しています。

ハードウェアは依然として初期コンプライアンスを支えているが、その貨物追跡ソリューションの市場シェアは、資本サイクルが完了する2030年までに29.77%を超える可能性が高いです。印刷、画像検査、改ざん防止モジュールは依然として不可欠であり、ベンダーはモジュール化によってレトロフィット時のライン停止時間を短縮することで差別化を図っています。RFIDプリンターとオンプリンター検証の需要は、包装ラインの段階的なセンサー化を反映して、ハードウェア・バスケット内で最も急速に伸びています。副次的な効果として、第2世代プリンターの再販市場が流動性を増し、新興国の後発メーカーの参入障壁が低くなります。

2024年の貨物追跡ソリューション市場シェアはバーコードが55.76%を占めているが、RFIDソリューションは2030年までCAGR 9.90%で拡大し、その差を着実に縮めると予測されます。手作業によるスキャンを削減しようと躍起になっている医薬品倉庫は、現在、高価値の生物製剤にはRFIDを搭載し、ジェネリック医薬品には2Dコードを残すという混合タグ方式を試験的に導入しており、コストと能力のバランスをとるハイブリッド・アプローチを実証しています。RFIDパレットからのリアルタイムのロケーション・データは、ピック時間を短縮するWMSアルゴリズムに供給され、大規模な流通センターでは、タグのコストを静かに相殺する利点があります。

バーコードの回復力は、ユビキタスなスキャナーと一貫した規制当局の受け入れに起因しており、このテクノロジーは当分の間関連性を保ち続ける。しかし、パッシブUHFインレイの価格下落は、RFIDが広く採用される変曲点が近づいていることを示唆しています。その証拠に、いくつかの国の医療サービスが病院物流にRFIDを要求しており、サプライチェーンにプル効果をもたらしています。このような嗜好の高まりは、包装ラインOEM各社にRFIDトンネルを標準機器に組み込むよう促しています。

地域分析

北米は2024年に42.24%の貨物追跡ソリューション市場シェアを占め、2025年8月までにユニットレベルのトレーサビリティを義務付ける医薬品サプライチェーンセキュリティ法のため、依然として最大地域です。その結果、小規模なジェネリック医薬品企業でさえ、供給の中断を避けるためにプロジェクトを加速させており、検証サービスに対する短期的な需要が高まっています。この地域の成熟した電子カルテインフラは、シリアル化データと臨床転帰のリンクを可能にし、価値ベースの契約に情報を提供するフィードバックループを提供します。この連携はまた、専門療法におけるアドヒアランスの検証を目的とする保険会社による分析投資を刺激します。大規模な卸売業者は、シリアル化をロボット工学と統合することで、手作業による症例処理を減らし、物流センター全体の労働力配分を再構築しています。

アジア太平洋地域はCAGR予測10.29%と最も速い軌道を示し、中国の積極的な偽造品防止キャンペーンとインドの輸出奨励策に支えられています。各国政府は、ローカルコンテンツ規制とトレーサビリティ助成金を組み合わせることが多く、国内IT企業がグローバル・ソリューション・プロバイダーと提携することを奨励しています。多国籍製造業者は、限られたスケジュールの中で、ルールの成熟度に合わせて各国のモジュールを切り替えることができる、コンフィギュラブルなクラウドプラットフォームを選択します。同じアーキテクチャは言語のローカライゼーションにも対応しており、これは言語的に多様な地域にまたがる、微妙だが重要な成功要因です。eコマースの急速な拡大により、規制当局は小包レベルの検証を強化せざるを得なくなり、導入がさらに急務となっています。

欧州は、検証を薬局のカウンターまで押し下げる成熟した偽造医薬品指令により、重要な地位を維持しています。すでに運用されている国家医薬品検証組織のデータベースは、ほぼすべての調剤ポイントをカバーする高密度のスキャンネットワークを支えています。メーカー各社は、カートンに改ざん防止シールを埋め込むことで対応しているが、これは世界的に消費者の期待を高めるデザインの選択です。この地域の次の焦点は環境の持続可能性であり、利害関係者はシリアライゼーション・データがカーボンフットプリント報告をどのようにサポートできるかを模索し、追跡インフラの多面的な可能性を実証しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 世界の医薬品トレーサビリティ規制の収束(WHO、ISO)

- 深刻化する偽造医薬品の脅威患者の安全確保が急務に

- エンド・ツー・エンドの可視性を必要とする患者直販とEコマース・チャネルの急増

- 医薬品サプライチェーンのデジタル化とクラウドネイティブSaaSの採用

- 個別化・少量化治療への移行、柔軟な連続化が必要

- ブランドの評判とリコールコスト回避がT&T分析への投資を促進

- 市場抑制要因

- 投資の不確実性を生む国レベルのタイムラインの相違

- レガシーMES/ERPとパッケージングラインの高い資本コストと統合コスト

- ネットワーク化されたトレーサビリティ・プラットフォームにおけるデータ・プライバシーとサイバーセキュリティ・リスク

- 利益率の低いジェネリック医薬品メーカーのROIは限定的

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- コンポーネント別

- ハードウェアシステム

- 印刷・マーキング機器

- モニタリング&検証システム

- ラベリングと改ざん防止ソリューション

- その他のハードウェア

- ソフトウェアソリューション

- 工場レベル管理スイート

- ラインコントローラーソフトウェア

- バンドル/パレット追跡ソフトウェア

- エンタープライズ&クラウドプラットフォーム

- プロフェッショナル&マネージドサービス

- ハードウェアシステム

- 技術別

- バーコード/2次元データマトリックス

- RFIDとNFC

- 先進IoTセンサーとBLEビーコン

- 用途別

- シリアライゼーションソリューション

- ボトルのシリアル化

- ブリスター&ストリップシリアライゼーション

- カートン&ケースシリアライゼーション

- データマトリクス/QRシリアライゼーション

- アグリゲーション・ソリューション

- バンドルアグリゲーション

- ケースアグリゲーション

- パレットアグリゲーション

- シリアライゼーションソリューション

- エンドユーザー別

- 製薬メーカー

- 製造・包装受託機関(CMOs/CPOs)

- 医療機器メーカー

- ヘルスケア流通・卸売業者

- その他のライフサイエンス・ステークホルダー(OTC、栄養補助食品、化粧品、合法大麻)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- OPTEL Group

- TraceLink Inc.

- Antares Vision SpA

- SEA Vision SRL

- Syntegon Technology GmbH

- Zebra Technologies Corp.

- Mettler-Toledo International Inc.

- Korber Medipak Systems GmbH

- ACG Worldwide

- VISIOTT

- Uhlmann

- Sato Holdings Corporation

- 74Software

- Siemens

- Brother Industries, Ltd.(Domino Printing Sciences plc)

- Dover Corporation(Markem-Imaje)

- Wipotec-OCS GmbH

- Veralto Corporation(Videojet Technologies Inc.)

- Coesia S.p.A.