|

|

市場調査レポート

商品コード

1749594

トラックアンドトレースソリューションの世界市場:製品別、シリアライゼーション別、アグリゲーション別、技術別、エンドユーザー別、地域別 - 予測(~2030年)Track and Trace Solutions Market by Product(Bundle Tracking, Checkweigher, Barcode Scanner, Labeler), Serialization(Carton, Bottle, Blister, Vial), Aggregation(Case, Pallet), Technology(2D Barcode, RFID), End User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| トラックアンドトレースソリューションの世界市場:製品別、シリアライゼーション別、アグリゲーション別、技術別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年06月12日

発行: MarketsandMarkets

ページ情報: 英文 339 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のトラックアンドトレースソリューションの市場規模は、2025年の69億6,000万米ドルから2030年までに122億7,000万米ドルに達すると予測され、予測期間にCAGRで12.0%の高成長が見込まれます。

市場の成長は、厳しい規制要件、偽造品への懸念の高まり、エンドツーエンドのサプライチェーン可視化へのニーズによって促進されます。医薬品、食品、医療機器などの産業では、コンプライアンス、製品の真正性、効率的なリコール管理を保証するために、こうしたシステムの採用が進んでいます。さらに、IoT、クラウドコンピューティング、オートメーションの進歩により、これらのソリューションがより利用しやすいスケーラブルなものとなり、より広範な市場採用が推進されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 製品、用途、技術、エンドユーザー |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

「スタンドアロンプラットフォームセグメントがトラックアンドトレースソリューション市場でもっとも速い成長速度となりました。」

2024年、スタンドアロンプラットフォームセグメントが予測期間を通じて最高のCAGRを達成する見込みです。この成長は、既存の企業システムとの大規模な統合を必要とせず、独立して展開できるカスタマイズ可能でスケーラブルかつコスト効率の高いソリューションへの選好の高まりに起因しています。これらのプラットフォームは、複雑なインフラ変更を必要とせず、迅速な導入と規制遵守を求める中小企業にとって特に魅力的です。さらに、スタンドアロンシステムの柔軟性とアップグレードの容易さは、さまざまな産業における迅速な採用をサポートします。

「シリアライゼーションソリューションセグメントが予測期間にもっとも急成長する見込みです。」

2024年、シリアライゼーションソリューションセグメントが予測期間にもっとも速い成長を示す見込みです。この成長の促進要因は、特に製薬・医療部門における、偽造品対策としてシリアライゼーションを義務付ける厳しい世界の規制です。シリアライゼーションは各製品ユニットの一意な識別を可能にし、トレーサビリティ、サプライチェーンの可視性、患者の安全性を高めます。さらに、製品認証に対する意識の高まりと、安全で透明性の高い流通プロセスに対するニーズの高まりが、産業全体におけるシリアライゼーションソリューションの採用をさらに加速しています。

「北米が2024年にトラックアンドトレースソリューション市場で最大のシェアを占めました。」

2024年、北米が世界のトラックアンドトレースソリューション市場で首位のシェアを占めました。この地域の成長は主に、製薬企業やバイオテクノロジー企業の大きなプレゼンスや、厳しい規制環境、ブランド保護の強化に向けたエンドユーザーセグメントにおけるトラックアンドトレースソリューションの採用率の向上によって推進されました。さらに、RFID、IoT、ブロックチェーンなどの先進技術の早期採用により、リアルタイムトラッキングとサプライチェーンの可視性が向上しました。Drug Supply Chain Security Act(DSCSA)など、偽造品対策や医薬品の安全性確保に向けた政府の強力な取り組みが、同地域の市場成長をさらに加速させています。

当レポートでは、世界のトラックアンドトレースソリューション市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- トラックアンドトレースソリューション市場の企業にとって魅力的な成長機会

- アジア太平洋のトラックアンドトレースソリューション市場:技術別、国別(2024年)

- トラックアンドトレースソリューション市場:地理的成長機会

- 地域の構成:トラックアンドトレースソリューション市場(2025年~2030年)

- トラックアンドトレースソリューション市場:先進国市場 vs. 新興国市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- 統合型の全自動シリアライゼーション・アグリゲーションシステムへの需要の増加

- トラックアンドトレースソリューションにおけるブロックチェーンの活用

- 技術分析

- 価格分析

- トラックアンドトレースソリューションの参考価格:製品別(2024年)

- トラックアンドトレースソリューションの参考価格:地域別(2024年)

- ポーターのファイブフォース分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制分析

- ラテンアメリカ、中東・アフリカ

- バリューチェーン分析

- エコシステム/市場マップ

- ケーススタディ分析

- 特許分析

- トラックアンドトレースソリューションに関する特許公報の動向

- 考察:管轄と主要申請者の分析

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- エンドユーザー分析

- アンメットニーズ

- エンドユーザーの期待

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 トラックアンドトレースソリューション市場:製品別

- イントロダクション

- ソフトウェアソリューション

- プラントマネージャー

- エンタープライズ・ネットワークマネージャー

- ラインコントローラー

- バンドルトラッキングソリューション

- ケーストラッキングソリューション

- 倉庫・出荷マネージャー

- パレットトラッキングソリューション

- ハードウェアコンポーネント

- 印刷・マーキングソリューション

- バーコードスキャナー

- モニタリング・検証ソリューション

- ラベラー

- チェックウェイアー

- RFIDリーダー

- スタンドアロンプラットフォーム

第7章 トラックアンドトレースソリューション市場:用途別

- イントロダクション

- シリアライゼーションソリューション

- カートンシリアライゼーション

- ボトルシリアライゼーション

- 医療機器シリアライゼーション

- ブリスターシリアライゼーション

- バイアル・アンプルシリアライゼーション

- アグリゲーションソリューション

- ケースアグリゲーション

- パレットアグリゲーション

- バンドルアグリゲーション

- トラック・トレース・レポートソリューション

第8章 トラックアンドトレースソリューション市場:技術別

- イントロダクション

- 2Dバーコード

- RFID

- リニアバーコード

第9章 トラックアンドトレースソリューション市場:エンドユーザー別

- イントロダクション

- 製薬企業・バイオ医薬品企業

- 食品産業

- 医療機器企業

- 化粧品産業

- その他のエンドユーザー

第10章 トラックアンドトレースソリューション市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- フランス

- イタリア

- スイス

- 英国

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益シェア分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 財務指標

- 企業の評価

- ブランド/ソフトウェアの比較分析

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- ANTARES VISION S.P.A.

- AXWAY

- OPTEL GROUP

- TRACELINK INC.

- SYNTEGON TECHNOLOGY GMBH

- ACG

- MARCHESINI GROUP S.P.A.

- MARKEM-IMAJE (DOVER COMPANY)

- UHLMANN

- SIEMENS

- SAP SE

- ZEBRA TECHNOLOGIES CORP.

- METTLER TOLEDO

- IBM

- WIPOTEC

- VISIOTT TECHNOLOGIE GMBH

- JEKSON VISION

- KEVISION

- その他の企業

- TRACKTRACERX INC.

- ARVATO SYSTEMS

- 3KEYS

- RN MARK INC

- KEZZLER

- SHUBHAM AUTOMATION PVT. LTD.

- BAR CODE INDIA LIMITED

第13章 付録

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: TRACK AND TRACE SOLUTIONS MARKET

- TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS

- TABLE 4 SERIALIZATION AND AGGREGATION REGULATIONS, BY COUNTRY/REGION

- TABLE 5 INDICATIVE PRICE FOR TRACK AND TRACE SOLUTIONS, BY HARDWARE COMPONENT

- TABLE 6 INDICATIVE PRICE FOR TRACK AND TRACE SOLUTIONS, BY REGION

- TABLE 7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: SERIALIZATION AND E-PEDIGREE REGULATIONS FOR PHARMACEUTICAL INDUSTRY

- TABLE 14 US: UDI REGULATIONS FOR MEDICAL DEVICES

- TABLE 15 EUROPE: SERIALIZATION REGULATIONS FOR PHARMACEUTICAL INDUSTRY

- TABLE 16 EUROPE: REGULATIONS FOR UDI SYSTEM COMPLIANCE

- TABLE 17 ASIA PACIFIC: SERIALIZATION REGULATIONS FOR PHARMACEUTICAL INDUSTRY

- TABLE 18 LATIN AMERICA AND MIDDLE EAST & AFRICA: SERIALIZATION REGULATIONS FOR PHARMACEUTICAL INDUSTRY

- TABLE 19 TRACK AND TRACE SOLUTIONS MARKET: ECOSYSTEM MAPPING

- TABLE 20 KEY PATENTS IN TRACK AND TRACE SOLUTIONS MARKET

- TABLE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 23 TRACK AND TRACE SOLUTIONS MARKET: LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 24 CHALLENGES ASSOCIATED WITH MANUAL TRACK AND TRACE OF PRODUCTS: END-USER PERSPECTIVE

- TABLE 25 TABLE 1: US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 27 TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 29 PLANT MANAGERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 30 ENTERPRISE & NETWORK MANAGERS OFFERED BY KEY MARKET PLAYERS

- TABLE 31 ENTERPRISE & NETWORK MANAGERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 32 LINE CONTROLLERS OFFERED BY KEY MARKET PLAYERS

- TABLE 33 LINE CONTROLLERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 34 BUNDLE TRACKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 35 BUNDLE TRACKING SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 36 CASE TRACKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 37 CASE TRACKING SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 38 WAREHOUSE & SHIPMENT MANAGERS OFFERED BY KEY MARKET PLAYERS

- TABLE 39 WAREHOUSE & SHIPMENT MANAGERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 40 PALLET TRACKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 41 PALLET TRACKING SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 42 TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 43 TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 44 PRINTING & MARKING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

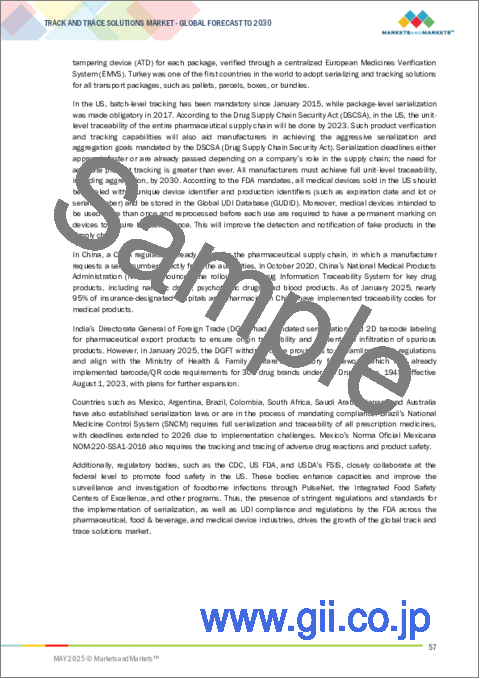

- TABLE 45 PRINTING AND MARKING SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 46 BARCODE SCANNERS OFFERED BY KEY MARKET PLAYERS

- TABLE 47 BARCODE SCANNERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 48 MONITORING & VERIFICATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 49 MONITORING & VERIFICATION SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 50 LABELERS OFFERED BY KEY MARKET PLAYERS

- TABLE 51 LABELERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 CHECKWEIGHERS OFFERED BY KEY MARKET PLAYERS

- TABLE 53 CHECKWEIGHERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 54 RFID READERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 55 STANDALONE PLATFORMS OFFERED BY KEY MARKET PLAYERS

- TABLE 56 STANDALONE PLATFORMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 57 TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 58 SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 59 SERIALIZATION SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 60 CARTON SERIALIZATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 61 BOTTLE SERIALIZATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 62 MEDICAL DEVICE SERIALIZATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 63 BLISTER SERIALIZATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 64 VIAL & AMPOULE SERIALIZATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 65 REGULATORY STANDARDS FOR AGGREGATION SOLUTIONS AT VARIOUS PACKAGING LEVELS

- TABLE 66 AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 AGGREGATION SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 CASE AGGREGATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 69 PALLET AGGREGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 BUNDLE AGGREGATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 71 TRACKING, TRACING, AND REPORTING SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 72 TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 73 2D BARCODES MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 74 RFID MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 75 LINEAR BARCODES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 77 TRACK AND TRACE SOLUTIONS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 78 TRACK AND TRACE SOLUTIONS MARKET FOR FOOD INDUSTRY, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 79 TRACK AND TRACE SOLUTIONS MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 80 TRACK AND TRACE SOLUTIONS MARKET FOR COSMETIC INDUSTRY, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 81 TRACK AND TRACE SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 82 TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 US: KEY MACROINDICATORS

- TABLE 93 US: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 94 US: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 US: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 US: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 97 US: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 98 US: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 US: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 US: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 101 CANADA: KEY MACROINDICATORS

- TABLE 102 CANADA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 103 CANADA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 CANADA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 119 GERMANY: KEY MACROINDICATORS

- TABLE 120 GERMANY: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 121 GERMANY: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 GERMANY: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 GERMANY: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 124 GERMANY: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 125 GERMANY: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 GERMANY: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 GERMANY: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 FRANCE: KEY MACROINDICATORS

- TABLE 129 FRANCE: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 130 FRANCE: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 FRANCE: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 FRANCE: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 133 FRANCE: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 134 FRANCE: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 FRANCE: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 FRANCE: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 ITALY: KEY MACROINDICATORS

- TABLE 138 ITALY: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 139 ITALY: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 ITALY: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 ITALY: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 142 ITALY: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 ITALY: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 ITALY: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 ITALY: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 146 SWITZERLAND: KEY MACROINDICATORS

- TABLE 147 SWITZERLAND: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 148 SWITZERLAND: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 SWITZERLAND: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 SWITZERLAND: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 151 SWITZERLAND: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 152 SWITZERLAND: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 SWITZERLAND: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SWITZERLAND: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 UK: KEY MACROINDICATORS

- TABLE 156 UK: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 157 UK: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 UK: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 UK: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 160 UK: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 UK: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 UK: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 UK: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 SPAIN: KEY MACROINDICATORS

- TABLE 165 SPAIN: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 166 SPAIN: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 SPAIN: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 SPAIN: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 169 SPAIN: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 170 SPAIN: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 SPAIN: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 SPAIN: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 174 REST OF EUROPE: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 REST OF EUROPE: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 REST OF EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 177 REST OF EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 178 REST OF EUROPE: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 REST OF EUROPE: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 REST OF EUROPE: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 CHINA: KEY MACROINDICATORS

- TABLE 191 CHINA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 192 CHINA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 CHINA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 CHINA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 195 CHINA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 196 CHINA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 CHINA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 CHINA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 199 JAPAN: KEY MACROINDICATORS

- TABLE 200 JAPAN: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 201 JAPAN: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 JAPAN: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 JAPAN: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 204 JAPAN: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 205 JAPAN: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 JAPAN: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 JAPAN: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 208 INDIA: KEY MACROINDICATORS

- TABLE 209 INDIA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 210 INDIA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 INDIA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 INDIA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 213 INDIA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 INDIA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 INDIA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 INDIA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 217 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 218 SOUTH KOREA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 219 SOUTH KOREA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 SOUTH KOREA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 SOUTH KOREA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 222 SOUTH KOREA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 223 SOUTH KOREA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 SOUTH KOREA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 SOUTH KOREA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 226 AUSTRALIA: KEY MACROINDICATORS

- TABLE 227 AUSTRALIA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 228 AUSTRALIA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 AUSTRALIA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 AUSTRALIA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 231 AUSTRALIA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 232 AUSTRALIA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 AUSTRALIA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 AUSTRALIA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 243 LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 244 LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 LATIN AMERICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 248 LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 LATIN AMERICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 252 BRAZIL: KEY MACROINDICATORS

- TABLE 253 BRAZIL: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 254 BRAZIL: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 BRAZIL: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 BRAZIL: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 257 BRAZIL: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 258 BRAZIL: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 BRAZIL: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 BRAZIL: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 261 MEXICO: KEY MACROINDICATORS

- TABLE 262 MEXICO: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 263 MEXICO: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 MEXICO: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 MEXICO: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 266 MEXICO: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 267 MEXICO: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 MEXICO: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 MEXICO: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 270 REST OF LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 275 REST OF LATIN AMERICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 REST OF LATIN AMERICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 287 GCC COUNTRIES: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 288 GCC COUNTRIES: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 GCC COUNTRIES: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 GCC COUNTRIES: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 291 GCC COUNTRIES: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 292 GCC COUNTRIES: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 GCC COUNTRIES: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 GCC COUNTRIES: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: TRACK AND TRACE SOFTWARE SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: TRACK AND TRACE HARDWARE COMPONENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 300 REST OF MIDDLE EAST & AFRICA: SERIALIZATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 REST OF MIDDLE EAST & AFRICA: AGGREGATION SOLUTIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 REST OF MIDDLE EAST & AFRICA: TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 303 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- TABLE 304 ELECTRONIC LAB NOTEBOOK MARKET: DEGREE OF COMPETITION

- TABLE 305 REGION FOOTPRINT ANALYSIS

- TABLE 306 PRODUCT FOOTPRINT ANALYSIS

- TABLE 307 APPLICATION FOOTPRINT ANALYSIS

- TABLE 308 END USER FOOTPRINT ANALYSIS

- TABLE 309 TRACK AND TRACE SOLUTIONS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 310 TRACK AND TRACE SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 311 TRACK AND TRACE SOLUTIONS MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 312 TRACK AND TRACE SOLUTIONS MARKET: DEALS, JANUARY 2022- MAY 2025

- TABLE 313 TRACK AND TRACE SOLUTIONS MARKET: EXPANSIONS, JANUARY 2022- MAY 2025

- TABLE 314 ANTARES VISION S.P.A.: COMPANY OVERVIEW

- TABLE 315 ANTARES VISION S.P.A: PRODUCTS & SERVICES OFFERED

- TABLE 316 ANTARES VISION S.P.A: DEALS, JANUARY 2022-MAY 2025

- TABLE 317 AXWAY: COMPANY OVERVIEW

- TABLE 318 AXWAY: PRODUCTS & SERVICES OFFERED

- TABLE 319 AXWAY: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 320 OPTEL GROUP: COMPANY OVERVIEW

- TABLE 321 OPTEL GROUP: PRODUCTS & SERVICES OFFERED

- TABLE 322 OPTEL GROUP: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 323 OPTEL GROUP: DEALS, JANUARY 2022- MAY 2025

- TABLE 324 OPTEL GROUP: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 325 TRACELINK INC.: COMPANY OVERVIEW

- TABLE 326 TRACELINK INC.: PRODUCTS & SERVICES OFFERED

- TABLE 327 TRACELINK INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 328 TRACELINK INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 329 SYNTEGON TECHNOLOGY GMBH: COMPANY OVERVIEW

- TABLE 330 SYNTEGON TECHNOLOGY GMBH: PRODUCTS & SERVICES OFFERED

- TABLE 331 ACG: COMPANY OVERVIEW

- TABLE 332 ACG: PRODUCTS & SERVICES OFFERED

- TABLE 333 ACG: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 334 ACG: DEALS, JANUARY 2022-MAY 2025

- TABLE 335 ACG: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 336 MARCHESINI GROUP S.P.A: COMPANY OVERVIEW

- TABLE 337 MARCHESINI GROUP S.P.A: PRODUCTS & SERVICES OFFERED

- TABLE 338 MARCHESINI GROUP S.P.A: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 339 MARCHESINI GROUP S.P.A: DEALS, JANUARY 2022-MAY 2025

- TABLE 340 MARKEM-IMAJE: COMPANY OVERVIEW

- TABLE 341 MARKEM-IMAJE: PRODUCTS & SERVICES OFFERED

- TABLE 342 MARKEM-IMAJE: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 343 MARKEM-IMAJE: DEALS, JANUARY 2022-MAY 2025

- TABLE 344 UHLMANN: COMPANY OVERVIEW

- TABLE 345 UHLMANN: PRODUCTS & SERVICES OFFERED

- TABLE 346 UHLMANN: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 347 SIEMENS: COMPANY OVERVIEW

- TABLE 348 SIEMENS: PRODUCTS & SERVICES OFFERED

- TABLE 349 SIEMENS: DEALS, JANUARY 2022-MAY 2025

- TABLE 350 SAP SE: COMPANY OVERVIEW

- TABLE 351 SAP SE: PRODUCTS & SERVICES OFFERED

- TABLE 352 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 353 ZEBRA TECHNOLOGIES CORP.: PRODUCTS & SERVICES OFFERED

- TABLE 354 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 355 ZEBRA TECHNOLOGIES CORP.: DEALS, JANUARY 2022-MAY 2025

- TABLE 356 ZEBRA TECHNOLOGIES CORP.: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 357 METTLER TOLEDO: COMPANY OVERVIEW

- TABLE 358 METTLER TOLEDO: PRODUCTS & SERVICES OFFERED

- TABLE 359 METTLER TOLEDO: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 360 METTLER TOLEDO: DEALS, JANUARY 2022-MAY 2025

- TABLE 361 METTLER TOLEDO: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 362 IBM: COMPANY OVERVIEW

- TABLE 363 IBM: PRODUCTS & SERVICES OFFERED

- TABLE 364 IBM: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 365 IBM: DEALS, JANUARY 2022-MAY 2025

- TABLE 366 WIPOTEC: COMPANY OVERVIEW

- TABLE 367 WIPOTEC: PRODUCTS & SERVICES OFFERED

- TABLE 368 WIPOTECH: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 369 VISIOTT TECHNOLOGIE GMBH: COMPANY OVERVIEW

- TABLE 370 VISIOTT TECHNOLOGIE GMBH: PRODUCTS & SERVICES OFFERED

- TABLE 371 VISIOTT TECHNOLOGIE GMBH: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 372 JEKSON VISION: COMPANY OVERVIEW

- TABLE 373 JEKSON VISION: PRODUCTS & SERVICES OFFERED

- TABLE 374 KEVISION: COMPANY OVERVIEW

- TABLE 375 KEVISION: PRODUCTS & SERVICES OFFERED

List of Figures

- FIGURE 1 TRACK AND TRACE SOLUTIONS MARKET SEGMENTATION & REGION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE), BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 TRACK AND TRACE SOLUTIONS MARKET: REGIONAL SNAPSHOT

- FIGURE 15 STRINGENT REGULATIONS AND STANDARDS FOR SERIALIZATION TO DRIVE MARKET

- FIGURE 16 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO DOMINATE TRACK AND TRACE SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 19 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 20 TRACK AND TRACE SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 NUMBER OF DRUG RECALLS, 2012-2023

- FIGURE 22 GLOBAL SALES OF GENERIC DRUGS, 2012-2023 (USD BILLION)

- FIGURE 23 PHARMACEUTICAL IMPORTS AND EXPORTS, BY COUNTRY, 2023 (USD BILLION)

- FIGURE 24 TRACK AND TRACE SOLUTIONS OFFERED BY VENDORS, BY LEVEL

- FIGURE 25 TRACK AND TRACE SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 TRACK AND TRACE SOLUTIONS MARKET: REGULATORY TIMELINES, BY COUNTRY

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 GLOBAL PATENT PUBLICATION TRENDS IN TRACK AND TRACE SOLUTIONS MARKET, 2017-2024

- FIGURE 30 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR TRACK AND TRACE SOLUTIONS PATENTS, JANUARY 2017-DECEMBER 2024

- FIGURE 31 TOP APPLICANTS FOR TRACK AND TRACE SOLUTIONS PATENTS (COUNTRY/REGION), JANUARY 2017-DECEMBER 2024

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 TRACK AND TRACE SOLUTIONS MARKET: INVESTMENT & FUNDING SCENARIO

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN TRACK AND TRACE SOLUTIONS MARKET, 2020-2024 (USD BILLION)

- FIGURE 38 TRACK AND TRACE SOLUTIONS: MARKET SHARE ANALYSIS, 2024

- FIGURE 39 TRACK AND TRACE SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 TRACK AND TRACE SOLUTIONS MARKET: COMPANY FOOTPRINT

- FIGURE 41 TRACK AND TRACE SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 EV/EBITDA OF KEY VENDORS

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF TRACK AND TRACE SOLUTION VENDORS

- FIGURE 44 TRACK AND TRACE SOLUTIONS MARKET: BRAND/PRODUCT COMPARISON ANALYSIS

- FIGURE 45 ANTARES VISION S.P.A.: COMPANY SNAPSHOT (2024)

- FIGURE 46 AXWAY: COMPANY SNAPSHOT (2023)

- FIGURE 47 SIEMENS: COMPANY SNAPSHOT (2024)

- FIGURE 48 SAP SE: COMPANY SNAPSHOT (2024)

- FIGURE 49 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT (2024)

- FIGURE 50 METTLER TOLEDO: COMPANY SNAPSHOT (2024)

- FIGURE 51 IBM: COMPANY SNAPSHOT (2024)

The global track and trace solutions market is projected to reach USD 12.27 billion by 2030 from USD 6.96 billion in 2025, at a high CAGR of 12.0% during the forecast period. The growth of the global track and trace solutions market is driven by strict regulatory requirements, rising counterfeit concerns, and the need for end-to-end supply chain visibility. Industries like pharmaceuticals, food, and medical devices are increasingly adopting these systems to ensure compliance, product authenticity, and efficient recall management. Additionally, advancements in IoT, cloud computing, and automation are making these solutions more accessible and scalable, fueling broader market adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, Technology, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

"The standalone platforms segment accounted for the fastest growth rate in the track and trace solutions market."

In 2024, the standalone platforms segment is projected to achieve the highest CAGR throughout the forecast period. This growth is attributed to the increasing preference for customizable, scalable, and cost-effective solutions that can be deployed independently without the need for extensive integration with existing enterprise systems. These platforms are especially attractive to small and medium-sized enterprises seeking quick implementation and regulatory compliance without complex infrastructure changes. Additionally, the flexibility and ease of upgrades in standalone systems support faster adoption across various industries.

"Serialization solutions segment is expected to witness the fastest growth during the forecast period."

In 2024, the serialization solutions segment is expected to witness the fastest growth during the forecast period. This growth is driven by stringent global regulations mandating serialization to combat counterfeit products, particularly in the pharmaceutical and healthcare sectors. Serialization enables unique identification of each product unit, enhancing traceability, supply chain visibility, and patient safety. Additionally, increasing awareness about product authentication and the growing need for secure and transparent distribution processes are further accelerating the adoption of serialization solutions across industries.

"North America accounted for the largest share of the track and trace solutions market in 2024."

In 2024, North America held the leading share of the global track and trace solutions market. The growth in this region was primarily propelled by the significant presence of pharmaceutical and biotechnology companies, a stringent regulatory environment, and the rising adoption of track and trace solutions among end-user segments for enhanced brand protection. Additionally, early adoption of advanced technologies such as RFID, IoT, and blockchain has improved real-time tracking and supply chain visibility. Strong government initiatives to combat counterfeiting and ensure drug safety, such as the Drug Supply Chain Security Act (DSCSA), have further accelerated market growth in the region.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 42%, Director-level: 31%, and Others: 27%

- By Region - North America: 40%, Europe: 20%, Asia Pacific: 30%, Latin America: 6%, Middle East & Africa: 4%.

Key Players in the Track and Trace Solutions Market

The key players functioning in the track and trace solutions market include ANTARES VISION S.p.A (Italy), Axway (France), OPTEL GROUP (Canada), TraceLink Inc. (US), Syntegon Technology GmbH (Germany), ACG (India), Marchesini Group S.p.A. (Italy), Markem-Imaje, a Dover Company (Switzerland), Uhlmann (Germany), Siemens (Germany), SAP SE (Germany), Zebra Technologies Corp. (US), METTLER TOLEDO (US), IBM (US), WIPOTEC GmbH (Germany), VISIOTT Technologie GmbH (Turkey), Jekson Vision (India), Kevision (India), TrackTraceRX Inc. (US), Arvato - Bertelsmann SE & Co. KGaA (Germany), 3KEYS GmbH (Germany), RN Mark Inc (Canada), Kezzler (Norway), Shubham Automation Pvt. Ltd. (India), and Bar Code India Limited (India).

Research Coverage:

The report analyzes the track and trace solutions market and aims to estimate the market size and growth potential of various market segments, based on product, application, technology, end user, and region. The report also analyses factors (such as drivers, restraints, opportunities, and challenges) affecting market growth. It evaluates the opportunities and challenges in the market for stakeholders. The report also studies micro markets with respect to their growth trends, prospects, and contributions to the total track and trace solutions market. The report forecasts the revenue of the market segments with respect to five major regions. It also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers: (Stringent regulations and standards for serialization, Increasing focus of manufacturers on brand protection, Growth in packaging-related product recalls), restraints (Long implementation timeframe of serialization and aggregation, Huge setup costs of technologies), opportunities (Increase in offshore pharmaceutical manufacturing, Remote authentication of products), and challenges (Lack of common standards for serialization and aggregation) influencing the growth of the track and trace solutions market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the track and trace solutions market.

- Market Development: Comprehensive information on the lucrative emerging markets, products, applications, technologies, end users, and regions.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the track and trace solutions market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players, such as ANTARES VISION S.p.A (Italy), Axway (France), OPTEL GROUP (Canada), TraceLink Inc. (US), Syntegon Technology GmbH (Germany), in the track and trace solutions market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 STUDY ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.5.1 METHODOLOGY-RELATED LIMITATIONS

- 2.5.2 SCOPE-RELATED LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN TRACK AND TRACE SOLUTIONS MARKET

- 4.2 ASIA PACIFIC: TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY AND COUNTRY (2024)

- 4.3 TRACK AND TRACE SOLUTIONS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 REGIONAL MIX: TRACK AND TRACE SOLUTIONS MARKET (2025-2030)

- 4.5 TRACK AND TRACE SOLUTIONS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent regulations and standards for serialization

- 5.2.1.2 Increase in focus of manufacturers on brand protection

- 5.2.1.3 Growth in packaging-related product recalls

- 5.2.1.4 High growth in generic and OTC markets

- 5.2.1.5 Growth of medical device industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Huge setup costs for technologies

- 5.2.2.2 Long implementation timeframe of serialization and aggregation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in offshore pharmaceutical manufacturing

- 5.2.3.2 Remote authentication of products

- 5.2.3.3 Significant technological advancements in R&D

- 5.2.3.4 Growth of food traceability market

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of common standards for serialization and aggregation

- 5.2.4.2 Existence of technologies to deter counterfeiters

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 RISE IN DEMAND FOR INTEGRATED, FULLY AUTOMATED SERIALIZATION AND AGGREGATION SYSTEMS

- 5.3.2 USE OF BLOCKCHAIN IN TRACK AND TRACE SOLUTIONS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 GROWTH IN DEMAND FOR L4 AND L5 TRACK AND TRACE SOLUTIONS IN PHARMACEUTICAL INDUSTRY FOR COMPLIANCE MANAGEMENT

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICE FOR TRACK AND TRACE SOLUTIONS, BY PRODUCT (2024)

- 5.5.2 INDICATIVE PRICE FOR TRACK AND TRACE SOLUTIONS, BY REGION (2024)

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF BUYERS

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 REGULATORY ANALYSIS

- 5.7.2.1 North America

- 5.7.2.2 Europe

- 5.7.2.3 Asia Pacific

- 5.7.3 LATIN AMERICA AND MIDDLE EAST & AFRICA

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 ECOSYSTEM/MARKET MAP

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 MARKET OPPORTUNITY ANALYSIS OF TRACK AND TRACE SOLUTIONS

- 5.10.2 TO SIMPLIFY PRODUCT TRACEABILITY FROM SEED TO STORE SHELF

- 5.10.3 TO FULFILL TRACK AND TRACE REGULATORY REQUIREMENTS ACROSS SEVERAL COUNTRIES WITH HELP OF VISIOTT TPS

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR TRACK AND TRACE SOLUTIONS

- 5.11.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 END-USER ANALYSIS

- 5.14.1 UNMET NEEDS

- 5.14.2 END-USER EXPECTATIONS

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia PACific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SOFTWARE SOLUTIONS

- 6.2.1 PLANT MANAGERS

- 6.2.1.1 Growth in awareness regarding secure packaging and strict regulations

- 6.2.2 ENTERPRISE & NETWORK MANAGERS

- 6.2.2.1 Reporting mandates of product information

- 6.2.3 LINE CONTROLLERS

- 6.2.3.1 Growth in need to improve supply chain efficiency

- 6.2.4 BUNDLE TRACKING SOLUTIONS

- 6.2.4.1 Demand for accuracy in serialization and identification

- 6.2.5 CASE TRACKING SOLUTIONS

- 6.2.5.1 Accurate serialization of cases to ensure traceability throughout supply chain

- 6.2.6 WAREHOUSE AND SHIPMENT MANAGERS

- 6.2.6.1 Management of order receipts from ERP and shipment operations

- 6.2.7 PALLET TRACKING SOLUTIONS

- 6.2.7.1 Need to identify and verify pallets throughout supply chain

- 6.2.1 PLANT MANAGERS

- 6.3 HARDWARE COMPONENTS

- 6.3.1 PRINTING & MARKING SOLUTIONS

- 6.3.1.1 Printing and marking solutions to dominate market

- 6.3.2 BARCODE SCANNERS

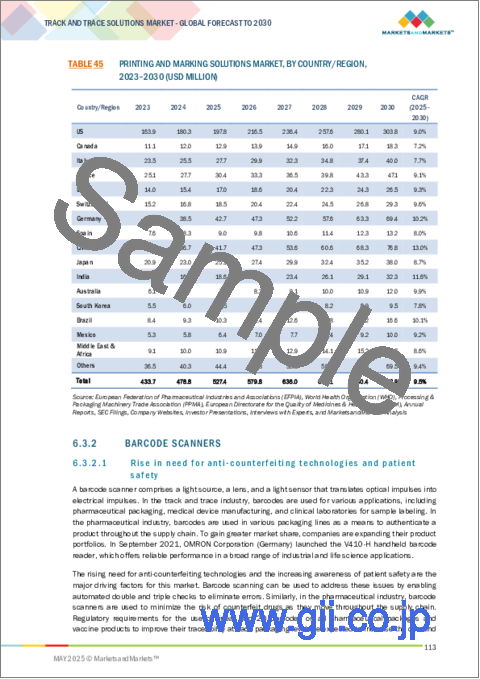

- 6.3.2.1 Rise in need for anti-counterfeiting technologies and patient safety

- 6.3.3 MONITORING & VERIFICATION SOLUTIONS

- 6.3.3.1 Optical character recognition and verification camera systems to verify serial numbers and code sets

- 6.3.4 LABELERS

- 6.3.4.1 Focus of pharmaceutical industry on implementing anti-counterfeiting measures and making labels tamper-evident

- 6.3.5 CHECKWEIGHERS

- 6.3.5.1 Automatic tracking of products from point-of-code verification to reject mechanism

- 6.3.6 RFID READERS

- 6.3.6.1 Reduced data entry errors with easier tracking of pharmaceutical drugs and medical devices

- 6.3.1 PRINTING & MARKING SOLUTIONS

- 6.4 STANDALONE PLATFORMS

- 6.4.1 INCREASE IN ADOPTION OF FULLY INTEGRATED PLATFORMS WITH AUTOMATED FORMAT ADJUSTMENT

7 TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 SERIALIZATION SOLUTIONS

- 7.2.1 CARTON SERIALIZATION

- 7.2.1.1 Serialization mandated to secure supply chain

- 7.2.2 BOTTLE SERIALIZATION

- 7.2.2.1 Implementation of serialization solutions in China and Turkey

- 7.2.3 MEDICAL DEVICE SERIALIZATION

- 7.2.3.1 Stringent implementation of label mandates, particularly in US

- 7.2.4 BLISTER SERIALIZATION

- 7.2.4.1 Higher growth in adoption in Europe and Asia Pacific

- 7.2.5 VIAL & AMPOULE SERIALIZATION

- 7.2.5.1 Increase in demand for serialization at primary packaging level

- 7.2.1 CARTON SERIALIZATION

- 7.3 AGGREGATION SOLUTIONS

- 7.3.1 CASE AGGREGATION

- 7.3.1.1 Benefits of better supply chain visibility among bundles

- 7.3.2 PALLET AGGREGATION

- 7.3.2.1 Higher demand for brand protection

- 7.3.3 BUNDLE AGGREGATION

- 7.3.3.1 Greater awareness about secure packaging and regulatory mandates

- 7.3.1 CASE AGGREGATION

- 7.4 TRACKING, TRACING, AND REPORTING SOLUTIONS

- 7.4.1 HIGHER EMPHASIS ON REGULATORY VIGILANCE

8 TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 2D BARCODES

- 8.2.1 HIGHER DATA DENSITY AND SPACE EFFICIENCY OF 2D BARCODES

- 8.3 RADIOFREQUENCY IDENTIFICATION

- 8.3.1 INCREASE IN ADOPTION OF MEDICAL DEVICES AND COSMETIC PRODUCT DISTRIBUTION

- 8.4 LINEAR BARCODES

- 8.4.1 HIGH ADOPTION IN ASIA PACIFIC COUNTRIES

9 TRACK AND TRACE SOLUTIONS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

- 9.2.1 REGULATORY MANDATES FOR SERIALIZATION IN PHARMACEUTICAL SUPPLY CHAINS

- 9.3 FOOD INDUSTRY

- 9.3.1 INCREASE IN FOODBORNE DISEASE OUTBREAKS AND HIGHER HEALTH CONSCIOUSNESS

- 9.4 MEDICAL DEVICE COMPANIES

- 9.4.1 MANDATES FOR SERIALIZATION AND UDI COMPLIANCE

- 9.5 COSMETIC INDUSTRY

- 9.5.1 IMPLEMENTATION OF MEASURES AGAINST COUNTERFEITING

- 9.6 OTHER END USERS

10 TRACK AND TRACE SOLUTIONS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Stringent mandates regarding identifiers in place for significantly large medical devices market

- 10.2.3 CANADA

- 10.2.3.1 Growth in government focus on serialization in pharmaceutical industry

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Presence of prominent pharmaceutical manufacturers, favorable regulatory policies, and well-developed healthcare system

- 10.3.3 FRANCE

- 10.3.3.1 Presence of leading pharmaceutical companies

- 10.3.4 ITALY

- 10.3.4.1 Growth in counterfeit and OTC drugs

- 10.3.5 SWITZERLAND

- 10.3.5.1 Implementation of serialization solutions with large-scale exports

- 10.3.6 UK

- 10.3.6.1 Large pharmaceutical market and growth of geriatric population

- 10.3.7 SPAIN

- 10.3.7.1 Increase in generic drugs and development of medical device sectors

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rapidly growing pharmaceutical industry and favorable government mandates

- 10.4.3 JAPAN

- 10.4.3.1 Greater use of serialization with track and trace solutions in pharmaceutical supply chain

- 10.4.4 INDIA

- 10.4.4.1 Low manufacturing cost and skilled workforce to attract outsourcing and investments

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increased spending on geriatric health and coverage for major chronic diseases

- 10.4.6 AUSTRALIA

- 10.4.6.1 Favorable R&D tax benefits for pharmaceutical industry

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Large pharmaceutical industry and increased investments in healthcare

- 10.5.3 MEXICO

- 10.5.3.1 Increase in government support for biotechnology and pharmaceutical industries

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Greater focus on enhancing patient safety

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN TRACK AND TRACE SOLUTIONS MARKET

- 11.3 REVENUE SHARE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 End user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS /SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 STARTING BLOCKS

- 11.6.4 RESPONSIVE COMPANIES

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/ SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/SOFTWARE COMPARISON ANALYSIS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ANTARES VISION S.P.A.

- 12.1.1.1 Business overview

- 12.1.1.2 Products & services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM View

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weakness and competitive threats

- 12.1.2 AXWAY

- 12.1.2.1 Business overview

- 12.1.2.2 Products & services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices made

- 12.1.2.4.3 Weakness and competitive threats

- 12.1.3 OPTEL GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products & services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices made

- 12.1.3.4.3 Weakness and competitive threats

- 12.1.4 TRACELINK INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products & services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices made

- 12.1.4.4.3 Weakness and competitive threats

- 12.1.5 SYNTEGON TECHNOLOGY GMBH

- 12.1.5.1 Business overview

- 12.1.5.2 Products & services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices made

- 12.1.5.3.3 Weakness and competitive threats

- 12.1.6 ACG

- 12.1.6.1 Business overview

- 12.1.6.2 Products & services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.7 MARCHESINI GROUP S.P.A.

- 12.1.7.1 Business overview

- 12.1.7.2 Products & services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 MARKEM-IMAJE (DOVER COMPANY)

- 12.1.8.1 Business overview

- 12.1.8.2 Products & services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 UHLMANN

- 12.1.9.1 Business overview

- 12.1.9.2 Products & services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 SIEMENS

- 12.1.10.1 Business overview

- 12.1.10.2 Products & services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 SAP SE

- 12.1.11.1 Business overview

- 12.1.11.2 Products & services offered

- 12.1.12 ZEBRA TECHNOLOGIES CORP.

- 12.1.12.1 Business overview

- 12.1.12.2 Products & services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Expansions

- 12.1.13 METTLER TOLEDO

- 12.1.13.1 Business overview

- 12.1.13.2 Products & services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Deals

- 12.1.13.3.3 Expansions

- 12.1.14 IBM

- 12.1.14.1 Business overview

- 12.1.14.2 Products & services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.15 WIPOTEC

- 12.1.15.1 Business overview

- 12.1.15.2 Products & services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Expansions

- 12.1.16 VISIOTT TECHNOLOGIE GMBH

- 12.1.16.1 Business overview

- 12.1.16.2 Products & services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Expansions

- 12.1.17 JEKSON VISION

- 12.1.17.1 Business overview

- 12.1.17.2 Products & services offered

- 12.1.18 KEVISION

- 12.1.18.1 Business overview

- 12.1.18.2 Products & services offered

- 12.1.1 ANTARES VISION S.P.A.

- 12.2 OTHER PLAYERS

- 12.2.1 TRACKTRACERX INC.

- 12.2.2 ARVATO SYSTEMS

- 12.2.3 3KEYS

- 12.2.4 RN MARK INC

- 12.2.5 KEZZLER

- 12.2.6 SHUBHAM AUTOMATION PVT. LTD.

- 12.2.7 BAR CODE INDIA LIMITED

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS