|

市場調査レポート

商品コード

1910500

電子薬局:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)E-pharmacy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電子薬局:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 115 Pages

納期: 2~3営業日

|

概要

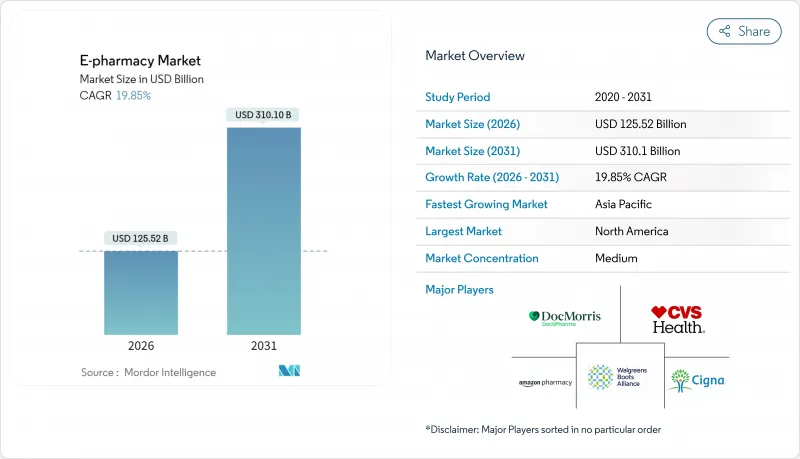

電子薬局市場は2025年に1,047億3,000万米ドルと評価され、2026年の1,255億2,000万米ドルから2031年までに3,101億米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは19.85%と見込まれます。

この拡大は、各国の電子処方箋義務化、保険会社による通信販売調剤の支援、自動化フルフィルメント拠点への資本流入に支えられています。支払機関や薬局給付管理会社が処方箋を提携デジタル調剤業者へ誘導するにつれ規模の経済が拡大し、ロボットピッキングラインが温度管理が必要な生物学的製剤の取り扱いを可能にしたことで、新たな専門分野の利益率が生まれています。その結果もたらされる利便性と透明性のある価格設定により、患者の忠誠心は実店舗からオンラインプラットフォームへと移行しつつあり、従来型店舗はオムニチャネル投資を加速させるか、販売量の減少に直面せざるを得ません。並行して、高齢化とモバイルヘルスアプリが単発購入者を定期購入ユーザーへと転換させ、予測可能な需要パターンを生み出し、サプライヤーの交渉力を強化しています。

世界の電子薬局市場の動向と洞察

全国的な電子処方箋義務化の展開

米国、北欧諸国、およびアジア太平洋地域の複数の市場における電子処方義務化により、デジタル薬局の接点が医師の業務フローに直接組み込まれています。処方箋の即時送信により手書きミスが解消され調剤時間が短縮されるため、高齢患者様の宅配サービス利用促進につながっています。オンライン薬局は診療現場で高い認知度を獲得し、従来店舗カウンターが持っていた優位性を置き換えています。医療システム研究によれば、電子処方箋が義務化されると一次医療における服薬不遵守率が低下し、電子薬局市場の成長見通しを強化しています。

モバイルヘルスアプリとの連携

ウェルネスアプリ内の薬局決済機能には、生体認証ログイン、後払いプラン、ポイントウォレットが搭載されています。これらの利便性により、家庭内の処方箋管理に追われる若い介護者の再注文障壁が低減され、リピート購入が促進されます。処方箋更新時の栄養補助食品のクロスセルにより購入額が増加し、アプリ活用深化の商業的価値が実証されています。スマートウォッチ通知と連携した服薬リマインダー機能では、初期パイロット段階で月間アクティブユーザーが二桁成長しています。

国境を越えた規制の断片化

複数の管轄区域で事業を展開する調剤業者は、異なる免許規則、プライバシー基準、規制薬物リストを調整する必要があります。コンプライアンスのオーバーヘッドは固定費を押し上げ、参入障壁を形成します。これにより、早期に地域展開した企業は保護されますが、広域展開は遅延します。欧州では、データ現地化法令を満たすため、並行したフルフィルメントセンターを維持する企業もあり、コスト優位性を損ない、国境を越えた展開を遅らせています。

セグメント分析

処方箋医薬品は2025年収益の71.62%を占め、電子薬局市場の経済的基盤となっています。慢性疾患患者は複数の治療法を併用することが多いため、1つのポータルで処方箋更新を統合することで服薬遵守が簡素化され、ユーザー1人あたりの生涯価値が向上します。このセグメントの堅調な浸透率は、自動ピッキング投資を持続させる信頼性の高い数量基盤も提供しています。一方、OTC製品は28.38%と規模は小さいもの、セルフケア文化の普及と当日配送ネットワークの拡大に伴い、17.65%のCAGRで成長が見込まれます。その急速な成長はプラットフォームの収益源を多様化し、保険会社からの償還への依存度を低減します。

デジタル診療フローへの消費者の受容度向上により、ブランド品からジェネリック医薬品への切り替えが促進され、対面カウンセリングなしでも保険者の処方薬リスト目標達成を支援しています。一方、ウェルネスブランドは同一の決済インフラを活用し、ビタミン剤と慢性疾患治療薬をセット販売。予防医療と治療薬販売を融合する戦略です。高血圧や脂質異常症向けの定期購入医薬品は、目立たない四半期ごとの小包で配送され、顧客定着率を高めると同時に、長期的なE-pharmacy市場規模の見通しを支えています。

風邪・インフルエンザ治療薬は2025年のカテゴリー収益の24.08%を占め、高発症率の冬季が宅配需要を喚起した恩恵を受けています。ベンダーはこれらの注文に体温計や消毒剤の追加販売を組み合わせ、感染拡大時に平均購入額を静かに拡大しています。ビタミン・栄養補助食品は現時点では規模が小さいもの、2031年までに20.95%のCAGRを記録し、他のほとんどの健康関連商品を上回ると予測されています。AIを活用した診断テストが血液検査結果を個人向けセット商品提案に変換し、コンバージョン率を向上させるとともに、予防医療を日常的な薬局取引に組み込んでいます。

スキンケア、歯科用品、体重管理商品は現在、非処方薬売上高の合計で半数に迫り、薬局を総合的な健康・美容拠点へと変貌させています。皮膚科治療品の目立たない包装は、実店舗の陳列棚では実現が難しいプライバシー保護の期待に応えます。化粧品メーカーが遠隔皮膚科相談サービスを展開するにつれ、クロスセリングの可能性はさらに高まり、電子薬局の総潜在市場を拡大しています。

地域別分析

北米は2025年に世界収益の41.88%を占め、新たなサービスモデルの主要な実験場としての役割を確固たるものにしました。米国では、保険会社が90日分の郵送処方箋を奨励し、地方の薬局が撤退したことでアクセス格差が生じましたが、デジタル配送サービスがこれを容易に埋めています。即日配送の試験運用は現在人口の45%に到達し、ラストマイルのスピードに対する期待値を再設定しています。カナダの単一支払者制度では、医薬品と遠隔医療を組み合わせたパッケージが試験導入され、支払者契約の再定義が模索されています。一方メキシコでは、フィンテック連携により新興中所得層が処方箋費用を分割払いで負担可能となり、慢性疾患治療の継続的受診に手頃な価格を実現しています。

アジア太平洋地域は2031年までに21.74%のCAGRが見込まれる最速成長地域として際立っています。インドではスマートフォン普及基盤と「アユシュマン・バーラト・デジタル・ミッション」が電子健康記録を促進し、処方箋のオンライン化を推進しています。中国の大手企業は薬局機能をスーパーアプリに統合し、スケールメリットにより注文当たりの物流コストを削減するとともに、E-pharmacy市場の拡大を実現しています。日本では規制上、初回の対面診察が義務付けられているため普及が遅れておりますが、オーストラリアでは市販薬の電子販売が許可されているため品揃えが拡大し、地域ごとの規制の差異が顕著です。

欧州は売上高で第3位ながら、政策調和が新たな需要を創出しています。国境を越えた電子処方箋枠組みにより、旅行中の住民も処方箋を利用可能となり、服薬遵守を円滑化するとともに市場横断的な流通を促進しています。ドイツの電子処方箋導入は既存オンライン事業者へ処方箋を誘導する一方、フランスのセキュアホスティング義務化は国内倉庫投資を促進しています。英国では、パンデミック後のデジタル利用への定着が、実店舗薬局の再開後も持続しており、チャネルシフトの持続性を裏付けています。中東欧地域は、ブロードバンド環境の改善とバランスの取れた監督体制により台頭しており、西欧モデルへの収束を示しています。

南米、中東・アフリカは依然として市場規模が小さいもの、持続的な二桁成長が追い上げの可能性を示しています。オンライン調剤に関する法規の明確化とスマートフォンの低価格化プログラムが重要な推進力となります。コールドチェーンの課題が残る地域では、地域の革新企業が宅配業者と提携し、断熱ロッカー配送の試験運用を開始しており、インフラ整備の進展が世界のE-pharmacy市場の拡大を徐々に促進する兆しが見られます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 全国的な電子処方箋導入の義務化

- モバイルヘルスアプリとの連携

- 高齢化社会と定期配送サービス

- 支払者・PBMと電子薬局間の戦略的提携

- 自動化・コールドチェーン対応のフルフィルメント及び当日配送物流への多額の投資

- 市場抑制要因

- 国境を越えた規制の断片化

- 不正なオンライン薬局と消費者信頼

- 処方薬および規制薬物に対する継続的な広告・販促制限

- 農村部・低所得地域におけるラストマイル配送コストの高騰とデジタルインフラの不足

- 規制・技術動向

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 薬剤タイプ別

- 処方薬

- 一般用医薬品(OTC医薬品)

- 製品タイプ別

- スキンケア

- 歯科

- 風邪・インフルエンザ

- ビタミン・栄養補助食品

- 体重管理

- その他の製品タイプ

- 治癒領域別

- 糖尿病

- 循環器系

- 呼吸器系

- 消化器系

- その他の治療領域

- プラットフォーム別

- モバイルユーザー

- デスクトップユーザー

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- CVS Health Corporation

- Walgreens Boots Alliance

- Cigna Corporation(Express Scripts Holdings)

- Optum Rx Inc.

- The Kroger Co.

- Amazon Pharmacy(PillPack)

- Giant Eagle Inc.

- Axelia Solutions(Pharmeasy)

- Netmeds.com

- Apollo Pharmacy

- DocMorris(Zur Rose Group AG)

- Flipkart Health+

- JD Health International

- Alibaba Health Information Tech

- Chemist Warehouse Group

- GoodRx Holdings Inc.

- Capsule Corp.

- Alto Pharmacy