|

市場調査レポート

商品コード

1641946

炭化ケイ素パワー半導体:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Silicon Carbide Power Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 炭化ケイ素パワー半導体:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

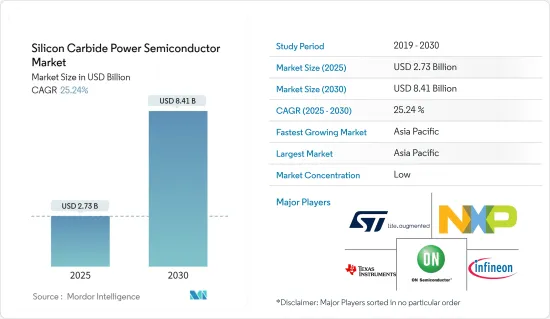

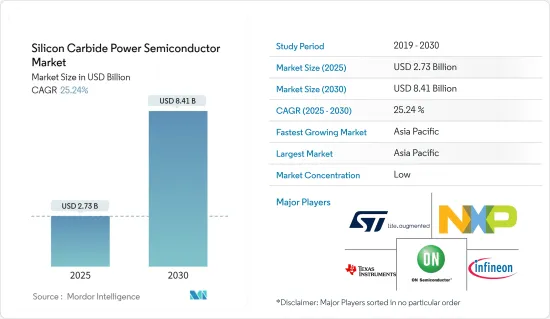

炭化ケイ素パワー半導体市場規模は、2025年に27億3,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは25.24%で、2030年には84億1,000万米ドルに達すると予測されています。

パンデミックの発生は、世界中の中小・大規模産業に経済的混乱をもたらしました。製造業の大部分には、生産性を向上させるために人々が密接に接触する工場現場での作業が含まれるためです。

主要ハイライト

- SiC(炭化ケイ素)はバンドギャップが広いため、高出力用途に使用されています。SiCには様々なポリタイプ(多形)が存在するが、4H-SiCはパワーデバイスに最も理想的です。材料能力の向上を目指した研究開発活動の増加は、市場成長の強力な原動力になると予想されます。例えば、米国エネルギー省(DOE)のAdvanced Research Projects AgencyEnergy(ARPA-E)は、Creating Innovative and Reliable Circuits Using Inventive Topologies and Semiconductors(CIRCUITS)プログラムの一環として、21のプロジェクトに3,000万米ドルの資金提供を発表しました。また、SiCパワーエレクトロニクスの製造コスト削減を意図したNREL主導の研究に対する米国DOEによる投資のようなイニシアティブは、このような動向をさらに後押しし、より堅牢なSiCベースのデバイスの範囲を拡大する可能性があります。

- 電気自動車は、自動車産業において、航続距離、充電時間、性能の向上など、顧客の期待に応える一定の利点を記載しています。しかし、電気自動車には、高温で効率的かつ効果的に動作するパワーエレクトロニクスデバイスが必要です。そのため、ワイドバンドギャップSiC技術を用いたパワーモジュールの開発が進められています。

- 電気自動車は、価格の低下と航続距離の伸びに伴い、今日では一般的なものとなりつつあります。国際エネルギー機関の報告書「Global EV 展望 2021」によると、2020年には1,020万台以上の小型電気乗用車が道路を走っていました。また、電気自動車の登録台数は2020年に41%増加し、市場に成長機会をもたらしています。

- 半導体はまた、エネルギー損失を減らし、太陽エネルギーや風力エネルギーの電力変換器を長寿命化するためにSiCを使用しています。例えば、太陽光発電エネルギーでは主に、効率、電力密度、信頼性を高めるために、高出力、低損失、高速スイッチング、高信頼性の半導体デバイスが必要とされます。したがって、SiCデバイスは、増大するエネルギー需要を満たすための太陽光発電エネルギー要件に対する有望なソリューションを記載しています。

- クリーンテック需要がもたらす可能性を利用するため、複数の企業がSiCパワー半導体市場に参入しています。例えば、2021年4月、ニューヨーク州立大学ポリテクニックラボ(SUNY Poly)からスピンオフしたNoMIS Power Groupは、SiCパワー半導体デバイス、モジュール、パワーマネジメント製品開発者へのサポートを提供するサービスの設計、製造、販売を計画していると発表しました。

- また、SiCパワー半導体は、高周波になると寄生容量やインダクタンスが大きくなり、本来の性能を発揮できなくなります。このような点から、SiCの普及には製造設備の更新が必要となる可能性があり、現在の開発ペースでは実現できないです。

炭化ケイ素パワー半導体市場動向

自動車産業が大きな成長を記録する見込み

- 自動車パワートレイン内での炭化ケイ素(SiC)デバイスの使用に関する調査活動が行われています。しかし、最近の進歩により、徐々に実現可能なソリューションになりつつあります。例えば、急速充電ソリューションを採用しているTeslaでは、現在すでにSiCを車載アーキテクチャーに使用しています。加えて、電気自動車は価格が下がり、航続距離が伸びているため、最近では一般的になりつつあります。国際エネルギー機関(IEA)によると、2021年の全世界でのプラグイン電気自動車の販売台数は約660万台に達します。

- SiC半導体は、プラグインハイブリッド車(PHEV)や完全電気自動車(EV)で使用される車載充電器やインバータなどのアプリケーションに最適です。そのエネルギー効率は、従来のシリコンに比べて格段に高いからです。

- また、EVが長距離を走行し、妥当な時間枠内で充電できるようにするには、車両のパワーエレクトロニクスが高温に対応できなければならないです。SiC半導体は、95%以上のエネルギー効率という利点があります。高出力急速充電器による充電など、電力変換時に熱として失われるエネルギーはわずか5%です。

- 日本では、東京大学がMitsubishi Electric Corporationと共同でSiC半導体デバイスの信頼性向上に取り組んでいます。これに先立ち、Mitsubishi Electricはハイブリッド車向けに設計された新しい超小型SiCインバータを公開し、2021年頃の量産化を目指しています。

- さらに、Delphi TechnologiesとCreeは提携し、CreeのSiC MOSFETを組み合わせた前者のインバータを開発しました。これにより、ハイブリッド車や完全電気自動車の航続距離延長をサポートする高出力を可能にしながら、パワーモジュール全体の温度を大幅に低減しました。また、これらのインバータは、競合モデルよりも40%軽量で30%コンパクトです。

- さらに、Infineon Technologiesは2021年5月、車載用CoolSiC MOSFET技術を搭載した新しいパワーモジュールを発表しました。Siの代わりにSiCを使用することで、電気自動車のコンバーターの高効率化を実現しています。例えば、Hyundai Motor Groupは、InfineonのCoolSiCパワーモジュールを搭載したトラクションインバータにより、Siベースのソリューションと比較してこのSiCソリューションの低損失による効率向上により、車両の航続距離を5%以上伸ばすことができたと報告しています。

- さらに、2021年3月、英国政府は、英国研究・イノベーション主導の産業戦略チャレンジ基金の一環として、炭化ケイ素(SiC)パワー半導体デバイスを製造し、輸送、家庭、産業用のより効率的なパワーエレクトロニクスを作成し、国家がネットゼロの野望を達成するのを支援するため、スウォンジー大学に480万英ポンドを授与しました。

アジア太平洋が最速の成長を遂げる

- アジア太平洋は世界のSiCパワー半導体市場を独占しており、これは世界半導体市場の成長に関連しており、政府の施策にも支えられています。さらに、この地域の半導体産業は、中国、台湾、日本、韓国が牽引しており、これらを合わせると世界のディスクリート半導体市場の約65%を占めます。これとは対照的に、タイ、ベトナム、シンガポール、マレーシアなども同地域の市場支配に大きく貢献しています。

- インド電子半導体協会によると、インドの半導体部品市場は2025年までに323億5,000万米ドル規模になり、CAGRは10.1%(2018~2025年)になると予想されています。同国は世界の研究開発センターにとって有利な進出先です。そのため、政府が進めているMake In Indiaイニシアチブは、半導体市場への投資につながると期待されています。

- さらに、同地域はエレクトロニクスのハブであり、他国への輸出や同地域での消費のために毎年数百万個の電子機器を生産しています。このような電子部品や電子機器の高い生産量は、調査対象市場のシェアに大きく貢献しています。例えば、インドにおける民生用電子機器の需要増加も、この地域の市場成長を促進しています。IBEFによると、インドにおける電子機器ハードウェアの需要は、2024年度までに4,000億米ドルに達すると予想されており、これが市場成長をさらに促進します。

- 中国は世界最大の電力生産国です。同国のエネルギー需要は増加し、その結果、エネルギー生産量も増加すると予想されます。例えば、IEAによると、中国では電気自動車の販売台数が2倍以上に増加しており、さらに2021年には、他国よりも約330万台多い電気自動車が販売されます。

- 中国では自動車産業が増加しており、世界の自動車市場でますます重要な役割を果たしています。中国政府は、自動車部品部門を含む自動車産業を基幹産業のひとつと位置づけています。政府は、中国の自動車生産台数が2020年までに3,000万台、2025年までに3,500万台に達すると見込んでいます。

- さらにインドでは、政府の野心的な計画や取り組みにより、電気自動車市場が勢いを増しています。インドの公的機関はここ数年、電気自動車関連の施策をいくつか発表しており、同国における電気自動車の普及に対する強いコミットメント、具体的な行動、大きな野心を示しています。

炭化ケイ素パワー半導体産業概要

炭化ケイ素パワー半導体市場の競争は激しいです。Infineon Technologies AG、Texas Instruments Inc.、ST Microelectronics NV、Hitachi Power Semiconductor Device Ltd.、NXP Semiconductor、富士電機、Semikron International GmbH、Cree Inc.、ON Semiconductor Corporation、Mitsubishi Electric Corporationなどです。これらの企業は、市場シェアを拡大するために、新製品の投入、提携、買収を行っています。

- 2021年6月-日本のエレクトロニクス企業であるHitachiは、ヒルズボロにおける既存のプレゼンスを拡大し、米国の製造顧客と協力して新技術を生み出すための大規模な半導体ラボを建設する計画を発表。

- 2021年4月-Infineon TechnologiesAGは、1200V製品ラインに新しいEasyPACK 2Bモジュールを発売しました。このモジュールは、CoolSiC MOSFET、TRENCHSTOP IGBT7デバイス、NTC温度センサ、PressFITコンタクト技術ピンを含む、3レベルのアクティブNPC(ANPC)トポロジーを記載しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- COVID-19の市場への影響

- 技術スナップショット

第5章 市場力学

- 市場促進要因

- コンシューマー・エレクトロニクスとワイヤレス通信の需要増加

- エネルギー効率の高いバッテリー駆動携帯機器への需要の高まり

- 市場課題

- シリコンウエハーの不足と駆動要件の変化

第6章 市場セグメンテーション

- エンドユーザー産業別

- 自動車(xEVとEV充電インフラ)

- IT・通信

- 電力(電源、UPS、PV、風力など)

- 産業用(モータードライブ)

- その他のエンドユーザー産業(鉄道、石油・ガス、軍事、医療、研究開発など)

- 地域別

- 南北アメリカ

- 欧州、中東・アフリカ

- アジア太平洋

第7章 競合情勢

- 企業プロファイル

- Infineon technologies AG

- UnitedSiC

- ST Microelectronics NV

- ON Semiconductor Corporation

- GeneSiC Semiconductor Inc.

- Danfoss A/S

- Microsemi Corporation

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Fuji Electric Co. Ltd

- Semikron International

第8章 投資分析

第9章 市場の将来

The Silicon Carbide Power Semiconductor Market size is estimated at USD 2.73 billion in 2025, and is expected to reach USD 8.41 billion by 2030, at a CAGR of 25.24% during the forecast period (2025-2030).

The pandemic outbreak created economic turmoil for small, medium, and large-scale industries worldwide. Adding to the woes, the country-wide lockdown inflicted by the governments across the globe (to minimize the spread of the virus) further resulted in industries taking a hit and disruption in supply chain and manufacturing operations across the world, as a large part of manufacturing includes the work on the factory floor, where people are in close contact as they collaborate to boost the productivity.

Key Highlights

- SiC (Silicon Carbide) is used for high-power applications due to the wide bandgap offered. While various polytypes (polymorphs) of SiC exist, 4H-SiC is the most ideal for power devices. The increase in R&D activities that target enhanced material capabilities is expected to provide a strong impetus for market growth. For instance, the United States Department of Energy's (DOE) Advanced Research Projects AgencyEnergy (ARPA-E) has announced a funding of USD 30 million for 21 projects as part of the Creating Innovative and Reliable Circuits Using Inventive Topologies and Semiconductors (CIRCUITS) program. Also, initiatives such as investment by US DOE for NREL-Led research with an intent to reduce SiC power electronics manufacturing costs could further support such trends and expand the scope of more robust SiC-based devices.

- Electric vehicles provide certain advantages within the automotive industry, such as increased range, charge-time, and performance, to meet customer expectations. However, they require power electronic devices capable of efficient and effective operation at elevated temperatures. Hence, power modules are being developed using wide-bandgap SiC technologies.

- Electric cars are becoming common on the road nowadays with prices coming down and range going up. As per the International Energy Agency's report Global EV Outlook 2021, over 10.2 million light-duty electric passenger cars were on the roads in 2020. In addition, electric car registration increased by 41% in 2020, which creates growth opportunities for the market.

- Semiconductors also use SiC for reduced energy loss and longer life solar and wind energy power converters. For instance, photovoltaic energy mainly requires high power, low loss, faster switching, and reliable semiconductor devices to increase efficiency, power density, and reliability. Thus, SiC devices provide a promising solution to photovoltaic energy requirements to meet the increasing energy demand.

- To tap the potential brought by the demand for cleantech, several players are entering the market for SiC power semiconductors. For instance, in April 2021, NoMIS Power Group, a spin-off from the State University of New York Polytechnic Institute (SUNY Poly), announced that it plans to design, manufacture and sell SiC power semiconductor devices, modules, and services for providing support to power management product developers.

- Moreover, parasitic capacitance and inductance become too great as soon as high frequencies are used, preventing the SiC-based power device from realizing its full potential. In such a regard, widespread usage of SiC may require updates to manufacturing facilities, something which cannot be achieved at the current pace of development.

Silicon Carbide Power Semiconductor Market Trends

Automotive Industry is Expected to Register Significant Growth

- Research activities are being conducted into the usage of silicon carbide (SiC) devices within automotive powertrains. However, due to recent advancements, it is gradually becoming a feasible solution. For instance, Tesla, which uses a rapid charging solution, is already using SiC within their vehicle architectures currently. In addition, electric cars are becoming common on the road nowadays with prices coming down and range going up. According to the International Energy Agency, plug-in electric light vehicle sales across the globe reached around 6.6 million in 2021.

- SiC semiconductors are ideal for applications, such as onboard chargers and inverters, being used within the plug-in hybrid (PHEV) and fully electric vehicles (EVs). This is because their energy efficiency is significantly higher compared to traditional silicon.

- Also, to ensure that EVs can operate over long distances and charge within a reasonable timeframe, the vehicle's power electronics must be capable of handling high temperatures. SiC semiconductors benefit from more than 95% energy efficiency. Only 5% of energy is lost as heat during power conversion, such as recharging the vehicle with a high-power rapid-charger.

- In Japan, the University of Tokyo has been working with Mitsubishi Electric Corporation to enhance the reliability of SiC semiconductor devices. Earlier, Mitsubishi Electric revealed a new ultra-compact SiC inverter designed for hybrid vehicles, with mass commercialization targeted around 2021.

- Moreover, Delphi Technologies and Cree have partnered to create the former's inverters, combined with Cree's SiC MOSFETs. It has significantly reduced the power module's overall temperature while enabling higher power outputs to support an extended range for hybrid and fully electric automobiles. These inverters are also 40% lighter and 30% more compact than competing models.

- Further, in May 2021, Infineon Technologies launched a new power module with CoolSiC MOSFET technology for automotive applications. The use of SiC instead of Si ensures higher efficiency in converters in electric vehicles. For example, Hyundai Motor Group reported that it was able to increase the range of its vehicles by more than 5% because of efficiency gains resulting from the lower losses of this SiC solution compared to the Si-based solution, with the help of the traction inverters based on Infineon's CoolSiC power module.

- Moreover, in March 2021, as part of the Industrial Strategy Challenge Fund led by the UK Research and Innovation, the UK government awarded GBP 4.8 million to Swansea University to manufacture silicon carbide (SiC) power semiconductor devices and create more efficient power electronics for transportation, homes, and industry, and help the nation achieve its net-zero ambitions.

Asia Pacific to Witness the Fastest Growth

- The Asia Pacific dominates the global SiC power semiconductor market, pertaining to global semiconductor market growth, which is also supported by government policies. Furthermore, the region's semiconductor industry is driven by China, Taiwan, Japan, and South Korea, which together account for around 65% of the global discrete semiconductor market. In contrast, others like Thailand, Vietnam, Singapore, and Malaysia also contribute significantly to the region's dominance in the market.

- According to the Indian Electronics and Semiconductor Association, India's semiconductor component market is expected to be worth USD 32.35 billion by 2025, displaying a CAGR of 10.1% (2018-2025). The country is a lucrative destination for worldwide R&D centers. Therefore, the government's ongoing Make In India initiative is expected to result in investments in the semiconductor market.

- Moreover, the region is an electronics hub that produces millions of electronic devices every year for exporting to other countries and consumption in the area. This high production of electronic components and devices largely contributes to the market share of the studied market. For instance, the increasing demand for consumer electronics in India has also facilitated the regional market's growth. According to IBEF, demand for electronics hardware in India is expected to reach USD 400 billion by FY2024, which will further drive market growth.

- China is the world's largest producer of electricity. The country's energy demand is expected to increase, thereby resulting in growth in energy production. For instance, according to the IEA, in China, sales of electric vehicles have more than doubled; further, in 2021, it sold approximately 3.3 million more electric cars than in other countries.

- The automotive industry has been increasing in China, and the country is playing an increasingly important role in the global automotive market. The Government of China sees its automotive industry, including the auto parts sector, as one of its pillar industries. The government expects China's automobile output to reach 30 million units by 2020 and 35 million units by 2025.

- Further, the electric vehicle market is gaining momentum in India, owing to the government's ambitious plans and initiatives. Public authorities in India have made several electric vehicle-related policy announcements over the past few years, showing strong commitment, concrete action, and significant ambition to deploy electric vehicles in the country.

Silicon Carbide Power Semiconductor Industry Overview

The silicon carbide power semiconductor market is highly competitive. It consists of several significant players, including Infineon Technologies AG, Texas Instruments Inc., ST Microelectronics NV, Hitachi Power Semiconductor Device Ltd, NXP Semiconductor, Fuji Electric Co. Ltd, Semikron International GmbH, Cree Inc., ON Semiconductor Corporation, Mitsubishi Electric Corporation, and others. These companies are introducing new products, partnerships, and acquisitions, to increase their market share.

- June 2021 - Hitachi, a Japanese electronics company, announced plans to extend its existing presence in Hillsboro by building a big semiconductor research lab to cooperate with manufacturing clients in the United States to create new technologies.

- April 2021 - Infineon Technologies AG launched a new EasyPACK 2B module to its 1200 V product line. The module offers a three-level Active NPC (ANPC) topology, including CoolSiC MOSFETs, TRENCHSTOP IGBT7 devices, NTC temperature sensor, and PressFIT contact technology pins.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Demand for Consumer Electronics and Wireless Communications

- 5.1.2 Growing Demand for Energy-Efficient Battery-Powered Portable Devices

- 5.2 Market Challenges

- 5.2.1 Shortage of Silicon Wafers and Variable Driving Requirements

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Automotive (xEVs and EV Charging Infrastructure)

- 6.1.2 IT and Telecommunication

- 6.1.3 Power (Power Supply, UPS, PV, Wind etc.)

- 6.1.4 Industrial (Motor drives)

- 6.1.5 Other End-user Industries (Rail, Oil & Gas, Military, Medical, R&D etc.)

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East and Africa

- 6.2.3 Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon technologies AG

- 7.1.2 UnitedSiC

- 7.1.3 ST Microelectronics NV

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 GeneSiC Semiconductor Inc.

- 7.1.6 Danfoss A/S

- 7.1.7 Microsemi Corporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Mitsubishi Electric Corporation

- 7.1.10 Fuji Electric Co. Ltd

- 7.1.11 Semikron International