|

市場調査レポート

商品コード

1641969

IoTセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)IoT Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| IoTセンサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

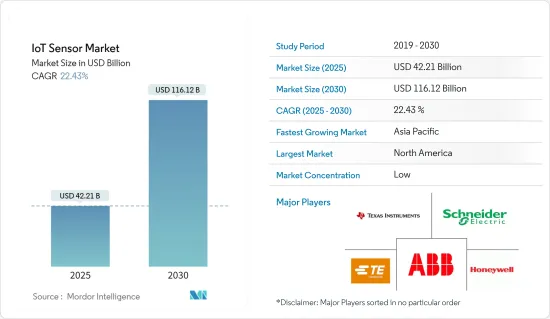

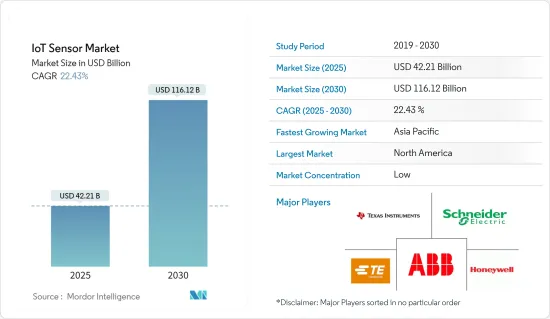

IoTセンサーの市場規模は2025年に422億1,000万米ドルと推定され、予測期間中(2025-2030年)のCAGRは22.43%で、2030年には1,161億2,000万米ドルに達すると予測されます。

新たな新興アプリケーションとビジネスモデルは、デバイスコストの低下と相まって、IoTの採用を大きく後押ししています。その結果、コネクテッドカー、機械、メーター、ウェアラブル、家電など、多くのコネクテッドデバイスが登場しています。エリクソンの調査によると、2021年までに接続される総デバイス数280億台のうち、160億台近くがIoTデバイスになるといいます。この力強い成長は、コネクテッド・エコシステムの展開への注目の高まりと、3GPPセルラーIoT技術の標準化によってもたらされると予想されます。

主なハイライト

- 欧州、中国などの地域におけるインダストリー4.0への取り組みが、IoT展開、ひいてはIoTセンサーの主な原動力となっています。アクセンチュアによると、製造企業の60%がすでにIoTプロジェクトに取り組んでおり、30%以上が初期導入段階にあります。さらに、IoTセンサーのコストが低下していることも、予測期間中に同技術の採用を促進する顕著な要因の1つです。

- そのほか、スマートシティ構想もIoTセンサーの需要促進に役立っています。シンガポールはすでにセンサーベースの高齢者モニタリング・システムを導入しており、自宅で暮らす高齢の両親や扶養家族の健康状態が悪化したり異常な行動を示したりした場合に、オフィスで働く家族がアラートを受け取るのに役立っています。

- さらに、フィールド・デバイス、センサー、ロボットの進歩は、市場の範囲を拡大すると予想されます。IoT技術は、製造業における労働力不足を克服しつつあります。より多くの組織にとって、ロボット化のようなインダストリー4.0技術の利用は日常業務の一部となっています。

- 例えば、より小型のチップ/ウエハーと進化した製造装置で開発された新世代のIoTセンサーは、より優れた柔軟性、接続性、効率を提供します。これからのコネクテッド・ファクトリーのインフラには、消費電力を抑えたビジョンが必要であり、IIoT環境の構築に適したインフラのアップグレードを支援し、需要を補完するソリューションの採用を業界に促すことが予想されます。

- 一方、最近のCOVID-19の発生により、世界のサプライチェーンと複数の製品の需要が混乱しています。IoTセンサーの導入は2020年末までに影響を受けると予想されます。さらに、中国などでの生産停止により、2月から3月にかけて複数の業界で様々な製品の品不足が観測されました。しかし、「社会的距離感」の長期化が常態化することで、さまざまな業界で自動化ソリューションへの依存が進むと予想されます。例えば、スマート小売は、非常に大きな盛り上がりを見せる可能性があります。

IoTセンサー市場動向

自動車・運輸産業が市場成長を牽引

- 自動車大手、サイバーセキュリティ・プロバイダー、チップ・メーカー、システム・インテグレーター間の最近の業務提携や合弁事業により、世界中の自動車産業は自律的な時代へと着実に移行しています。

- これは、早ければ2020年までに高度(レベル4)、完全(レベル5)自律走行車の出現が避けられないことを示しています。意思決定」のための車両間の適切な通信には、視覚、地理、音声、その他のデータの適切な同化と理解のための車両接続性が必要になると予想されます。

- スマートシティが出現するにつれて、Car2Carコネクティビティや高度な車両管理が出現し、IoTセンサーの活躍の場が広がると予想されます。これが急速な技術革新とインテリジェントセンサー技術の採用を促進し、IoTセンサーの需要を押し上げています。

- メルセデス・ベンツ、フォルクスワーゲン、ボルボ、トヨタ、グーグルなどの企業は、より安全で便利で快適な運転体験を提供する豊富な機能を備えたスマートカーの開発にますます投資しています。NASDAQによると、ドライバーレス自動車は2030年までに市場を席巻する可能性が高いです。さらに、DHL SmarTruckingは2028年までに1万台のIoT対応トラックのフリート構築を目指しています。これにより、予測期間中にIoTセンサーの導入が促進されると予想されます。

- IoTはまた、自動車、運輸、ロジスティクス業界に大規模な革命をもたらしています。予防保全へのアクセス、コネクテッド・モビリティ、リアルタイム・データ・アクセスは、調査対象セグメントにおけるIoT採用を促進する重要な要因です。世界のIoT輸送・ロジスティクス支出は、このところ指数関数的な勢いで増加しています。

- IoTによって、多くの輸送機関は最も効率的なルートをマッピングし、燃料使用量を最大化し、物流会社は出荷を追跡追跡し、駐車場新興企業は利用可能なスポットをリアルタイムで監視できるようになった。IoTデバイスは、自動車内のテレマティクス・システム、輸送事業者が使用する予約・予約システム、セキュリティ・監視システム、遠隔車両監視システムなどの交通渋滞制御システムに導入されています。

北米が大きな市場シェアを占める

- 北米は、同地域に複数の定評あるベンダーが存在し、さまざまな産業でIoT技術が最も早くから採用されていることから、最大市場の1つとなっています。この地域の企業の多くは、IoTを採用することで製品の性能を把握し、コストのかかる故障や非効率な定期メンテナンスのシャットダウンを回避しようとしています。

- 同地域におけるIoTの利用も、調査対象市場を大きく牽引しています。例えば、スタンフォード大学とアバストの調査によると、北米の家庭は世界のどの地域よりもIoTデバイスの密度が高いです。特に、同地域の家庭の66%には少なくとも1台のIoTデバイスが設置されています。さらに、北米の家庭の25%は2台以上のデバイスを所有しています。

- さらに、中央監視システムにデータを遠隔送信するIoT対応医療用ウェアラブル温度センサーのようなデバイスは、すでに導入されています。医療スタッフは、動向やしきい値に基づき、患者と部屋を特定してアラートを発し、それに応じて対応することができます。

- さらに、カナダのエンドユーザーもこの市場に投資しています。例えば、カナダのエネルギー部門は、発電所、配電網、スマートホームメーターなど、さまざまな活動の監視に向けてインターネット接続センサーを調達しています。しかし、北米の中小企業を対象とした2020年先進製造業調査によると、米国と比較してカナダの企業は先進技術の導入が遅れています。

- さらに、同地域のIoTセンサーの需要は、ADASシステムの需要増加に伴って拡大すると予想されています。ドイツ銀行によると、米国のADAS生産台数は2021年までに1,845万台に達します。

IoTセンサー業界の概要

IoTセンサー市場は断片化されており、複数のセンサーメーカーが競争力を維持しようと努力しています。このことが市場競争を激化させています。市場のプレーヤーは、市場シェアを獲得するために、パートナーシップ、製品開拓、合併、買収などの戦略的活動を採用しています。

- 2020年7月:テキサス・インスツルメンツ・インコーポレイテッドは、業界初のゼロドリフト・ホール効果電流センサTMCS1100とTMCS110を発売しました。同社によると、この新型センサーは、時間温度に対して最も低いドリフトと高い精度を実現できます。また、産業用モーター・ドライブ、ソーラー・インバータ、エネルギー貯蔵装置、電源装置などのACまたはDC高電圧システム向けに、信頼性の高い3kVrms絶縁を提供します。

- 2020年6月TEコネクティビティはLVDT位置センサーを発売しました。これらのセンサーは、ICTオフハイウェイ機器や産業用工作機械の油圧アプリケーション要件に基づく標準およびカスタムソリューションを提供します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- IoTセンサー市場へのCOVID-19の影響評価

- 市場促進要因

- コストとサイズの削減によるIoTセンサーの使用増加

- インダストリー4.0とコネクテッドデバイスのアプリケーションの増加

- 市場抑制要因

- データセキュリティに関する懸念の高まり

第5章 市場セグメンテーション

- タイプ別

- 圧力

- 温度

- 化学

- モーション/近接

- その他のタイプ

- エンドユーザー別

- ヘルスケア

- 自動車・輸送

- 製造/産業

- その他のエンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他アジア太平洋地域

- 世界のその他の地域

- ラテンアメリカ

- 中東・アフリカ

- 北米

第6章 競合情勢

- 企業プロファイル

- ABB Ltd

- Schneider Electric SE

- TE Connectivity

- Robert Bosch GmbH

- OMRON Corporation

- Sensata Technologies

- Honeywell International Inc.

- TDK Corporation

- STMicroelectronics NV

- Texas Instruments Inc.

第7章 投資分析

第8章 市場の将来

The IoT Sensor Market size is estimated at USD 42.21 billion in 2025, and is expected to reach USD 116.12 billion by 2030, at a CAGR of 22.43% during the forecast period (2025-2030).

The new emerging applications and business models, coupled with the falling device costs, have been significantly driving the adoption of IoT. Consequently, many connected devices - connected cars, machines, meters, wearables, and consumer electronics. According to the Ericsson study, of the 28 billion total devices connected by 2021, close to 16 billion will be IoT devices. This robust growth is expected to be driven by the increased focus on deploying a connected ecosystem and the standardization of 3GPP cellular IoT technologies.

Key Highlights

- Industry 4.0 initiatives across regions like Europe, China, etc., are the major drivers of the IoT deployments, and therefore, the IoT sensors. According to Accenture, 60% of the manufacturing companies are already engaged in IoT projects, and more than 30% are at an early deployment stage. Moreover, the decreasing cost of IoT sensors is one of the prominent factors that would fuel the technology's adoption over the forecast period.

- Besides, smart city initiatives are also instrumental in driving the demand for IoT sensors. Singapore has already implemented a sensor-based Elderly Monitoring System that helps office working family members to receive alerts when the health condition of their home living elderly parents or dependents deteriorates or exhibits abnormal behaviors.

- Further, the advancements in field devices, sensors, and robots are expected to expand the market's scope. IoT technologies are overcoming the labor shortage in the manufacturing sector. For more and more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations.

- For instance, the new-gen IoT sensors, developed on smaller chips/wafers and evolved fabrication units, offer better flexibility, connectivity, and efficiency. It is deemed necessary for upcoming connected factory infrastructure to be visioned, with less power consumption, and are expected to prompt industry to adopt solutions that help them upgrade their infrastructure suited for creating an IIoT environment and complement the demand.

- On the other hand, owing to the recent outbreak of COVID-19, the global supply chain and demand for multiple products have been disrupted. The IoT sensor adoption is expected to be influenced by the end of 2020. Moreover, due to the production shutdown in countries like China, multiple industries have observed a shortage of various products during February and March. However, with the prolonged period of "social distancing," becoming a norm is expected to drive the reliance on automated solutions in various industries. Smart retail, for instance, could see a tremendous boost.

IoT Sensor Market Trends

Automotive and Transportation Industry to Drive the Market Growth

- The automotive sector across the globe is steadily transitioning toward an autonomous era, owing to the recent business collaborations and joint ventures among automotive giants, cybersecurity providers, chip makers, and system integrators.

- This indicates the inevitable advent of highly (Level 4) and fully (Level 5) autonomous vehicles, at the earliest, by 2020. Vehicle connectivity is expected to become necessary for proper communication among vehicles for 'decision-making' proper assimilation and comprehension of visual, geographical, audio, and other data.

- As smart cities emerge, Car2Car connectivity and advanced fleet management are expected to emerge, thus, providing scope for IoT sensors. This has fuelled rapid innovation and the adoption of intelligent sensor technology, driving the demand for IoT sensors.

- Companies such as Mercedes-Benz, Volkswagen, Volvo, Toyota, and Google Inc. are increasingly investing in developing smart cars with rich features that deliver safer, convenient, and comfortable driving experiences. According to a NASDAQ, driverless cars are likely to dominate the market by 2030. Moreover, DHL SmarTrucking aims to build a fleet of 10,000 IoT- enabled trucks by 2028. This is expected to boost the adoption of IoT sensors over the forecast period.

- IoT is also bringing a massive revolution in the automotive, transportation, and logistics industries. Access to preventative maintenance, connected mobility, and real-time data access are significant factors driving IoT adoption in the studied segment. The global IoT transportation and logistics spending almost increased by an exponential rate in the recent times.

- The IoT has enabled many transportation organizations to map the most efficient routes, maximize fuel usage, logistics companies track-and-trace their shipments, and parking start-ups to monitor their available spots in real-time. IoT devices are deployed in traffic congestion control systems in telematics systems within motor vehicles, reservation and booking systems used by transport operators, security and surveillance systems, and remote vehicle monitoring systems.

North America to Account for a Significant Market Share

- North America is one of the largest markets due to several established vendors in the region and the earliest adoption of IoT technology in various industries. Most of the companies in this region are increasingly adopting IoT to keep track of their offering's performance, thus, avoiding costly breakdowns or inefficient routine maintenance shutdowns.

- The usage of IoT in the region is also significantly driving the studied market. For instance, according to a study by Stanford University and Avast, North American homes have the highest density of IoT devices in any region in the world. Notably, 66% of homes in the region have at least one IoT device. Additionally, 25% of North American homes boast more than two devices.

- Further, devices like IoT-enabled medical wearable temperature sensors that transmit data remotely to a central monitoring system are already implemented. Medical staff is alerted based on trends and thresholds, identifying the patient and room, and can respond accordingly.

- Additionally, end-users in Canada have also been investing in the market. For instance, the Canadian energy sector has been procuring internet-connected sensors toward monitoring a range of activities across generating plants, distribution networks, and smart home meters. However, compared to the United States, Canadian companies have been slower to adopt advanced technologies, as per the 2020 Advanced Manufacturing survey of SMEs in North America.

- Further, the demand for IoT sensors in the region is anticipated to grow with the increasing demand for ADAS systems. According to Deutsche Bank, the US ADAS unit production volume will reach 18.45 million by 2021.

IoT Sensor Industry Overview

The IoT sensor market is fragmented, with several sensor manufacturers striving to maintain a competitive edge. This factor is, thereby, intensifying the competition in the market. Players in the market adopt strategic activities such as partnerships, product development, mergers, and acquisitions to capture the market share.

- July 2020: Texas Instruments Incorporated launched the industry's first zero-drift Hall-effect current sensors, TMCS1100 and TMCS110. The new sensors can enable the lowest drift and highest accuracy over time temperature, according to the company. In contrast, they provide reliable 3-kVrms isolation, especially for AC or DC high-voltage systems such as industrial motor drives, solar inverters, energy storage equipment, and power supplies.

- June 2020: TE Connectivity launched the LVDT position sensor. These sensors provide standard and custom solutions based on the hydraulic application requirements of ICT off-highway equipment and industrial machine tools.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of COVID-19 Impact on IoT Sensor Market

- 4.5 Market Drivers

- 4.5.1 Rising use of IoT sensors due to reduced cost and size

- 4.5.2 Increasing applications of Industry 4.0 and connected devices

- 4.6 Market Restraints

- 4.6.1 Rising concerns related to data security

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Pressure

- 5.1.2 Temperature

- 5.1.3 Chemical

- 5.1.4 Motion/Proximity

- 5.1.5 Other Types

- 5.2 By End User

- 5.2.1 Healthcare

- 5.2.2 Automotive and Transportation

- 5.2.3 Manufacturing / Industrial

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Rest of the Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Schneider Electric SE

- 6.1.3 TE Connectivity

- 6.1.4 Robert Bosch GmbH

- 6.1.5 OMRON Corporation

- 6.1.6 Sensata Technologies

- 6.1.7 Honeywell International Inc.

- 6.1.8 TDK Corporation

- 6.1.9 STMicroelectronics NV

- 6.1.10 Texas Instruments Inc.