|

|

市場調査レポート

商品コード

1404398

フレグランスとパフューム:市場シェア分析、産業動向と統計、2024~2029年の成長予測Fragrances and Perfumes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フレグランスとパフューム:市場シェア分析、産業動向と統計、2024~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 134 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

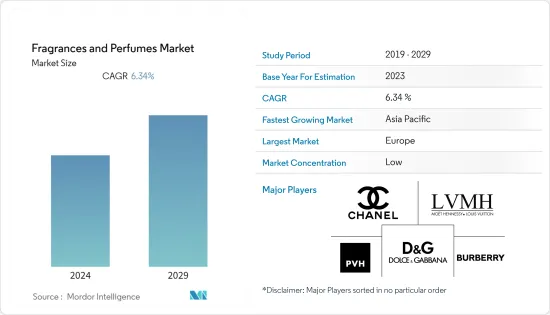

2024年のフレグランスとパフューム市場規模は657億1,000万米ドルと推定されます。

2029年には893億5,000万米ドルに達すると予測され、予測期間中のCAGRは6.34%です。

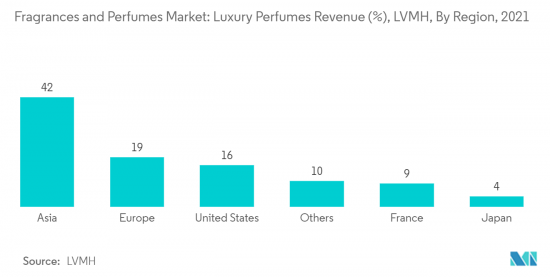

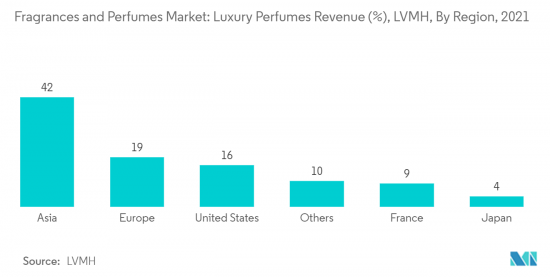

人々は古くからパフュームやフレグランスを使用しています。パフュームやフレグランスは、個人の衛生、アロマセラピー、自信の向上などに貢献しています。これらは身だしなみを整える上で欠かせない製品となっています。アロマは、ファッション業界やオフィス、日常生活で働く人々に役立っています。自信を高め、不快な体臭を隠し、その人の個性を示すからです。こうした要因から、パフュームやフレグランスの需要は世界的に高まっています。可処分所得の増加とライフスタイルの変化により、高級パフュームの売上は伸びています。LMVHの年次報告書2021によると、2021年のパフュームと化粧品の売上は26%増加しました。

さらに、パフュームやフレグランスがハイクラスの人々の間でスタイルの主張となりつつあるため、ユニセックスパフュームの需要が高いです。また、合成成分の健康への影響に対する意識の高まりから、天然パフュームに対する消費者の需要が高まっています。市場の主なプレーヤーは、世界のさまざまな消費者グループを魅了する刺激的な新しい香りの開発に注力しています。特にミレニアル世代を中心に香りの薄い製品の人気が高まっており、手頃な価格のボディスプレー、ボディミスト、コロンボディスプレーが新興経済諸国におけるパフューム・フレグランス製品の売上を押し上げると予想されます。また、有名人の推薦、製品広告、ソーシャルメディアの動向は、消費者がさまざまな香りのバリエーションから選ぶよう誘惑します。需要は増加しているが、市場における偽ブランドの存在は成長とブランドの地位を妨げ、市場の成長を抑制する可能性があります。しかし、パフュームとフレグランスの需要は、流通網の拡大、eコマース小売の浸透、高品質製品に対する需要の高まりによって増加すると予想されます。

フレグランスとパフューム市場の動向

高級パフュームの需要増加

可処分所得の増加により、消費者の間で高級パフュームやフレグランスの需要が増加しています。パフュームやフレグランスは個人的な衛生用品であり、最近ではスタイルの主張と考えられています。そのため、天然ベースの高品質で長持ちする香りの需要が高まっています。市場各社は研究開発部門に投資し、革新的な香りを生み出しています。ソーシャルメディアと有名人の推薦の台頭は、主要市場プレーヤーが採用する広告戦略に影響を与えます。オンライン販売の増加に伴い、化粧品やパフュームの小売業者はパフュームやフレグランスの売上を伸ばすために画像や動画を追加することが増えています。一部のオンライン化粧品小売業者は、パフュームやパフュームをカスタマイズする可能性も提供しています。このように、主要な市場プレーヤーは、イノベーションを通じて消費者を引き付けるために、広告やプロモーションに多額の投資を行っています。例えば、2021年12月、LorealのブランドであるYSL Beautyは香りステーションを発売しました。この技術は神経科学に基づいており、消費者の感情に応じてパフュームを提案します。消費者がパフュームを購入する際に、より良い意思決定をするのに役立ちます。さらに、今後5年間は、広告・宣伝費の増加により、職人技を駆使したカスタムフレグランス製品の売上が大きく伸びると予想されます。

アジア太平洋が急成長市場として浮上

中国は世界のホットスポットの一つであり、最も変化の激しい美容市場です。高級パフュームやフレグランスの需要が急増しています。そのため、中国市場に進出する外資系メーカーが増加しています。可処分所得の増加、願望の高まり、ライフスタイルの変化、ライフスタイル志向の高級製品に対する値ごろ感の向上などを背景に、インドの都市部では組織小売の成長と若い都市人口の出現が、この地域におけるフレグランスとパフュームの需要を押し上げる主な要因となっています。さらなる促進要因としては、eコマース市場の成長により、より優れた製品の選択肢と入手可能性が高まっていることが挙げられます。

最近、ポケットパフュームやミニパフューム、旅行用サイズのパフュームの人気が高まっています。そのため、メーカー各社はさまざまなサイズのボトルに入った新しいパフュームを発売しています。例えば、2021年10月、Kanelleはインドでフレグランスシリーズ「Scentationally You」を発売しました。同ブランドのeコマース・ストアでは、5種類の香りが販売されています。フルサイズとミニボトルのサイズ展開があり、いくつかの製品オプションもあります。

フレグランスとパフューム業界の概要

フレグランスとパフューム市場は競争が激しく、国際的・地域的競合が存在します。同市場の著名なプレーヤーには、Burberry Group PLC、Chanel SA、PVH Corp.、LVMH Moet Hennessy Louis Vuitton、Dolce &Gabbanaが含まれます。市場プレーヤーは、買収、拡大、製品発売などの戦略を採用しています。また、より多くの顧客を引き付けるために、オンライン製品の流通チャネル、マーケティング、ブランディングにも注力しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 高級パフュームの需要

- 天然製品の人気

- 市場抑制要因

- 偽造品の存在

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 製品タイプ

- パルファンまたはドゥパルファン

- オードパルファム(EDP)

- オードトワレ(EDT)

- オーデコロン(EDC)

- その他の製品タイプ

- 消費者グループ

- 男性

- 女性

- ユニセックス

- 流通チャネル

- オンラインストア

- オフライン小売店

- スーパーマーケット/ハイパーマーケット

- 専門店

- コンビニエンスストア

- その他のオフライン小売店

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- スペイン

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Dolce & Gabbana S.r.l.

- Burberry Group PLC

- PVH Corp.

- Chanel SA

- Coty Inc.

- Kering SA

- The Estee Lauder Companies Inc.

- LVMH Moet Hennessy Louis Vuitton

- L'Oreal SA

- Natura Cosmeticos SA

第7章 市場機会と今後の動向

The Fragrance & Perfume Market size is estimated at USD 65.71 billion in 2024. It is anticipated to reach USD 89.35 billion by 2029, registering a CAGR of 6.34% during the forecast period.

People are using perfumes and fragrances since ancient times. Fragrances and perfumes contribute to personal hygiene, aromatherapy, confidence boosting, and more. These became essential products in personal grooming. Aromas benefit people working in fashion industries, offices, and everyday life. It is because they boost confidence, hide unpleasant body odors, and indicate a person's individuality. Owing to these factors, the demand for perfumes and fragrances is increasing worldwide. The sales of luxury perfumes are growing due to rising disposable income and changing lifestyles. According to LMVH's annual report 2021, sales of perfumes and cosmetics grew by 26% in 2021.

Furthermore, unisex perfumes are in high demand as perfumes and fragrances are becoming style statements among high-class people. Also, consumer demand for natural perfumes is increasing due to rising consciousness about the health impact of synthetic ingredients. Key market players are focusing on developing exciting new fragrances to attract different consumer groups worldwide. The rising popularity of lighter-scented products, especially among the millennial population, and affordable body splashes, body mists, and cologne body sprays are expected to boost the sales of perfume and fragrance products in developed economies. Also, celebrity endorsements, product advertising, and social media trends entice consumers to choose from different variants of fragrances. Although the demand is increasing, the presence of fake brands in the market can hamper the growth and brand position, restraining the market growth. However, the demand for perfumes and fragrances is expected to increase owing to the expanding distribution network, penetration of e-commerce retail, and rising demand for high-quality products.

Fragrance & Perfume Market Trends

Increasing Demand for Luxury Perfumes

Due to rising disposable income, the demand for luxury perfumes and fragrances is increasing among consumers. Perfumes and fragrances are considered personal hygiene products and style statements these days. Due to this, the demand for natural-based and high-quality, long-lasting scents is increasing. The market players are investing in their research and development departments to produce innovative fragrances. The rise of social media and celebrity endorsement impacts the advertisement strategies adopted by key market players. With the rise in online sales, cosmetics, and perfume retailers are increasingly adding images and videos to boost the sales of perfumes and fragrances. Some online cosmetics retailers also offer the possibility to customize their perfumes and fragrances. Thus, the key market players heavily invest in advertisement and promotion to attract consumers through innovations. For instance, in December 2021, YSL Beauty, a brand of Loreal, launched the scent station. This technology works based on neuroscience and suggests the perfume for consumers according to their emotions. It helps consumers in better decision-making while purchasing perfumes. Furthermore, the market is expected to witness significant growth in artisanal and custom fragrance product sales over the next five years, owing to the increasing expenditure on advertisement and promotion.

Asia-Pacific Emerges as the Fastest-growing Market

China is one of the world's hotspots and fastest-changing beauty markets. It is experiencing a burgeoning demand for luxury perfume and fragrances. It led to an increasing number of foreign manufacturers expanding their footprints in the Chinese market. The growth in organized retail and the emergence of a young urban population in Indian cities, with increasing disposable income, mounting aspirations, changing lifestyles, and increased affordability for lifestyle-oriented and luxury products, are the main drivers boosting the demand for fragrance and perfumes in the region. Further drivers include more excellent product choice and availability, given the growth of the e-commerce market in the country.

Lately, pocket perfumes and mini and travel-sized perfumes increased in popularity because they are convenient to carry around and can be used on the go. Owing to this, the manufacturers are launching new perfumes in different-sized bottles. For instance, in October 2021, Kanelle launched its fragrance range, Scentsationally You, in India. The fragrance is available in five different scents on the brand's e-commerce store. It includes a range of sizes with full-size and mini bottles and several product options.

Fragrance & Perfume Industry Overview

The fragrances and perfumes market is highly competitive and comprises international and regional competitors. The prominent players in the market include Burberry Group PLC, Chanel SA, PVH Corp., LVMH Moet Hennessy Louis Vuitton, and Dolce & Gabbana. The market players are adopting strategies like acquisitions, expansions, and product launches. They are also focusing on online product distribution channels, marketing, and branding to attract more customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Demand for Luxury Perfumes

- 4.1.2 Popularity of Natural Products

- 4.2 Market Restraints

- 4.2.1 Presence of Counterfeit Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Parfum or De Parfum

- 5.1.2 Eau De Parfum (EDP)

- 5.1.3 Eau De Toilette (EDT)

- 5.1.4 Eau De Cologne (EDC)

- 5.1.5 Other Product Types

- 5.2 Consumer Group

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Unisex

- 5.3 Distribution Channel

- 5.3.1 Online Retail Stores

- 5.3.2 Offline Retail Stores

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Specialty Stores

- 5.3.2.3 Convenience Stores

- 5.3.2.4 Other Offline Retail Stores

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Dolce & Gabbana S.r.l.

- 6.3.2 Burberry Group PLC

- 6.3.3 PVH Corp.

- 6.3.4 Chanel SA

- 6.3.5 Coty Inc.

- 6.3.6 Kering SA

- 6.3.7 The Estee Lauder Companies Inc.

- 6.3.8 LVMH Moet Hennessy Louis Vuitton

- 6.3.9 L'Oreal SA

- 6.3.10 Natura Cosmeticos SA