|

|

市場調査レポート

商品コード

1437932

陸上掘削リグ:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Land Drilling Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 陸上掘削リグ:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

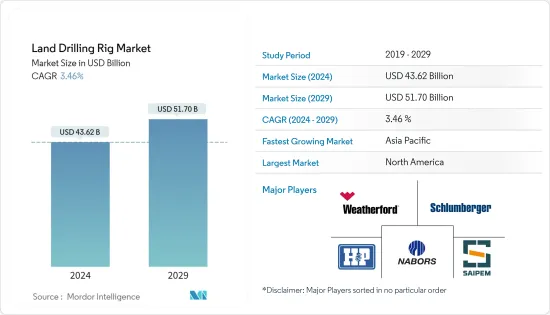

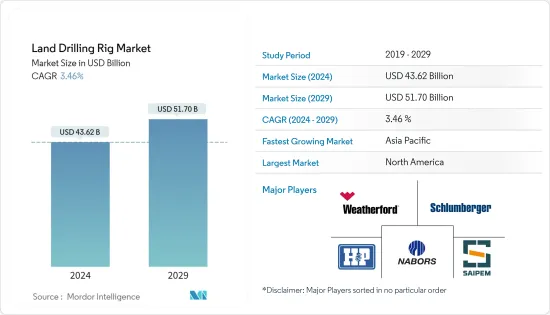

陸上掘削リグ市場規模は、2024年に436億2,000万米ドルと推定され、2029年までに517億米ドルに達すると予測されており、予測期間(2024年から2029年)中に3.46%のCAGRで成長します。

主なハイライト

- 中期的には、高馬力リグやハイテクリグの使用が増加し、大型リグの需要が増加することにより、ランドリグ市場は近年大きく進化しました。さらに、原油と天然ガスの需要の増加に対応するために非在来型埋蔵量を開発することは、予測期間中に陸上掘削リグ市場に大きな需要を生み出すことが予想されます。

- 一方で、発電用の再生可能エネルギー源への世界の移行は石油・ガス部門にとって大きな脅威となっており、ひいては予測期間中に陸上掘削リグ市場の成長にとって大きな課題となることが予想されます。期間。

- それにもかかわらず、アジア太平洋および中東地域の大量需要市場は中流インフラに多額の投資を行っています。新しいインフラストラクチャと比較的堅牢な設備投資予算により、リグがこれらの地域に参入/再参入する機会が得られます。

- 北米は、主にタイトオイルとシェール埋蔵量の探査と生産活動の増加により、米国が主導する陸上掘削リグの最大の市場の1つです。

陸上掘削リグ市場動向

市場を独占するモバイルリグセグメント

- ポータブルまたはモバイルリグは、デリック、ドローワーク、泥水ポンプを含むトラックに搭載されたユニットです。ポータブルリグの主な利点には、リグアップとリグダウンにかかる時間が短く、トラックのレンタル要件が低いことが含まれます。

- ポータブルリグは、改修作業や約10,000フィートの深さまで掘削する場合に頻繁に使用されます。リグは1日あたり8、12、または24時間ベースで使用でき、従来のリグに比べていくつかの利点があります。

- 多くの陸上リグ請負業者は、より高馬力の新しい建造物で自社のフリートをアップグレードし、トップドライブから自動化されたパイプハンドリング、ある坑井現場から別の坑井現場に素早く移動するための機動性まで、高度な技術能力を備えたより強力なリグを追加しています。

- ベーカー・ヒューズによると、2023年10月時点で陸上リグの総数は736基で、リグ総数の約75%を占めました。陸上地域のリグ数の増加に伴い、掘削および生産活動の需要が高まることが予想され、それが陸上掘削リグ市場を牽引することになります。

- さらに、カナダ、中国、アルゼンチンなどの国々(米国以外)で非在来型埋蔵量での掘削が徐々に勢いを増しているため、ハイテクリグ設計とより大きな馬力を備えたポータブルリグがモバイル掘削に大きな機会を生み出すことが期待されています。すぐにリグ。

- また、原油価格の上昇により、非在来型油田の開発への段階的な移行が促進されています。その結果、非在来型埋蔵量での今後のプロジェクトは、土地掘削市場の需要を促進すると予想されます。

- したがって、上記の点により、モバイルリグセグメントは予測期間中に市場を独占すると予想されます。

北米が市場を独占する

- 石油・ガスの価格上昇を受けて、北米での掘削活動が増加しています。北米の陸上リグ数は2022年に897基に達し、2021年から約48%増加しました。

- 米国は掘削活動を強化しており、稼働中の掘削装置の数が最も多いです。 2023年 6月の時点で、アクティブなリグ数は約9%増加し、687を超えました。その結果、掘削リグに対する高い需要が生じています。

- 水圧破砕における技術の向上と低い損益分岐点価格が、この国の活発な掘削活動を支えています。その結果、国内の航空機利用率は2年間低下していた後、46%に上昇しました。米国における水平掘削のシェアの増加により、高仕様の掘削リグに対する高い需要が生じています。

- 一部の大手請負業者は、新しいリグの注文を受けるだけでなく、これらの要件を満たすためにリグをアップグレードします。今後数年間で米国の掘削が改善されるにつれて、ハイスペック掘削リグの需要が高まることが予想されます。

- また、カナダでは計画されている多数のオイルサンドプロジェクトの開始と拡大によってリグ需要が大幅に成長する可能性があり、予測期間中の陸上掘削リグ市場の発展につながります。

- したがって、上記の要因に基づいて、北米は予測期間中に世界の陸上掘削リグ市場を独占すると予想されます。

陸上掘削リグ業界の概要

陸上掘削リグ市場は適度に統合されています。市場の主要企業(順不同)には、Nabors Industries Ltd、Helmerich &Payne Inc.、Schlumberger Limited、Saipem SpA、Weatherford International PLCなどが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提条件

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2028年までの市場規模と需要予測(金額)

- 主要国の世界の陸上稼働リグ数(2022年まで)

- 2028年までのオンショア設備投資予測(金額)

- 最近の動向と発展

- 政府の政策と規制

- 市場力学

- 促進要因

- 高馬力およびハイテクリグの使用の増加

- 非在来型埋蔵量の活用

- 抑制要因

- 再生可能エネルギー源への世界の移行

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- タイプ

- 従来型

- 携帯

- 駆動方式

- 機械式

- 電気

- コンパウンド

- 地域

- 北米

- 米国

- カナダ

- その他

- 欧州

- 英国

- フランス

- イタリア

- ドイツ

- その他

- アジア太平洋

- 中国

- インド

- 韓国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東とアフリカ

- アラブ首長国連邦

- サウジアラビア

- イラン

- イラク

- カタール

- その他

- 北米

第6章 競合情勢

- 合併と買収、合弁事業、コラボレーション、および契約

- 有力企業が採用した戦略

- 企業プロファイル

- Nabors Industries Ltd

- Helmerich &Payne Inc.

- Eurasia Drilling Company Limited

- Ensign Energy Services Inc.

- Precision Drilling Corp.

- Patterson-UTI Energy Inc.

- Schlumberger Limited

- Saipem SpA

- Weatherford International PLC

- KCA Deutag Group

第7章 市場機会と将来の動向

- 新しいインフラストラクチャと比較的堅牢な設備投資予算

目次

Product Code: 62664

The Land Drilling Rig Market size is estimated at USD 43.62 billion in 2024, and is expected to reach USD 51.70 billion by 2029, growing at a CAGR of 3.46% during the forecast period (2024-2029).

Key Highlights

- Over the medium period, the land rig market has evolved significantly in recent years with the increasing use of high horsepower and hi-tech rigs and the increasing demand for heavy rigs. Moreover, exploiting unconventional reserves to meet the increasing demand for crude oil and natural gas is expected to create significant demand for the land drilling rig market during the forecast period.

- On the other hand, the global shift towards renewable energy sources for electricity generation poses a huge threat to the oil and gas sector, which, in turn, is expected to be a major challenge for the growth of the land drilling rig market during the forecast period.

- Nevertheless, the high-volume and demand markets in Asia-Pacific and the Middle Eastern regions are investing highly in midstream infrastructure. New infrastructure and relatively robust CAPEX budgets provide rigs opportunities to enter/re-enter these geographies.

- North America is one of the largest markets for land drilling rigs, led by the United States, mainly due to increased exploration and production activities of its tight oil and shale reserves.

Land Drilling Rigs Market Trends

The Mobile Rig Segment to Dominate the Market

- A portable or mobile rig is a truck-mounted unit that contains the derrick, draw-works, and mud pumps. The principal advantage of the portable rig includes low rig-up and rig-down time, as well as lower truck hire requirements.

- Portable rigs are used frequently in workover operations and when drilling to depths of about 10,000 ft. The rigs may be used on an 8, 12, or 24-hr/day basis and have several advantages over conventional rigs.

- Many land rig contractors have upgraded their fleet with higher-horsepower new builds, adding more powerful rigs with advanced technological capabilities, from top drives to automated pipe handling and the mobility to quickly move from one well site to another.

- According to Baker Hughes, as of October 2023, the total land rig counts accounted for 736 units, approximately 75% of the total rig counts. With the increasing rig counts on the land region, drilling and production activity are expected to be in demand, which, in turn, will drive the land drilling rig market.

- Moreover, as drilling in unconventional reserves is gradually gaining momentum in countries (other than the United States) such as Canada, China, and Argentina, portable rigs with high-tech rig designs and bigger horsepower are expected to create a significant opportunity for the mobile rigs soon.

- Also, the increasing crude oil prices have favored the gradual shift towards developing unconventional fields. As a result, the upcoming projects in unconventional reserves are expected to drive the demand in the land drilling market.

- Thus, owing to the above points, the mobile rig segment is expected to dominate the market in the forecast period.

North America to Dominate the Market

- Drilling activities in North America have increased amid rising oil and gas prices. The North American land rig count reached 897 in 2022, i.e., an increase of around 48% from 2021.

- The United States has increased its drilling activity and has the highest active rig counts. As of June 2023, the active rig count increased by around 9%, i.e., the count crossed 687, resulting in high demand for drilling rigs.

- Technological improvements in hydraulic fracturing and low breakeven prices support the robust drilling activity in the country. As a result, fleet utilization in the country rose to 46% after two years of decline. The increasing share of horizontal drilling in the United States has resulted in high demand for high-specification drilling rigs.

- In addition to receiving new rig orders, some large contractors upgrade their rigs to meet these requirements. As the United States drills better in the coming years, the demand for high-spec drilling rigs is expected to grow.

- Also, there is a significant potential growth for rig demand in Canada, driven by the start-up and expansion of numerous planned oil sand projects, leading to the development of the land drilling rig market during the forecast period.

- Therefore, based on the factors mentioned above, North America is expected to dominate the global land drilling rig market during the forecast period.

Land Drilling Rigs Industry Overview

The land drilling rig market is moderately consolidated. The key players in the market (in no particular order) include Nabors Industries Ltd, Helmerich & Payne Inc., Schlumberger Limited, Saipem SpA, and Weatherford International PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Global Onshore Active Rig Count of Major Countries, till 2022

- 4.4 Onshore CAPEX Forecast in USD billion, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Use of High Horsepower and Hi-Tech Rigs

- 4.7.1.2 Exploiting Unconventional Reserves

- 4.7.2 Restraints

- 4.7.2.1 The Global Shift Towards Renewable Energy Sources

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional

- 5.1.2 Mobile

- 5.2 Drive Mode

- 5.2.1 Mechanical

- 5.2.2 Electrical

- 5.2.3 Compound

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 Germany

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Iran

- 5.3.5.4 Iraq

- 5.3.5.5 Qatar

- 5.3.5.6 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nabors Industries Ltd

- 6.3.2 Helmerich & Payne Inc.

- 6.3.3 Eurasia Drilling Company Limited

- 6.3.4 Ensign Energy Services Inc.

- 6.3.5 Precision Drilling Corp.

- 6.3.6 Patterson-UTI Energy Inc.

- 6.3.7 Schlumberger Limited

- 6.3.8 Saipem SpA

- 6.3.9 Weatherford International PLC

- 6.3.10 KCA Deutag Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Infrastructure and Relatively Robust CAPEX Budgets