|

市場調査レポート

商品コード

1851639

磁気センサー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Magnetic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 磁気センサー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月11日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

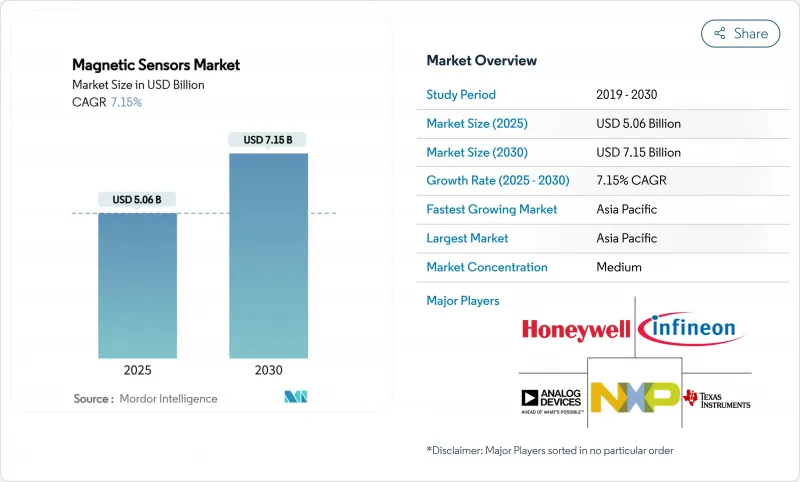

磁気センサーの市場規模は2025年に50億6,000万米ドルで、CAGR 7.15%を反映して2030年には71億5,000万米ドルに達すると予測されています。

電気自動車ドライブトレインの義務化、インダストリー4.0生産ラインの進展、民生機器における3軸センシングの拡大が、この着実な成長を支えています。自動車メーカーは機能安全目標を達成するためにより高精度の位置センサーと電流センサーを指定し、スマートフォンとウェアラブルブランドは拡張現実と屋内ナビゲーション機能のために小型トンネル磁気抵抗(TMR)ダイを統合しています。データセンター事業者は、ストレージ密度を高めるために量子グレードのTMRヘッドを支持し、サプライヤーを高級で高感度な設計へと押し上げています。レアアース磁石をめぐるサプライチェーンリスクは依然として高く、企業はリサイクル、現地加工、代替材料への投資を余儀なくされています。大手ベンダーは、ホール効果による価格下落の環境下で利幅を守るため、垂直統合、TMRポートフォリオの拡大、デジタル出力ロードマップに注力しており、競合の激しさは緩やかです。

世界の磁気センサー市場の動向と洞察

EVドライブトレイン電動化の義務化

欧州連合(EU)とカリフォルニア州における電気自動車規制は、ローターの位置や温度の追跡からバッテリー管理サブシステムまで、幅広いセンサーの展開に拍車をかけています。コンチネンタルのe-Motorローター温度センサーは、測定公差を3℃に抑え、設計者が性能を保護しながら希土類磁石の含有量を削減できるようにしています。このような精度は、EVプラットフォーム全体のコンプライアンス目標とコスト抑制戦略の両方をサポートします。

スマートフォンやウェアラブルに3軸磁気センシングが普及

携帯電話ベンダーは3-D磁気センサーを組み込み、拡張現実のオーバーレイや正確な屋内ナビゲーションを実現しています。小型のTMRダイが角度精度と消費電力の要件を満たし、異業種間需要の波及を促します。TDKのNivio(TM)xMRコンポーネントは、実験室グレードのSQUIDよりも小さなフットプリントで生体磁場を測定し、医療機器への波及の可能性を示唆しています。

コモディティ化したホール効果ICの価格低下

ホール効果デバイスは、低コストの中国ファブとの競争激化に直面しています。2024年以降、ネオジム価格が42%下落したことで、かつてプレミアムサプライヤーが保持していた材料コスト面での優位性が損なわれ、プレッシャーが高まっています。そのためベンダーは、差別化されたTMRやGMRラインに研究開発を振り向けたり、信号処理ブロックを統合したりして価格競争力を維持しています。

セグメント分析

TMRセンサーはCAGR 8.80%で拡大しており、主要テクノロジーの中で最も速いペースです。ホール効果ソリューションは、成熟した金型と魅力的な価格設定により、2024年においても磁気センサー市場シェアの48.0%を占めています。しかし、自動車の安全システムやインダストリー4.0ロボットは、TMRが得意とする-40℃~+150℃の範囲で、度以下の角度精度を指定するようになっています。Allegro MicroSystemsは、ホール効果に比べ10倍の感度と50%の低消費電流を実現したXtremeSense(TM)を販売しています。

GMRは、TMRのようなコスト・プレミアムを伴わずに感度の向上を求める顧客向けの中間的な製品であり、AMRはシンプルなシグナル・チェーンを必要とする産業用リニア・エンコーダのニッチ製品です。フラックスゲートとSQUIDデバイスは、ハイエンドの実験機器、防衛機器、医療機器に使用されています。このような技術構成から、コスト重視のラインではホール効果の優位が続くと思われるが、磁気センサー市場ではTMRが付加価値創出のほとんどを吸収すると思われます。

2024年の磁気センサー市場規模の56.0%は自動車が占める。電動パワートレインとADASの普及がこの基盤を安定させているが、際立った成長ストーリーはデータセンターです。HDDとSSD向けの量子グレードのTMRヘッドが、ハイパースケーラのテラバイト密度向上にCAGR 9.60%で貢献しています。事業者はまた、脱炭素化目標の中でラックレベルのエネルギー使用を最適化するため、配電ユニットにホールベースの電流センサーを導入しています。ヘルスケアでは、TDKの生体磁気イノベーションに支えられた非侵襲イメージングやインプラントモニタリングにより、新たな可能性が広がっています。

磁気センサー市場は、技術別(ホール効果、AMR、GMR、TMR、その他の技術)、用途別(自動車、家電、その他)、最終用途産業別(自動車OEMおよびTier-1、家電OEM、その他)、出力信号別(デジタル、アナログ)、地域別に分類されています。市場予測は金額(米ドル)で提供されます。

地域別分析

アジア太平洋は2024年に42.0%のシェアで磁気センサー市場をリードし、中国の半導体工場と日本の精密センサーのノウハウによってCAGR 9.40%に向かっています。中国のレアアース輸出抑制は、脅威と恩恵の両方を生み出します。国内ファブは磁石の虜となる供給を得る一方、輸出志向の自動車メーカーは代替調達に奔走します。日本のTMRロードマップは、計測の奥行きを活かしてセンサーの小型化を推し進め、自動車と医療の両分野に貢献します。韓国のストレージデバイス大手は高密度TMRヘッドへの需要を高め、インドの自動車生産台数拡大はこの地域の顧客基盤を拡大します。

北米は、材料供給上の痛手にもかかわらず、依然として極めて重要です。Allegro MicroSystemsの2024年度の売上高は10億5,000万米ドルで、e-モビリティ関連で38%増加しました。ノベオン・マグネティクスのテキサス工場のようなプロジェクトは、国内レアアース加工に対する州の優遇措置によって支えられていますが、その量は数年間アジアに遅れを取るでしょう。自動車メーカーは、米国道路交通安全局のソフトウェア更新要件を満たすため、現地のセンサー設計センターに大きく依存しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- EVドライブトレインの電動化義務化

- スマートフォンやウェアラブルにおける3軸磁気センシングの普及

- 自動車におけるADASとeモーターポジションのニーズの高まり

- インダストリー4.0へのファクトリーオートメーションシフト

- オンボードDC急速充電電流モニタリング

- データセンター向けHDD/SSDヘッドにおける量子グレードTMRの採用

- 市場抑制要因

- コモディティ化したホール効果ICの価格低下

- 希土類磁石のサプライチェーン集中度

- 高速電動化プラットフォームのEMI対応コスト

- xMRセンサー特許をめぐる知財訴訟リスク

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 技術別

- ホール効果

- 異方性磁気抵抗(AMR)

- 巨大磁気抵抗(GMR)

- トンネル磁気抵抗(TMR)

- その他のテクノロジー

- 用途別

- 自動車

- コンシューマーエレクトロニクス

- 産業オートメーション

- ヘルスケアと医療機器

- 航空宇宙・防衛

- データセンターおよびサーバー・ストレージ

- その他の用途

- 最終用途産業別

- 自動車OEMおよびTier-1

- コンシューマーエレクトロニクスOEM

- 産業機器メーカー

- エネルギー・公益事業

- ヘルスケアOEM

- 航空宇宙・防衛プライム

- 出力信号別

- デジタル(IC/SPI、SENT、PSI5)

- アナログ(リニア電圧/電流)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- ASEAN-5

- オーストラリアおよびニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- トルコ

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- ナイジェリア

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Infineon Technologies AG

- Allegro MicroSystems LLC

- NXP Semiconductors NV

- TDK Corporation

- Honeywell International Inc.

- Analog Devices Inc.

- STMicroelectronics NV

- Murata Manufacturing Co. Ltd

- TE Connectivity Ltd

- Texas Instruments Inc.

- NVE Corporation

- Crocus Technology Inc.

- Omron Corporation

- Asahi Kasei Microdevices(AKM)

- Diodes Incorporated

- Melexis NV

- ams-OSRAM AG

- Sensitec GmbH

- TT Electronics plc

- Robert Bosch GmbH

- Lake Shore Cryotronics Inc.