|

|

市場調査レポート

商品コード

1773187

磁気電流センサーの世界市場:タイプ別、ループタイプ別、産業別、地域別 - 2030年までの予測Magnetic Current Sensor Market by Type (Hall-effect, Flux Gate, Anisotropic Magnetoresistance, Giant Magnetoresistance, Tunnel Magnetoresistance), Loop Type (Open-loop, Closed-loop), Industry (Renewable, Photovoltaic) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 磁気電流センサーの世界市場:タイプ別、ループタイプ別、産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月17日

発行: MarketsandMarkets

ページ情報: 英文 273 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の磁気電流センサーの市場規模は、2025年の19億8,000万米ドルから2030年には35億1,000万米ドルに成長し、CAGRが12.1%になると予測されています。

最新の電子機器には、コンパクトでエネルギー効率に優れ、正確な電流センシングソリューションが必要であるため、民生用電子機器業界からの需要の増加が、磁気電流センサー市場の大きな促進要因となっています。スマートフォン、ラップトップ、タブレット、スマートホームデバイス、ウェアラブルエレクトロニクスなどは、安全性、性能、バッテリー効率を確保するために正確な電力管理に依存しています。磁気電流センサー、特にホール効果型や磁気抵抗型は、スペースに制約のあるデバイスへの統合に必要な感度とサイズの柔軟性を提供します。よりスマートで、より速く、より効率的な電子機器に対する消費者の期待が高まり続ける中、メーカーは製品の信頼性を高め、電力損失を低減し、急速充電やインテリジェント電力制御などの機能をサポートするために、先進的な電流センサーを取り入れています。このように、個人および家庭用電子機器の幅広い分野で電流センシング技術の統合が進んでいることが、市場の持続的な需要を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、ループタイプ別、産業別、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ホール効果電流センサーは、その幅広い適用性、費用対効果、非侵入操作で交流と直流の両方の電流を測定できる能力により、磁気電流センサー市場で最大のシェアを占めると予想されます。これらのセンサーは、自動車システム、産業機械、電源装置、家電製品などに広く使用されており、幅広い電流レベルで信頼性の高い性能を発揮します。シンプルな構造、コンパクトなサイズ、低消費電力により、バッテリー駆動やスペースに制約のある機器への組み込みに最適です。さらに、ホール効果センサーはオープン・ループとクローズド・ループの両方の構成で利用できるため、設計者は精度とコストのバランスを柔軟に調整できます。半導体製造とシグナル・コンディショニングの継続的な進歩により、ホール効果センサーの精度、温度安定性、応答時間はさらに改善され、大量生産で推奨されるセンシング技術としての地位を確固たるものにしています。産業界が安全性、効率、コンパクト設計を優先する中、ホール効果センサーの需要は着実に伸び続けています。

自動車の急速な電動化と自動車電子システムの複雑化により、自動車産業が磁気電流センサー市場を独占しています。磁気電流センサーは、電気自動車やハイブリッド自動車に不可欠なコンポーネントであり、バッテリー管理システム、インバーター、電気モーターの電流の流れを監視し、安全で効率的な電力使用を保証します。さらに、従来の内燃機関自動車にも、ADAS(先進運転支援システム)、インフォテインメント、配電ユニットなど、より多くの電子機器が組み込まれており、これらすべてに正確な電流センシングが必要とされています。エネルギー効率の向上、排出ガス規制への対応、コネクテッドカーやインテリジェントカーに対する消費者の需要の高まりが、自動車メーカーに高度な電流センシング技術の統合を促しています。自動車産業が持続可能性とデジタル化に向けて変革期を迎えている中、磁気電流センサーは制御、安全性、性能を実現する上で重要な役割を果たしており、同市場における業界の主導的地位を強化しています。

米国は、自動車、産業オートメーション、再生可能エネルギー、民生用電子機器などの高価値産業が強く存在するため、北米の磁気電流センサー市場で最大のシェアを占めると予想されます。同国は電気自動車の技術革新と生産の中心地であり、大手自動車メーカーやEV新興企業はバッテリー管理、モーター制御、充電システムを強化するために高度な電流センシング技術を統合しています。さらに米国は、スマートオートメーションとエネルギー効率に優れたシステムへの依存度を高めている確立された産業基盤を有しており、磁気電流センサーは電力使用の監視と最適化に不可欠です。主要センサーメーカーやテクノロジー企業の存在は、製品開発と採用をさらに加速させています。クリーンエネルギーや国内製造を支援する政府の政策も相まって、米国は複数のアプリケーション分野で電流センサーの需要を引き続き大きく牽引しています。

当レポートでは、世界の磁気電流センサー市場について調査し、タイプ別、ループタイプ別、産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- 磁気電流センサー市場におけるAIの影響

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 2025年の米国関税が磁気電流センサー市場に与える影響

- 貿易分析

- 関税と規制状況

- 特許分析

- 2025年~2026年の主な会議とイベント

第6章 磁気電流センサー市場(タイプ別)

- イントロダクション

- ホール効果電流センサー

- フラックスゲート電流センサー

- XMR技術

第7章 磁気電流センサー市場(ループタイプ別)

- イントロダクション

- オープンループ

- クローズドループ

第8章 磁気電流センサー市場(産業別)

- イントロダクション

- 自動車

- 家電

- 通信・ネットワーク

- ヘルスケア

- 工業

- エネルギーと電力

- その他

第9章 磁気電流センサー市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

- 製品の発売

- 取引

- 拡張

第11章 企業プロファイル

- 主要参入企業

- ALLEGRO MICROSYSTEMS, INC.

- INFINEON TECHNOLOGIES AG

- TDK CORPORATION

- ASAHI KASEI CORPORATION

- LEM INTERNATIONAL SA

- MELEXIS

- HONEYWELL INTERNATIONAL INC.

- VACUUMSCHMELZE GMBH & CO. KG

- TEXAS INSTRUMENTS INCORPORATED

- TAMURA CORPORATION

- YAGEO GROUP

- ANALOG DEVICES, INC.

- LITTELFUSE, INC.

- PIHER SENSORS & CONTROLS S.A.

- BROADCOM

- ACEINNA

- その他の企業

- KOHSHIN ELECTRIC CORPORATION

- ICE COMPONENTS, INC.

- MAGNESENSOR TECHNOLOGY

- AMERICAN AEROSPACE CONTROLS

- ELECTROHMS PRIVATE LIMITED

- DARE ELECTRONICS, INC.

- YUANXING ELECTRONICS CO., LTD.

- SENSOR ELECTRONIC TECHNOLOGY(SET)

- TELL-I TECHNOLOGIES, INC.

- SINOMAGS ELECTRONIC TECHNOLOGY CO., LTD.

- NINGBO CRRC TIMES TRANSDUCER TECHNOLOGY CO., LTD.

- HONGFA

- ZHEJIANG MEGATRON INTELLIGENT TECHNOLOGY CO., LTD.

- BYD SEMICONDUCTOR CO., LTD.

- AIM DYNAMICS

- AMBO TECHNOLOGY

- BITUOTECHNIK

- COBONTECH CO., LTD.

- CR MAGNETICS

- DANISENSE

- FRER SRL

- IVY METERING CO., LTD.

- LUKSENS

- MAGENTA MAGNETIC

- MAGNETEC

- RED LION

- HUBEI RICHSENS SCI&TECH CO., LTD.

- SAME SKY

- WINSON SEMICONDUCTOR CORP.

第12章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS, BY SEGMENT

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 KEY PARTICIPANTS IN INTERVIEWS, BY ORGANIZATION

- TABLE 4 DATA CAPTURED FROM PRIMARY SOURCES

- TABLE 5 RESEARCH ASSUMPTIONS

- TABLE 6 RESEARCH LIMITATIONS

- TABLE 7 RISK ANALYSIS

- TABLE 8 ROLE OF COMPANIES IN MAGNETIC CURRENT SENSOR ECOSYSTEM

- TABLE 9 PRICING RANGE OF HALL-EFFECT CURRENT SENSORS OFFERED BY KEY PLAYERS (USD), 2024

- TABLE 10 PRICING RANGE OF FLUXGATE CURRENT SENSORS OFFERED BY KEY PLAYERS (USD), 2024

- TABLE 11 PRICING AND SPECIFICATIONS OF MAGNETIC CURRENT SENSORS, BY COMPANY

- TABLE 12 MAGNETIC CURRENT SENSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 16 EXPECTED CHANGE IN PRICES AND IMPACT ON INDUSTRIES DUE TO TARIFFS

- TABLE 17 MFN TARIFF FOR HS CODE 850490-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 18 MFN TARIFF FOR HS CODE 850490-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 19 MFN TARIFF FOR HS CODE 850490-COMPLIANT PRODUCTS EXPORTED BY UK, 2024

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 LIST OF MAJOR PATENTS, 2020-2024

- TABLE 25 MAJOR CONFERENCES AND EVENTS, 2025-2026

- TABLE 26 MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 29 MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

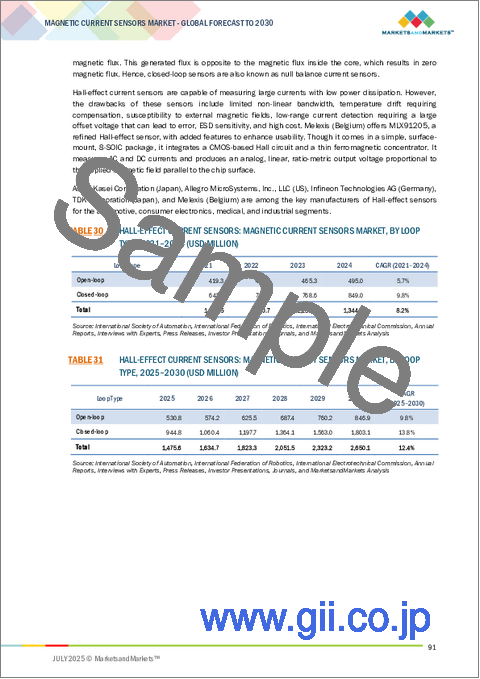

- TABLE 30 HALL-EFFECT CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2021-2024 (USD MILLION)

- TABLE 31 HALL-EFFECT CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2025-2030 (USD MILLION)

- TABLE 32 HALL-EFFECT CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 33 HALL-EFFECT CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 FLUXGATE CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2021-2024 (USD MILLION)

- TABLE 35 FLUXGATE CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2025-2030 (USD MILLION)

- TABLE 36 FLUXGATE CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 37 FLUXGATE CURRENT SENSORS: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 38 CHARACTERISTICS OF MAGNETORESISTIVE CURRENT SENSORS

- TABLE 39 XMR TECHNOLOGIES: MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2021-2024 (USD MILLION)

- TABLE 40 XMR TECHNOLOGIES: MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2025-2030 (USD MILLION)

- TABLE 41 XMR TECHNOLOGIES: MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 XMR TECHNOLOGIES: MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 XMR TECHNOLOGIES: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 XMR TECHNOLOGIES: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2021-2024 (USD MILLION)

- TABLE 46 MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE, 2025-2030 (USD MILLION)

- TABLE 47 OPEN-LOOP: MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 OPEN-LOOP: MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 CLOSED-LOOP: MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 CLOSED -LOOP: MAGNETIC CURRENT SENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 76 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 77 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 78 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 79 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 80 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 81 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 82 TELECOM & NETWORKING: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 83 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 84 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 85 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 86 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 87 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 88 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 89 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 90 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 91 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 92 HEALTHCARE: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 93 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 INDUSTRIAL: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 108 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 109 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 112 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 113 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET, BY ENERGY SOURCE, 2021-2024 (USD MILLION)

- TABLE 114 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET, BY ENERGY SOURCE, 2025-2030 (USD MILLION)

- TABLE 115 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET, BY RENEWABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 116 ENERGY & POWER: MAGNETIC CURRENT SENSORS MARKET, BY RENEWABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 117 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 118 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 119 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 120 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 121 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 122 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 123 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 124 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 125 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 126 OTHER INDUSTRIES: MAGNETIC CURRENT SENSORS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 127 MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 NORTH AMERICA: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 ROW: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 ROW: MAGNETIC CURRENT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 ROW: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 144 ROW: MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 145 MIDDLE EAST: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST: MAGNETIC CURRENT SENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 MAGNETIC CURRENT SENSORS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 148 MAGNETIC CURRENT SENSORS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 149 MAGNETIC CURRENT SENSORS MARKET: REGION FOOTPRINT

- TABLE 150 MAGNETIC CURRENT SENSORS MARKET: TYPE FOOTPRINT

- TABLE 151 MAGNETIC CURRENT SENSORS MARKET: LOOP TYPE FOOTPRINT

- TABLE 152 MAGNETIC CURRENT SENSORS MARKET: INDUSTRY FOOTPRINT

- TABLE 153 MAGNETIC CURRENT SENSORS MARKET: KEY STARTUPS/SMES

- TABLE 154 MAGNETIC CURRENT SENSORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 155 MAGNETIC CURRENT SENSORS MARKET: PRODUCT LAUNCHES, J ANUARY 2021-JANUARY 2025

- TABLE 156 MAGNETIC CURRENT SENSORS MARKET: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 157 MAGNETIC CURRENT SENSORS MARKET: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 158 ALLEGRO MICROSYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 159 ALLEGRO MICROSYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 ALLEGRO MICROSYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 161 ALLEGRO MICROSYSTEMS, INC.: DEALS

- TABLE 162 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 163 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 165 INFINEON TECHNOLOGIES AG: EXPANSIONS

- TABLE 166 INFINEON TECHNOLOGIES AG: OTHER DEVELOPMENTS

- TABLE 167 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 168 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 170 TDK CORPORATION: EXPANSIONS

- TABLE 171 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 172 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 ASAHI KASEI CORPORATION: PRODUCT LAUNCHES

- TABLE 174 ASAHI KASEI CORPORATION: EXPANSIONS

- TABLE 175 LEM INTERNATIONAL SA: COMPANY OVERVIEW

- TABLE 176 LEM INTERNATIONAL SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 LEM INTERNATIONAL SA: PRODUCT LAUNCHES

- TABLE 178 LEM INTERNATIONAL SA: DEALS

- TABLE 179 LEM INTERNATIONAL SA: EXPANSIONS

- TABLE 180 MELEXIS: COMPANY OVERVIEW

- TABLE 181 MELEXIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 MELEXIS: PRODUCT LAUNCHES

- TABLE 183 MELEXIS: DEALS

- TABLE 184 MELEXIS: EXPANSIONS

- TABLE 185 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 186 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 VACUUMSCHMELZE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 188 VACUUMSCHMELZE GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 VACUUMSCHMELZE GMBH & CO. KG: DEALS

- TABLE 190 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 191 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 192 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 193 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 194 TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS

- TABLE 195 TAMURA CORPORATION: COMPANY OVERVIEW

- TABLE 196 TAMURA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 TAMURA CORPORATION: EXPANSIONS

- TABLE 198 YAGEO GROUP: COMPANY OVERVIEW

- TABLE 199 YAGEO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 201 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 LITTELFUSE, INC.: COMPANY OVERVIEW

- TABLE 203 LITTELFUSE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LITTELFUSE, INC.: DEALS

- TABLE 205 LITTELFUSE, INC.: EXPANSIONS

- TABLE 206 PIHER SENSORS & CONTROLS S.A.: COMPANY OVERVIEW

- TABLE 207 PIHER SENSORS & CONTROLS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 PIHER SENSORS & CONTROLS S.A.: PRODUCT LAUNCHES

- TABLE 209 BROADCOM: COMPANY OVERVIEW

- TABLE 210 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ACEINNA: COMPANY OVERVIEW

- TABLE 212 ACEINNA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ACEINNA: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 MAGNETIC CURRENT SENSORS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA DURATION COVERED IN REPORT

- FIGURE 3 MAGNETIC CURRENT SENSORS MARKET: RESEARCH DESIGN

- FIGURE 4 PRIMARY AND SECONDARY RESEARCH ACTIVITIES

- FIGURE 5 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 6 EXPERT INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEW, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 REVENUE GENERATED BY COMPANIES FROM SALES OF MAGNETIC CURRENT SENSORS (SUPPLY SIDE)

- FIGURE 9 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 10 MAGNETIC CURRENT SENSORS MARKET: BOTTOM-UP APPROACH

- FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 12 DATA TRIANGULATION

- FIGURE 13 HALL-EFFECT CURRENT SENSORS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2030

- FIGURE 14 CLOSED-LOOP MAGNETIC SENSOR SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 15 AUTOMOTIVE INDUSTRY TO DOMINATE MARKET IN 2030

- FIGURE 16 ASIA PACIFIC HELD LARGEST MARKET SHARE IN 2024

- FIGURE 17 RISING ADOPTION OF ELECTRIC VEHICLES TO CREATE LUCRATIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MAGNETIC CURRENT SENSORS MARKET

- FIGURE 18 CHINA AND AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2025

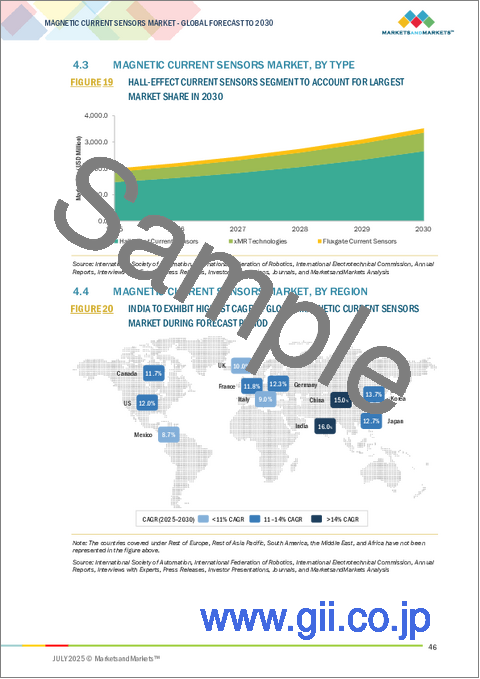

- FIGURE 19 HALL-EFFECT CURRENT SENSORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 20 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MAGNETIC CURRENT SENSORS MARKET DURING FORECAST PERIOD

- FIGURE 21 MAGNETIC CURRENT SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 IMPACT ANALYSIS: DRIVERS

- FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 25 IMPACT ANALYSIS: CHALLENGES

- FIGURE 26 MAGNETIC CURRENT SENSORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 MAGNETIC CURRENT SENSORS MARKET ECOSYSTEM ANALYSIS

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE OF HALL-EFFECT CURRENT SENSORS PROVIDED BY KEY PLAYERS, 2024

- FIGURE 30 AVERAGE SELLING PRICE OF FLUXGATE CURRENT SENSORS OFFERED BY KEY PLAYERS, 2024

- FIGURE 31 AVERAGE SELLING PRICE TREND OF MAGNETIC CURRENT SENSORS, BY REGION, 2021-2024

- FIGURE 32 MAGNETIC CURRENT SENSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 850490-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 850490-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 38 HALL-EFFECT CURRENT SENSORS TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 39 CLOSED-LOOP MAGNETIC CURRENT SENSORS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 40 AUTOMOTIVE INDUSTRY TO HOLD MAJORITY OF MAGNETIC CURRENT SENSORS MARKET SHARE IN 2030

- FIGURE 41 ASIA PACIFIC TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: MAGNETIC CURRENT SENSORS MARKET SNAPSHOT

- FIGURE 43 EUROPE: MAGNETIC CURRENT SENSORS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MAGNETIC CURRENT SENSORS MARKET SNAPSHOT

- FIGURE 45 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MAGNETIC CURRENT SENSORS, 2024

- FIGURE 46 MAGNETIC CURRENT SENSORS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 47 MAGNETIC CURRENT SENSORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 48 MAGNETIC CURRENT SENSORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 MAGNETIC CURRENT SENSORS MARKET: COMPANY FOOTPRINT

- FIGURE 50 MAGNETIC CURRENT SENSORS MARKET: COMPANY EVALUATION MATRIX (STARTUS/SMES), 2024

- FIGURE 51 ALLEGRO MICROSYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 52 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 53 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 LEM INTERNATIONAL SA: COMPANY SNAPSHOT

- FIGURE 56 MELEXIS: COMPANY SNAPSHOT

- FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 58 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 59 TAMURA CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 YAGEO GROUP: COMPANY SNAPSHOT

- FIGURE 61 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 62 LITTELFUSE, INC.: COMPANY SNAPSHOT

- FIGURE 63 BROADCOM: COMPANY SNAPSHOT

The global magnetic current sensor market is expected to grow from USD 1.98 billion in 2025 to USD 3.51 billion by 2030 at a CAGR of 12.1%. The increasing demand from the consumer electronics industry is a significant driving factor for the magnetic current sensor market, as modern electronic devices require compact, energy-efficient, and accurate current sensing solutions. Applications such as smartphones, laptops, tablets, smart home devices, and wearable electronics rely on precise power management to ensure safety, performance, and battery efficiency. Magnetic current sensors, particularly Hall-effect and magneto-resistive types, offer the sensitivity and size flexibility needed for integration into space-constrained devices. As consumer expectations for smarter, faster, and more efficient electronics continue to rise, manufacturers are incorporating advanced current sensors to enhance product reliability, reduce power loss, and support features like fast charging and intelligent power control. This growing integration of current sensing technology across a broad range of personal and home electronics is fueling sustained demand in the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Installation Type, Technology, Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Hall-effect current sensors to account for significant share of magnetic current sensor market"

Hall-effect current sensors are expected to hold the largest share in the magnetic current sensor market due to their broad applicability, cost-effectiveness, and ability to measure both AC and DC currents with non-intrusive operation. These sensors are widely used in automotive systems, industrial machinery, power supplies, and consumer electronics, offering reliable performance across a wide range of current levels. Their simple construction, compact size, and low power consumption make them ideal for integration into battery-powered and space-constrained devices. Moreover, Hall-effect sensors are available in both open-loop and closed-loop configurations, providing flexibility for designers to balance precision and cost. Continued advancements in semiconductor fabrication and signal conditioning have further improved their accuracy, temperature stability, and response time, solidifying their position as the preferred sensing technology in high-volume applications. As industries prioritize safety, efficiency, and compact designs, the demand for Hall-effect sensors continues to grow steadily.

"Automotive sector to dominate magnetic current sensor market during forecast period"

The automotive industry dominates the magnetic current sensor market due to the rapid electrification of vehicles and the increasing complexity of automotive electronic systems. Magnetic current sensors are essential components in electric and hybrid vehicles, where they monitor current flow in battery management systems, inverters, and electric motors to ensure safe and efficient power usage. Additionally, traditional internal combustion engine vehicles are also incorporating more electronics, such as advanced driver assistance systems (ADAS), infotainment, and power distribution units, all of which require accurate current sensing. The push for energy efficiency, regulatory compliance on emissions, and growing consumer demand for connected and intelligent vehicles are driving automakers to integrate advanced current sensing technologies. With the automotive sector undergoing a transformative shift toward sustainability and digitization, magnetic current sensors play a critical role in enabling control, safety, and performance, reinforcing the industry's leading position in the market.

"US to account for largest share of North America magnetic current sensor market"

The US is expected to account for the largest share of the North America magnetic current sensor market due to the strong presence of high-value industries such as automotive, industrial automation, renewable energy, and consumer electronics. The country is a hub for electric vehicle innovation and production, with major automakers and EV startups integrating advanced current sensing technologies to enhance battery management, motor control, and charging systems. Additionally, the US has a well-established industrial base that increasingly relies on smart automation and energy-efficient systems, where magnetic current sensors are essential for monitoring and optimizing power usage. The presence of leading sensor manufacturers and technology companies further accelerates product development and adoption. Coupled with favorable government policies supporting clean energy and domestic manufacturing, the US continues to drive significant demand for magnetic current sensors across multiple application sectors.

In-depth interviews have been conducted with C-level executives (CEOs), directors, and other executives from various key organizations operating in the magnetic current sensor marketplace.

- By Company Type: Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation: C-level Executives-35%, Directors-45%, and Others-20%

- By Region: North America-45%, Europe-25%, Asia Pacific-20%, and RoW-10%

The study includes an in-depth competitive analysis of these key players in the magnetic current sensor market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the magnetic current sensor market by type, loop type, industry, and region (North America, Europe, Asia Pacific, and RoW). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the magnetic current sensor market. A thorough analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies such as contracts, partnerships, agreements, new product & service launches, and acquisitions, and recent developments associated with the magnetic current sensor market. This report covers a competitive analysis of the upcoming magnetic current sensor market ecosystem startups.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the magnetic current sensor market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing use of battery-powered systems and increasing focus on renewable energy, High adoption of Hall-effect current sensors, Increasing demand from consumer electronics industry), restraints (Intense pricing pressure resulting in fluctuations in average selling price (ASP) and Accuracy and sensitivity trade-offs with high electromagnetic interference (EMI)), opportunities (Increase in number of networked devices, Increase in manufacturing of hybrid and electric cars, Miniaturization of current sensors, Global investments in renewable energy adoption), and challenges (Fluctuations in accuracy of current sensors over varying temperature ranges and Need for product differentiation and development of innovative solutions) influencing the growth of the magnetic current sensor market.

- Product Development/Innovation: The report includes detailed insights on upcoming technologies, research & development activities, and product launches in the magnetic current sensor market.

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the magnetic current sensor market across varied regions.

- Market Diversification: This includes exhaustive information about new products, untapped geographies, recent developments, and investments in the magnetic current sensor market.

- Competitive Assessment: The magnetic current sensor market report includes information about in-depth assessments of market shares, growth strategies, and service offerings of leading players, such as Allegro MicroSystems, Inc. (US), Infineon Technologies AG (Germany), TDK Corporation (Japan), Asahi Kasei Corporation (Japan), LEM International SA (Switzerland), Melexis (Belgium), TAMURA Corporation (Japan), and VACUUMSCHMELZE GMBH & CO. KG (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants and key opinion leaders

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MAGNETIC CURRENT SENSORS MARKET

- 4.2 MAGNETIC CURRENT SENSORS MARKET IN ASIA PACIFIC, BY COUNTRY AND INDUSTRY

- 4.3 MAGNETIC CURRENT SENSORS MARKET, BY TYPE

- 4.4 MAGNETIC CURRENT SENSORS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Significant focus on renewable energy expansion

- 5.2.1.2 High adoption of Hall-effect magnetic current sensors in advanced applications

- 5.2.1.3 Thriving consumer electronics industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Declining average selling price due to intense pricing pressure

- 5.2.2.2 Degradation in sensor performance caused by electromagnetic interference

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Scaling IoT infrastructure

- 5.2.3.2 Increasing production of hybrid and electric vehicles

- 5.2.3.3 Miniaturization of magnetic current sensors

- 5.2.3.4 Global investments in renewable energy initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuations in accuracy of magnetic current sensors over varying temperature ranges

- 5.2.4.2 Responding to market maturity with product diversification

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 PRICING RANGE OF HALL-EFFECT CURRENT SENSORS, BY KEY PLAYER, 2024

- 5.6.2 PRICING RANGE OF FLUXGATE CURRENT SENSORS, BY KEY PLAYER, 2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF MAGNETIC CURRENT SENSORS, BY REGION, 2021-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 AMR, GMR, and TMR magnetic current sensors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Analog front-end signal conditioning

- 5.7.2.2 Isolation techniques (magnetic and optical isolation)

- 5.7.2.3 Integrated microcontrollers

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 IoT and edge computing

- 5.7.1 KEY TECHNOLOGIES

- 5.8 IMPACT OF AI ON MAGNETIC CURRENT SENSORS MARKET

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MONOLITHIC POWER SYSTEMS TRANSFORMS ATMS WITH ULTRA-SMALL, LINEAR HALL-EFFECT MAGNETIC CURRENT SENSORS

- 5.11.2 HANGZHI PRECISION'S MAGNETIC CURRENT SENSOR MEETS STRINGENT REQUIREMENTS OF VACUUM COATING APPLICATIONS

- 5.11.3 NVE'S GMR SENSORS REVOLUTIONIZE CORROSION DETECTION IN INDUSTRIAL PIPELINES

- 5.12 IMPACT OF 2025 US TARIFFS ON MAGNETIC CURRENT SENSORS MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON INDUSTRIES

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 850490)

- 5.13.2 EXPORT SCENARIO (HS CODE 850490)

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 STANDARDS

- 5.14.3.1 IEEE 1451 Standard for smart transducer interface for sensors and actuators

- 5.14.3.2 IEEE C37.118 Standard mentioning sensor requirements of smart grids

- 5.14.3.3 (IEC) 60079-0:2017

- 5.14.3.4 IEC 60364-4-43: Low-voltage electrical installations - protection for safety - protection against overcurrent

- 5.14.3.5 IEC 60269

- 5.14.3.6 Atmosphere explosible (ATEX)

- 5.14.3.7 Edison Testing Laboratories (ETL) Certification

- 5.14.4 REGULATIONS

- 5.15 PATENT ANALYSIS

- 5.16 KEY CONFERENCES AND EVENTS, 2025-2026

6 MAGNETIC CURRENT SENSORS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 HALL-EFFECT CURRENT SENSORS

- 6.2.1 RISING USE IN AUTOMOTIVE SYSTEMS TO BOOST SEGMENTAL GROWTH

- 6.3 FLUXGATE CURRENT SENSORS

- 6.3.1 SURGING REQUIREMENT FOR HIGH-ACCURACY MEASUREMENTS IN INDUSTRIAL AND MEDICAL EQUIPMENT TO SUPPORT SEGMENTAL GROWTH

- 6.4 XMR TECHNOLOGIES

- 6.4.1 ANISOTROPIC MAGNETORESISTANCE (AMR)

- 6.4.1.1 Growing adoption in consumer electronics, automotive, and medical sectors to fuel segmental growth

- 6.4.2 GIANT MAGNETORESISTANCE (GMR)

- 6.4.2.1 Wide use in electrical and automobile equipment to foster segmental growth

- 6.4.3 TUNNEL MAGNETORESISTANCE (TMR)

- 6.4.3.1 Rising use to measure current, position, motion, and direction to propel segmental growth

- 6.4.1 ANISOTROPIC MAGNETORESISTANCE (AMR)

7 MAGNETIC CURRENT SENSORS MARKET, BY LOOP TYPE

- 7.1 INTRODUCTION

- 7.2 OPEN-LOOP

- 7.2.1 NEED FOR COST-EFFECTIVE AND EFFICIENT ENERGY MONITORING SOLUTIONS TO FUEL MARKET GROWTH

- 7.3 CLOSED-LOOP

- 7.3.1 HIGH DEMAND FROM EV, INDUSTRIAL AUTOMATION, AND RENEWABLE ENERGY APPLICATIONS TO SUPPORT MARKET GROWTH

8 MAGNETIC CURRENT SENSORS MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- 8.2 AUTOMOTIVE

- 8.2.1 INCREASING ADOPTION OF EVS AND HEVS TO STIMULATE MARKET GROWTH

- 8.3 CONSUMER ELECTRONICS

- 8.3.1 GROWING INTEGRATION INTO VARIOUS CONSUMER ELECTRONIC PRODUCTS TO CONTRIBUTE TO MARKET GROWTH

- 8.4 TELECOM & NETWORKING

- 8.4.1 EXPANSION OF 5G NETWORKS AND DATA CENTERS TO BOOST MAGNETIC CURRENT SENSOR DEMAND

- 8.5 HEALTHCARE

- 8.5.1 INCREASING APPLICATIONS IN MEDICAL DEVICES TO BOOST MARKET GROWTH

- 8.6 INDUSTRIAL

- 8.6.1 ELEVATING ADOPTION OF AUTOMATION AND ROBOTICS IN INDUSTRIAL PLANTS TO CREATE GROWTH OPPORTUNITIES

- 8.7 ENERGY & POWER

- 8.7.1 FAST RESPONSE TIME AND EXCELLENT THERMAL STABILITY FEATURES TO ACCELERATE DEMAND

- 8.7.2 RENEWABLE

- 8.7.2.1 Transition toward low-carbon power generation to boost demand

- 8.7.2.2 Solar/Photovoltaic

- 8.7.2.3 Wind

- 8.7.2.4 Others

- 8.7.3 NON-RENEWABLE

- 8.7.3.1 Need for optimal energy output and safe operation to stimulate demand

- 8.8 OTHER INDUSTRIES

- 8.8.1 AEROSPACE & DEFENSE

- 8.8.2 RAILWAY

- 8.8.3 BUILDING AUTOMATION

9 MAGNETIC CURRENT SENSORS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Automotive electrification and automation trends to support market expansion

- 9.2.3 CANADA

- 9.2.3.1 Commitment to zero-emission mobility to boost demand

- 9.2.4 MEXICO

- 9.2.4.1 Robust automotive manufacturing ecosystem to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Premium vehicle production and electronics integration to boost market

- 9.3.3 UK

- 9.3.3.1 Strong focus on enhancing commercial use of connected and autonomous vehicles to fuel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Increasing focus on R&D activities pertaining to low-carbon aviation technologies to stimulate demand

- 9.3.5 ITALY

- 9.3.5.1 Stringent energy regulations and digital transformation across automotive, manufacturing, and healthcare sectors to spike demand

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Leading position in EV production to spur demand

- 9.4.3 JAPAN

- 9.4.3.1 Rising deployment of smart factories and adoption of advanced manufacturing processes to complement market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Initiatives promoting environmentally friendly and self-driving vehicle technologies to elevate demand

- 9.4.5 INDIA

- 9.4.5.1 Rapid expansion of automotive and electronics industries to foster market growth

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Smart cities and sustainable energy projects to create opportunities

- 9.5.2.2 GCC

- 9.5.2.3 Rest of Middle East

- 9.5.3 AFRICA

- 9.5.3.1 Expanding renewable energy and smart grid projects to accelerate market growth

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Investment in automotive electrification to drive market

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Type footprint

- 10.6.5.4 Loop type footprint

- 10.6.5.5 Industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPETITIVE SCENARIO

- 10.9 PRODUCT LAUNCHES

- 10.10 DEALS

- 10.11 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ALLEGRO MICROSYSTEMS, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 INFINEON TECHNOLOGIES AG

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 TDK CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 ASAHI KASEI CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 LEM INTERNATIONAL SA

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 MELEXIS

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.7 HONEYWELL INTERNATIONAL INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 VACUUMSCHMELZE GMBH & CO. KG

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 TEXAS INSTRUMENTS INCORPORATED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Expansions

- 11.1.10 TAMURA CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.11 YAGEO GROUP

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 ANALOG DEVICES, INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.13 LITTELFUSE, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.13.3.2 Expansions

- 11.1.14 PIHER SENSORS & CONTROLS S.A.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.15 BROADCOM

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.16 ACEINNA

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches

- 11.1.1 ALLEGRO MICROSYSTEMS, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 KOHSHIN ELECTRIC CORPORATION

- 11.2.2 ICE COMPONENTS, INC.

- 11.2.3 MAGNESENSOR TECHNOLOGY

- 11.2.4 AMERICAN AEROSPACE CONTROLS

- 11.2.5 ELECTROHMS PRIVATE LIMITED

- 11.2.6 DARE ELECTRONICS, INC.

- 11.2.7 YUANXING ELECTRONICS CO., LTD.

- 11.2.8 SENSOR ELECTRONIC TECHNOLOGY (SET)

- 11.2.9 TELL-I TECHNOLOGIES, INC.

- 11.2.10 SINOMAGS ELECTRONIC TECHNOLOGY CO., LTD.

- 11.2.11 NINGBO CRRC TIMES TRANSDUCER TECHNOLOGY CO., LTD.

- 11.2.12 HONGFA

- 11.2.13 ZHEJIANG MEGATRON INTELLIGENT TECHNOLOGY CO., LTD.

- 11.2.14 BYD SEMICONDUCTOR CO., LTD.

- 11.2.15 AIM DYNAMICS

- 11.2.16 AMBO TECHNOLOGY

- 11.2.17 BITUOTECHNIK

- 11.2.18 COBONTECH CO., LTD.

- 11.2.19 CR MAGNETICS

- 11.2.20 DANISENSE

- 11.2.21 FRER SRL

- 11.2.22 IVY METERING CO., LTD.

- 11.2.23 LUKSENS

- 11.2.24 MAGENTA MAGNETIC

- 11.2.25 MAGNETEC

- 11.2.26 RED LION

- 11.2.27 HUBEI RICHSENS SCI&TECH CO., LTD.

- 11.2.28 SAME SKY

- 11.2.29 WINSON SEMICONDUCTOR CORP.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS