|

市場調査レポート

商品コード

1445949

フィンテック向けAI:市場シェア分析、業界動向と統計、成長予測(2024~2029年)AI in Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フィンテック向けAI:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

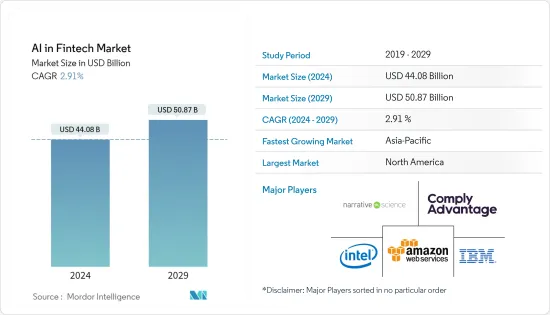

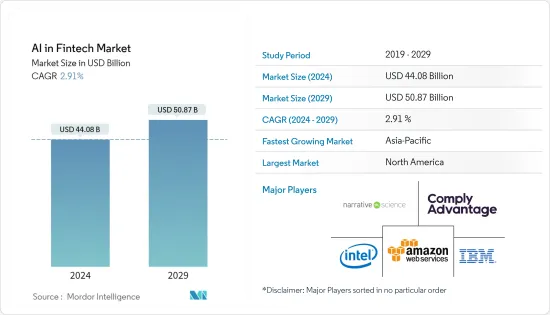

フィンテック(FinTech)向けAIの市場規模は、2024年に440億8,000万米ドルと推定され、2029年までに508億7,000万米ドルに達すると予測されており、予測期間(2024~2029年)中に2.91%のCAGRで成長します。

COVID-19のパンデミックの発生により、人々が金融サービスと関わる方法の変化が加速しています。決済と富を重視するフィンテック企業は、新しいリソースに投資したり、取引量の増加によるシステムへのストレスに耐えられる容量を拡大したりして、既存のインフラを強化することに重点を置いています。フィンテック企業にとってこれは困難に見えましたが、これらの企業は収益を取引量に依存しているため、このような取り組みはAIソリューションの大きなニーズをもたらしています。このような要因により、フィンテック向けAI市場ソリューションの需要が加速すると予想されます。

主なハイライト

- 金融会社は、メインフレームコンピューターとリレーショナルデータベースを早期に採用してきました。彼らは次のレベルの計算能力を熱心に待っていました。人工知能(AI)は、人間の知能の側面から派生した手法をより広範囲に適用することで結果を向上させます。過去数年間にわたるコンピューターの軍拡競争は、フィンテック企業に革命をもたらしました。機械学習、AI、ニューラルネットワーク、ビッグデータ分析、進化的アルゴリズムなどのテクノロジにより、コンピューターはこれまで以上に巨大で、多様で、多様で深いデータセットを処理できるようになりました。

- さらに、AIと機械学習は、顧客に関する膨大な情報を処理できるため、銀行やフィンテックに利益をもたらしています。このデータと情報は、顧客が望むタイムリーなサービス/製品に関する結果を得るために比較され、基本的に顧客関係の構築に役立ちます。

- さらに、機械学習は、特に傾向モデルの作成のために、前例のない割合で導入されています。銀行や保険会社は、Webアプリケーションやモバイルアプリケーション向けに機械学習ベースのソリューションを導入しています。これにより、リアルタイムの行動データに基づいて顧客の製品傾向を予測することで、リアルタイムのターゲットマーケティングがさらに強化されました。

- いくつかの既存市場企業は、銀行向けのAIチャットボットなどのソリューションを明示的に提供することでニッチ市場を確立しています。たとえば、2021年 6月には、TalismaとActive.Aiが提携し、会話 AI対応チャットボットを使用してBFSIでの顧客体験の向上を実現しました。

- さらに、いくつかのクレジットカード会社は、既存の不正検出ワークフローに予測分析を導入して、誤検知を削減しています。この調査対象市場は、クレジットカード会社やその他の金融機関向けにAIベースのマネーロンダリング対策(AML)および不正行為検出ソリューションを提供する複数の企業により、さらに勢いを増しています。

- たとえば、2022年 6月、AI主導のマネーロンダリング対策(AML)ソフトウェアの開発会社であるLucinityは、不正行為管理会社SEONと提携して、AMLコンプライアンスソフトウェアにリアルタイムの不正行為防止機能を組み込みました。 SEONの不正防止ソリューションは、Lucinityのプラットフォームを通じて利用可能となり、取引監視からリアルタイムの不正検出と防止に至るまで、コンプライアンスリスクサービスを顧客に提供します。

- さらに、AI対応インフラは、効率的なデータ管理が可能であり、十分な処理能力を備え、俊敏性、柔軟性、拡張性があり、さまざまな量のデータに対応できる容量を備えている必要があります。したがって、フィンテック中小企業にとって、AIをサポートするために必要なハードウェア要素とソフトウェア要素を組み立てることはより困難になるでしょう。さらに、AIとディープラーニングアプリケーションの民主化が拡大するにつれ、テクノロジー大手だけでなく中小企業でも利用できるようになりました。この作業を行うAI専門家の需要も同様に増大しており、訓練を受けたリソースの不足がフィンテック向けAIの大きな課題となっています。

フィンテック向けAI市場の動向

不正検出は大幅な成長が見込まれる

- 人工知能は、金融詐欺や不正行為を迅速かつ効果的に検出する方法を特定するのに役立ちます。これにより、機械は膨大なデータセットを正確に処理できるようになりますが、人間はこれに苦労することがあります。不正行為の検出に人工知能を使用すると、さまざまな利点があります。高速に計算できることは、AIと機械学習の利点としてよく知られています。取引方法や支払いなど、ユーザーのアプリ利用習慣を把握し、リアルタイムで異常を発見できるようにします。手動手法よりも効率的であるため、誤検知が減り、専門家はより複雑な問題に集中できるようになります。

- Certified Fraud Examiners(ACFE)と分析のパイオニアであるSASが実施した新しい世論調査によると、昨年、不正検出のための人工知能(AI)と機械学習(ML)の使用が国際的に増加しました。調査によると、組織の13%が不正行為の検出と阻止のために人工知能(AI)と機械学習を採用しており、さらに25%が今後1~2年以内に導入を計画しており、約200%の成長を示しています。世論調査によると、不正検査官は、この技術と、業界を超えて広く普及しているその他の不正対策技術の開発を特定しました。

- さらに、インド準備銀行(RBI)は、2022年度にインド全土で約9,103件の銀行詐欺事件が発生したと報告しました。これは前年比増加し、過去10年間の傾向が逆転しました。銀行詐欺の総額は1兆3,800億ルピーから6,040億ルピーに減少しました。銀行詐欺事件がこのように急増したことで、AI市場関係者は顧客の幅広いニーズに応える新しいソリューションやツールを開発できるようになると思われます。

- 市場のプレーヤーは顧客により良いサービスを提供するために協力しています。たとえば、2023年 2月、マスターカードは中東とアフリカのデジタルコマースの主要プロバイダーであるネットワークインターナショナルと提携し、不正行為、拒否、チャージバックに対処し、買収者のコストとリスクを最小限に抑えました。この提携を通じて、ネットワークはマスターカードのBrighterion人工知能(AI)テクノロジーを地域全体に展開し、アクワイアラーと企業に取引詐欺のスクリーニングと加盟店の監視を提供します。

- さらに、2022年 3月には、世界の保険業界にAI主導の意思決定自動化および最適化ソリューションを提供するShift Technologyと、損害保険業界にテクノロジーソリューションを提供する世界のプロバイダであるDuck Creek Technologiesがソリューションパートナーシップを発表しました。 AIを活用した不正検出機能は2022年に市場投入されます。完全に統合されると、Duck Creek Claimsのユーザーはリアルタイムの不正アラートを請求管理ソフトウェアシステムに直接受け取るようになります。

北米が最大の市場シェアを占める

- 北米は、著名なAIソフトウェアおよびシステムのサプライヤー、金融機関によるAIプロジェクトへの共同投資、ほとんどのフィンテック向けAIソリューションの採用により、フィンテック向けAI市場を支配すると予想されています。この地域は今後数年間でこの分野で大幅な成長が見込まれると予想されます。さらに、北米は多くのAIフィンテック企業のビジネスハブとして機能しており、Sidetradeのような企業は北米拠点をカルガリーに置くことを選択しています。

- AIに対する政府の取り組みと投資。たとえば市場を牽引するでしょう。スタンフォード大学の最近の調査データによると、2022会計年度に米国政府は人工知能(AI)契約に33億米ドルを支出しました。連邦政府機関によるテクノロジーへの支出は、2021年の27億米ドルから年間6億米ドル以上増加しており、意思決定科学、コンピュータービジョン、自律型部門が投資の大部分を占めています。米国政府が人工テクノロジーに13億米ドルを支出した2017年以来、AI契約への総支出は2.5倍以上に増加しました。

- 市場のプレーヤーは、この地域の顧客により良いサービスを提供するために協力しています。たとえば、2022年 8月、NACUSOのCUSO of the Year Awardを受賞し、スコアリングの改善を通じて信用アクセスの向上に貢献したZest AIは、世界のデータ、分析、テクノロジー企業であるEquifax, Inc.との提携を発表しました。この提携により、Zest AIの引受技術を利用する信用組合は、Equifaxが提供するデータをより多く分析し、特に従来銀行不足だった信用組合が、より多くの申請をより迅速に受け付けることができるようになります。これは、Zest AIと国家消費者報告庁との最初の大規模な販売関係です。

- 一部の企業のソリューションは、企業が次善策ソフトウェアでリテールバンキングを成長させ、金融詐欺を検出して対処し、マルチチャネルカスタマーエクスペリエンスソリューションで顧客関係を改善するのに役立ちます。ちなみに、2022年4月、共同売掛金のプレーヤーであるVersapayは、米国に拠点を置くフィンテックスタートアップDadeSystemsの買収を完了したと本日発表しました。 Versapayの一連の売掛金(AR)自動化ソリューションは、買収の結果、AIおよび機械学習機能と同様に拡張されました。また、成長するスタッフに重要なスキルを追加しながら、Versapayの企業および中間市場の拠点を拡大します。

- この地域の銀行は、データを記録し、不正行為と闘うためにブロックチェーン技術の使用を開始しています。ブロックチェーンは各トランザクションの詳細を記録するため、ハッカーの試みを簡単に検出できます。このテクノロジーにより世界中での支払いが可能になり、低手数料で迅速なトランザクションが可能になります。ブロックチェーンの分散台帳技術(DLT)は、さまざまな店舗や分散ネットワーク間でのデータの記録と共有を支援します。さらに、暗号化およびアルゴリズム手法により、金融ネットワーク全体でデータが同期されます。トランザクションデータはさまざまな場所に保存できるため、これは重要なステップです。これにより、ブロックチェーンの相互運用性と業界を超えたデータ交換への道が開かれます。

フィンテック向けAI業界の概要

フィンテック向けAI市場は、多くの世界のプレーヤーによって細分化されつつあります。イノベーションに焦点を当てて、大企業のさまざまな買収や提携が間もなく行われることが予想されます。市場の主要なプレーヤーには、IBM Corporation、Intel Corporation、Narrative Science、Microsoft Corporationなどがあります。

2023年 2月、ブルネイのバイドゥリ銀行は、人工知能(AI)を使用して信用リスク管理を最新化するために、シンガポールを拠点とするSoftware-as-a-Service(SaaS)フィンテック Finbots.aiを選択しました。 Finbots.aiによると、同社のAIクレジットモデリングソリューションであるCreditXにより、Baiduri Bankは数分の1の時間とコストで高品質のクレジットスコアカードを設計および導入できるようになります。これにより、信用リスクが最小限に抑えられ、小売業者や中小企業(SME)の効率性と機敏性が向上するとともに、十分なサービスが提供されていないクレジット市場に対する銀行の金融包摂キャンペーンが促進されます。

2023年 2月、スコシアバンクは顧客の資産管理を強化するための新しいツールであるScotia Smart Investorを導入しました。カナダの金融業者は、AIを活用した推奨とリアルタイムのパーソナライズされた支援を組み合わせた、Assistance+を通じて新しいデバイスを導入しました。 Scotia Smart Investorは、Scotiabankにリンクされている投資信託ディーラーであるScotia Securitiesによって作成されました。このツールにはAIを活用したアドバイスエンジンが含まれており、ユーザーの財務目標の設計、計画、監視、更新を支援します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の激しさ

- 金融テクノロジーにおけるAIの新たな用途

- テクノロジーのスナップショット

- COVID-19の市場への影響

第5章 市場力学

- 市場促進要因

- 金融機関におけるプロセス自動化の需要の高まり

- データソースの可用性の向上

- 市場抑制要因

- 熟練した労働力の必要性

第6章 市場セグメンテーション

- タイプ別

- ソリューション

- サービス

- 展開別

- クラウド

- オンプレミス

- 用途別

- チャットボット

- 信用スコアリング

- 定量的および資産管理

- 不正検出

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋地域

- 世界のその他の地域

第7章 競合情勢

- 企業プロファイル

- IBM Corporation

- Intel Corporation

- ComplyAdvantage.com

- Narrative Science

- Amazon Web Services Inc.

- IPsoft Inc.

- Next IT Corporation

- Microsoft Corporation

- Onfido

- Ripple Labs Inc.

- Active.Ai

- TIBCO Software(Alpine Data Labs)

- Trifacta Software Inc.

- Data Minr Inc.

- Zeitgold

- Sift Science Inc.

- Pefin Holdings LLC

- Betterment Holdings

- WealthFront Inc.

第8章 投資分析

第9章 市場の将来

The AI in Fintech Market size is estimated at USD 44.08 billion in 2024, and is expected to reach USD 50.87 billion by 2029, growing at a CAGR of 2.91% during the forecast period (2024-2029).

The COVID-19 pandemic outbreak has been accelerating the change in the way how people interact with financial services. Payment- and wealth-focused fintech companies have focused on bolstering their existing infrastructure by investing in new resources or expanding capacity to withstand the stress to their systems from higher transaction volumes. Though it seemed challenging for fintech companies, such actions have provided a significant need for AI solutions as these companies depend on transaction volumes for revenue. Such factors are expected to spearhead the demand for AI solutions in the fintech market.

Key Highlights

- Financial firms have been the early adopters of the mainframe computer and relational database. They eagerly waited for the next level of computational power. Artificial Intelligence (AI) improves results by applying methods derived from the aspects of human intelligence at a broader scale. The computational arms race for past years has revolutionized fintech companies. Technologies, such as machine learning, AI, neural networks, Big Data Analytics, evolutionary algorithms, and much more, have allowed computers to crunch huge, varied, diverse, and deep datasets than ever before.

- Moreover, AI and machine learning have benefited banks and fintech as they can process vast amounts of information about customers. This data and information are then compared to obtain results about timely services/products that customers want, which has aided, essentially, in developing customer relations.

- Additionally, machine learning is being adopted at unprecedented rates, specifically to create propensity models. Banks and insurance companies are introducing machine learning-based solutions for web and mobile applications. This has further enhanced the real-time target marketing by predicting the product propensity of the customers based on behavioral data in real-time.

- Several market incumbents are establishing a niche by explicitly offering solutions, like AI Chatbots for banking. For instance, in June 2021, Talisma and Active.Ai has partnered to enable improved customer experience in BFSI using conversation AI enabled Chatbot.

- Moreover, several credit card companies implement predictive analytics into their existing fraud detection workflows to reduce false positives. The studied market further gains traction with several players offering AI-based Anti-money Laundering (AML) and Fraud detection solutions for credit card companies and other financial institutions.

- For instance, in June 2022, Lucinity, a developer of AI-driven anti-money laundering (AML) software has partnered with fraud management company SEON to include real time fraud prevention capabilities in AML compliance software. SEON's fraud prevention solution will be available through Lucinity's platform, providing customers with compliance risk services from transaction monitoring to real-time fraud detection and prevention.

- Further, AI-ready infrastructure should be capable of efficient data management, have enough processing power, be agile, flexible, and scalable, and have the capacity to accommodate different volumes of data. Therefore, it would be more challenging for fintech small businesses to assemble the necessary hardware and software elements to support AI. Moreover, as the democratization of AI and deep learning applications expands, not only for tech giants but is now viable for small and medium-sized businesses. The demand for AI professionals to do the work has ballooned as well, and the scarcity of trained resources is the major challenge for AI in fintech.

AI in Fintech Market Trends

Fraud Detection is Expected to Witness Significant Growth

- Artificial intelligence can assist in identifying rapid and effective ways to detect financial fraud and malpractice. They allow machines to process enormous datasets accurately, which people sometimes struggle with. Using artificial intelligence for fraud detection has various advantages. The ability to compute quickly is a well-known benefit of AI and machine learning. It creates a grasp of a user's app usage habits, such as transaction methods, payments, and so on, allowing it to spot anomalies in real-time. It reduces false positives and allows specialists to focus on more complex issues because it is more efficient than manual techniques.

- According to a new poll conducted by Certified Fraud Examiners (ACFE) and analytics pioneer SAS, the use of Artificial Intelligence (AI) and Machine Learning (ML) for fraud detection increased internationally last year. According to the poll, 13% of organizations employ artificial intelligence (AI) and machine learning to detect and deter fraud, with another 25% planning to do so in the next year or two, representing roughly 200% growth. According to the poll, fraud examiners identified this and other anti-fraud tech developments in a cross-industry that are extensively spreading.

- Further, the Reserve Bank of India (RBI) reported around 9,103 bank fraud incidents across India in fiscal year 2022. This increased over the previous year, reversing the last decade's trend. The total value of bank scams fell from INR 1.38 trillion to INR 604 billion. Such high rise in the bank fraud cases would allow the AI market players to develop new solutions or tools to cater wide range of needs of the customer.

- The players in the market are collobarting to provide better service to its customer. For instance, in february 2023, Mastercard partnered with Network International, the Middle East and Africa's premier provider of digital commerce, to address fraud, declines, and chargebacks to minimise costs and risk for acquirers. Through the collaboration, Network will roll out Mastercard's Brighterion Artificial Intelligence (AI) technology across the region, providing acquirers and businesses with transaction fraud screening and merchant monitoring.

- Further, in March 2022, Shift Technology, a provider of AI-driven decision automation and optimisation solutions for the global insurance industry, and Duck Creek Technologies, a global provider of technology solutions to the P&C insurance industry, have announced a solution partnership to bring AI-enabled fraud detection capabilities to market in 2022. Once fully integrated, Duck Creek Claims users will receive real-time fraud alerts directly into their claims management software system.

North America Accounts For the Largest Market Share

- North America is expected to dominate the AI in Fintech market due to prominent AI software and systems suppliers, combined investment by financial institutions into AI projects, and the adoption of most AI in Fintech solutions. The region is expected to experience significant growth in this area in the coming years. Additionally, North America serves as the business hub for many AI Fintech firms, with companies like Sidetrade choosing to locate their North American operations in Calgary.

- Government initiatives and investments towards AI. would drive the market for instance. In fiscal year 2022, the U.S. government spent USD 3.3 billion on artificial intelligence (A.I.) contracts, according to data from a recent Stanford University study. Spending by federal government agencies on technology climbed by over USD 600 million annually, from USD 2.7 billion in 2021, with the decision science, computer vision, and autonomous segments receiving the majority of investment. Since 2017, when the U.S. government spent USD 1.3 billion on artificial technology, total spending on A.I. contracts has climbed by over 2.5 times.

- The players in the market are collobarting to provide better service to the customer in the region. For instance, in august 2022, Zest AI, the recipient of NACUSO's CUSO of the Year Award and a player in improving credit access through better scoring announced a partnership with Equifax, Inc., a worldwide data, analytics, and technology firm. The collaboration will allow credit unions that use Zest AI's underwriting technology to analyze more of the data sourced by Equifax to accept more applications with better speed, particularly those who have traditionally been underbanked. This is Zest AI's first big distribution relationship with a National Consumer Reporting Agency.

- Some companies' solutions help businesses grow retail banking with next-best-action software, detect and combat financial fraud, and improve client relationships with multichannel customer experience solutions. For insatnce, in April 2022, Versapay, a player in Collaborative Accounts Receivable, said today that it has finalised its acquisition of DadeSystems, a fintech startup based in the United States. Versapay's array of accounts receivable (AR) automation solutions has been expanded, as have its AI and machine learning capabilities, as a result of the acquisition. It also broadens Versapay's enterprise and mid-market footprint while adding critical skills to its growing staff.

- Banks in the region have started using blockchain technology to record data and combat fraud. Blockchain records the details of each transaction, making it easier to detect hacker attempts This technology permits worldwide payments and allows for speedy transactions with low commissions. The Distributed Ledger Technology (DLT) of Blockchain assists in the recording and sharing data across different stores and a distributed network. Furthermore, cryptographic and algorithmic methods synchronize data across the financial network. This is a significant step since transaction data can be stored in different locations. It paves the way for blockchain interoperability and cross-industry data exchange.

AI in Fintech Industry Overview

AI in the Fintech market is moving towards fragmented due to many global players. Various acquisitions and collaborations of large companies are expected to occur shortly, focusing on innovation. Some major players in the market include IBM Corporation, Intel Corporation, Narrative Science, and Microsoft Corporation.

In February 2023, Baiduri Bank in Brunei chose Singapore-based Software-as-a-Service (SaaS) fintech Finbots.ai to modernize its credit risk management with artificial intelligence (AI). According to Finbots.ai, its AI credit modeling solution, creditX, will allow Baiduri Bank to design and deploy high-quality credit scorecards in a fraction of the time and cost. This will minimize credit risk, increase efficiency and agility for retail and small and medium-sized organizations (SMEs), as well as expedite the bank's financial inclusion campaign for the underserved credit market.

In February 2023, Scotiabank introduced a new tool, Scotia Smart Investor, to give customers greater asset control. The Canadian lender introduced the new device via assistance+, combining AI-powered recommendations with real-time personalized assistance. Scotia Smart Investor was created by Scotia Securities, Scotiabank's linked mutual fund dealer. The tool, which includes an AI-powered advice engine, will assist users in designing, planning, monitoring, and updating financial goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Emerging Uses of AI in Financial Technology

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Process Automation Among Financial Organizations

- 5.1.2 Increasing Availability of Data Sources

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Application

- 6.3.1 Chatbots

- 6.3.2 Credit Scoring

- 6.3.3 Quantitative & Asset Management

- 6.3.4 Fraud Detection

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 ComplyAdvantage.com

- 7.1.4 Narrative Science

- 7.1.5 Amazon Web Services Inc.

- 7.1.6 IPsoft Inc.

- 7.1.7 Next IT Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Onfido

- 7.1.10 Ripple Labs Inc.

- 7.1.11 Active.Ai

- 7.1.12 TIBCO Software (Alpine Data Labs)

- 7.1.13 Trifacta Software Inc.

- 7.1.14 Data Minr Inc.

- 7.1.15 Zeitgold

- 7.1.16 Sift Science Inc.

- 7.1.17 Pefin Holdings LLC

- 7.1.18 Betterment Holdings

- 7.1.19 WealthFront Inc.