|

市場調査レポート

商品コード

1640457

ビジネスプロセス管理-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Business Process Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ビジネスプロセス管理-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

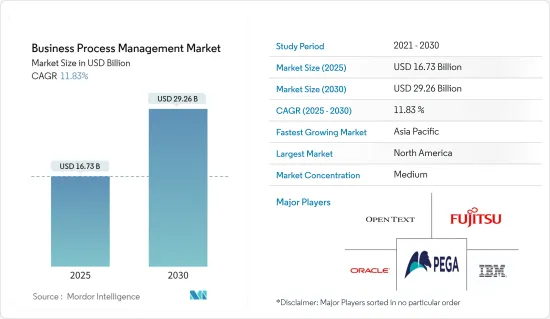

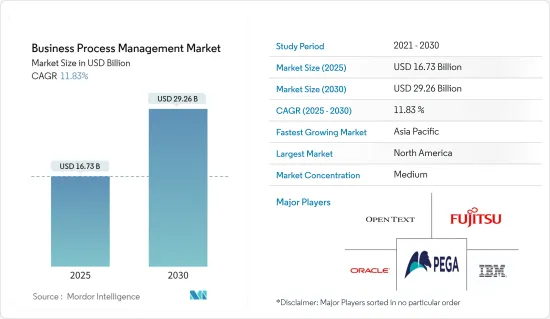

ビジネスプロセス管理市場規模は2025年に167億3,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは11.83%で、2030年には292億6,000万米ドルに達すると予測されます。

主要ハイライト

- 近年、ビジネスプロセス管理(BPM)は、生産性の向上と大幅なコスト削減を実現する可能性があることから、大きな注目を集めています。これは、特定のプロセス設計によって駆動される汎用的なソフトウェアシステムであり、業務上のビジネスプロセスを制定管理します。

- ビジネスプロセス管理(BPM)とは、タスクを完了し、顧客を提供し、収益を得るための組織のアプローチを最適化する体系的なプロセスです。ビジネスプロセスとは、収益を上げる、労働力の多様性を高めるなど、組織の目的達成を支援する活動や一連の業務のことです。BPMは、ビジネスプロセスを分析し、複数のシナリオでどのように動作するかをモデル化し、修正を実施し、新しいアプローチをモニタリングし、望ましいビジネス目標と結果を生み出す能力を継続的に改善します。

- 市場はまた、企業(エンドユーザー)がアプリケーションを構築できるようにすることに関する動向も示しました。調査対象となった市場のほとんどのベンダーは、ローコードアプリケーション開発機能をリードしています。BPMプラットフォームは、コンテンツやファイルの共有、社内コミュニケーション、人事管理、課題管理など、すべてのコラボレーション機能を統合する必要があるため、ローコードアプリケーションの開発は重要なブレークスルーとなっています。

- 例えば、IBMのインテリジェントビジネスプロセス管理スイート(iBPMS)は、人工知能(AI)などの機能を追加したビジネスプロセス管理(BPM)ソフトウェアを提供しています。これは主に、企業がワークフローをダイナミックに自動化するのを支援するように設計されています。これらのスイートは多くの場合クラウドに対応しており、開発者がワークフローソリューションを迅速かつ容易に作成できるよう、ローコードツールを提供しています。

- BPM市場の大きな動向のひとつに、ローコードプラットフォームプロバイダーとしての位置づけへの移行があります。この開発により、BPM市場の細分化が進むと予想されます。

- 企業の選択基準として特定された使用事例には、デジタルビジネスの最適化と変革、セルフサービスインテリジェントビジネスプロセスの自動化、適応ケース管理などがあります。

- 同市場の主要企業は、戦略的提携に注力し、新しいソリューションを市場に投入してサービスを向上させています。例えば、オープンテキストは今年、完全子会社であるOpenText UK Holding Limited(Bidco)を通じて、マイクロフォーカスの発行済みと発行予定の株式資本合計を1株当たり532ペンスで買収(買収)する契約を締結したと発表しました。

- TIBCOは今年、革新的で強力なマスターデータ管理(MDM)SaaS(Software-as-a-Service)ソリューションであるTIBCO CloudTM EBXの提供を発表しました。TIBCO Cloud EBXは、マスター、リファレンス、メタデータを含むビジネスデータをどこからでも管理することを可能にします。SaaS製品であるEBXは、クラウドネイティブなMDM機能へのセルフサービスアクセスを顧客に提供し、より迅速で賢明な実装を実現します。このソリューションは、TIBCO CloudTM Passportの一部です。この新しいコンサンプションベースの料金プランは、単一のモデルでTIBCO SaaSの全機能への柔軟なFinOps(金融業務)アクセスを記載しています。

- ビジネスプロセス管理の需要は、さまざまなセグメントにおけるプロセス自動化の必要性に直結しているため、世界中でプロセス自動化の需要が高まれば高まるほど、ビジネスプロセス管理ソリューションの需要も高まります。このような要因は、組織やベンダーがビジネスプロセス管理市場への参入に注力し、そのコアコンピテンシーが組織全体の成長につながることを後押ししています。

- COVID-19の開始により、供給ネットワークの脆弱性が露呈しました。脆弱なエコシステムには、ほとんどのIT企業にとって不可欠なITサービスのプロバイダーが含まれています。さらに、在宅勤務の義務化により、サービスプロバイダーは、ミッション・クリティカルな企業顧客に対し、提供するサービスのスピード、セキュリティ、品質、総合的な有効性を向上させるツールと技術を保証するよう求められており、市場の成長を促進しています。

- パンデミック後のシナリオでは、デジタル化と新技術の採用が増加しており、市場の成長を促進しています。BPMは最適化を支援し、企業がアプリケーションケースをサポートする新しいソリューションを実装できるようにします。

ビジネスプロセス管理(BPM)市場の動向

BFSI産業が市場成長を牽引する見込み

- 銀行、金融サービス、保険の各セクターは、BPMの需要が大きいです。同産業は経済・金融危機を示唆しているため、金融機関はリソースとプロセスの最適化を支援する技術的ツールに依存しています。

- 今日のデジタルファーストの顧客は、手元で金融サービスを利用できることを求めています。顧客の期待が変化しているため、銀行はあらゆるデジタルプラットフォームでサービスを利用できるようにする必要に迫られています。オンボーディングプロセスも同様です。しっかりとしたBPMシステムは、銀行がエンド・ツー・エンドのオンボーディングプロセスを最適化・自動化し、プロセスのボトルネックを解消し、ストレート・スルー・ケースの処理を加速し、適切なナレッジ・ワーカーに転送することで例外的な状況を専門的に管理するのに役立ちます。

- Huaweiは今年、テメノスのオープンプラットフォーム上に構築されたデジタルバンキング2.0ソリューションを発表し、顧客や金融産業の主要パートナーと会談して、ビジネスの俊敏性と産業のイノベーションを実現するためのクラウドネイティブアーキテクチャの確立について議論しました。

- 銀行や金融機関のITインフラは、定期的な更新が必要です。複数の勘定系システムが衝突し、効果的な意思決定が妨げられる可能性があるからです。そのため、コストの効率化や、2つの融合した事業体間の適切な統合を実現することは課題となっています。さらに、IBMの調査によると、銀行や金融機関のCEOの50%以上が、複雑さを効果的に管理するために、商品や業務の簡素化に重点を置いていることが明らかになっています。

- さらに、Software AGは、ING GroupによるビジネスプロセスモデリングとカスタマージャーニーマッピングにARISを使用することに成功しました。同社は、GDPRに準拠し、潜在的なリスク管理機能を網羅するパイロットを設定するためにARISを使用しています。

- さらに、同じ規律がフィンテックと技術市場展望に影響を与えたため、リテールバンキングは先進技術の採用から恩恵を受けています。EFMAが最近実施したリテールバンキングに関する調査によると、前年、銀行や信用組合は、プロダクト・アジリティ(32%)、デジタルマーケティング(31%)、デジタルチャネルの移行(29%)、コスト削減(28%)に向けて調整する可能性があると予想されています。これは、銀行の従業員が顧客や自動化されたプロセスから発信される膨大な量のデータを扱うことにつながります。

北米が大きな市場シェアを占める

- 銀行、金融サービス、保険の各セクターは、BPMを強く求めています。この産業は経済・金融危機の兆候を示すため、金融機関はリソースとプロセスの最適化を支援する技術的ツールに依存しています。

- 銀行や金融機関のITインフラは定期的な更新が必要で、複数のコア・バンキングシステムが衝突し、効果的な意思決定を妨げる可能性があるからです。そのため、コストの効率化や、両者の適切な統合が課題となっています。さらに、IBMの調査によると、銀行・金融機関の最高経営責任者(CEO)の50%以上が、複雑性を効果的に管理するために、商品や業務の簡素化に注力していることが明らかになっています。

- ビジネスプロセス管理ツールは、銀行が融資、口座開設、取引先からの決済、リスク管理、顧客からの問い合わせ、苦情、サポートプロセスなどを自動化することを可能にします。そのため、世界的に複数の銀行がBPMに移行しています。例えば、セルビア市場の大手銀行の1つであるSociete Generale Serbiaは、顧客により良いサービスを提供するために、IBMのBusiness Process ManagerとIBM Application Connect Enterpriseの導入に頼っていました。

- さらに、Software AGは、ING GroupによるビジネスプロセスのモデリングとカスタマージャーニーマッピングにARISを使用することに成功しました。同社は、GDPRに準拠し、潜在的なリスク管理機能全般にわたるパイロット設定を行うためにARISを使用しています。

ビジネスプロセス管理(BPM)産業概要

ビジネスプロセス管理市場は、地域や国際的な参入企業の存在により競争が激しいです。参入企業は市場での地位を維持するためにM&Aや製品革新を行っており、競合企業間の激しい競争が繰り広げられています。最近の市場開拓の動向は以下の通りです。

2022年7月、TIBCO ModelOpsがリリースされ、企業はAIモデルをより速く、どこからでも、確実かつ大規模に展開できるようになりました。この新機能は、クラウドベースの分析モデルの管理、展開、モニタリング、ガバナンスを簡素化し、顧客の規模を拡大します。

2022年7月、Comindware Inc.は、米国におけるデジタルトランスフォーメーションの加速と長期的なデジタル基盤へのコミットメントにおける重要なマイルストーンを発表しました。昨年行われたイノベーションラボの設立計画について、Comindwareは、ローコード、BPM、関連技術の新しい企業ソリューションへの応用を促進し、サステイナブルデジタルの未来への道筋において信頼できる技術を企業に提供するため、世界クラスのラボを立ち上げたことを確認しました。

2022年3月、Pegasystemsはローコード機能であるPega Infinityを発表しました。Pega Infinityは、ローコードオプションの改善を対象としたプラットフォームで、Pega Infinityソフトウェア包装のバージョン8.7です。ローコード、自動化、人工知能(AI)、クラウドアーキテクチャのアップデートが含まれています。Pegaのコアソフトウェアスイートに対する新しいインテリジェントなローコードアップグレードは、ブランドがより迅速に革新し、従業員と顧客のエクスペリエンスを向上させるのに役立ちます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19のビジネスプロセス管理市場への影響評価

第5章 市場力学

- 市場促進要因

- ローコードシステムの需要

- 予測可能なタスクの効率化(適応ケース管理)

- 製造業におけるボットとAI

- 市場課題

- 自動化のコスト高とROIの低さ

- 統合の失敗

第6章 市場セグメンテーション

- 展開別

- クラウド

- オンプレミス

- ソリューション別

- プロセス改善

- プロセス自動化

- コンテンツ・ドキュメント管理

- ケース管理

- その他のソリューション(最適化管理、アプリケーション統合)

- エンドユーザー産業別

- 銀行、金融サービス、保険(BFSI)

- 政府・防衛

- 医療

- IT・通信

- 小売

- 製造業

- その他のエンドユーザー産業(エネルギー、教育など)

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- IBM Corporation

- Open Text Corporation

- Oracle

- Software AG

- Tibco Software Inc.

- Fujitsu

- Ultimus Inc.

- BP Logix Inc.

- Pegasystems Inc.

- Appian

- Signavio GmbH

- ASG Technologies Group Inc.

- Kissflow Inc.

- Nintex UK Ltd

- CMW Lab

第8章 投資分析

第9章 今後の市場展望

The Business Process Management Market size is estimated at USD 16.73 billion in 2025, and is expected to reach USD 29.26 billion by 2030, at a CAGR of 11.83% during the forecast period (2025-2030).

Key Highlights

- In recent years, business process management (BPM) has received considerable attention due to its potential to increase productivity and significantly reduce costs. These are generic software systems driven by specific process designs that enact and manage operational business processes.

- Business process management (BPM) is a systematic process of optimizing organizations' approaches to complete tasks, provide customers, and earn revenue. A business process is an activity or series of operations that assist an organization in achieving its objectives, such as raising revenues or boosting workforce diversity. BPM analyses a business process, models how it operates in multiple scenarios, implements modifications, monitors the new approach, and continuously improves its ability to produce desired business objectives and results.

- The market also witnessed trends concerning enabling the companies (end users) to build their applications. Most of the vendors in the market studied are leading to Low-code App Development capabilities. With BPM platforms required to integrate all the collaboration functionalities, like content and file sharing, internal communication, personnel management, and issue management, among others, the development of low-code applications has been a significant breakthrough.

- For instance, IBM's Intelligent business process management suites (iBPMS) offer business process management (BPM) software with additional capabilities, such as artificial intelligence (AI). It is mainly designed to assist companies in the dynamic automation of workflows. These suites are often cloud-enabled and provide low-code tools that help developers create workflow solutions quickly and easily.

- One of the significant trends in the BPM market includes the transition towards positioning themselves as low-code platform providers. This development is expected to increase the fragmentation of the BPM market.

- A few use cases identified as enterprise selection criteria include digital business optimization and transformation, self-service intelligent business process automation, and adaptive case management.

- The key players in the market are focusing on strategic collaborations and improving their services by launching new solutions into the market. For instance, this year, OpenText announced that it had signed a deal for the total issued and to be issued share capital of Micro Focus for 532 pence per share (the acquisition) through its wholly-owned subsidiary, OpenText UK Holding Limited (Bidco), implying an enterprise value of approximately USD 6.0 billion.

- This year, TIBCO announced the availability of TIBCO CloudTM EBX, an innovative and powerful master data management (MDM) software-as-a-service (SaaS) solution. TIBCO Cloud EBX allows customers to manage business data from anywhere, including the master, reference, and metadata. As a SaaS product, EBX now provides customers with self-service access to cloud-native MDM features for faster and wiser implementation. The solution is part of the TIBCO CloudTM Passport. This new consumption-based pricing plan offers flexible FinOps (financial operations) access to all TIBCO SaaS capabilities under a single model.

- As the demand for business process management is directly related to the need for process automation in different sectors, the higher the demand for process automation around the world, the higher the demand for business process management solutions. These factors help organizations and vendors focus on entering the business process management market, as their core competency results in organizations' overall growth.

- The fragility of supply networks has been exposed with the commencement of COVID-19. The fragile ecosystem includes providers of vital IT services for most IT firms. Furthermore, work-from-home mandates have prompted service providers to guarantee that mission-critical enterprise customers have the tools and technology to improve the speed, security, quality, and overall efficacy of services supplied, promoting the market growth.

- In the post-pandemic scenario, increasing the adoption of digitalization and new technologies drives growth in the market. BPM helps optimize and allows businesses to implement new solutions to support application cases.

Business Process Management (BPM) Market Trends

BFSI Industry is Expected to Drive the Market Growth

- The banking, financial service, and insurance sectors significantly demand BPM. As the industry is indicative of economic and financial crises, financial entities rely on technological tools to help them optimize their resources and processes.

- Today's digital-first customers demand financial services to be at their fingertips. Because of changing client expectations, banks are forced to make their services available across all digital platforms. And the onboarding process is no different. A solid BPM system may help banks optimize and automate their end-to-end onboarding process, eliminate process bottlenecks, accelerate the processing of straight-through cases, and manage exceptional circumstances expertly by forwarding them to the appropriate knowledge worker.

- During this year, Huawei launched the Digital Banking 2.0 solution, built on the Temenos open platform, and met with customers and leading financial sector partners to discuss establishing a cloud-native architecture to achieve business agility and industry innovation.

- IT infrastructure in banks and financial institutions needs regular updating, as multiple core-banking systems can collide, hampering effective decision-making. Therefore, achieving cost efficiencies or proper integration between the two blended entities becomes challenging. Moreover, an IBM study reveals that over 50% of banking and financial organization CEOs focus on simplifying their products and operations to manage complexity effectively.

- Moreover, Software AG successfully used ARIS for business process modeling and customer journey mapping by ING Group. The company has been using it to comply with GDPR and set up pilots across potential risk management capabilities.

- Additionally, retail banking has benefited from adopting advanced technologies as the same discipline impacted the fintech and technology market landscape. As per a recent EFMA survey on retail banking, it is expected that in the previous year, banks and credit unions may be aligned toward product agility (32%), digital marketing (31%), digital channel migration (29%), and cutting costs (28%). It leads to bank employees dealing with a vast volume of data originating from customers and automated processes.

North America Accounts for a Significant Market Share

- The banking, financial service, and insurance sectors significantly demand BPM. As the industry is indicative of economic and financial crises, financial entities rely on technological tools to help them optimize their resources and processes.

- IT infrastructure in banks and financial institutions needs regular updating, as multiple core-banking systems can collide, hampering effective decision-making. Therefore, achieving cost efficiencies or proper integration between the two blended entities becomes challenging. Moreover, an IBM study reveals that over 50% of banking and financial organization CEOs focus on simplifying their products and operations to manage complexity effectively.

- Business process management tools enable banks to automate lending loans, account opening, getting payment from the parties, risk management, and customer inquiries, complaints, and support processes, to name a few. Therefore, multiple banks globally are shifting to BPM. For instance, Societe Generale Serbia, one of the leading banks in the Serbian market, resorted to deploying IBM's Business Process Manager and IBM Application Connect Enterprise to serve its clients better.

- Moreover, Software AG successfully used ARIS for business process modeling and customer journey mapping by ING Group. The company has been using it to comply with GDPR and set up pilots across potential risk management capabilities.

Business Process Management (BPM) Industry Overview

The business process management market is competitive due to regional and international players' presence. Players are doing mergers and acquisitions and product innovation to maintain their position in the market, which holds an intense rivalry among competitors. Some of the recent developments in the market are:

In July 2022, TIBCO ModelOps was released, allowing enterprises to deploy AI models faster, from anywhere to everywhere, reliably, and at scale. This new addition to the company's game-changing analytics offering simplifies and scales cloud-based analytic model administration, deployment, monitoring, and governance for customers.

In July 2022, Comindware Inc. announced a significant milestone in its commitment to accelerated digital transformation and a long-term digital foundation in the United States. Regarding plans made last year to create an innovation lab, Comindware has confirmed that it has launched a world-class lab to promote the application of low-code, BPM, and related technologies in new corporate solutions and to equip businesses with dependable technology on their way to a sustainable digital future..

In March 2022, Pegasystems launched its low-code capabilities, Pega Infinity, a platform targeting improved low-code options, which is version 8.7 of its Pega Infinity software package. It includes low-code, automation, artificial intelligence (AI), and cloud architecture updates. New intelligent, low-code upgrades to Pega's core software suite help brands innovate faster and improve employee and customer experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the COVID-19 Impact on the Business Process Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Low-code Systems

- 5.1.2 Increasing Efficiency of Predictable Tasks (Adaptive Case Management)

- 5.1.3 Bots and AI Across Manufacturing Domain

- 5.2 Market Challenges

- 5.2.1 Automation Becoming Costly and Low ROI Proposition

- 5.2.2 Integration Failures

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Solution

- 6.2.1 Process Improvement

- 6.2.2 Process Automation

- 6.2.3 Content and Document Management

- 6.2.4 Case Management

- 6.2.5 Other Solutions (Optimization Management and Application Integrations)

- 6.3 By End-User Industry

- 6.3.1 Banking, Financial Services, and Insurance (BFSI)

- 6.3.2 Government and Defense

- 6.3.3 Healthcare

- 6.3.4 IT and Telecommunication

- 6.3.5 Retail

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries (Energy, Education, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Open Text Corporation

- 7.1.3 Oracle

- 7.1.4 Software AG

- 7.1.5 Tibco Software Inc.

- 7.1.6 Fujitsu

- 7.1.7 Ultimus Inc.

- 7.1.8 BP Logix Inc.

- 7.1.9 Pegasystems Inc.

- 7.1.10 Appian

- 7.1.11 Signavio GmbH

- 7.1.12 ASG Technologies Group Inc.

- 7.1.13 Kissflow Inc.

- 7.1.14 Nintex UK Ltd

- 7.1.15 CMW Lab