|

市場調査レポート

商品コード

1910427

レーダーセンサー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Radar Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| レーダーセンサー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

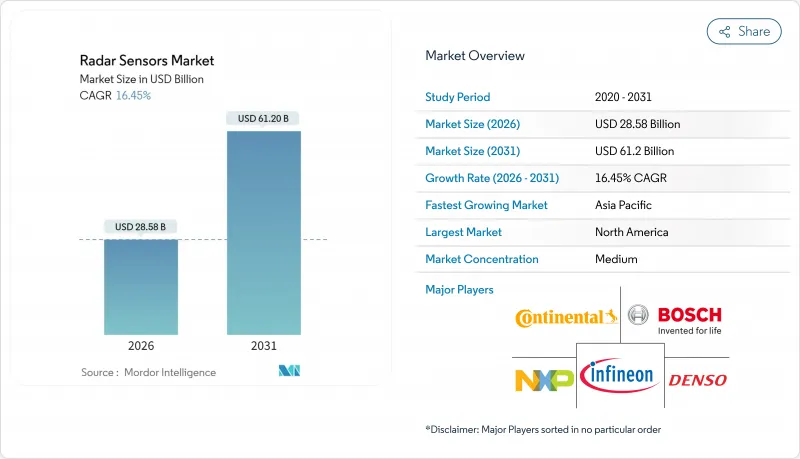

レーダーセンサー市場は、2025年の245億4,000万米ドルから2026年には285億8,000万米ドルへ成長し、2026年から2031年にかけてCAGR16.45%で推移し、2031年までに612億米ドルに達すると予測されています。

この急速な拡大は、同技術が防衛用途から、自動車安全、産業オートメーション、ドローン測量、スマートインフラプログラムといった大量生産分野へ移行していることを反映しています。欧州連合の一般安全規制(EU General Safety Regulation)など、新車に77-81 GHzレーダーを用いた自動緊急ブレーキの搭載を義務付ける安全規制が採用を後押ししています。供給面の促進要因としては、手頃な価格のミリ波チップセットや窒化ガリウムパワーデバイスが挙げられます。これらは距離分解能を向上させつつ、サイズ・重量・電力要件を低減します。アジア太平洋地域における堅調な軍事近代化、欧州での5G対応道路プロジェクトの拡大、世界の気候変動に強い気象レーダーネットワークの構築が、潜在的な需要をさらに拡大させています。短期的な課題としては、10GHz未満帯域のスペクトル混雑、イメージングアレイの校正費用、そして中国の生産シェア98%に起因するガリウム供給リスクが中心となります。

世界のレーダーセンサー市場の動向と洞察

自動車安全システムにおける77-81 GHzレーダーの採用拡大

規制当局と自動車メーカーは、従来型の24GHzデバイスよりも長い検知距離と鋭い角度分解能を実現する77-81GHzを推奨しています。コンチネンタル社のARS640は300mを超える検知距離を実現し、レベル2+の自動運転に適した物体分類を可能にします。中国工業情報化部は2022年、新規24GHzレーダーの認可を停止し、国内OEMメーカーに周波数帯の移行を迫りました。ボッシュはオートバイ分野へも展開を拡大し、KTMバイクに210m検知距離のレーダーを搭載、アダプティブクルーズコントロールや死角警報を実現しています。こうした動きは、車両クラスを問わずセンサーの着実な普及を後押しし、レーダーセンサー市場の成長を支えています。

ドローンによる地形マッピングにおけるコンパクトイメージングレーダーの需要急増

マルチローター型ドローンは軽量合成開口レーダーを採用し、光学式ペイロードが機能しない植生やクラウド域においてもサブメートル級標高モデルを生成します。調査によれば、鉱山探査ミッションの72.73%がヘリコプタープラットフォームよりマルチローターを優先しており、調査コストを60%削減しつつ空間分解能を向上させています。米国地質調査所の移動式レーダー観測所は、山火事発生数分後に降雨流出データを取得し、緊急対応を支援しています。こうした実証事例が、高帯域幅チップセットとオンボード処理技術への研究開発投資を促進し、レーダーセンサー市場の拡大を後押ししています。

10GHz未満帯域における周波数割当の制約

レーダー開発企業は、10GHz未満の限られた周波数帯を通信事業者や衛星事業者との間で競合しています。米国防総省は3GHz未満で120基以上のレーダーを運用しており、民間による周波数再利用の可能性を制限しています。連邦通信委員会(FCC)は国際的な規制を満たすため、24GHz帯の帯域外制限を最近強化し、設計変更を余儀なくさせています。認証待ちの列は9ヶ月にも及び、製品発売の遅延や短期的なレーダーセンサー市場の普及抑制につながっています。

セグメント分析

非撮像デバイスは2025年の収益の70.35%を占め、駐車支援や基本適応型クルーズコントロールにおける定着した利用状況を示しています。しかしながら、レベル2以上の自動運転が普及するにつれ、イメージングソリューションは2031年までに18.12%のCAGRを記録すると予測されています。NXPとsinProの48チャンネルエントリーレベル4Dユニットは方位角1度、フレームあたり2,000ポイントクラウドを実現し、高解像度知覚技術の普及を示唆しています。イメージング機能により、自動ブレーキシステムは歩行者と道路標識を識別可能となり、OEM搭載が高級車種を超えて拡大しています。イメージング対応モジュールのレーダーセンサー市場規模は2031年までに197億6,000万米ドルに達すると予測され、ソフトウェア定義車両の予算拡大を牽引します。一方、コスト最適化された非イメージングカテゴリーは、識別精度が重要でない配送ロボット、フォークリフト衝突警報、降雨量推定分野で優位性を維持します。メーカー各社は、部品コスト削減とレーダーセンサー市場の拡大維持のため、シンプルなFMCWダイとパッケージ内蔵アンテナ設計を組み合わせた製品を提供しております。

競合ロードマップでは現在、組み込み信号プロセッサとエッジAIアクセラレーションを組み合わせ、遅延の低減を図っています。コンチネンタル社のARS640はニューラルネットワークフィルタリングを統合し、脆弱な道路利用者をリアルタイムで分類することで機能安全指標を向上させております。材料面では、シリコンゲルマニウム製フロントエンドがGaAs既存製品に課題を抱えており、大量生産時には10米ドル未満のダイ価格を実現する見込みです。このコスト曲線は中級車における段階的なイメージング機能の向上を支え、スクーターやマイクロモビリティ分野へのレーダーセンサー市場参入の道を開いております。

77-81GHz帯域は、伝送損失とアンテナ開口面積のバランスが最適であることから、2025年の売上高の42.55%を占めました。この帯域は250mの自動車検知を可能としつつ、コスト効率を維持します。欧州・中国・北米における規制調和により認証プロセスが簡素化され、レーダーセンサー市場が拡大しました。STマイクロエレクトロニクスの77GHzトランシーバーは、雪や汚れの中でも性能を維持し、過酷な環境下での道路側ユニットへの適用を実証しています。94 GHz以上では、超広帯域チャネルが舗装ひび割れ監視や医療用マイクロドップラー画像診断で求められるサブセンチメートル級解像度を実現します。ウエハースケールGaNパワーアンプの成熟に伴い、94 GHz以上の出荷台数は2031年までに3倍以上に増加し、21.25%のCAGRが見込まれます。

10 GHz以下の周波数帯域は飽和状態に直面しており、開発者はより高い周波数帯域への移行を迫られています。中国では新規24GHz自動車レーダーの承認が停止され、世界の周波数帯移行が加速しています。短距離60GHz機器は車内センシング、乗車検知、ジェスチャー制御に優れており、テキサス・インスツルメンツのシングルチップレーダーはカメラなしで子供の存在検知精度を98%に向上させました。複合マルチバンド構成では24GHzコーナーユニット、77GHzフロントユニット、60GHz室内ユニットが採用され、レーダーセンサー市場が複数層に拡大しています。

地域別分析

2024年においても北米は、先進運転支援システムの導入と大規模な防衛装備更新に支えられ、最大の地域貢献地域であり続けました。しかしながら、ガリウム供給リスクは6,020億米ドルに上る米国経済生産を脅かしており、政策立案者らはGaNエピタキシーの現地化とスクラップリサイクルを推進しています(csis.org)。米国では認証遅延による民生向け展開の遅れも課題となっていますが、カナダでは自動車用レーダー試験施設の拡充が進み、メキシコではティア1生産ラインのニアショアリングによる恩恵を受けています。

欧州は統一された安全規制と大規模なスマート道路投資により、最も高い将来CAGRを記録しています。EUのAEB義務化により全車種でセンサー設置が統一され、各国道路機関は渋滞分析用レーダーを導入しています。smartmicro UKは道路脇設置ユニット1,000基を突破し、インテグレーターの勢いを示しています(smartmicro.com)。サプライチェーンの国内回帰が半導体不足に対抗し、5G回廊ではレーダーとV2Xビーコンが連携して組み込まれています。

アジア太平洋地域は防衛・気象分野の支出を牽引しております。日本のAN/SPY-7導入と韓国のL-SAM IIプロジェクトは、国内GaNファウンダリ成長を牽引する高予算プログラムの典型例です。中国が24GHz自動車レーダーから77GHzへの移行を推進する政策転換により、現地OEM工場全体で移行が加速しています。インドの5,000万米ドル規模の気象レーダー発注は、精密気象観測に対する公共部門の需要の高さを示しています。これらの取り組みが相まって、レーダーセンサー市場は消費者向けモビリティ分野を超えて拡大しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 自動車安全システムにおける77-81GHzレーダーの採用拡大

- ドローンによる地形マッピングにおけるコンパクトイメージングレーダーの需要急増

- アジア太平洋地域におけるアクティブ電子走査アレイ(AESA)レーダーへの軍事支出の増加

- 産業用ロボットの衝突回避におけるミリ波センサーの需要拡大

- 欧州におけるスマートハイウェイと交通監視レーダーのインフラ整備推進

- 気候変動に伴う沿岸地域におけるドップラー気象レーダーの導入拡大

- 市場抑制要因

- サブ10GHz帯における周波数割当の制約

- イメージングレーダーアレイの高校正・保守コスト

- 高出力ミリ波チップセットにおける熱管理の課題

- 小売分野における3D人物追跡レーダーのデータプライバシーに関する懸念

- バリュー/サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- イメージングレーダー

- 非画像レーダー

- 周波数帯別

- 10 GHz未満(HF/UHF/Lバンド)

- 24 GHz ISMバンド

- 60-64 GHz

- 77-81 GHz

- 94 GHz以上

- 範囲別

- 短距離レーダーセンサー(30メートル未満)

- 中距離レーダーセンサー(30~150 m)

- 長距離レーダーセンサー(150メートル以上)

- 技術別

- パルスレーダー

- 周波数変調連続波(FMCW)レーダー

- フェーズドアレイ/AESAレーダー

- デジタル変調およびMIMOレーダー

- エンドユーザー別

- 自動車

- 航空宇宙・防衛

- セキュリティおよび監視(固定式および移動式)

- 産業用オートメーションおよびロボティクス

- 環境・気象監視

- 交通監視およびスマートインフラ

- 医療・介護施設

- その他のエンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動き(M&A、資金調達、提携)

- 市場シェア分析

- 企業プロファイル

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Denso Corporation

- Hella GmbH and Co. KGaA

- Veoneer Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Valeo SA

- Hitachi Astemo Ltd.

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Baumer Group

- Banner Engineering Corp.

- Lockheed Martin Corporation

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Thales Group

- Honeywell International Inc.