|

|

市場調査レポート

商品コード

1832111

レーダーセンサーの市場規模、シェア、動向、予測:タイプ、レンジ、用途、地域別、2025~2033年Radar Sensors Market Size, Share, Trends and Forecast by Type, Range, Application, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| レーダーセンサーの市場規模、シェア、動向、予測:タイプ、レンジ、用途、地域別、2025~2033年 |

|

出版日: 2025年10月01日

発行: IMARC

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

概要

レーダーセンサーの世界市場規模は2024年に213億3,000万米ドルとなりました。今後、IMARC Groupは、2033年には775億米ドルに達し、2025年から2033年にかけて15.4%のCAGRを示すと予測しています。現在市場を独占しているのは北米で、2024年には36.9%以上の市場シェアを占める。継続的な技術進歩、自律走行車に対する需要の高まり、安全規制の強化、航空宇宙・防衛・産業分野での用途拡大、車両の安全性・ナビゲーションモニタリング機能の強化などが、この地域の市場成長に影響を与える主な要因となっています。

世界のレーダーセンサー市場の成長を牽引しているのは、自動車安全システムの進歩、スマートホーム技術の採用拡大、産業オートメーション需要の高まりです。ADAS(先進運転支援システム)におけるレーダー機能の強化が、自動車分野での採用に拍車をかけています。さらにレーダーセンサーは、IoTアプリケーションの普及に後押しされ、正確な物体検出とモーションセンシングのために、セキュリティシステムやスマートデバイスに不可欠なものとなりつつあります。また、航空宇宙・防衛分野におけるナビゲーションや衝突回避システムの改善需要も市場拡大を後押ししています。さらに、小型化とコスト効率に優れた製造プロセスの進歩がアクセシビリティを高め、民生用電子機器や産業用アプリケーションへの展開を促し、市場の成長軌道をさらに加速させています。

米国は全体の94.60%を占め、主要市場の一つとして浮上しています。ADAS(先進運転支援システム)や自律走行車を推進する自動車セクターは、衝突回避やアダプティブクルーズコントロールなどの機能のためにレーダーセンサーの統合を進めています。2023年の世界の自動車販売台数は、2022年の6,730万台から約7,530万台に増加し、自動車用レーダーアプリケーションの市場が拡大していることを示しています。また、米国の国防予算は世界最高であり、ミサイル探知や航空管制などの用途のレーダー技術に多額の資源が割り当てられています。モノのインターネット(IoT)デバイスやスマートホーム技術の採用が増加しているため、セキュリティシステムやオートメーションにおけるレーダーセンサーの需要が高まっています。

レーダーセンサーの市場動向:

レーダー技術の継続的開発:

急速な技術進歩がレーダーセンサーに革命をもたらしています。フェーズドアレイレーダーや合成開口レーダー(SAR)などのレーダー技術の革新は、性能と精度を向上させています。フェーズドアレイレーダーは、電子ビームステアリングを使用するため、物理的な移動が不要となり、目標の探知と追跡の効率が向上します。この特徴は、より高い解像度と素早い応答時間を持ち、自律走行車や防衛システムにおけるアプリケーションのニーズに合致しています。その一例が、イスラエルの防空システム「アイアンドーム」で、2023年10月7日以来、襲来する脅威の90%以上の迎撃に成功しています。一方、合成開口レーダーは、あらゆる天候や光の条件下で高解像度の画像を提供するため、監視・偵察任務への応用が期待されます。レーダーセンサーに機械学習(ML)と人工知能(AI)を組み込むことで、複雑なデータを処理・解釈する能力が強化され、レーダーセンサーの市場見通しが向上します。

自律走行車に対する需要の高まり:

自動車業界は自律走行車や半自律走行車へのシフトを進めており、これが市場を牽引しています。レーダーセンサーは、アダプティブクルーズコントロール、衝突回避、車線維持支援に使用される重要な機能を実現するため、ADASや自律走行の機能を実現する上で極めて重要です。例えば、2035年までに自律走行は3,000億~4,000億米ドルの収益をもたらします。マッキンゼーアンドカンパニーによれば、これは自動車セクターにとって変革の可能性を秘めています。レーダーセンサーは安全性と性能にとって極めて重要であり、それゆえ自動運転車の将来にとって不可欠です。その結果、自動車市場は、これらのシステムの安全性と効率的な動作を確保するために、レーダー技術に多額の投資を行うようになりました。その結果、安全規制の厳しい要件と、より高度な安全機能を備えた自動車に対する消費者の需要が、成長をさらに後押ししています。自動車メーカーが厳しい安全基準や規制要件に対応するため、レーダーセンサーの需要は増加し続けると予測されます。

軍事および航空宇宙用途への重点化

レーダーセンサーは、監視、ナビゲーション、照準システムに不可欠な機能を持つため、防衛および航空宇宙分野で広く使用されています。これらのレーダーは、脅威の識別、目標の追跡、ミサイルの誘導に不可欠であり、現代の戦争において重要な戦略的利益をもたらしています。高度なレーダーシステムは、早期警戒システムや、戦場での作戦を効果的に管理する上で重要な役割を果たしています。航空宇宙産業では、レーダーセンサーがナビゲーション、天候監視、衝突回避に使用されています。例えば、SIPRIが報告したように、世界の防衛企業は2023年に武器販売を4%増加させており、これは軍事投資の高まりを反映しています。この急増は、現代の防衛システムにおける状況認識と作戦精度の強化に不可欠なレーダーセンサーの需要が高まっていることを裏付けています。これに加え、地政学的緊張や国防予算の増加と相まって、軍事・航空宇宙システムの近代化が進行していることも、レーダー技術への大きな投資を促しています。両部門とも、作戦能力を強化し戦略的優位性を維持するため、レーダーの性能と信頼性の向上を追求し続けています。

目次

第1章 序文

第2章 調査範囲と調査手法

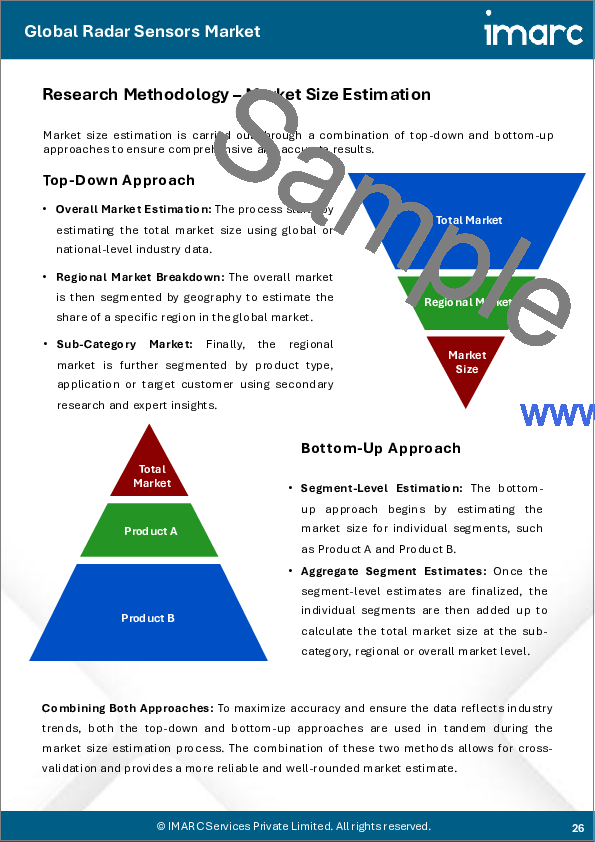

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界のレーダーセンサー市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- イメージング

- 主要セグメント

- 連続波(CW)レーダー

- パルスレーダー

- その他

- 主要セグメント

- 非イメージング

- 主要セグメント

- スピードゲージ

- レーダー高度計

- 主要セグメント

第7章 市場内訳:レンジ別

- 短距離

- 中距離

- 長距離

第8章 市場内訳:用途別

- 自動車

- 航空宇宙および防衛

- 環境と気象の監視

- トラフィック管理と監視

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 SWOT分析

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Continental AG

- DENSO Corporation

- Hitachi Ltd

- Honeywell International Inc.

- Infineon Technologies AG

- L3harris Technologies Inc.

- Lockheed Martin Corporation

- NXP Semiconductors N.V

- Raytheon Technologies Corporation

- Robert Bosch GmbH

- Saab AB

- STMicroelectronics

- Texas Instruments Incorporated

- Thales Group