|

|

市場調査レポート

商品コード

1432979

In-Vitro診断用ラボオートメーション:市場シェア分析、産業動向、成長予測(2024年~2029年)Lab Automation For In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| In-Vitro診断用ラボオートメーション:市場シェア分析、産業動向、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

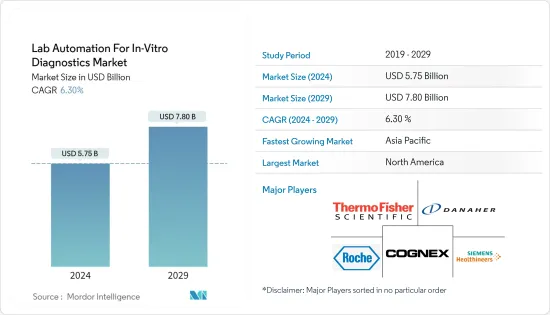

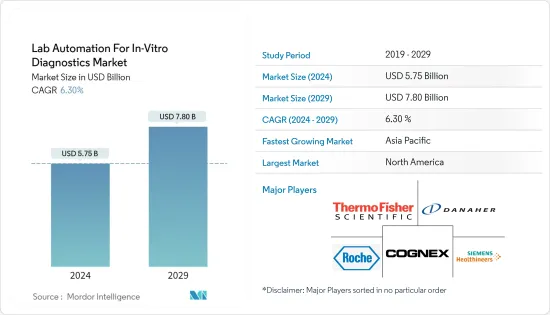

- 目次

In-Vitro診断用ラボオートメーション市場規模は2024年に57億5,000万米ドルと推計され、2029年には78億米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは6.30%で成長する見込みです。

パンデミックによる検査の増加や、迅速かつ正確でミスのない診断を提供するためのラボ用自動体外診断システムの開発が、市場成長の要因と考えられます。

主なハイライト

- ラボオートメーションとは、検体処理装置を用いて臨床研究を行うことです。この手順は、生産性を向上させ、時間サイクルを短縮するために新技術を開発するために実施されます。体外診断薬は、検査室、クリニック、教育機関、診断センター、個人宅など様々な環境で使用されています。

- In-Vitro診断用医薬品(IVD)の製品ポートフォリオには、臨床化学や免疫測定、尿検査、ポイントオブケア検査、患者の自己検査装置などを支援する装置が含まれます。市場は、IVD(体外診断薬)製品を導入する大手企業の増加により拡大しています。

- ラボオートメーションは、特にIn-Vitro診断用医薬品の開発において一般的になりつつあります。かつてない規模で、体外診断の生産性とスループットの向上にテクノロジーが貢献しています。さらに、In-Vitro診断用医薬品市場は、診断検査情報を補完する認知的機械学習機能とビッグデータ、および複数の機器システム間のシームレスな接続を可能にする技術から恩恵を受けると予想されます。このような技術進歩の結果、自動化ソリューションの需要が高まると予想されます。

- 製薬業界における研究開発活動の増加や、食品安全のためのプロセス自動化に対する需要の増加が、In-Vitro診断用医薬品市場におけるラボ自動化の成長を促進しています。ヘルスケア産業におけるワークフローの標準化と厳格な規制管理の結果として、これらのシステムの採用が増加していることが、In-Vitro診断用ラボオートメーション市場の成長に影響を与えています。

- 先端技術への多額の投資と、製品や付加価値サービスによるビジネスモデルの変革が、市場の推進力になると予想されます。さらに、既存の疾病の急速な蔓延と新たな疾病の発見により、早期治療と診断の需要が高まっています。これにより、臨床診断アプリケーションの割合が増加し、ラボ自動化ソリューションの採用に拍車がかかると予想されます。

- 体外診断装置の自動化により、ヘルスケア診断業界は潜在的なエラーを大幅に削減し、感染の検出、病状の診断、病気の予防、薬物療法のモニタリングをより正確に行うことができます。例えば、パンデミック(世界的大流行)の発生時には、ロボット工学を利用して、感染への暴露を減らし、薬や食料を配給し、バイタルサインを評価し、国境管理を促進し、消毒を自動化することができます。

- さらに、検査室のワークフローにAIや分析ツールを組み込むことで、検査室自動化市場の収益機会が拡大します。しかし、熟練した検査専門家の不足と、分析ラボにおける技術統合の限られた実現可能性が、体外診断ラボ自動化市場の課題と妨げになると思われます。

- COVID-19パンデミックの継続的な市場への影響と消費者需要の増加は、分子診断学に起因しています。例えば、インフルエンザとCOVID-19は区別が難しい症状を持っています。さらに、COVID-19の流行に伴い、いくつかの地域ではウイルスを検出するための検査件数が増加しており、ラボオートメーション技術が必要とされています。

In-Vitro診断用ラボオートメーション市場動向

ロボットアームの採用が市場成長を助ける

- 体外診断(IVD)は、病気の診断や治療方針の決定に重要な情報を提供することで、ヘルスケアシステムに欠かせないものとなっています。ロボット手術の範囲、開腹手術から腹腔鏡手術への移行、複雑なロボット医療処置の専門知識を持つ外科医の需要はすべて拡大します。

- 臨床診断と体外診断(IVD)市場は、個々のピペッティング作業や他の種類の手作業ではなく、強化されたリキッドハンドリング・ロボットのソリューションなど、現在の自動化とロボット工学の進歩から利益を得ています。ロボット超音波は、手術室、遠隔診療所、宇宙など様々な環境でテストされています。

- ロボットアームは、柔軟性、効率的なスペース利用、ラボ周辺機器とのシームレスな統合を必要とするアプリケーションのために、研究室での使用が増加しています。アームのプログラミングが容易であることから、採用は時間の経過とともに増加しています。その結果、研究室の自動化にロボットアームが採用されるようになり、市場が牽引されることになります。

- 研究室におけるロボット工学の最も一般的な用途は、労働要件を減らし生産性を高めるための機械操作やピック・アンド・プレイスです。しかし、モジュラー機器の進歩により、小規模なラボでも自動化のメリットを享受できるようになった。様々なベンダーの支援により、あらゆる規模の検査室が、ロボットによる検査室自動化の多くの利点を急速に実現しつつあります。

- 技術の進歩と結果に対する要求の増加により、検査室はますます自動化システムを利用するようになってきています。その正確さ、データ管理能力の向上、繰り返しの減少、そして最終的には人的介入の減少により、ラボオートメーションはより一般的になり、より高い処理能力と正確さをもたらしています。例えば、血液サンプルを選別するロボットアームは、安全性を確保しつつ、病院の診断センター職員の作業負担を軽減します。

- さらに、IoT対応システムは、様々なセンサーのサーバー制御と監視を提供し、追加のハードウェア・インターフェース・モジュールを扱うように簡単に構成することができます。ロボットに取り付けられたセンサーやデバイスに搭載されたセンサーは、データ収集やクラウドサーバーや他のデバイスとの通信を支援することができます。さらに、研究所はIoTを通じて正確で変更されていないデータを提供しながら、高いセキュリティレベルでデータを維持することができます。

北米が最大の市場シェアを占める

- 北米は、大手製薬会社の存在と創薬・ゲノム分野への投資の急増により、In-Vitro診断用ラボオートメーション市場を独占しています。一方、米国は、新規技術の開発増加、急速な人口増加、継続的な技術進歩により、予測期間中に大きな成長率が見込まれています。

- 北米は長年にわたり臨床研究のリーダー的存在です。ファイザー、ノバルティス、グラクソ・スミスクライン、J&J、ノバルティスなどがこの地域に本社を置く大手製薬企業です。加えて、この地域には医薬品開発業務受託機関(CRO)が最も集中しています。重要なCROには、ラボラトリー・コーポレーション・オブ・アメリカ・ホールディングス、IQVIA、シネオス・ヘルス、パレクセル・インターナショナルなどがあります。

- 政府資金が利用可能であること、FDAの規制が厳しいこと、遺伝子疾患やがんスクリーニングにおける分子診断の利用が拡大していること、そしてこの地域の主要プレイヤーのほとんどがこの地域で活動していることから、この地域が大きな市場シェアを占めると予想されます。

- さらに、手術件数の増加や様々な慢性疾患の蔓延が、臨床診断業界における自動化需要の原動力となっています。米国整形外科学会(AAOS)は、2030年までに米国で約300万件の人工膝関節全置換術が実施されると予測しています。これらの疾患やその他の慢性疾患の診断にはサンプル採取が必要であり、これが検討中の市場の需要を高めています。

- さらに、優れた技術へのアクセスの増加、検査室の自動化に対する需要の増加、米国における遺伝性疾患やがんスクリーニングのための分子診断の拡大は、すべて北米の市場需要を押し上げる可能性があります。ボストンを拠点とするLaboratory-as-a-Service(LaaS)のリーダーであるSmartLabsは、ボストンとベイエリアにおけるSmartLabsの高度な人材確保に加え、2022年8月に同市で最初の施設を開設する計画を発表しており、2025年の完成時には同市で最も著名なライフサイエンス研究・生産スペースになる見込みです。

- さらに、COVID-19の流行に伴い、この地域ではウイルスを検出するための検査件数が増加しました。2022年2月、アメリカ政府は、COVID-19の大流行によって診断されなくなった症例を発見するため、がん検診の受診率を高める「キャンサー・ムーンショット」を開始しました。政府は早期発見・早期治療により、今後25年間でがんによる死亡者数を半減させる方針であり、これによりがんIn-Vitro診断用医薬品の需要が高まる。

- ヘルスケアプランとプロバイダー向けの人工知能とケアマネジメントソリューションのリーディングプロバイダーであるDiagnostic Robotics社は、本日、StageOne投資家が主導する4,500万米ドルのシリーズB資金調達ラウンドの完了を発表しました。このような投資は、医療検査室における自動化ソリューションの使用を促進します。

In-Vitro診断用ラボオートメーション産業概要

In-Vitro診断用ラボオートメーション市場は統合市場です。ラボのインフラを構築するための参入コストは依然として高く、そのため市場を独占しているのは少数の大手企業のみです。さらに、同市場はすでに統合が一巡しています。コグネックス、Roche Holding AG、Thermo Fisher Scientific Inc.、Abbott Laboratoriesなどがその代表例です。この業界では、革新的な製品の発売や戦略的契約による市場支配が続いています。

2022年1月、In-Vitro診断用医薬品の世界リーダーである富士レビオは、広く使用されているINNO-LIAスコアアッセイの自動処理用クローズドシステムであるRoboBlot装置の商業的発売を発表しました。このシステムは、あらかじめプログラムされた検査プロトコールにより、検体の添加からストリップの処理、画像の取り込み、結果の解釈を自動化し、必要に応じて検査情報システム(LIS)との通信も自動化します。

2022年2月、個々の作業のためのロボットアームの開発から始まったオートマタは、最初から最後までラボの全プロセスを自動化するために5,000万米ドルを調達しました。このラウンドはOctopus Venturesが主導し、Hummingbird、Latitude Ventures、ABB Technology Ventures、Isomer Capital、In-Q-Telなどが参加しました。同社は、部分的自動化から完全自動化への移行は、大幅な時間節約とスループットの向上につながると考えています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 業界バリューチェーン分析

- 市場促進要因

- ラボ自動化システムの柔軟性と適応性

- IoTによるラボのデジタルトランスフォーメーション

- 市場抑制要因

- 中小ラボによる導入率の遅れ

- 熟練した検査専門家の不足

- COVID-19の業界への影響評価

第5章 市場セグメンテーション

- 装置別

- 自動プレートハンドラ

- 自動リキッドハンドラー

- ロボットアーム

- 自動保管・検索システム

- 分析装置

- エンドユーザー別

- アカデミック

- 研究機関

- その他のエンドユーザー

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情勢

- 企業プロファイル

- Cognex Corporation

- Roche Holding AG

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Abbott Laboratories

- PerkinElmer Inc.

- Tecan Group Ltd

- Becton, Dickinson and Company

- Siemens Healthineers AG

第7章 投資分析

第8章 市場機会と今後の動向

The Lab Automation For In-Vitro Diagnostics Market size is estimated at USD 5.75 billion in 2024, and is expected to reach USD 7.80 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

The increase in testing due to the pandemic and the development of automated in-vitro diagnostic systems for labs to provide quick, precise, and error-free diagnoses can be attributed to market growth.

Key Highlights

- Lab automation is the process of using specimen-processing equipment to conduct clinical research. This procedure is carried out in order to develop new technology in order to increase productivity and decrease time cycles. In-vitro diagnostics is used in various settings, including laboratories, clinics, educational institutions, diagnostic centers, and private homes.

- The IVD product portfolio includes devices that aid clinical chemistry and immunoassays, urinalysis, point-of-care testing, and patient self-testing devices. The market is expanding as a result of significant players introducing an increasing number of IVD (in vitro diagnostics) products.

- Lab automation is becoming more common, particularly in the development of IVD medical devices. On an unprecedented scale, technology is assisting in increasing the productivity and throughput of in vitro diagnostics. Furthermore, the IVD market is expected to benefit from cognitive machine-learning capabilities and Big Data to supplement diagnostic test information and technologies to enable seamless connectivity between multiple instrument systems. Automation solutions will be in high demand as a result of such technological advancements.

- The increase in R&D activities in the pharmaceutical industries and the increase in demand for process automation for food safety are driving the growth of lab automation for the in-vitro diagnostics market. The increased adoption of these systems as a result of workflow standardization and stringent regulatory control in the healthcare industry influences the growth of lab automation for the in-vitro diagnostics market.

- Significant investments in advanced technologies and business model transformation, driven by products and value-added services, are expected to propel the market. Furthermore, the rapid spread of existing diseases and the discovery of new diseases increase the demand for early treatment and diagnosis. This is expected to increase the rate of clinical diagnostic applications, fueling the adoption of lab automation solutions.

- Automating in-vitro diagnostic devices allows the healthcare diagnostic industry to drastically reduce potential errors, detect infection, diagnose medical conditions, prevent disease, and monitor drug therapies more accurately. For example, in pandemic outbreaks, robotics can be used to reduce infection exposure, distribute medications and food, assess vital signs, promote border control, and automate disinfection.

- Furthermore, incorporating AI and analytical tools into laboratory workflows expands the lab automation market's profitable opportunities. However, a lack of skilled laboratory professionals and the limited feasibility of technology integration in analytical labs will challenge and hinder the in-vitro diagnostics lab automation market.

- The COVID-19 pandemic's continued market impact and increased consumer demand can be attributed to molecular diagnostics. Flu and COVID-19, for example, have symptoms that are difficult to distinguish. Furthermore, with the outbreak of COVID-19, several regions have seen an increase in the number of tests performed to detect the virus, necessitating lab automation technologies.

Lab Automation For In-Vitro Diagnostics Market Trends

Adoption of Robotics Arms Aids the Market Growth

- In-vitro diagnostics (IVD) has become indispensable in the healthcare system by providing critical information to diagnose diseases and guide therapeutic decisions. The scope of robotic surgery, the transition from open to laparoscopic surgery, and the demand for surgeons with expertise in complex robotic medical procedures will all expand.

- Clinical diagnostics and in vitro diagnostic (IVD) markets benefit from current advancements in automation and robotics, such as enhanced liquid handling robot solutions rather than individual pipetting chores or other types of manual handling. Robotic ultrasound has been tested in various settings, including operating rooms, remote clinics, and space.

- Robotic arms are increasingly used in research laboratories for applications requiring flexibility, efficient space utilization, and seamless integration of lab peripherals. Adoption has grown over time due to the ease with which the arms can be programmed. As a result, the market will be driven by the increased adoption of robotic arms for lab automation.

- The most common application of robotics in laboratories is machine tending or pick and place to reduce labor requirements and increase productivity. However, thanks to advancements in modular equipment, even small laboratories can reap the benefits of automation. With the assistance of various vendors, laboratories of all sizes are quickly realizing the many advantages of robotic laboratory automation.

- Because of technological advancements and increased demand for results, laboratories are increasingly utilizing automated systems. Because of its precision, improved data management capabilities, reduced repetitiveness, and eventually less human intervention, lab automation is becoming more popular, resulting in higher throughput and accuracy. For example, a robot arm for sorting blood samples reduces hospital diagnostic center personnel's workload while ensuring safety.

- Moreover, IoT-enabled systems provide server control and monitoring of various sensors and can be easily configured to handle additional hardware interface modules. Sensors installed in robots and loaded onto devices may aid data collection and communication with cloud servers and other devices. Furthermore, laboratories can maintain data with high levels of security while providing accurate and unaltered data via IoT.

North America to Hold the Largest Market Share

- North America dominates the lab automation for the in-vitro diagnostics market due to the presence of large pharmaceutical companies and the rapid increase in investment in the drug discovery and genomics sectors. The United States, on the other hand, is expected to have a significant growth rate during the forecast period due to the increased development of novel technologies, rapid population growth, and continuous technological advancements.

- North America has been a leader in clinical research for many years. Pfizer, Novartis, GlaxoSmithKline, J&J, and Novartis are among the major pharmaceutical companies headquartered in this region. In addition, the area has the greatest concentration of contract research organizations (CROs). Some significant CROs are Laboratory Corp. of America Holdings, IQVIA, Syneos Health, and Parexel International Corp.

- Because of the availability of government funds, stringent FDA regulations, the growing use of molecular diagnostics in genetic disorders and cancer screening, and most of the major players in this region, the region is expected to account for a major market share.

- Additionally, the growing number of surgeries and the prevalence of various chronic diseases drive demand for automation in the clinical diagnostics industry. The American Orthopedic Surgeons (AAOS) predicts that approximately 3.0 million total knee arthroplasty surgeries will be performed in the United States by 2030. The diagnosis of these and other chronic conditions necessitates sample collection, which increases demand for the market under consideration.

- Moreover, increased access to superior technologies, increased demand for laboratory automation, and the expansion of molecular diagnostics for genetic disorders and cancer screening in the United States may all boost market demand in North America. SmartLabs, a Boston-based Laboratory-as-a-Service (LaaS) leader, announced plans to open its first facility in the city in August 2022, in addition to SmartLabs' advanced resourcing in Boston and the Bay Area, which is expected to become the city's most prominent life sciences research and production space upon completion in 2025.

- Furthermore, with the outbreak of COVID-19, the region saw an increase in the number of tests performed to detect the virus. In February 2022, the American government launched the Cancer Moonshot to increase cancer screening rates to find cases that had gone undiagnosed due to the COVID-19 pandemic. The government intends to cut cancer deaths by half in the next 25 years through early detection and treatment, which will increase demand for cancer IVD tests.

- Diagnostic Robotics, a leading provider of Artificial Intelligence and Care Management solutions for Healthcare plans and providers, today announced the closing of a USD 45M Series B funding round led by StageOne investors, which will help to drive vastly improved care management for members in July 2022. Such investments will encourage the use of automation solutions in medical laboratories.

Lab Automation For In-Vitro Diagnostics Industry Overview

Lab automation for the in-vitro diagnostics market is a consolidated market. The entry cost for setting up lab infrastructure remains high, and hence, only a few major players dominate the market. Moreover, this market has undergone a round of consolidation already. The major players in this market are Cognex Corporation, Roche Holding AG, Thermo Fisher Scientific Inc., and Abbott Laboratories. Market domination through innovative product launches and strategic agreements continues across this industry.

In January 2022, Fujirebio, a global leader in IVD testing, announced the commercial launch of the RoboBlot instrument, a closed system for the automated processing of the widely used INNO-LIA Score assays. The system's preprogrammed test protocols automate sample addition to strip processing, image capture, and result interpretation, as well as laboratory information system (LIS) communication where applicable.

In February 2022, Automata, which began by developing a robotic arm for individual tasks, raised USD 50 million to automate entire lab processes from beginning to end. Octopus Ventures led the round, which included Hummingbird, Latitude Ventures, ABB Technology Ventures, Isomer Capital, In-Q-Tel, and others. The company believes transitioning from partial to full automation will result in significant time savings and increased throughput.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.2.6 Industry Value Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Flexibility and Adaptability of Lab Automation Systems

- 4.3.2 Digital Transformation for Laboratories with IoT

- 4.4 Market Restraints

- 4.4.1 Slow Adoption Rates by Small and Medium Laboratories

- 4.4.2 Lack of Skilled Laboratory Professionals

- 4.5 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Equipment

- 5.1.1 Automated Plate Handler

- 5.1.2 Automated Liquid Handler

- 5.1.3 Robotic Arm

- 5.1.4 Automated Storage and Retrieval System

- 5.1.5 Analyzer

- 5.2 By End User

- 5.2.1 Academic

- 5.2.2 Laboratory

- 5.2.3 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cognex Corporation

- 6.1.2 Roche Holding AG

- 6.1.3 Thermo Fisher Scientific Inc.

- 6.1.4 Danaher Corporation

- 6.1.5 Agilent Technologies Inc.

- 6.1.6 Abbott Laboratories

- 6.1.7 PerkinElmer Inc.

- 6.1.8 Tecan Group Ltd

- 6.1.9 Becton, Dickinson and Company

- 6.1.10 Siemens Healthineers AG