|

市場調査レポート

商品コード

1640702

医療用センサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Medical Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医療用センサー:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 128 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

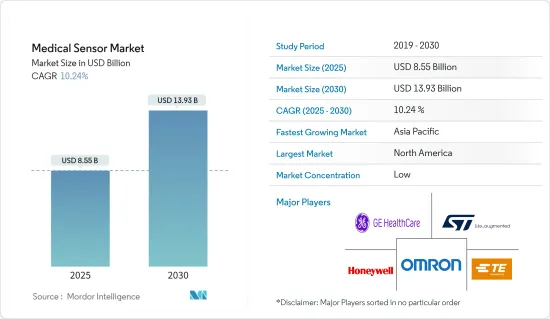

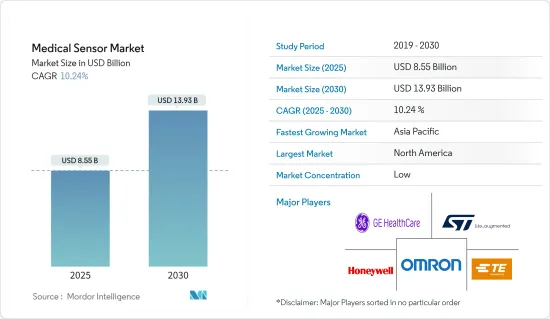

医療用センサー市場規模は2025年に85億5,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは10.24%で、2030年には139億3,000万米ドルに達すると予測されます。

より迅速な分析、低コスト、ユーザーフレンドリーな新デバイスの開発が医療用センサー市場の成長に寄与しています。

主なハイライト

- 医療用センサーは、音、圧力、熱、光、特定の動きなど、さまざまな物理的刺激に反応し、その結果生じるインパルスを医療現場で検査するために伝達する装置です。これらの機器は物理的刺激を電気インパルスに変換します。医療用センサーは、病気の診断、治療、管理に大きな利点をもたらします。

- 低消費電力エレクトロニクス、MEMS技術、パワーハーベスティング、スマート材料の進歩により、医療・ヘルスケア産業におけるこれらの技術の応用が拡大しています。単純な医療機器からインテリジェントな分散型ヘルスケアシステム、患者の健康状態の正確な検出、早期警告に至るまで、センサーはこの業界で大きな役割を果たしています。さらに、目立たないセンシング・ソリューションの開発により、患者の健康増進への道が開かれました。

- この市場を牽引しているのは、mヘルス製品に対する政府のイニシアチブの増加、センサー技術を搭載したスマートフォンやその他の電子機器の採用の増加、mヘルスにおけるセンサー展開への官民投資の増加、IoTや先端技術の採用の増加です。

- 統合の容易さにつながるセンサーの小型化は、医療用センサー市場の促進要因として機能します。これは、非常に詳細なセンシング技術を必要とする病気の診断に役立ちます。

- 医療機器メーカーは、センサー付き携帯機器の開発に力を入れています。このような機器での利用が増加しているため、小型のフォームファクター、優れた機能性、低消費電力、高信頼性を備えた低コストの高度なセンサーの需要が増加しています。

- さらに、医療施設の増加に伴う医療インフラ開拓の高まりは、医療機器や装置の需要を促進し、市場成長をさらに促進すると予想されます。

- 多くの低開発国や新興諸国では、健康状態が依然として悪いです。この問題は、これらの国の人々が最適な医療サービスを適切に利用できない原因となっています。ほとんどのヘルスケアシステムは、民間であれ公的であれ、あるいは政府であれ、都市部に集中しており、農村部では医療サービスが不足しています。

医療用センサー市場の動向

圧力センサーが大きな成長を遂げる見込み

- 圧力センサーは、医療機器にとって、より効果的で安全な操作の質を維持・向上させるための重要なコンポーネントです。さらに、医療アプリケーションの設計に不可欠な要素となって以来、ポータブルヘルスケアモニタリング製品が顕著に増加している理由でもあります。

- 圧力センサーは、様々な状態に対して確実で信頼性の高い診断を提供することで、患者の状態をモニターすることができます。これには、酸素濃縮器における酸素療法の有効性の監視、輸液ポンプにおける適切な量と速度の輸液による薬剤注入の自動化、あるいは血圧の測定などが含まれます。

- さらに、多くの人が喘息発作に苦しんでおり、その解決策として吸入器を使用しています。吸入器の技術が低いと、患者は治療効果を十分に受けることができないです。この状況に対抗するため、大手医療機器メーカーは吸入器に圧力センサーを採用し、個人が適切な喘息ケア対策を受け始めています。

- 慢性閉塞性肺疾患(COPD)や喘息などの呼吸器疾患の症例が増加していることが、圧力センサーの高い需要を生み出し、市場の成長をさらに後押ししています。ウェアラブル圧力センサーは、重要な徴候を追跡する医療や、機械的な指が繊細な物体を操作するのを助けるロボット工学で広く使用されています。しかし、従来のソフトな静電容量式圧力センサーは3kPa以下の圧力でしか動作しないため、ぴったりした衣服のような単純な衣服でも性能に影響を及ぼす可能性があります。

- 糖尿病の有病率の増加により、糖尿病の管理、監視、治療に使用される様々な医療機器やシステムにおける圧力センサーの需要が高まっています。圧力センサーは、これらの機器の精度、信頼性、有効性を確保する上で重要な役割を果たし、糖尿病患者の転帰と生活の質の向上に貢献します。

- 国際糖尿病連合によると、2021年には世界の成人人口の約10.5%が糖尿病を患っていましたが、2045年には12%以上に増加すると予想されています。糖尿病は、慢性的な高血糖を引き起こす代謝疾患です。

- さらに、家庭用医療ウェアラブル、フィットネストラッカー、ヘルスモニターは、圧力センサーの需要を大幅に増加させています。これは、データ中心システムへの注目が高まっているためです。これらのシステムでは、機能性の向上と消費電力の削減が求められています。この動向は、人と環境を綿密に監視し、警告、行動、または行動の提案を積極的に提供するインテリジェント・システムの開発によって推進されています。

北米が最大の市場シェアを占める

- 北米の医療機器市場は、全地域の中でも最大規模であり、予測期間中に大幅な成長が見込まれています。医療インフラが発達していること、適切かつ有利な償還政策が存在すること、先進医療技術が急速に採用されていること、同地域内の大手企業が存在することなどの要因が市場成長の要因となっています。

- 慢性疾患の罹患率や有病率の上昇により、診断や治療を受ける患者数が増加している地域は、ここ数年で先進医療機器や関連センサーの受け入れを促進しています。

- 米国国立がん研究所によると、2022年1月現在、米国には約1,810万人のがんサバイバーがいます。これは人口の約5.4%に相当します。がんサバイバーの数は、2032年までに24.4%増の2,250万人になると推定されています。がんは米国における死因の第2位であり、次いで心臓病です。がん患者の増加は、医療用画像診断機器の需要を増加させ、市場成長を促進します。

- さらに、センサーは医療機器に不可欠な部品であるため、在宅ヘルスケア機器への需要の高まりや医療機器研究開発への投資の増加が市場開拓を後押しします。

- 医療機器は、米国が競合優位性を持ついくつかの産業(計測器、通信、バイオテクノロジー、マイクロエレクトロニクス、ソフトウェア開発など)に依存しています。協働により、神経刺激装置、ステント技術、バイオマーカー、ロボット支援、埋め込み型電子機器などが最近進歩しました。

- この地域の政府は、医療サービスの進歩を達成するために、多くの連邦政策、プログラム、行動を開始しています。例えば米国では、連邦政府が様々な政策やイニシアチブを通じてヘルスケアデータの利用を奨励しています。米国で最も重要なヘルスケア法である医療費負担適正化法(ACA)は、保健福祉省にヘルスケアと医療保険市場の透明性を促進するデータの公開を許可しました。

- 2023年10月、ミンドレイは、クリティカルケアモニタリングと構造的心臓病のための医療イノベーションを提供するエドワーズライフサイエンス社との協業契約の一環として、新たな統合を発表しました。この新しいソリューションは、マインドレイのBeneVision Nシリーズ患者モニタリングシステムとエドワーズのFloTracセンサーを統合し、血行動態モニタリングを可能にします。

医療用センサー業界の概要

医療用センサー市場は、世界プレーヤーと中小企業の両方が存在するため、非常に断片化されています。同市場の主要企業には、GEヘルスケア社、STマイクロエレクトロニクスNV社、ハネウェル・インターナショナル社、TEコネクティビティ社(ファースト・センサーズAG社)、オムロン社などがあります。市場参入企業は、製品ラインナップを強化し、持続可能な競争優位性を獲得するために、提携や買収などの戦略を採用しています。

- 2024年2月GEヘルスケアとBiofourmis社は、安全で効果的かつ利用しやすい在宅ケアを可能にすることでケアの継続性を強化し、病院を超えた患者の旅をサポートする戦略的提携を発表しました。このパートナーシップは、革新的な在宅ケアソリューションを拡大・提供するために、市場をリードする2社の専門知識を結集したものです。

- 2024年2月エレクトロニクス・アプリケーションのあらゆる分野で顧客にサービスを提供する世界の半導体リーダーの1つであるSTマイクロエレクトロニクスと、環境物理学に特化したソフトウェア開発の新興企業であるモバイル・フィジックスは、スマートフォンやその他のデバイスに内蔵された光学センサーで家庭や周囲の空気の質を測定できるようにする提携を明らかにしました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 統合の容易さにつながるセンサーの小型化

- 医療機器とアクセサリーの高度化

- 市場の課題

- 開発途上地域における先進医療システムの普及率の低下

- 製品承認のための厳しい規制環境

第6章 市場セグメンテーション

- コンポーネント別

- フローセンサー

- バイオセンサー

- 温度センサー

- 圧力センサー

- その他のタイプ

- 用途別

- 臨床用途

- 消費者用途

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- GE Healthcare Inc

- STMicroelectronics NV

- Honeywell International Inc.

- TE Connectivity Ltd(First Sensors AG)

- Omron Corporation

- Servoflo Corporation

- Sensirion Holding AG

- Siemens AG

- NXP Semiconductors(Freescale Semiconductor)

- Amphenol Advanced Sensors(Amphenol Corporation)

第8章 投資分析

第9章 市場の将来

The Medical Sensor Market size is estimated at USD 8.55 billion in 2025, and is expected to reach USD 13.93 billion by 2030, at a CAGR of 10.24% during the forecast period (2025-2030).

The development of new devices that provide faster analysis, lower costs, and are user-friendly contributes to the growth of the medical sensor market.

Key Highlights

- Medical sensors are devices that respond to various physical stimuli, such as sound, pressure, heat, light, and any particular motion, and communicate the resulting impulse for examination at the point of care. These devices convert physical stimuli into electrical impulses. Medical sensors offer significant benefits in disease diagnosis, treatment, and management.

- Advances in low-power electronics, MEMS technology, power harvesting, and smart materials have increased the applications of these technologies in the medical and healthcare industries. From simple medical devices to intelligent distributed healthcare systems, accurate detection, and early warning of patients' healthcare conditions, sensors have played a major role in this industry. Furthermore, the development of unobtrusive sensing solutions has paved the path for enhanced patient health.

- This market is driven by increasing government initiatives for mHealth products, increasing adoption of smartphones and other electronic devices equipped with sensor technology, increasing public and private investments in sensor deployment in mHealth, and increasing adoption of IoT and advanced technologies.

- Miniaturization of sensors leading to ease in integration acts as a driver to the medical sensor market. This can help in diagnosing diseases that require very detailed sensing techniques.

- Manufacturers of medical devices are putting a lot of effort into developing portable devices with sensors. Due to their rising usage in these devices, the demand for low-cost advanced sensors with a tiny form factor, better functionality, low power consumption, and high reliability is increasing.

- Moreover, the rising medical infrastructure developments with increased medical facilities are expected to propel the demand for medical devices or equipment, further driving market growth.

- In many underdeveloped and developing countries, the health status is still poor. This problem causes the people of these countries not to have proper access to optimal health services. Most healthcare systems, whether private or public, or government, are clustered in urban areas, and there is a scarcity of health services in rural belts.

Medical Sensors Market Trends

Pressure Sensors are Expected to Witness Significant Growth

- Pressure sensors are crucial components for medical devices to sustain and enhance the quality of a more effective and safe operation. Furthermore, they are the reason there has been a notable increase in portable healthcare monitoring products since they became an integral part of designing medical applications.

- Pressure sensors can monitor a patient's condition by providing definite and reliable diagnostics for various conditions. This can include monitoring oxygen therapy effectiveness in oxygen concentrators, automating drug infusion by administering the correct volume and rate of fluid in infusion pumps, or even measuring blood pressure.

- Moreover, many people suffer from asthma attacks and use inhalers as a solution. Poor inhaler techniques prevent patients from receiving their full therapeutic benefits. In order to counter this situation, leading medical equipment manufacturers are employing pressure sensors in inhalers, and individuals are starting to receive proper asthma care measures.

- The increasing cases of respiratory diseases such as chronic obstructive pulmonary disorder (COPD) and asthma are creating a high demand for pressure sensors, further supporting market growth. Wearable pressure sensors are widely used in medicine to track important signs and in robotics to help mechanical fingers manipulate delicate objects. However, traditional soft capacitive pressure sensors only work at pressures below 3 kPa, so even simple clothing, such as close-fitting clothing, can affect performance.

- The increasing prevalence of diabetes drives the demand for pressure sensors in various medical devices and systems used for diabetes management, monitoring, and treatment. Pressure sensors play a vital role in ensuring these devices' accuracy, reliability, and effectiveness, contributing to improved outcomes and quality of life for individuals with diabetes.

- According to the International Diabetes Federation, around 10.5% of the global adult population suffered from diabetes in 2021; by the year 2045, this is expected to rise to over 12%. Diabetes, or diabetes mellitus, is a group of metabolic disorders resulting in chronic high blood sugar levels.

- Additionally, home medical wearables, fitness trackers, and health monitors have significantly increased the demand for pressure sensors. This is due to the increasing focus on data-centric systems. These systems require increased functionality and reduced power consumption. This trend is driven by the development of intelligent systems that closely monitor people and the environment and proactively provide warnings, actions, or suggestions for action.

North America Holds the Largest Market Share

- The medical device market in North America is one of the largest among all the regions and is expected to grow considerably during the forecast period. Factors such as a well-developed healthcare infrastructure, the presence of adequate and favorable reimbursement policies, rapid adoption of advanced medical technologies, and major players within the region are responsible for market growth.

- The growing number of patients undergoing diagnosis and treatment in the regions due to a rising incidence and prevalence of chronic conditions has promoted the acceptance of advanced medical devices and associated sensors in the past few years.

- As of January 2022, there were around 18.1 million cancer survivors in the United States, according to the National Cancer Institute. This represented about 5.4% of the population. The number of cancer survivors is estimated to increase by 24.4% to 22.5 million by 2032. Cancer is the second leading cause of death in the United States, followed by heart disease. The rising number of cancer patients increases the demand for medical imaging devices, thus driving market growth.

- Furthermore, the growing demand for home healthcare devices and increased investments in medical device research and development will support market growth as sensors are integral parts of medical devices.

- Medical devices rely on several industries in which the United States has competitive advantages, including instrumentation, telecommunications, biotechnology, microelectronics, and software development. Collaborations have led to recent advances in neurostimulators, stent technology, biomarkers, robotic assistance, and implantable electronics.

- Many federal policies, programs, and actions have been initiated by governments in the region to achieve progress in health services. For example, within the United States, the federal government has been encouraging the use of healthcare data through various policies and initiatives. Affordable Care Act (ACA), the most important healthcare legislation in the United States, authorized the Department of Health and Human Services to release data that promotes transparency in healthcare and medical insurance markets.

- In October 2023, Mindray announced new integrations as part of a collaboration agreement with Edwards Lifesciences, a provider of medical innovations for critical care monitoring and structural heart disease. The new solution integrates Mindray's BeneVision N-series patient monitoring system and Edwards' FloTrac sensor to enable hemodynamic monitoring.

Medical Sensors Industry Overview

The medical sensor market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are GE Healthcare Inc., STMicroelectronics NV, Honeywell International Inc., TE Connectivity Ltd (First Sensors AG), and Omron Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: GE HealthCare and Biofourmis announced a strategic collaboration to enhance continuity of care by enabling safe, effective, and accessible care in the home to support the patient's journey beyond the hospital setting. The partnership leverages the combined expertise of two market leaders to scale and deliver innovative care-at-home solutions.

- February 2024: STMicroelectronics, one of the global semiconductor leaders serving customers across the spectrum of electronics applications, and Mobile Physics, a software development start-up specializing in environmental physics, revealed a partnership that enables smartphones and other devices to measure household and ambient air quality with a built-in optical sensor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Miniaturization of Sensors Leading to Ease in Integration

- 5.1.2 Increasing Advancement in Medical Devices and Accessories

- 5.2 Market Challenges

- 5.2.1 Slower Rate of Penetration of Advanced Medical Systems in Developing Regions

- 5.2.2 Stringent Regulatory Environment for Product Approvals

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Flow Sensor

- 6.1.2 Biosensor

- 6.1.3 Temperature Sensor

- 6.1.4 Pressure Sensor

- 6.1.5 Other Types

- 6.2 By Application

- 6.2.1 Clinical Applications

- 6.2.2 Consumer Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GE Healthcare Inc

- 7.1.2 STMicroelectronics NV

- 7.1.3 Honeywell International Inc.

- 7.1.4 TE Connectivity Ltd (First Sensors AG)

- 7.1.5 Omron Corporation

- 7.1.6 Servoflo Corporation

- 7.1.7 Sensirion Holding AG

- 7.1.8 Siemens AG

- 7.1.9 NXP Semiconductors (Freescale Semiconductor)

- 7.1.10 Amphenol Advanced Sensors (Amphenol Corporation)