|

市場調査レポート

商品コード

1849864

防爆機器:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Explosion Proof Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 防爆機器:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 179 Pages

納期: 2~3営業日

|

概要

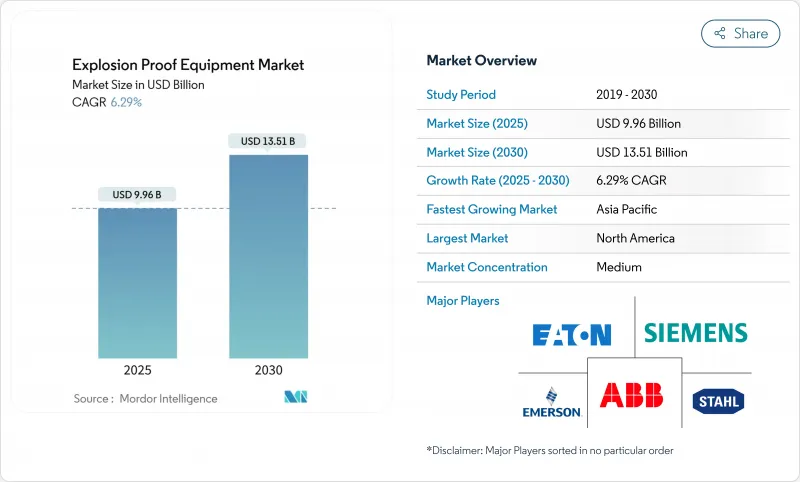

防爆機器市場の2025年の市場規模は99億6,000万米ドルで、2030年には135億1,000万米ドルに達すると予測され、CAGRは6.29%で進展します。

拡大は、ATEXおよびIECEx規則の普遍的な施行、グリーン水素プラントの迅速な建設、危険区域での予知保全を促進するIIoT対応改修への持続的な資本支出に支えられています。また、オフショアおよびオンショア施設でのLED照明への大量転換や、アジア太平洋全域でのリチウムイオンギガファクトリーの立ち上げも需要に寄与しており、それぞれが防塵ゾーンのギアを必要としています。北米は、OSHA規則と老朽化設備の近代化によって規模の主導権を維持しているが、アジア太平洋は、新興の水素回廊、バッテリー・サプライチェーン、化学処理クラスターのおかげで、最速の増加量を生み出しています。競合情勢は、ABB、シーメンス、イートンがバランスシートの強みを現地生産能力に再配分する一方、新規参入企業がニッチ認証のギャップを埋めるため、適度に断片化されたままです。目先の逆風としては、鋳造品不足と中国製エンクロージャーの関税があり、これらはマージンを圧迫し、マルチソーシングを促します。

世界の防爆機器市場の動向と洞察

世界的なATEX/IECEx施行の厳格化

規制当局は2024年4月にATEXガイドラインを強化し、適合性評価を強化し、試験量を前年比40%増加させました。トルコと韓国はIECExに準拠した法令を制定してこの動きを反映し、サプライヤーはしばしば20年間稼働するレガシーラインのアップグレードを余儀なくされています。多国籍企業は、1つの認証が複数地域での販売を可能にし、サイクルタイムを短縮し、エンジニアリングのばらつきを低減するため、整合化を歓迎しています。このような規制の厳格化により、製油所、ケミカルパーク、LNG輸出ハブなどでの交換需要が加速しています。

クラスIの機器を必要とするグリーン水素プロジェクトの増加

水素は空気中で4~75%の可燃性を持つため、発火リスクが高く、高度な封じ込め、検知、換気システムが必要となります。中国、オーストラリア、メキシコ湾岸のギガワット規模の電解槽では、特注の防炎スイッチギヤと本質安全防爆センサーを調達しており、防爆機器市場内に専用の調達チャネルを形成しています。水素に特化した認証書を持つサプライヤーは、いち早く先行者利益を確保し、バリューチェーン全体におけるポートフォリオの切り分けや研究開発提携を促しています。

高い認証・再認証コスト

エンド・ツー・エンドのATEXおよびIECExバリデーションは開発予算の15~25%を消費し、高度なアセンブリーではラボの待ち時間が6~12カ月に及ぶ。小規模な企業では複数の申請書類を作成するための資金繰りに苦労しており、リスク分担策としてM&Aや合弁会社の設立に拍車をかけています。規格が進化するにつれて、再認証サイクルは粗利を削り、価格調整を下流に誘導します。

セグメント分析

2024年の売上高の46%を防炎格納容器が占め、防爆機器市場での中心的役割を確認しました。この設計の頑丈な筐体とサービス実績が、特に成熟した石油・ガス盆地における高出力ポンプ、コンプレッサー、MCCパネルの普及を支えています。しかし、CAGR 7.9%で成長する本質安全防爆は、発火エネルギーしきい値以下で動作する低電力エレクトロニクス、マイクロセンサー、フィールドバストポロジーを利用しています。資産管理者がデジタル診断を強化するにつれて、本質安全防爆設計は封じ込めの割合を着実に減少させるが、新しいセンサー・ノードを危険区域に送り込むことで防爆機器市場全体の規模は拡大します。

加圧およびパージされたキャビネットは、大型フレームVFDとPLCスイートにとって引き続き不可欠であり、防爆ライニングと分離モジュールは、バッテリー工場の特殊なダストプロセスに対応しています。エネルギー制限経路へのシフトは、市場が「封じ込め」から「防止」へと軸足を移していることを示しており、世界的な安全哲学を反映し、長期的な拡大を支えています。

ゾーン1は防爆機器市場の2024年売上高の32%を占め、これは日常運転で蒸気が発生する産業プロセスが広く存在することを反映しています。事業者は、メンテナンスサイクル中の継続性を確保するために、認証された照明器具、ケーブルグランド、ジャンクションボックスを好んで使用しています。しかし、CAGR8.5%で予測されるゾーン0は、継続的な爆発性雰囲気で最高グレードのハードウェアが要求されるグリーン水素と深海掘削の設備投資の優先順位を集めています。このため、総台数が減少していても、製品ミックスの収益性が再重視されます。

ゾーン2のプロジェクトは、特にレガシーセットアップから移行する食品、飲食品、飲料工場で、低スペックのギアを大量に生み出します。ダストゾーン21と22は、バッテリーの正極と負極の粉塵が、広く知られるようになった火災事故の後に可視化され、OEMに微粒子の脅威に対する設計を強制し、ダスト定格製品の防爆機器市場シェアをエスカレートさせるため、加速します。

防爆機器市場は、保護方法別(爆発隔離、爆発防止、その他)、ゾーン別(ゾーン0、ゾーン20、ゾーン1、その他)、エンドユーザー別(製薬、化学、石油化学、その他)、システム別(電源システム、マテリアルハンドリング、その他)、地域別にセグメンテーションされています。市場規模および予測は金額(米ドル)で提供されます。

地域別分析

北米は2024年に35%の売上を占め、NECの500-516条とメキシコ湾岸沿いの石油化学ハブにおける経常的なターンアラウンド・プログラムに活力を得る。米国の製油会社は中期的な改修を推進し、カナダは冬期SAGDユニットに低温認定エンクロージャを装備します。高いIIoTの導入とLEDの改修が地域の平均販売価格を上昇させ、防爆機器市場の堅調なEBITマージンを維持。

アジア太平洋地域はCAGR 7.6%で成長し、リチウムイオンギガファクトリー、陸上化学コンビナート、海上LNGトレインが建設され、防爆機器市場規模を拡大しています。中国はバッテリーパークにダストゾーンを配備し、インドは製薬と特殊化学品にPLI奨励金を投入し、日本は特注のクラスI空気圧機器を必要とする水素の谷を開拓しています。各地域のサプライヤーはIECExラインを迅速に開発し、リードタイムを短縮して地域のサービスノードを構築しています。

欧州は、ドイツのATEXに関する専門知識と、EU指令2014/34/EUに適合させながらプラントの寿命を延ばすカーボンニュートラルへの投資によって、堅調を維持しています。英国のブレグジット後の政策の継続性は、ABBの3,500万米ドルの研究開発と工場のアップグレードを後押しし、地域の能力に対する好意的なセンチメントを示しています。中東とアフリカはグリーンフィールドの石油化学とLNGのメガプロジェクトに依存しており、南米はブラジルのエタノールと石油化学の回廊に勢いが集まっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- より厳格な世界のATEX/IECExの施行

- クラスI機器を必要とするグリーン水素プロジェクトの増加

- IIoT対応防爆改修

- 危険照明における急速なLED移行

- リチウムイオンギガファクトリーにおけるダストゾーン用機器の需要

- 宇宙産業の試験設備における防爆システムの必要性

- 市場抑制要因

- 認証および再認証のコストが高め

- 地域によって異なるゾーニング基準

- 耐火鋳物のサプライチェーンの遅延

- 中国製輸入製品に対する反ダンピング関税

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 保護方法別

- 爆発封じ込め(耐火)

- 本質的安全性

- 加圧/パージ

- 爆発防止

- 爆発分離

- ゾーン別

- ゾーン0

- ゾーン1

- ゾーン2

- ゾーン20

- ゾーン21

- ゾーン22

- エンドユーザー業界別

- 石油・ガス

- 化学および石油化学製品

- 鉱業と金属

- エネルギーと電力

- 医薬品

- 食品・飲料加工

- 廃水処理

- 水素製造と燃料電池

- その他の産業

- システム別

- 電力供給と配電

- モーターとドライブ

- 自動化および制御システム

- 照明システム

- マテリアルハンドリング機器

- 監視と検出

- 暖房と空調

- その他のシステム

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- トルコ

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ABB Ltd

- Eaton Corporation plc

- Siemens AG

- Honeywell International Inc.

- R. STAHL AG

- Pepperl+Fuchs GmbH

- Emerson Electric Co.

- Bartec GmbH

- Rockwell Automation Inc.

- Intertek Group plc

- Marechal Electric Group

- Adalet Inc.

- CZ Electric Co. Ltd

- MAM Explosion-proof Technology(Shanghai)Co. Ltd

- G.M. International SRL

- Alloy Industry Co. Ltd

- Hawke International

- Cooper Crouse-Hinds(Eaton)

- WEG Industries

- Advantech Co. Ltd