|

市場調査レポート

商品コード

1444117

装甲戦闘車両:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Armored Fighting Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 装甲戦闘車両:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

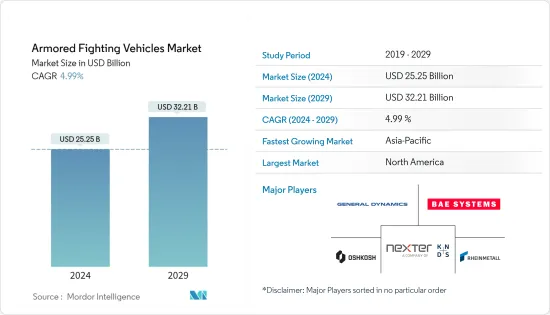

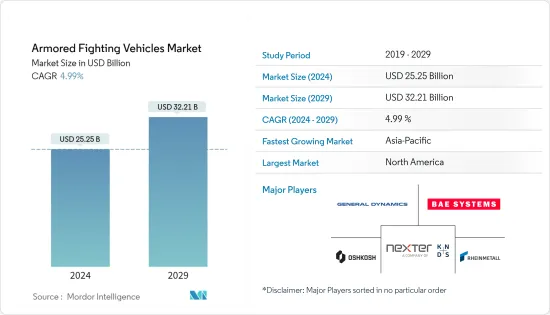

装甲戦闘車両の市場規模は2024年に252億5,000万米ドルと推定され、2029年までに322億1,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に4.99%のCAGRで成長します。

主なハイライト

- COVID-19のパンデミックが世界経済に重大な影響を与えたにもかかわらず、調達プロジェクトが軌道に乗り、製造会社の装甲車両の売上高と収益が着実に増加したため、装甲戦闘車両の市場は依然として影響を受けなかった。ただし、統合サブシステムの複雑さと重要なコンポーネント要件により、特定の車両モデルではサプライチェーンの混乱が発生しました。

- アジア太平洋、欧州、中東・アフリカなどの地域における地政学的亀裂の拡大と国境を越えた紛争の増加が、地上戦闘能力を強化するための新しい装甲車両の調達の主な需要の要因となっています。現在、世界の軍隊の大部分は古く老朽化した装甲車両を運用しています。老朽化した装甲車両部隊を置き換えるために、軍は効率性、致死性、監視能力が強化された新世代の装甲車両プログラムの調達に投資しています。アジア太平洋地域、中東・アフリカ地域での現地製造能力の開発にますます重点が置かれています。地元の装甲車両メーカーによる新しい装甲車両モデルの開発により、地域市場での存在感が高まることが予想されます。

装甲戦闘車両の市場動向

歩兵戦闘車(IFV)が市場シェアを独占

- 歩兵戦闘車両セグメントは、予測期間中にその優位性を示すと予想されます。 IFVの調達増加と防衛支出の増加がこの部門の成長を牽引しています。歩兵戦闘車両は、機械化歩兵ユニットを効果的に戦闘に運び、直接射撃支援を提供します。これらのIFVは、さまざまな弾薬や弾丸から保護するために、モジュール式の追加装甲や複合装甲または離間積層装甲を取り付けることができます。

- 米国議会予算局(CBO)によると、米国陸軍の地上戦闘車両の総取得費は2050年まで平均して年間約50億米ドルと予測されており、そのうち調達費は45億米ドル、RDT&E費は5億米ドルとなります。予想される取得コストは主に既存車両の再製造およびアップグレード版のものです。

- また、米国陸軍は、ブラッドレー装甲兵員輸送車に代わるオプションの有人戦闘車両、エイブラムス戦車よりも軽量な新しい移動式防護火力戦車、および、エイブラムス戦車に代わる装甲多目的車両を調達する予定です。 M113装甲兵員輸送車。

- また、オーストラリア陸軍は現在、プロジェクト LAND 400フェーズ 3の下で約450両の装軌式IFVの取得に向けて装甲車両と協議を行っており、これは陸軍で使用されているM113AS4装甲兵員輸送車の代替となる予定です。車両の総取得費は最大270億米ドル相当と推定されています。このような大規模な調達と現在のフリートのアップグレードに対する支出の増加により、予測期間中にこのセグメントの成長がさらに促進される可能性があります。

アジア太平洋地域は予測期間中に最高の成長を遂げると予想される

- アジア太平洋地域は、地域諸国の軍事支出が堅調に増加しているため、予測期間中に最も高い成長が見込まれると予想されます。この地域における地政学的緊張の高まりにより、中国、インド、オーストラリア、韓国、シンガポール、日本などの国々は、30年以上運用されてきた老朽化した装甲車両を置き換えるために、新しい装甲車両の調達に多額の投資を行っています。 2021年3月初め、日本の防衛装備庁(ATLA)は、客室スペースの狭さとエンジンからの排出量の多さの問題を理由に、軽装甲車両(LAV)を置き換える計画を発表しました。

- 2022年12月、インド陸軍は、新しい未来型歩兵戦闘車両(装軌式)の調達の必要性が認められたことを明らかにしました。 2023年 2月の時点で、米国政府はインドへのストライカー装甲兵員輸送車(APC)の技術移転(ToT)を許可する可能性があります。インド陸軍が輸入品ではなく国産APCを選択する意思があるかどうかはまだ明らかではないが、ストライカー装甲兵員輸送車(APC)の契約はインドの防衛製造産業に後押しとなることが期待されています。

- 同様に、インド国防省は、マヒンドラ・ディフェンス・システムズ(MDS)に対し、軽特殊車両(LSV)を供給する1億4,600万米ドル(1,056カロールインドルピー)相当の契約を締結しました。契約に基づき、同社は2021年から2025年までに1,300台のLSVを納入する予定です。この地域の国々は、地域の軍隊を支援するために現地の製造能力を強力に開発しています。例えば、中国のNORINCO社はここ数年、国産装甲車両の生産と販売の拡大に注力しています。このような発展により、この地域の市場の成長が加速すると予想されます。

装甲戦闘車両業界の概要

装甲戦闘車両市場は適度に細分化されており、市場には多くの国際的および地域的企業が存在します。市場における著名な企業には、General Dynamics Corporation、Oshkosh Corporation、BAE Systems plc、Rheinmetall AG、Nexter Groupなどがあります。数十年にわたり、装甲戦闘車両の市場は高度に統合され、少数の国際的な企業が市場の大部分のシェアを占めていました。

しかし、ここ数年、国産製造業の世界的傾向により、多くの新たな地元企業がアジア太平洋地域および中東地域の市場に参入してきました。サウジアラビア軍事産業(SAMI)、STREIT Group、Nurol Makina、BMC Otomotiv Sanayi ve Ticarest AS(BMC)、Katmerciler HIZIRなどは、中東地域に拠点を置く地元企業の一部です。

市場での展開をさらに強化するために、地元企業は地域軍の要件を満たす長期契約を結んでいます。この点において、トルコの企業は、地元国防当局との戦略的パートナーシップを通じて、中東および北アフリカ諸国での存在感を急速に拡大しています。市場での競争力が高いため、国際的な企業は自律機能を備えた次世代装甲車両モデルや先進兵器、電気光学式赤外線センサースイートの開発に投資しており、これにより軍人の状況認識と生存性が向上します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- タイプ

- 装甲兵員輸送車(APC)

- 歩兵戦闘車(IFV)

- 地雷耐性待ち伏せ保護(MRAP)

- 主力戦車(MBT)

- その他のタイプ

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東およびアフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- General Dynamics Corporation

- Rheinmetall AG

- BAE Systems plc

- Textron Inc.

- Elbit Systems Ltd.

- Oshkosh Corporation

- Nexter Group

- Denel SOC Ltd.

- FNSS Savunma Sistemleri AS

- BMC Otomotiv Sanayi ve Ticarest AS

- Saudi Arabian Military Industries(SAMI)

- Patria Group

- Hanwha Corporation

- Mitsubishi Heavy Industries Ltd.

第7章 市場機会と将来の動向

The Armored Fighting Vehicles Market size is estimated at USD 25.25 billion in 2024, and is expected to reach USD 32.21 billion by 2029, growing at a CAGR of 4.99% during the forecast period (2024-2029).

Key Highlights

- Despite the significant impact of the COVID-19 pandemic on the global economy, the market for armored fighting vehicles remained unaffected, as the procurement projects were on track and the sales and revenues of armored vehicles increased steadily for the manufacturing companies. However, there were some supply chain disruptions pocketed for certain vehicle models owing to the complexity and critical component requirements of the integrated subsystems.

- The widening of geopolitical rifts and rising instances of cross-border conflicts in regions such as Asia-Pacific, Europe, the Middle East, and Africa has been the primary demand driver for the procurement of new armored vehicles to enhance the combat capabilities of the ground forces. Currently, the majority of the armed forces globally are operating old and aging armored vehicles. To replace the aging armored vehicles fleet, the armed forces are investing in the procurement of new-generation armed vehicle programs with enhanced efficiency, lethality, and surveillance capabilities. There is a growing emphasis on developing local manufacturing capabilities in the Asia-Pacific and the Middle East and African regions. The development of new armored vehicle models by local armored vehicle manufacturers is anticipated to increase their presence in the regional market.

Armored Fighting Vehicles Market Trends

Infantry Fighting Vehicle (IFV) to Dominate Market Share

- The infantry fighting vehicle segment is expected to show its domination during the forecast period. Increasing procurement of IFVs and rising defense expenditure are driving the segment's growth. Infantry fighting vehicles effectively carry mechanized infantry units into battle and provide direct-fire support. These IFVs can be fitted with modular add-on armor and composite or spaced laminated armor for protection against various munitions or rounds.

- According to the US Congressional Budget Office (CBO), the total acquisition costs for the US Army's ground combat vehicles are forecasted to average about USD 5 billion per year through 2050, of which USD 4.5 billion for procurement and USD 0.5 billion for RDT&E. The projected acquisition costs are mainly for remanufactured and upgraded versions of existing vehicles.

- Also, the US Army plans to procure an optionally manned fighting vehicle, which will replace the Bradley armored personnel carrier, a new mobile protected firepower tank, which will be lighter than an Abrams tank, and an armored multi-purpose vehicle, which will replace the M113 armored personnel carrier.

- Also, the Australian Army is currently in talks with armored vehicles for the acquisition of about 450 tracked IFVs under Project LAND 400 Phase 3, which will replace M113AS4 armored personnel carriers in service of the Army. The total acquisition cost of the vehicles is estimated to be worth up to USD 27 billion. Such large-scale procurements and growing expenditure on the upgradation of the current fleet may further propel the growth of this segment during the forecast period.

Asia-Pacific Region is Expected to Witness the Highest Growth During the Forecast Period

- The Asia-Pacific region is expected to witness the highest growth during the forecast period due to the robustly growing military spending of the countries in the region. Due to the increasing geopolitical tensions in the region, countries like China, India, Australia, South Korea, Singapore, and Japan are significantly investing in the procurement of new armored vehicles to replace their aging fleets that have been in operation for over 30 years. Earlier in March 2021, the Acquisition, Technology & Logistics Agency (ATLA) of Japan announced its plan to replace the light armored vehicles (LAV) due to their issue of lower cabin space and high emissions from engines.

- In December 2022, the Indian Army revealed that an acceptance of necessity was granted for the procurement of new Futuristic Infantry Combat Vehicles (Tracked). As of February 2023, the United States government may allow the Transfer of Technology (ToT) for the Stryker armored personnel carrier (APC) to India. Although it is not yet clear whether the Indian Army is willing to go for a domestically produced APC over imported ones, the deal for the Stryker armored personnel carrier (APC) is expected to provide a boost to India's defense manufacturing industry.

- Likewise, the Indian Ministry of Defense awarded Mahindra Defence Systems (MDS) a contract worth USD 146 million (INR 1,056 crore) to supply light specialist vehicles (LSVs). Under the contract, the company is expected to deliver 1,300 LSVs from 2021 through 2025. The countries in the region are robustly developing their local manufacturing capabilities to support their regional armed forces. For instance, China's NORINCO has been focusing on increasing the production and sales of domestically manufactured armored vehicles for the past few years. Such developments are anticipated to accelerate the growth of the market in this region.

Armored Fighting Vehicles Industry Overview

The armored fighting vehicles market is moderately fragmented, with many international and regional players in the market. Some of the prominent players in the market are General Dynamics Corporation, Oshkosh Corporation, BAE Systems plc, Rheinmetall AG, and Nexter Group. For decades, the market for armored fighting vehicles was highly consolidated, with few international players accounting for the majority share of the market.

However, over the past few years, due to the global trend of indigenous manufacturing, many new local players have entered the market in the Asia-Pacific and Middle Eastern regions. Saudi Arabian Military Industries (SAMI), STREIT Group, Nurol Makina, BMC Otomotiv Sanayi ve Ticarest AS (BMC), and Katmerciler HIZIR, among others, are some of the local players based out of the Middle Eastern region.

To further enhance their footprint in the market, the local players are signing long-term contracts to meet the requirements of the regional armed forces. In this regard, companies in Turkey have been rapidly expanding their presence in Middle Eastern and North African countries through strategic partnerships with the local defense authorities. Due to high competitiveness in the market, the international players are investing in the development of next-generation armored vehicle models with autonomous capabilities as well as advanced weapons and electro-optic infrared sensor suites, which will enhance situational awareness and survivability of the military personnel on the battlefield.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Armored Personnel Carrier (APC)

- 5.1.2 Infantry Fighting Vehicle (IFV)

- 5.1.3 Mine-resistant Ambush Protected (MRAP)

- 5.1.4 Main Battle Tank (MBT)

- 5.1.5 Other Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Turkey

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.2 Rheinmetall AG

- 6.2.3 BAE Systems plc

- 6.2.4 Textron Inc.

- 6.2.5 Elbit Systems Ltd.

- 6.2.6 Oshkosh Corporation

- 6.2.7 Nexter Group

- 6.2.8 Denel SOC Ltd.

- 6.2.9 FNSS Savunma Sistemleri A.S.

- 6.2.10 BMC Otomotiv Sanayi ve Ticarest AS

- 6.2.11 Saudi Arabian Military Industries (SAMI)

- 6.2.12 Patria Group

- 6.2.13 Hanwha Corporation

- 6.2.14 Mitsubishi Heavy Industries Ltd.